Limited Liability Company With The Ability To Establish Series

Description

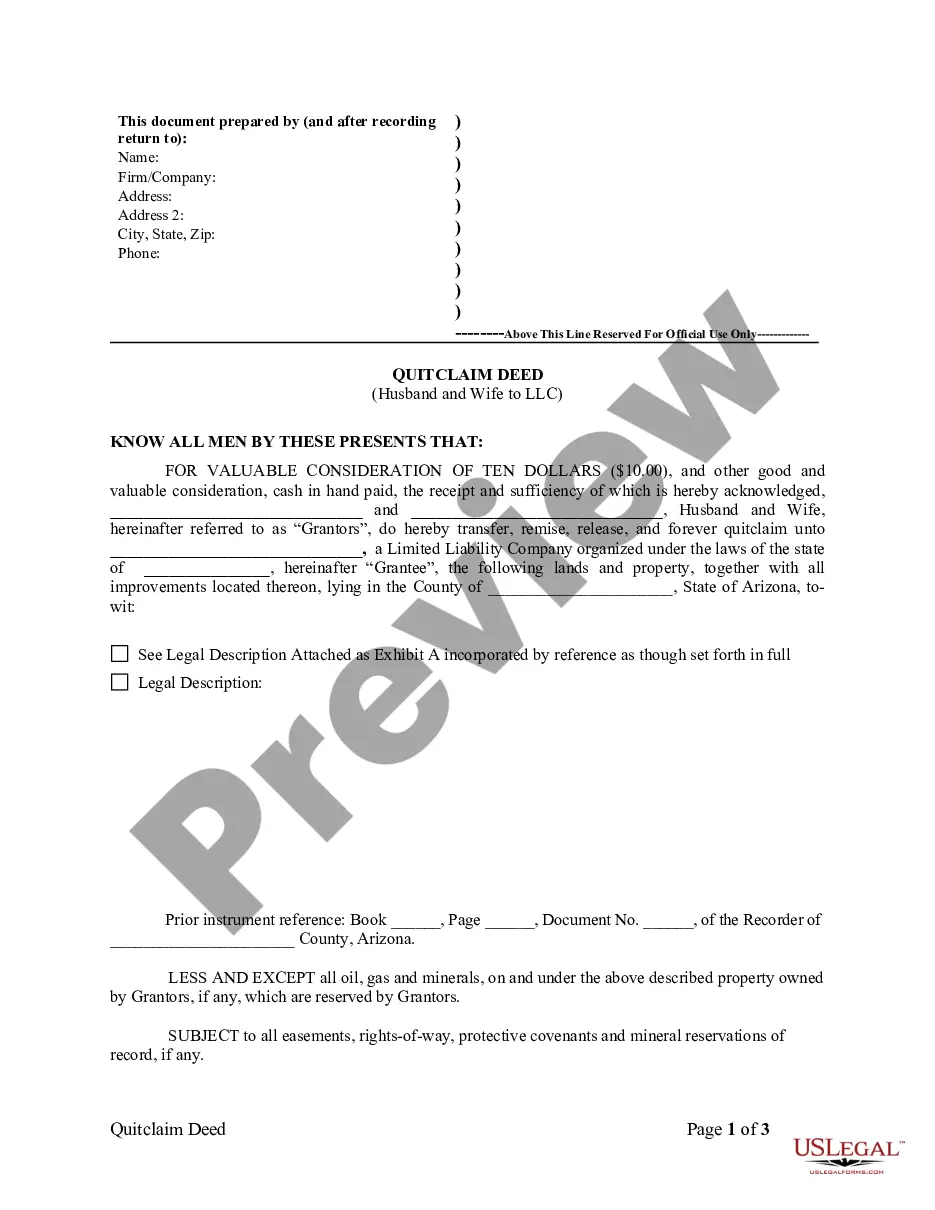

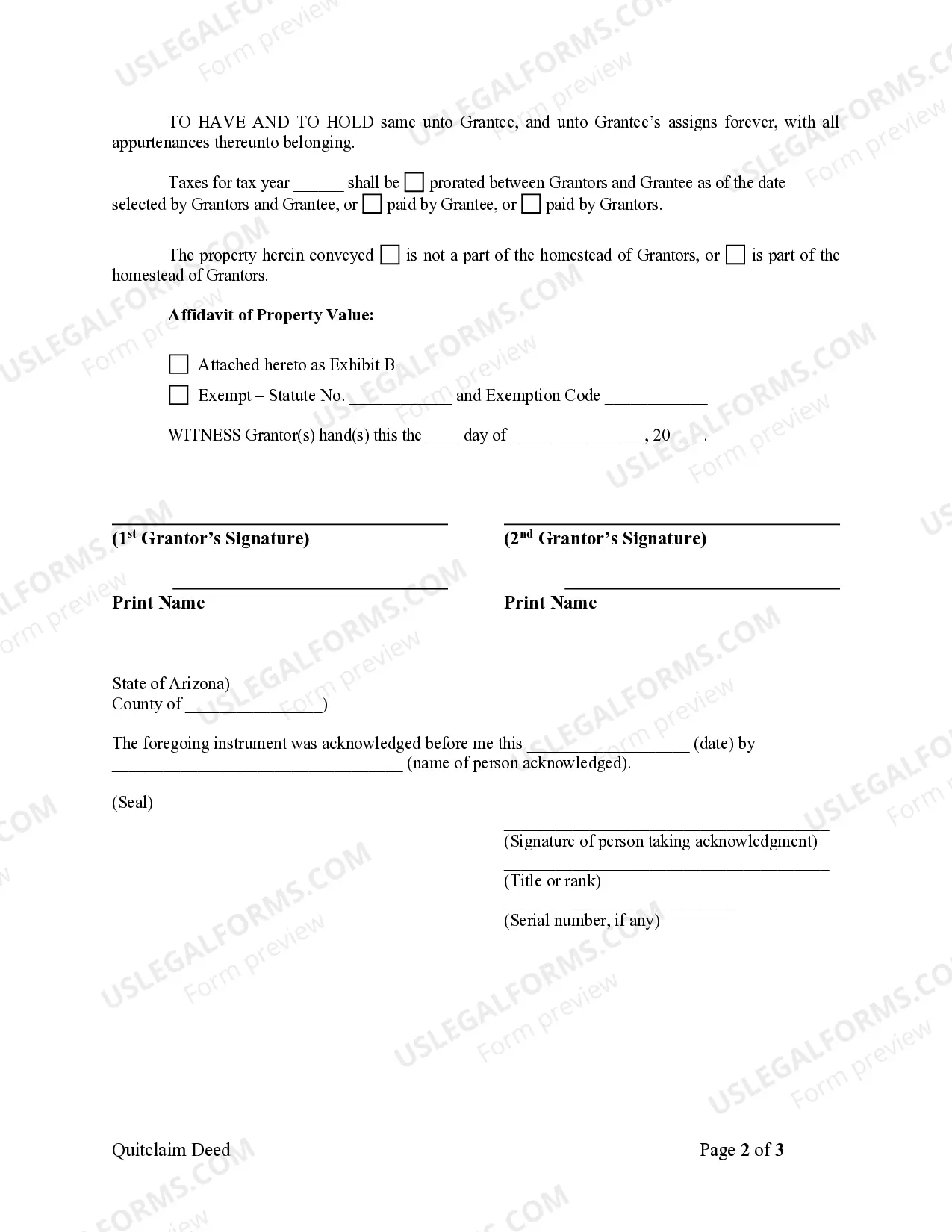

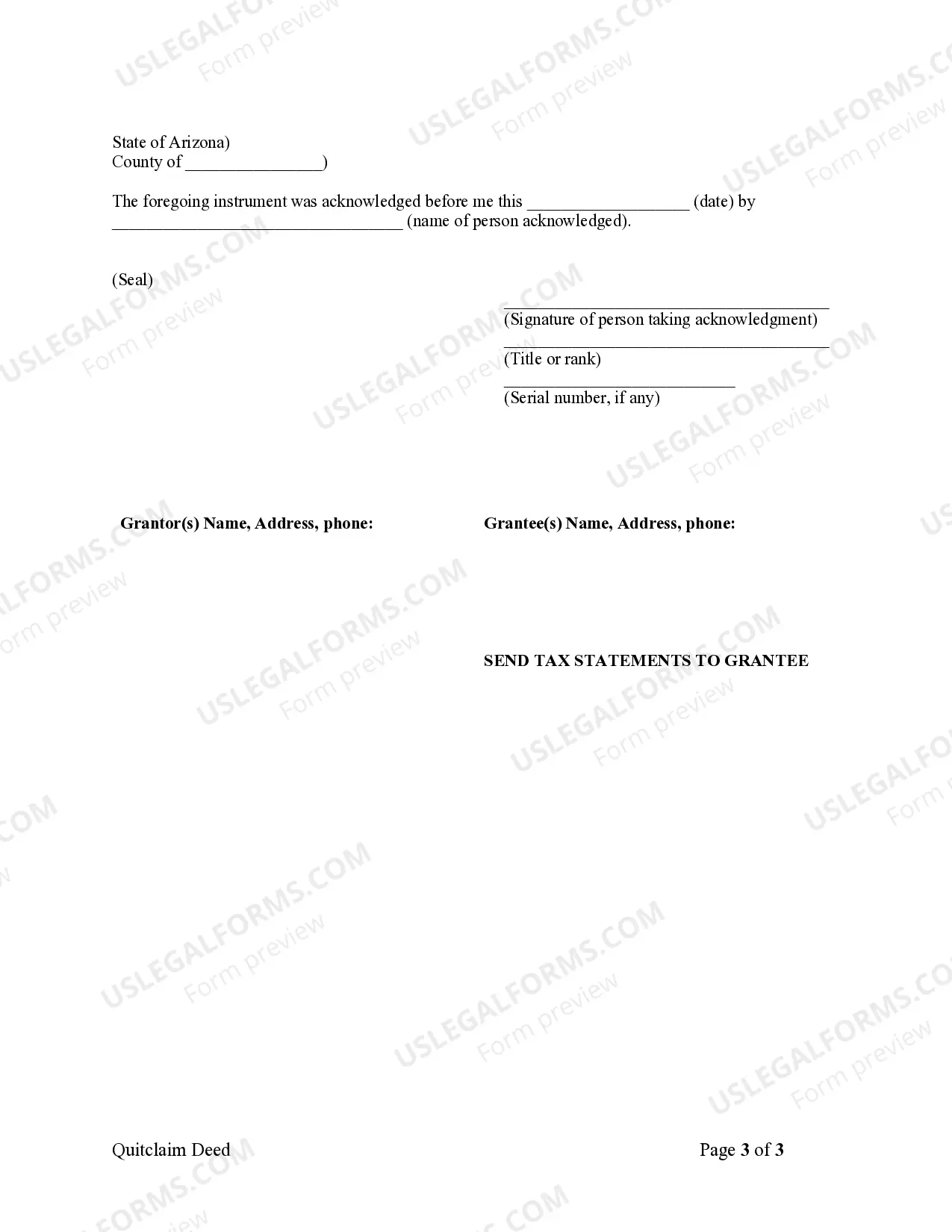

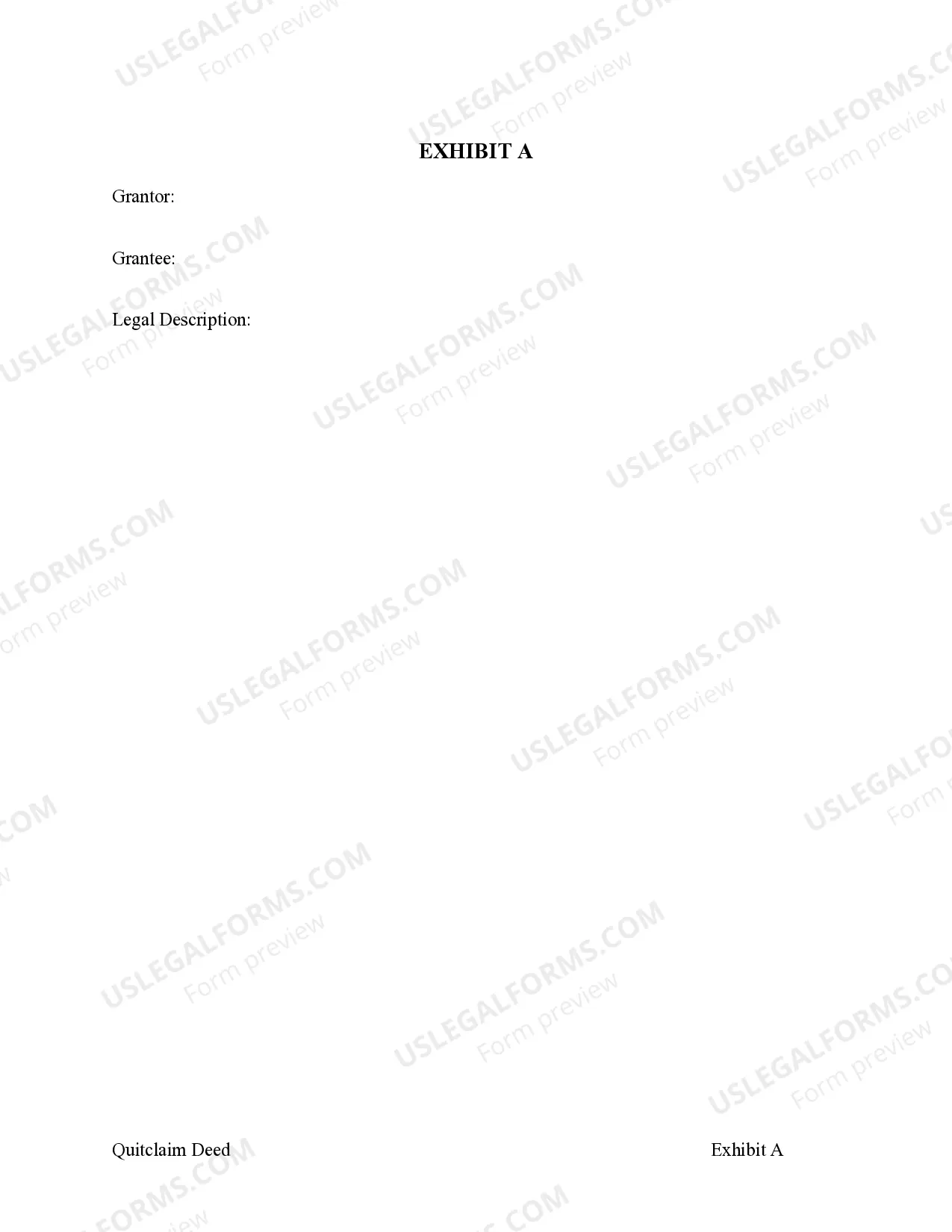

How to fill out Arizona Quitclaim Deed From Husband And Wife To LLC?

- If you're a returning user, log in to your account at US Legal Forms and locate the form you need. Click the Download button, ensuring your subscription is current. If it needs renewal, follow the prompt to update your plan.

- For first-time users, start by exploring the Preview mode and reading the form description to confirm it meets your needs and local jurisdiction requirements.

- If necessary, utilize the Search tab to find an alternate template that fits your specific situation.

- To purchase, click on the Buy Now button, select a subscription plan, and create an account to access the full library of resources.

- Proceed to enter your payment details; options include credit card or PayPal for your subscription fee.

- Once payment is complete, download the template to your device. Your form can also be found later in the My Forms section of your profile.

US Legal Forms is designed to empower individuals and attorneys by providing a comprehensive library of over 85,000 legal templates. This extensive collection includes more forms than many competitors, ensuring you find exactly what you need.

With access to premium experts who can assist you in completing your forms, you can achieve peace of mind knowing your documents are precise and legally sound. Start your journey today!

Form popularity

FAQ

To obtain an EIN for your limited liability company with the ability to establish series, you can apply online through the IRS website. The application process is straightforward and requires basic information about your business structure and type. Each series within your Series LLC should have its own EIN for tax reporting purposes. USLegalForms can help you understand these requirements and streamline your EIN application.

Yes, changing the classification of a limited liability company is possible. You may choose to reclassify your LLC from a partnership or sole proprietorship to a corporation, or vice versa. This change usually requires filing specific forms with the IRS and updating your state registration. For guidance through this process, USLegalForms provides helpful templates and advice that can simplify your experience.

An LLC with the ability to establish series is a unique legal structure that allows a single company to create multiple series, each with its own assets and liabilities. This setup can provide liability protection for each series, meaning risks cannot impact the others. It is a versatile option for entrepreneurs looking to manage diverse business ventures under one umbrella.

To convert an LLC into a Limited Liability Company with the ability to establish series, first revise your operating agreement to allow for multiple series. You will also need to file amendments with your state’s Secretary of State, ensuring that you address specific regulations. Utilizing platforms such as US Legal Forms can simplify this process by providing tailored forms and instructions.

Yes, you can change your LLC to a Limited Liability Company with the ability to establish series through a formal amendment process. This involves updating your operating agreement and submitting necessary documentation to your state. It is essential to ensure compliance with state regulations, and resources like US Legal Forms can guide you through the transition.

To convert your existing LLC into a Limited Liability Company with the ability to establish series, you must file specific documents with your state's Secretary of State. This usually involves amending your operating agreement to include provisions for the series structure. Consulting legal resources, like the US Legal Forms platform, can provide the necessary forms and guidance for this process.

Yes, each series within a Limited Liability Company with the ability to establish series typically requires its own Employer Identification Number (EIN). This helps to maintain separate identities and financial records for each series. By obtaining an EIN for each one, you ensure compliance with tax regulations and simplify bookkeeping.

Yes, you can convert your existing LLC to a series LLC, but the process may vary based on state laws. Typically, you will need to amend your existing operating agreement and file the appropriate documentation with the state. Transitioning to a limited liability company with the ability to establish series offers enhanced flexibility and protection but requires careful planning. Consulting a legal expert can help ensure a smooth conversion.

Yes, it is advisable for each series within a series LLC to have separate bank accounts. This practice helps maintain clear financial records and provides an essential layer of legal protection between the series. By keeping finances separate, you reduce the risk of mingling assets, which could complicate both accounting and legal matters. Consider utilizing tools like uslegalforms to help establish and manage these accounts effectively.

The worth of a series LLC largely depends on your business structure and objectives. If you plan to manage several ventures or properties, the reduced costs and streamlined management can provide significant value. Moreover, it protects your separate series from each other in case of liabilities. Assessing your unique situation with a financial advisor can help determine if a limited liability company with the ability to establish series aligns with your goals.