Real Estate Disclosure Requirements

Description

Form popularity

FAQ

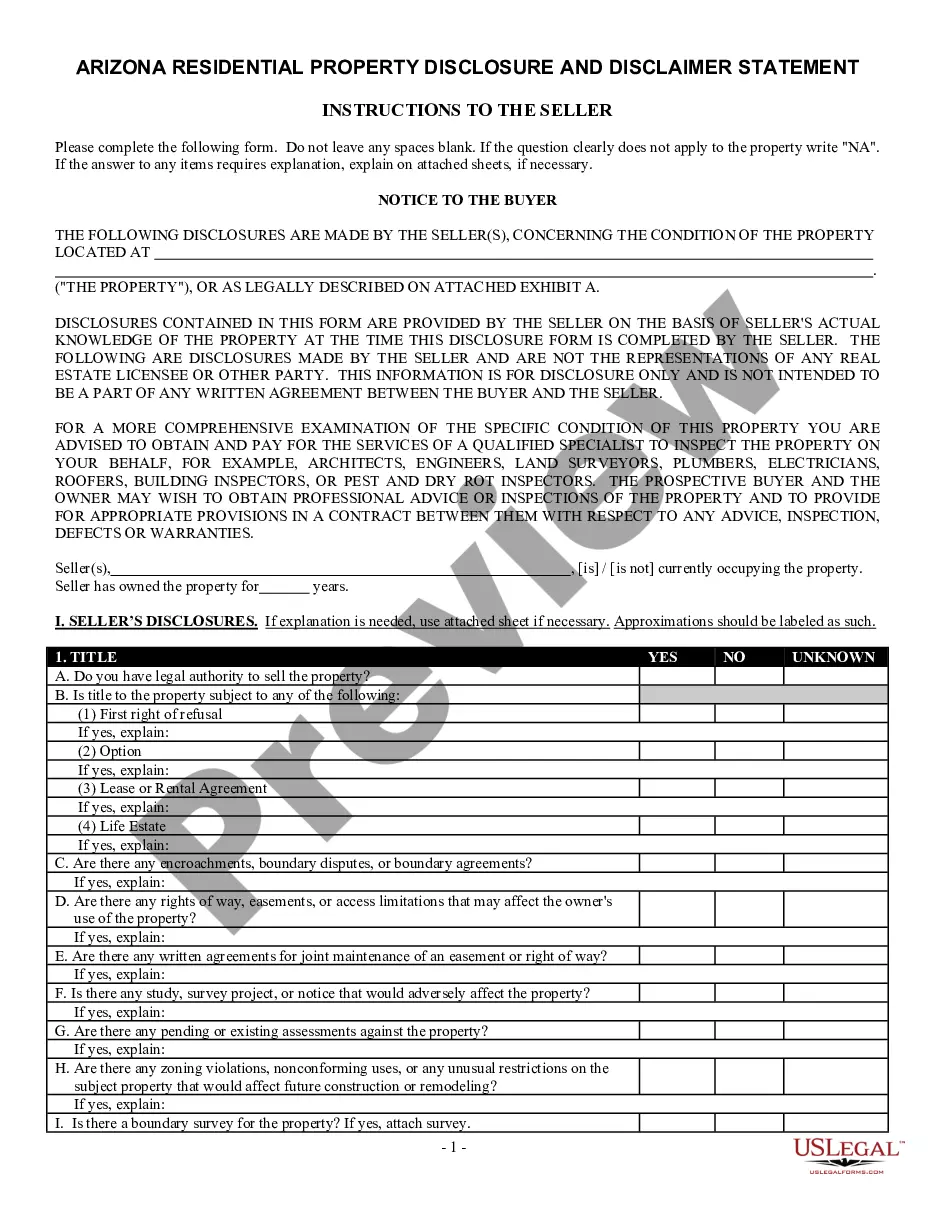

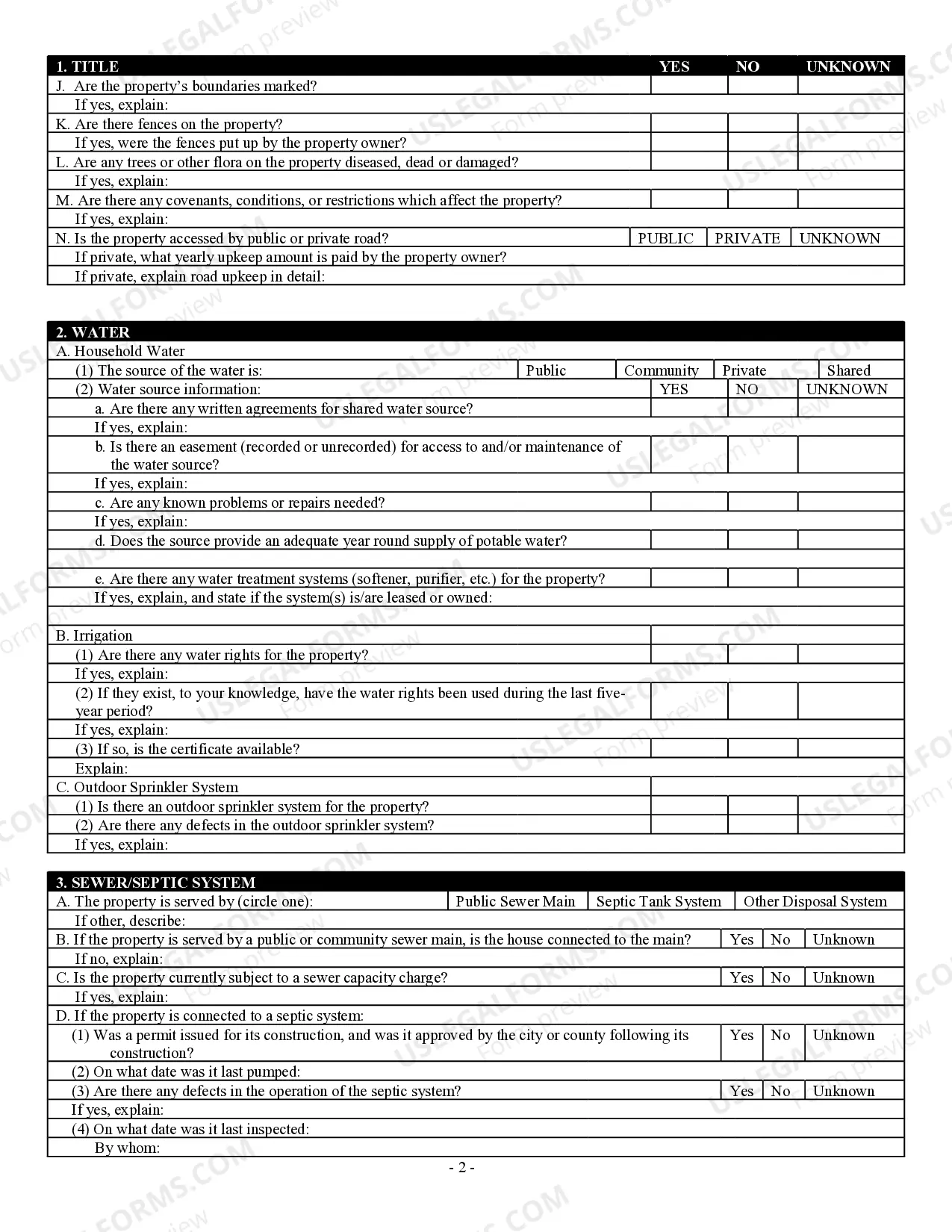

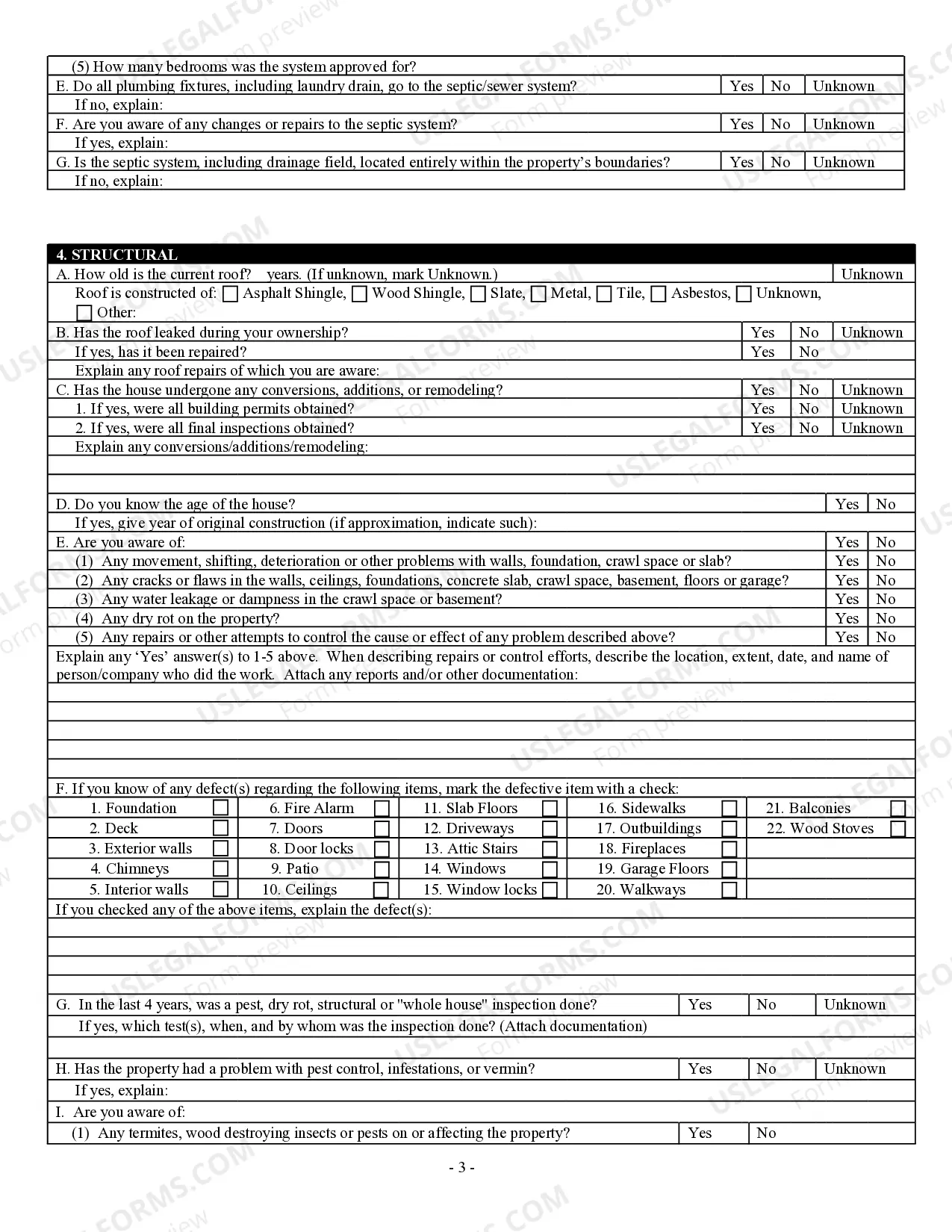

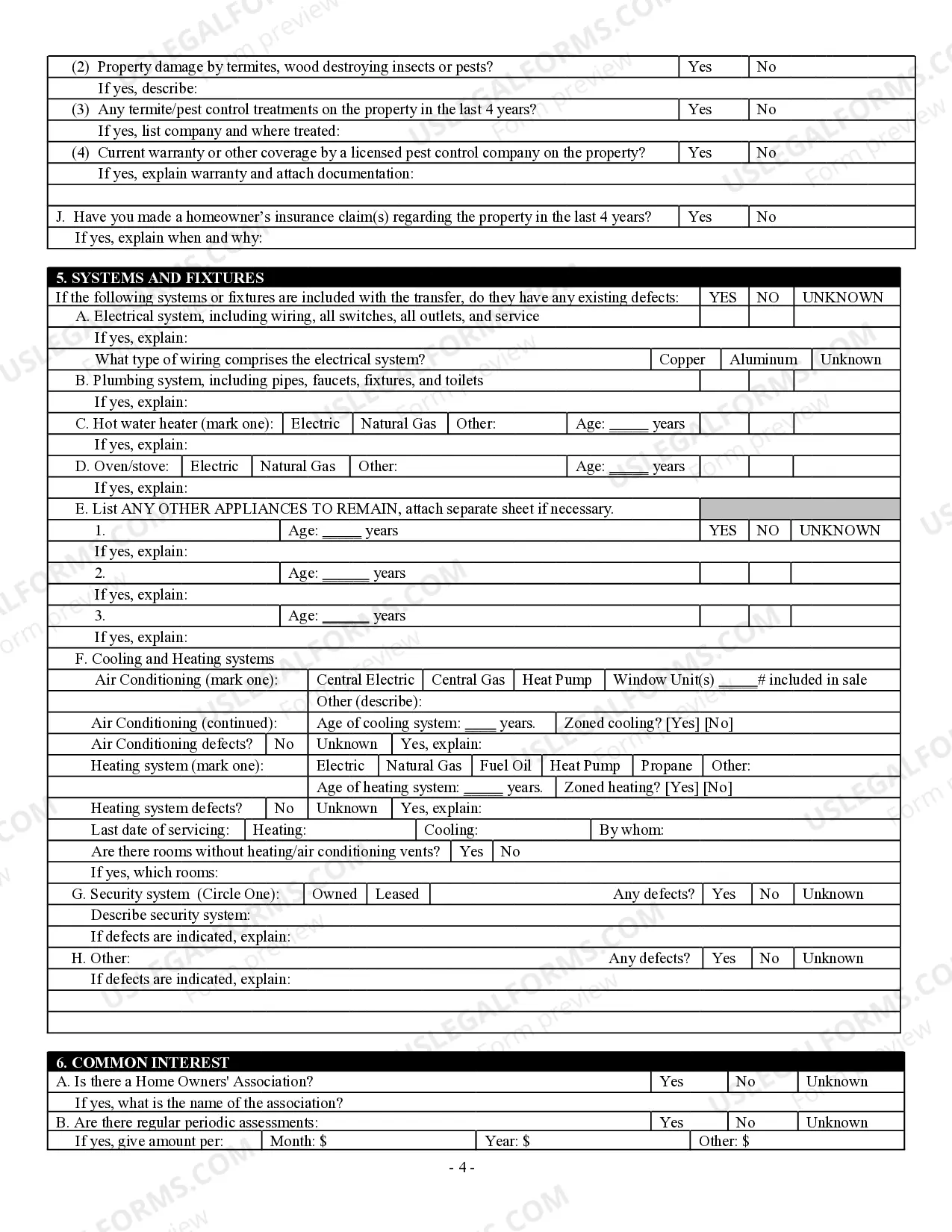

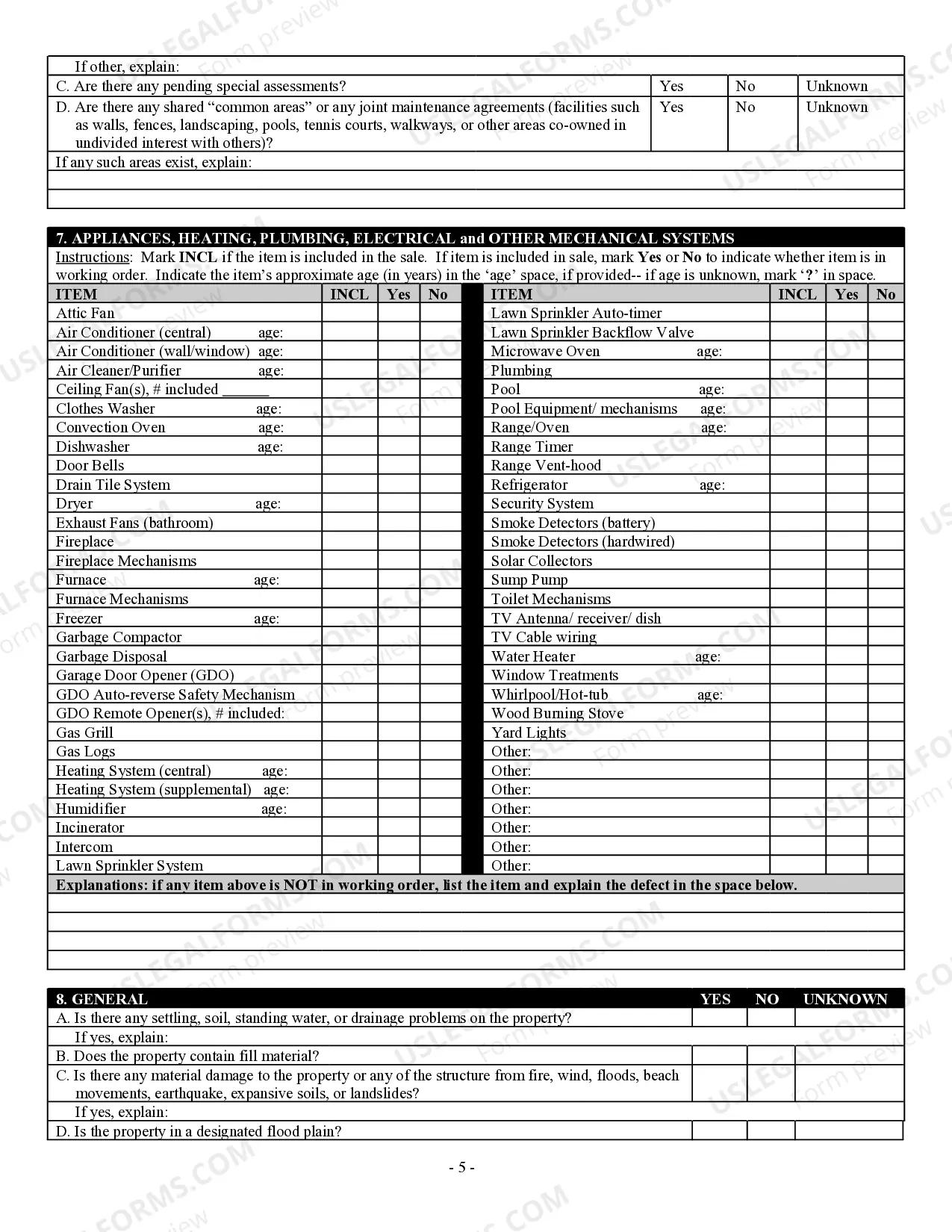

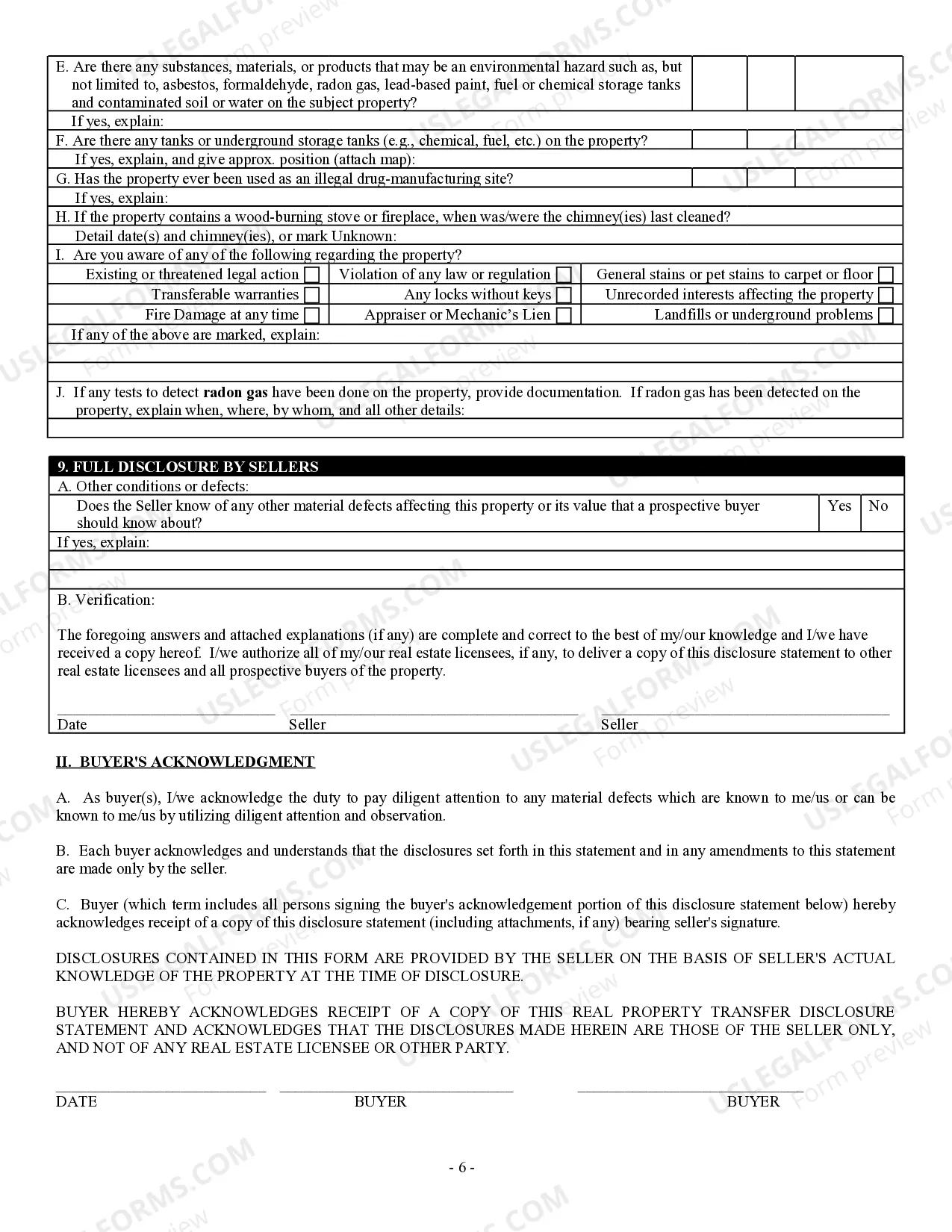

A disclosure form is a document that informs potential buyers about the condition of a property. It outlines important details regarding any known issues, repairs, or legal matters that could affect the property’s value. Understanding real estate disclosure requirements is crucial, as it helps you make informed decisions when buying or selling a home. On the US Legal Forms platform, you can easily access various disclosure forms that meet state-specific requirements.

The NC Residential Property Disclosure Act mandates sellers to provide a written disclosure statement regarding the condition of the property. This act aims to protect buyers and promote transparency in real estate transactions. Understanding real estate disclosure requirements is key to ensuring compliance.

The most common disclosure in real estate typically relates to the condition of the property. Sellers must often reveal any significant defects or issues that could affect the property's value. Adhering to real estate disclosure requirements is crucial for maintaining transparency.

The most commonly required disclosure in residential real estate involves property condition. Buyers seek out detailed information about the home’s issues, such as past repairs or pest infestations. Meeting real estate disclosure requirements builds credibility and trust in the transaction.

In New York, exceptions to the property condition disclosure statement may include properties sold as-is or transactions involving new constructions. These scenarios have specific rules that can differ from traditional sales. Understanding real estate disclosure requirements is essential to navigate these exceptions.

The new law in New York State for real estate emphasizes detailed disclosure of property conditions and hazards. This law requires sellers to provide clear, written statements to potential buyers. Following these real estate disclosure requirements helps protect all parties during the transaction.

Sellers are required to disclose situations like previous insurance claims related to property damage. This ensures buyers are aware of any potential risks. Meeting real estate disclosure requirements creates more trust in the buying process.

Most seller property disclosures are required to inform buyers of the condition and history of the property. This includes known issues like plumbing problems or previous pest infestations. Understanding real estate disclosure requirements helps ensure buyers are well-informed.

A material fact that must be disclosed in North Carolina includes any history of flooding or water damage. Such information is vital for buyers when making informed decisions. Adhering to real estate disclosure requirements protects both parties involved in the transaction.

The purpose of the disclosure document in real estate is to inform potential buyers about the property's condition and any known defects. This transparency fosters accountability between sellers and buyers. Meeting real estate disclosure requirements ensures a legally compliant sale.