Husband And Wife

Description

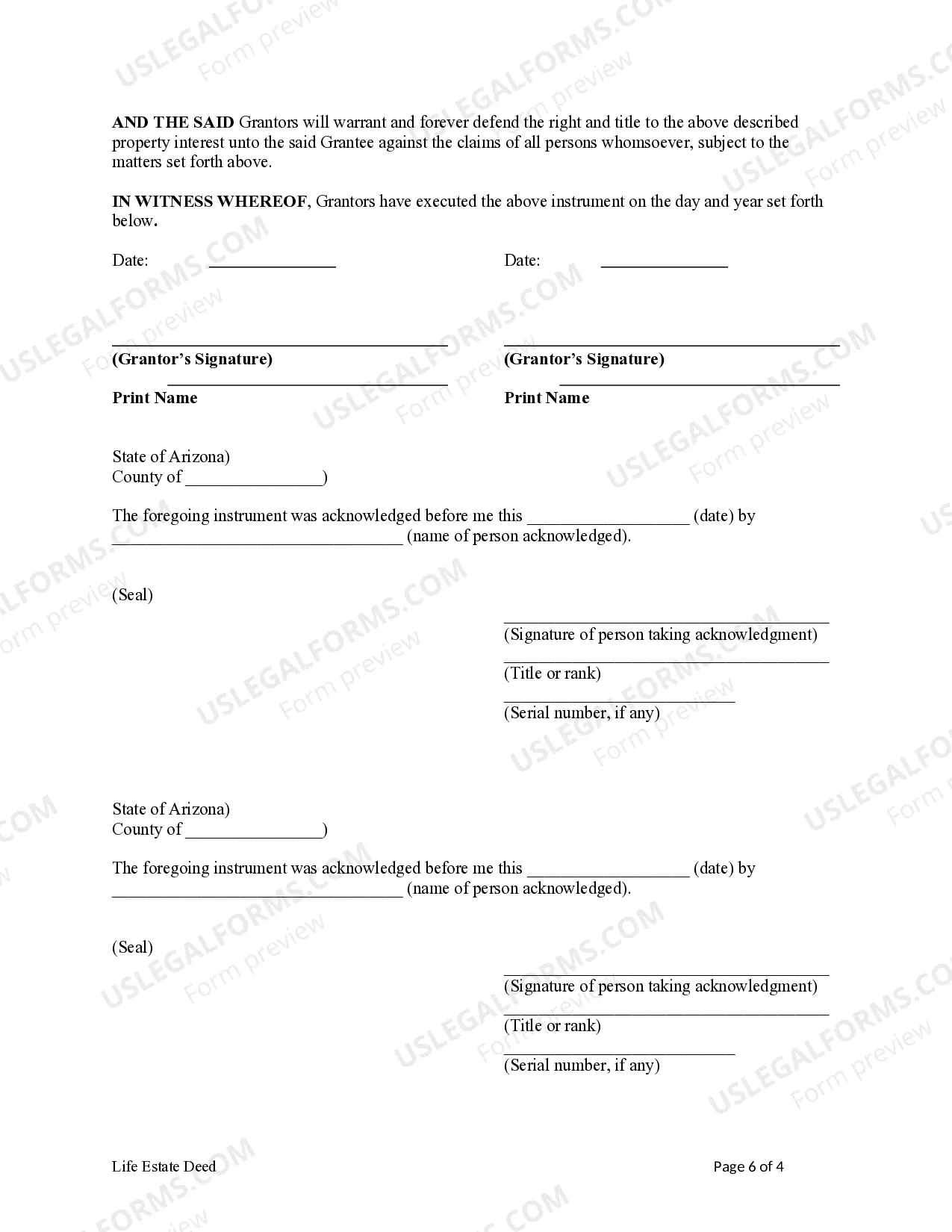

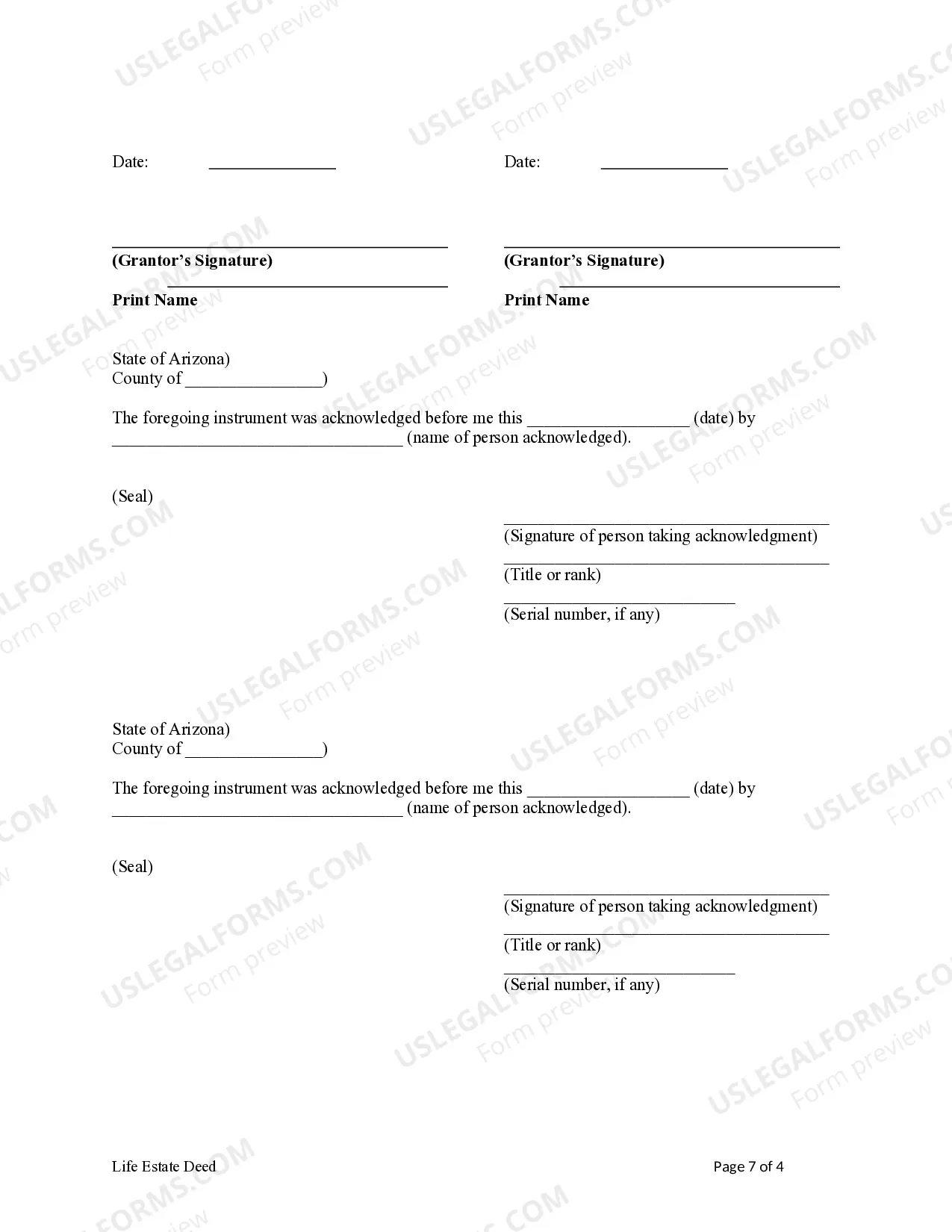

How to fill out Arizona Life Estate Deed From Two Married Couples To An Individual?

- Begin by visiting the US Legal Forms website. If you are an existing user, simply log in to access your account.

- Verify your subscription status to ensure uninterrupted access to the necessary documents. If required, update your plan accordingly.

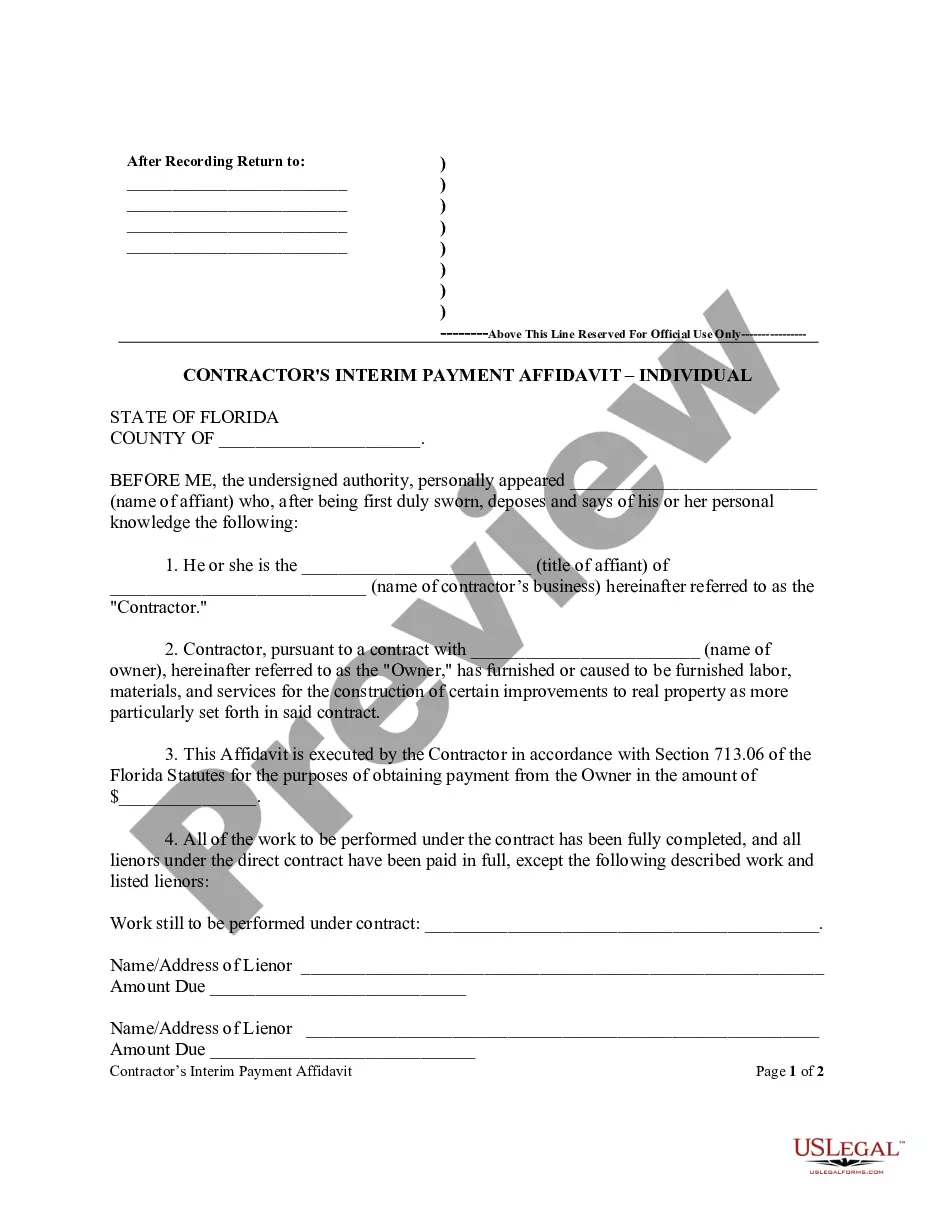

- Explore the Preview mode for descriptions of forms. It’s crucial to select a document that aligns with your needs and complies with your local jurisdiction.

- If the selected form isn't suitable, utilize the Search tab to discover other options. Identifying the correct template is key to ensuring your legal requirements are met.

- To proceed, purchase the chosen form by clicking on the Buy Now button and selecting your preferred subscription plan, creating an account if you haven’t already.

- Finalize the payment process by entering your credit card information or opting for PayPal. Following this, your form will be available for download.

- Save the completed template to your device, and access it anytime through the My Forms section in your profile.

By using US Legal Forms, husband and wife can benefit from a robust collection of legal documents that suit their particular needs, ensuring a smooth legal process.

Take control of your legal requirements today! Sign up for US Legal Forms and explore the extensive library of over 85,000 forms.

Form popularity

FAQ

The best filing status for married couples is generally married filing jointly, which allows both spouses to take advantage of higher deduction limits and lower tax rates. This status also qualifies couples for various tax credits, maximizing potential tax savings. Nevertheless, evaluating individual circumstances, such as debts or significant deductions, is important. Make use of resources like uslegalforms for assistance in exploring these options.

For a husband and wife who live together, the most beneficial filing status is usually married filing jointly. This option optimizes tax advantages like a higher standard deduction and eligibility for various tax credits. However, if there are specific financial circumstances, such as one spouse incurring significant deductions, a separate filing could be more advantageous. Consulting with uslegalforms can help clarify the best option.

The filing status of married couples typically leads to lower overall taxes compared to single status, mainly due to higher deduction limits. However, if a husband and wife file separately, they may face a disadvantage in tax brackets, reducing their potential savings. Understanding how tax rates apply based on filing status is crucial. Resources from uslegalforms can assist in clarifying these nuances.

Generally, filing jointly as a husband and wife offers better tax benefits, including higher income thresholds for tax brackets and access to various credits. However, there are circumstances where filing separately may be advantageous, particularly in cases of significant medical expenses or student loans. It's wise to compare both options carefully and select the one that maximizes your tax refund. Utilizing uslegalforms can streamline this analysis.

The best way for a husband and wife to file is typically through the joint filing option. This method maximizes tax benefits, such as credits and deductions, that may not be available when filing separately. However, if one spouse has significant medical expenses or miscellaneous deductions, it may be beneficial to evaluate filing separately. Uslegalforms can guide you through this decision-making process.

Married couples who choose to file jointly must report all income on one tax return, making both spouses responsible for the information provided. A husband and wife can claim various deductions and credits that may be unavailable if they file separately. It's essential to ensure both individuals agree on the filing status, as it can affect future tax liabilities. Consulting resources from uslegalforms can simplify understanding these rules.

When a husband and wife file taxes, the best option often depends on their financial situation. By filing jointly, couples can take advantage of a higher standard deduction and potentially lower tax rates. Additionally, this option allows both spouses to combine their incomes, which can lead to significant tax savings. Using a reliable platform like uslegalforms can help ensure that you navigate the process efficiently.

The golden rule for husband and wife is to always act with empathy and kindness towards each other. Prioritizing each other's feelings and perspectives creates a harmonious relationship. Living by this rule helps couples navigate conflicts and enhances their emotional connection.

The Golden Rule for couples is to always communicate openly and honestly with each other. This means expressing needs and feelings without fear of judgment. By adhering to this rule, husband and wife can strengthen their relationship and grow together through shared experiences.

The most important thing between husband and wife is mutual respect. This respect forms the backbone of any successful partnership, allowing both individuals to feel safe and valued. When respect prevails, it fosters love, understanding, and a healthy environment in which both partners can thrive.