Arizona Beneficiary Deed Form

Description

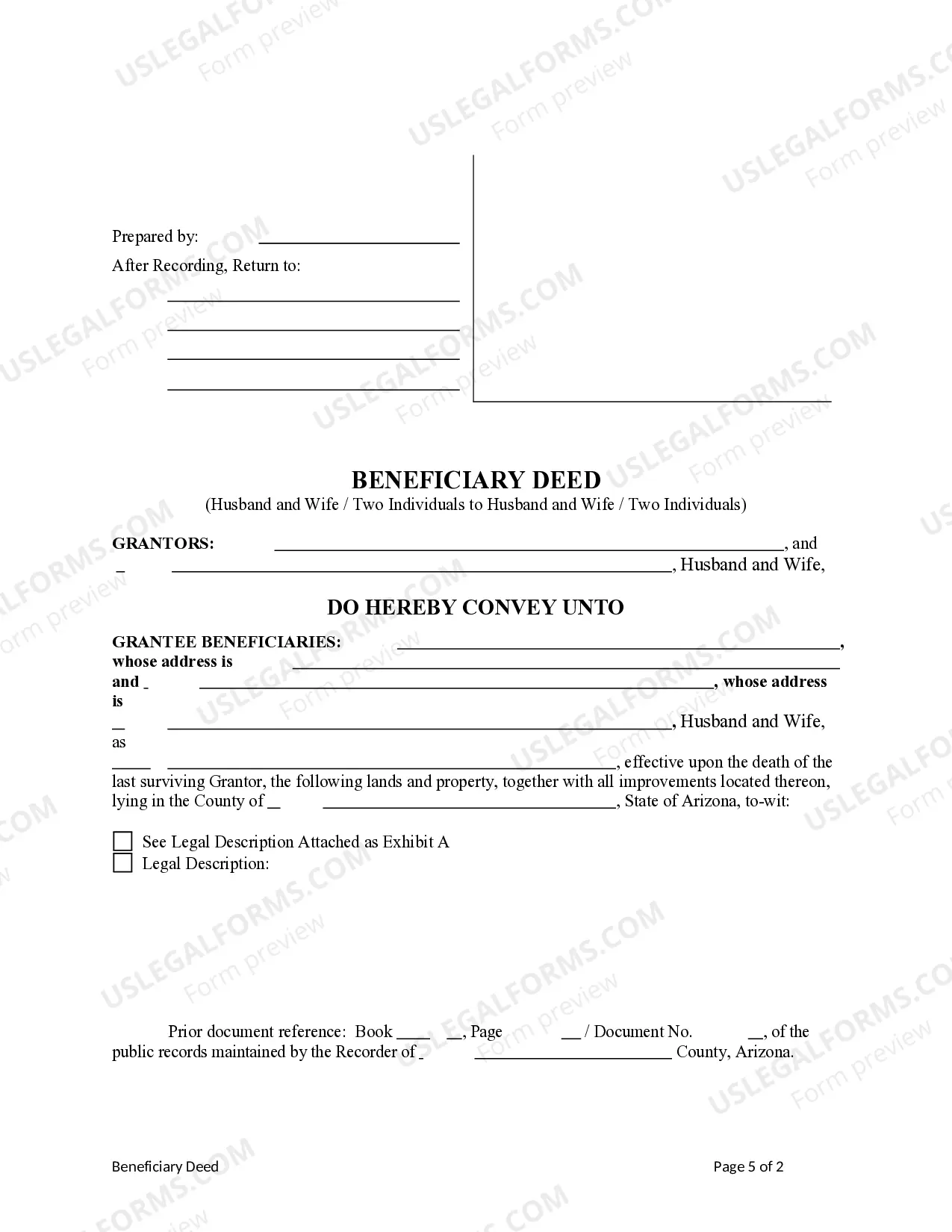

How to fill out Arizona Beneficiary Or Transfer Of Death (TOD) Deed - Husband And Wife / Two Individuals To Husband And Wife / Two Individuals?

When you are required to complete the Arizona Beneficiary Deed Form that adheres to your local state's statutes and rules, there may be numerous alternatives to select from.

There's no need to verify every form to ensure it fulfills all the legal requirements if you are a subscriber of US Legal Forms.

It is a dependable resource that can assist you in acquiring a reusable and current template on any topic.

Utilize the Preview mode and review the form description if available.

- US Legal Forms is the largest online directory with a collection of over 85k ready-to-utilize documents for business and personal legal matters.

- All templates are validated to comply with each state's regulations.

- Thus, when downloading the Arizona Beneficiary Deed Form from our site, you can trust that you possess a legitimate and recent document.

- Obtaining the needed sample from our platform is incredibly simple.

- If you already have an account, just Log In to the system, verify that your subscription is valid, and save the selected file.

- In the future, you can access the My documents tab in your profile and keep access to the Arizona Beneficiary Deed Form at any time.

- If it's your first time using our website, please follow the instructions below.

- Visit the suggested page and check it for alignment with your criteria.

Form popularity

FAQ

A beneficiary deed and a transfer on death (TOD) designation both allow property to pass outside of probate, but they function differently. The Arizona beneficiary deed form allows you to name beneficiaries who will receive your property upon your death. In contrast, a transfer on death designation is primarily used for financial accounts and does not require the same formalities as a beneficiary deed. Understanding these distinctions can help you choose the right method for your estate planning needs.

To get a beneficiary deed form, you can visit specific legal websites that specialize in estate planning documents. US Legal Forms provides downloadable and customizable beneficiary deed forms tailored for Arizona. This platform simplifies the process by offering clear instructions and guidance, making it easier for you to ensure everything is filled out correctly. Utilizing a dedicated service allows you to expedite your document preparation with ease.

You can obtain a beneficiary deed in Arizona through various sources, such as local government offices, legal service providers, or online platforms. One efficient way is to visit US Legal Forms, which offers a comprehensive library of legal documents, including the Arizona beneficiary deed form. These resources ensure that you have the proper documentation to meet your needs. By using a reliable source, you can complete your estate planning with confidence.

An example of a beneficiary designation could involve a homeowner specifying that their child will inherit their house upon their death. In this case, the homeowner would complete an Arizona beneficiary deed form listing the child's name and the property's legal description. This ensures a smooth transfer of ownership, allowing the child to receive the property outside of the probate process.

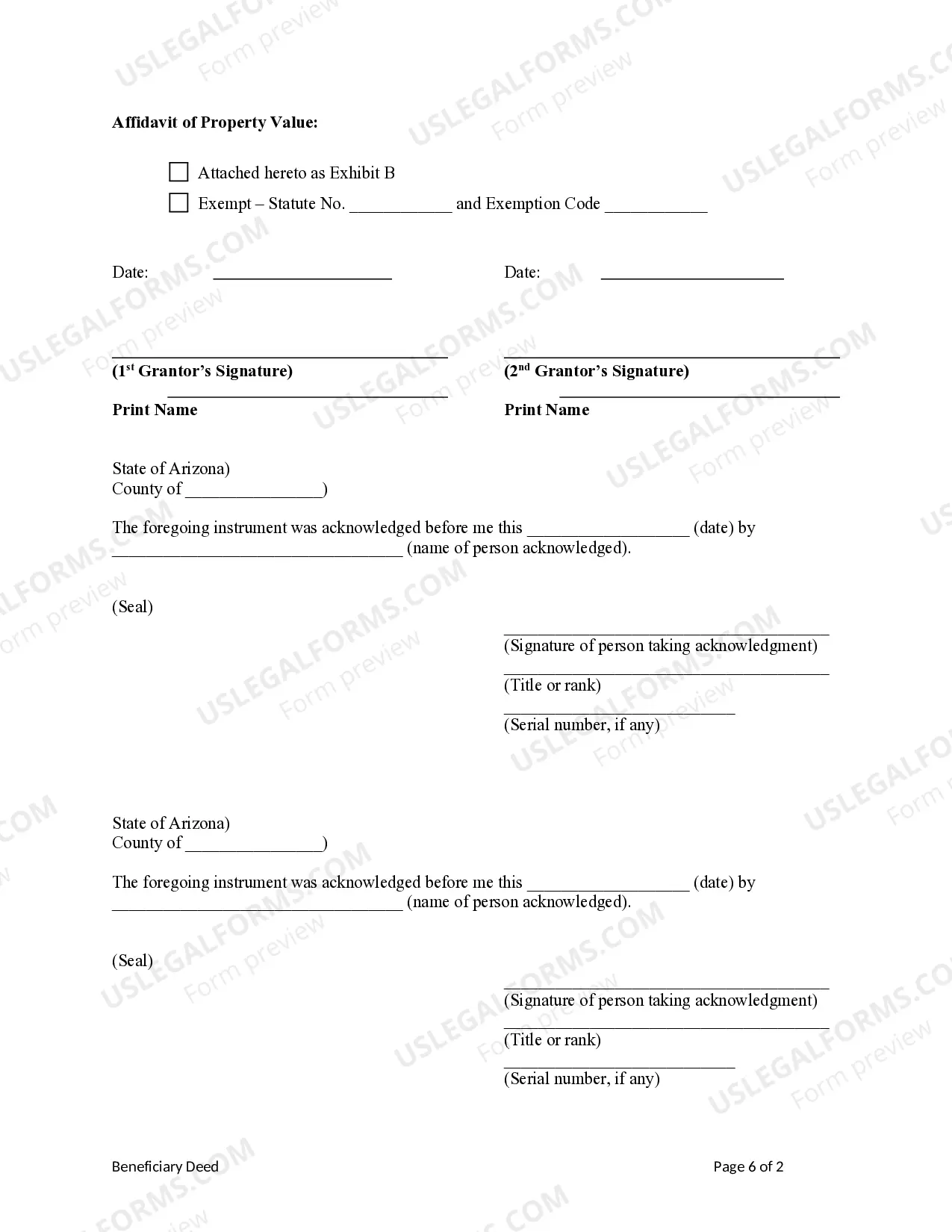

To create a beneficiary deed in Arizona, you’ll need to draft the deed using specific language and information about your property and beneficiaries. After that, sign the document in front of a notary and record it with the county recorder's office. This deed must be executed during your lifetime, and it's wise to consult an attorney or use an Arizona beneficiary deed form as a template to ensure it meets legal requirements.

Filling out beneficiary details involves accurately listing each beneficiary's name, address, and the percentage of the property they will receive. Ensure you double-check for any spelling errors to avoid confusion in the future. Additionally, it is wise to confirm that each beneficiary is aware of their designation and is prepared to manage the property. A precise approach is essential when working with the Arizona beneficiary deed form.

To fill out a designation of beneficiary form, begin by providing your name and identifying the associated property. Clearly state the name and contact details of the beneficiary, along with any percentage interest they will receive. Lastly, date and sign the form; this ensures that it is legally binding. Utilizing an Arizona beneficiary deed form can simplify this process and provide a clear outline for the transfer.

When specifying a beneficiary percentage, consider how you want to divide your property among beneficiaries. You can allocate equal shares, or assign different percentages based on your wishes. For example, you might want one beneficiary to receive 50% and another to receive 30%. Make sure that the total percentage always equals 100% when using the Arizona beneficiary deed form to avoid confusion.

Adding someone to a deed in Arizona can have several tax implications. Generally, this may be seen as a gift, which could trigger gift tax reporting if the value exceeds certain limits. Furthermore, it may impact property taxes if the new owner becomes responsible for these taxes. It’s advisable to consult with a tax professional for personalized guidance regarding your specific situation involving the Arizona beneficiary deed form.

To fill out a beneficiary designation form, start by clearly identifying the property and the beneficiaries. You’ll need to include the name, address, and relationship of each beneficiary. Additionally, make sure the form complies with local laws, and consider using an Arizona beneficiary deed form for added clarity. This helps to prevent any potential disputes or confusion later.