Estate Documents

Description

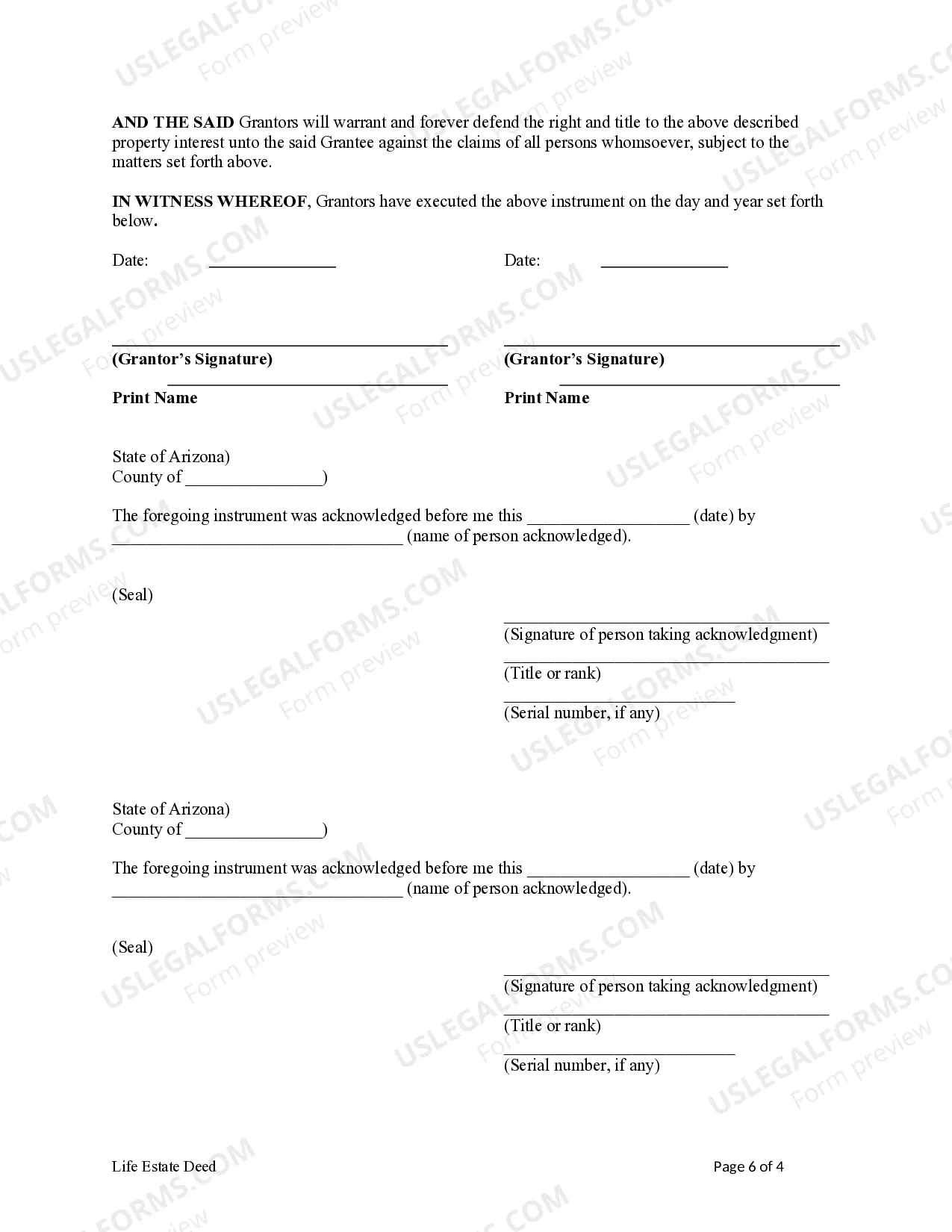

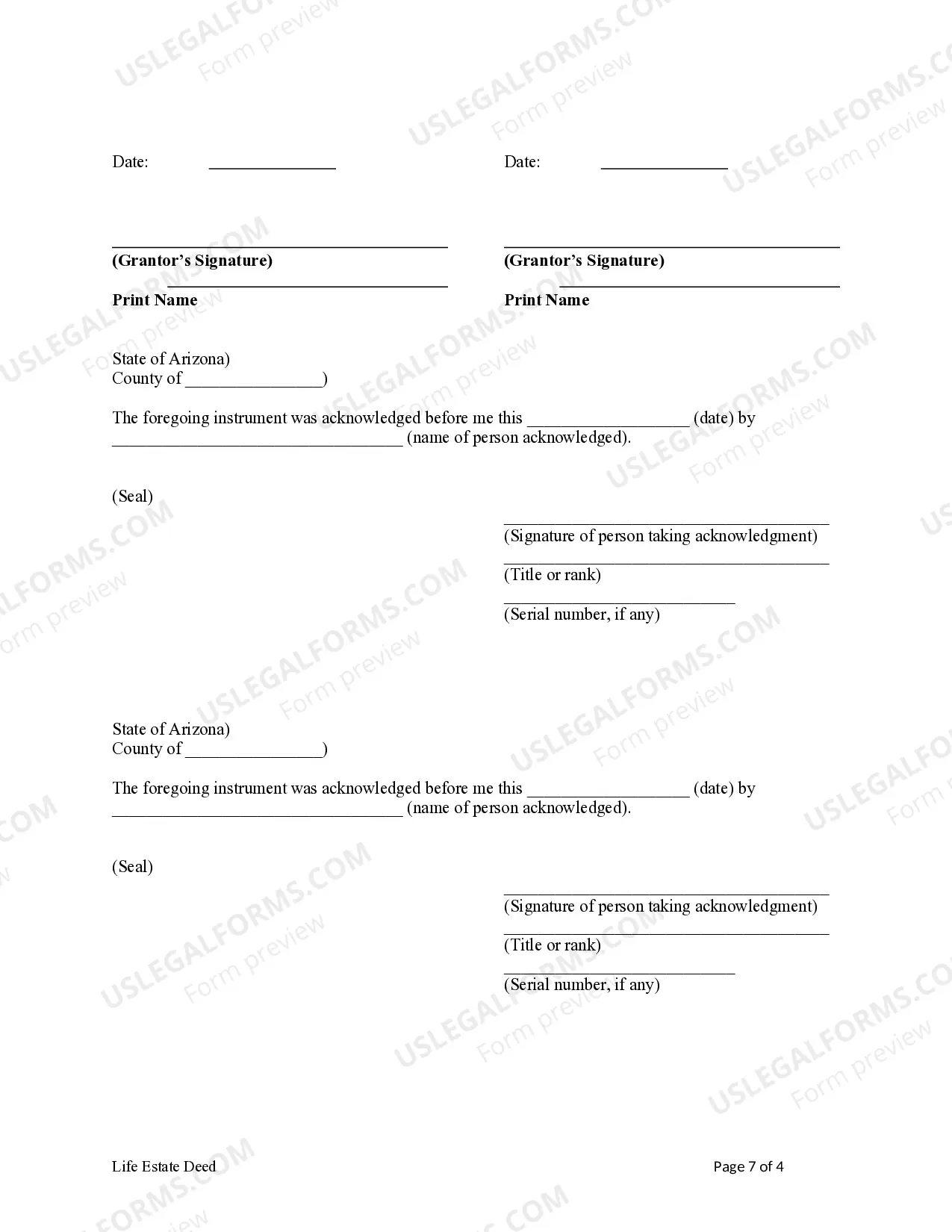

How to fill out Arizona Life Estate Deed From Two Married Couples To An Individual?

- If you are a returning user, log in to your account and click the Download button to retrieve the necessary form template. Ensure your subscription is active; if not, renew it according to your payment plan.

- For first-time users, browse through the Preview mode and review the form descriptions to ensure you’ve selected the right document that complies with local jurisdiction requirements.

- If you encounter any discrepancies or require a different template, utilize the Search tab to find the appropriate form that meets your criteria. Select it to continue.

- Purchase the document by clicking on the Buy Now button and choose your preferred subscription plan. You'll need to create an account to access the library's resources.

- Complete your purchase by entering your payment information, either through credit card or PayPal, to finalize your subscription.

- Download the form to your device, allowing you to fill it out easily, and access it later through the My Forms menu in your profile.

In conclusion, US Legal Forms offers a powerful solution for acquiring estate documents with ease. Their diverse collection and expert assistance ensure you create precise and legally sound documents. Take the next step towards securing your legal needs today!

Explore the benefits of US Legal Forms and get started on your intended documents now.

Form popularity

FAQ

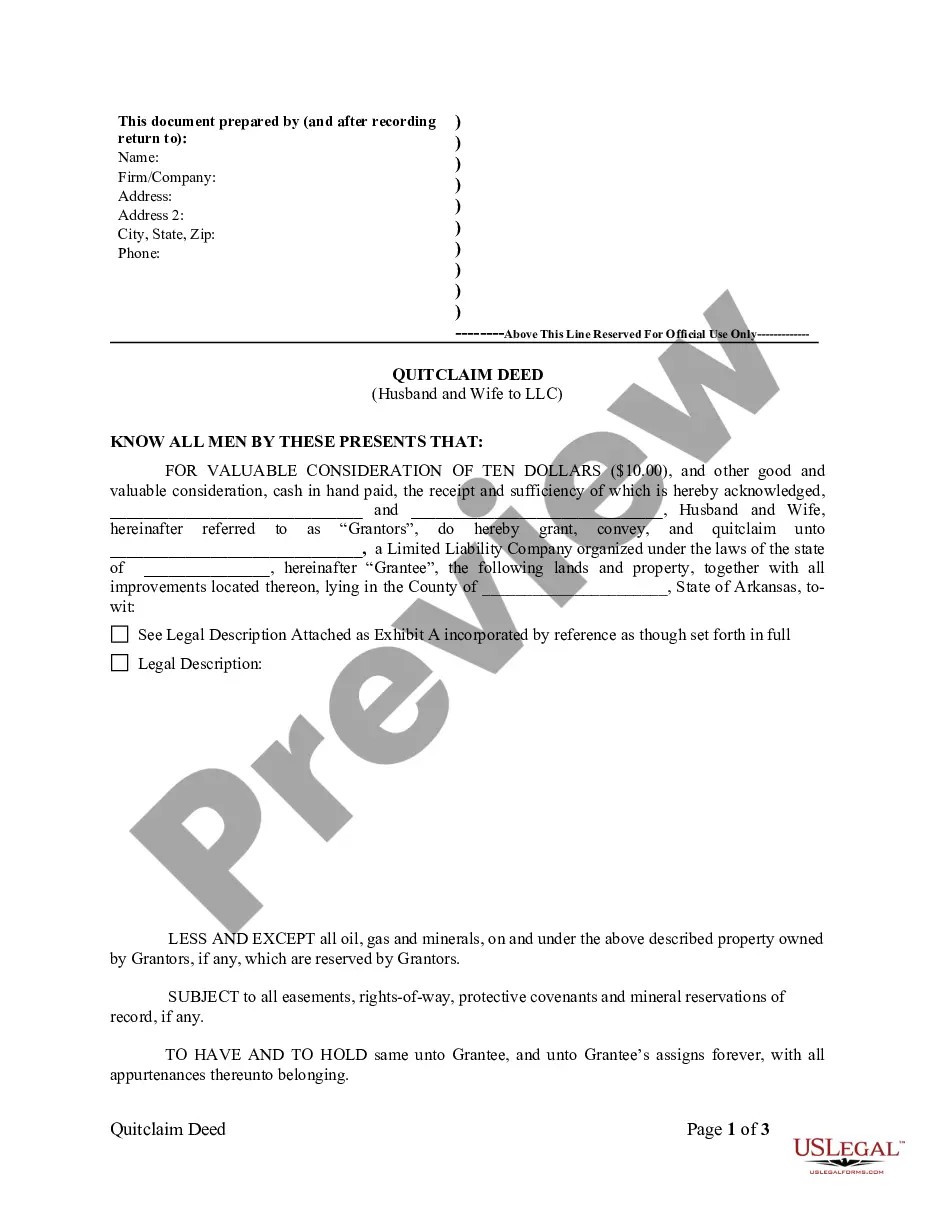

Estate documents are legal papers that outline how a person's assets and responsibilities should be managed during their lifetime and after their death. These documents define your wishes regarding property distribution, healthcare decisions, and financial management. By creating these essential estate documents, you ensure that your intentions are honored and that your loved ones are cared for. US Legal Forms can help you draft these crucial documents with ease.

The 5 D's of estate planning refer to five key aspects: death, disability, divorce, disinheritance, and distribution. Each factor plays an essential role in shaping an effective estate plan and highlights potential areas of concern. By addressing these D's through your estate documents, you can better protect your interests and those of your loved ones. Use US Legal Forms to find the tools needed to incorporate these elements into your estate planning.

The most important component of your estate plan is the last will and testament. This fundamental estate document outlines how your assets should be distributed after your death. It also allows you to name guardians for any dependents, giving you control over their future. To ensure your wishes are clearly expressed, consider creating your will using US Legal Forms, which provides easy access to reliable templates.

Estate planning documents typically include wills, trusts, powers of attorney, and advance healthcare directives. These estate documents facilitate the transfer of your assets and specify your wishes regarding their distribution. By properly organizing these documents, you protect your legacy and provide clear instructions for your family and loved ones. US Legal Forms offers a wide range of templates to assist you in creating these necessary estate planning documents.

Suze Orman emphasizes the necessity of four vital estate documents: a will, a living trust, a power of attorney, and a healthcare proxy. These estate documents help ensure that your wishes regarding finances and medical care are honored after your passing or if you become incapacitated. Having these documents in place provides peace of mind for you and your loved ones. You can easily prepare these essential documents using the resources available on US Legal Forms.

The four foundational estate documents usually include a last will and testament, a durable power of attorney, a healthcare power of attorney, and a living trust. Each document plays a crucial role in managing your assets, expressing your wishes, and appointing agents to act on your behalf. Together, these documents create a comprehensive estate plan that ensures your goals are met. For a seamless experience, consider using US Legal Forms to create these important estate documents.

An example of non-probate property includes assets that pass directly to a beneficiary, such as life insurance policies, retirement accounts, and properties held in joint tenancy. These assets do not enter probate, allowing for direct transfer to chosen individuals. Ensuring that your estate documents reflect these assets can help streamline the succession process and support your wishes.

Generally, you must file for probate within a certain time frame, often within 30 to 60 days after a person's death. This deadline varies by state; therefore, checking local laws is important. Prompt filing helps facilitate the distribution of estate documents and ensures that everything proceeds smoothly for the beneficiaries.

To fill out an estate inventory, start by listing all assets, liabilities, and their respective values. You should include real estate, bank accounts, investments, and personal belongings. By thoroughly documenting these items, you create clarity for your estate documents, which also aids in the probate process if it becomes necessary.

Creating a living trust stands as one of the best strategies to avoid probate. When you place your assets in a trust, you retain control while ensuring a direct transfer to beneficiaries upon your passing, without court involvement. It's essential to recognize the value of incorporating trusts into your estate documents to streamline the distribution process.