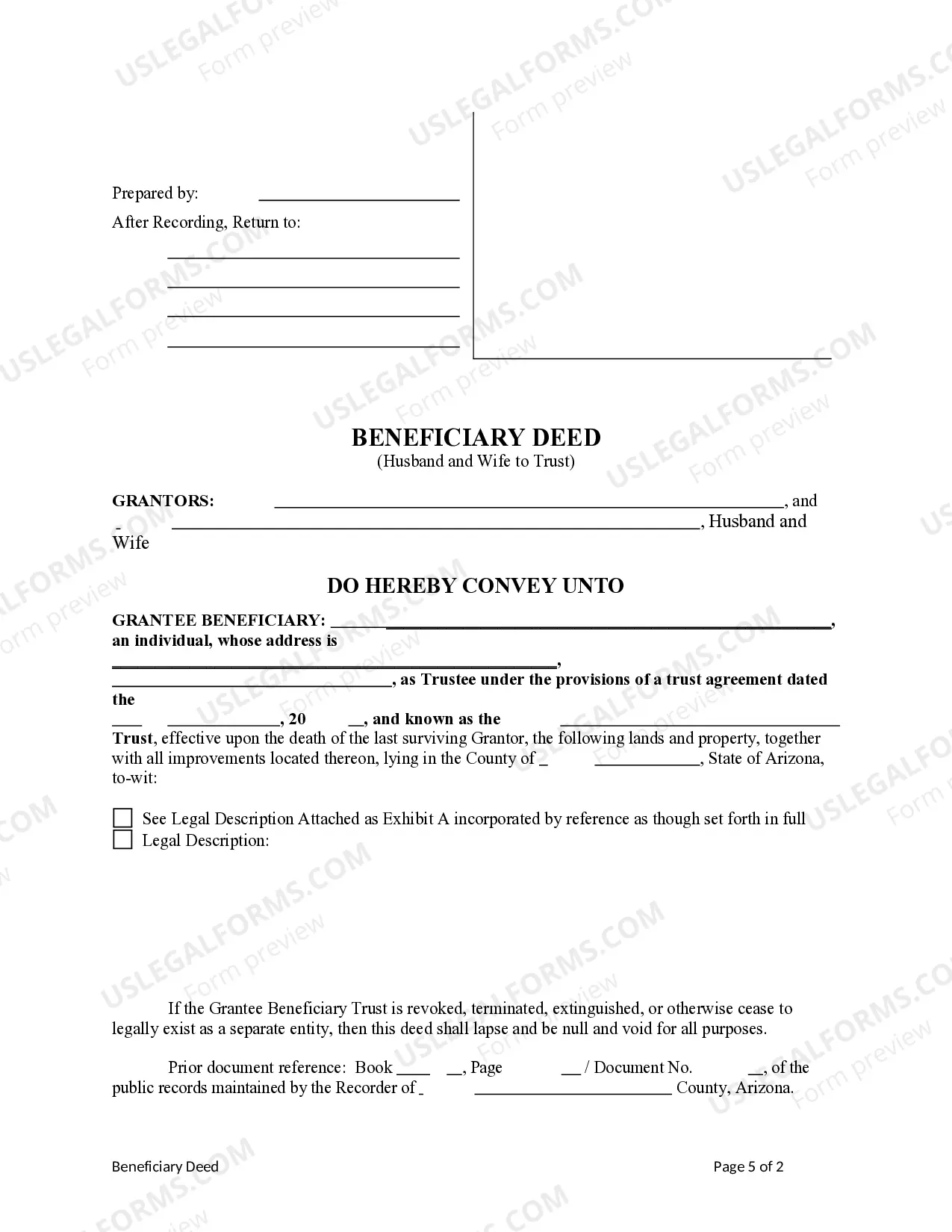

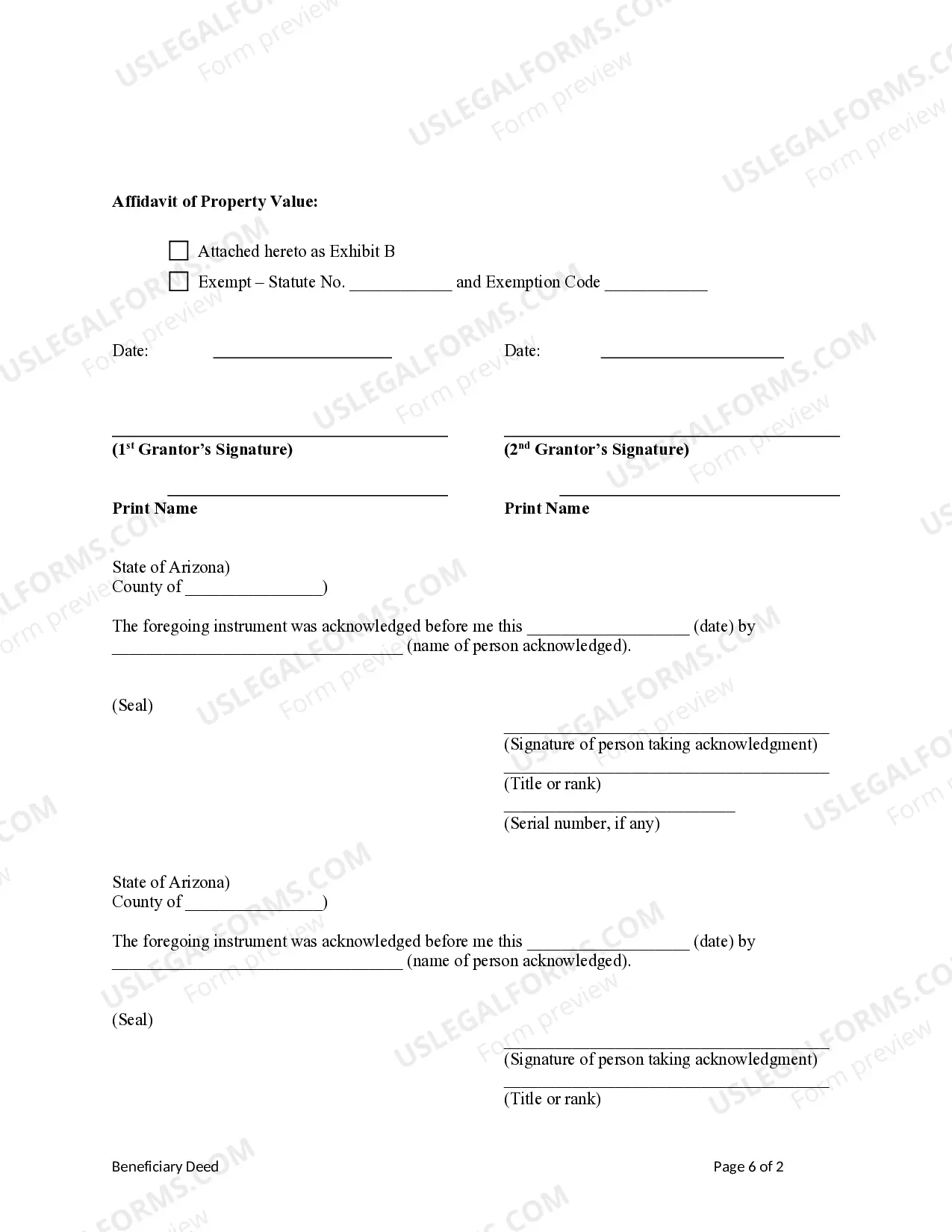

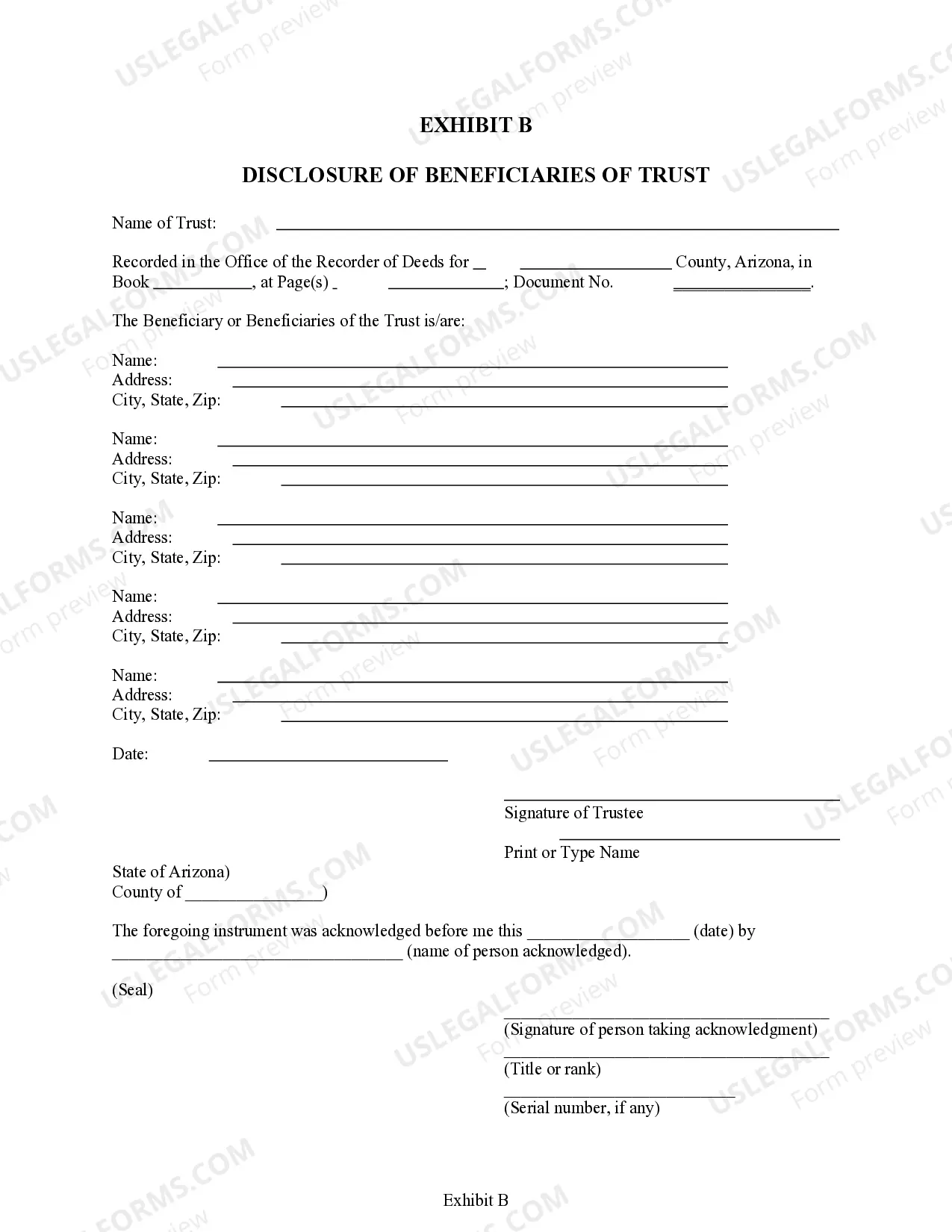

This form is a Beneficiary or Transfer on Death Deed where the Grantors are husband and wife and the Grantee Beneficiary is a Trust. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. The deed is not effective unless recorded before the death of the last surviving Grantor. This deed complies with all state statutory laws.

Beneficiary Deed Trust With Income

Description

How to fill out Arizona Beneficiary Deed From Husband And Wife To Trust?

Individuals typically link legal documentation with a process that is intricate and requires expert intervention.

In a sense, this is accurate, because creating a Beneficiary Deed Trust With Income demands extensive understanding of relevant criteria, which includes local and regional laws.

However, with US Legal Forms, the situation has become simpler: a collection of ready-made legal templates tailored for various life and business circumstances specific to state legislation is now gathered in a single online repository and is accessible to everyone.

All templates within our collection are reusable: once purchased, they remain saved in your profile. You can access them whenever necessary through the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe now!

- US Legal Forms offers over 85,000 current forms categorized by state and purpose, allowing you to find the Beneficiary Deed Trust With Income or any other specific template in just a few minutes.

- Users who have already registered and possess a valid subscription must Log In to their account and click Download to obtain the form.

- New users to the platform must first create an account and subscribe before they can store any paperwork.

- Here is a detailed guide on how to acquire the Beneficiary Deed Trust With Income.

- Review the content of the page thoroughly to ensure it meets your requirements.

- Read the form description or view it via the Preview option.

- If the previous form does not meet your needs, find another sample using the Search bar in the header.

- Once you locate the correct Beneficiary Deed Trust With Income, click Buy Now.

- Choose a subscription plan that aligns with your needs and financial situation.

- Log In or create an account to continue to the payment page.

- Complete your subscription payment through PayPal or with your credit card.

- Choose your file format and click Download.

- Print your document or upload it to an online editor for faster completion.

Form popularity

FAQ

The income beneficiary of a trust is the individual or entity entitled to receive income generated from the trust's assets. In the case of a beneficiary deed trust with income, this arrangement aims to provide a source of income for the designated beneficiary, ensuring financial support over time. Understanding the role of the income beneficiary can enhance estate planning and asset management.

Distributing income from a trust usually involves following the trust’s specific provisions regarding payouts. For a beneficiary deed trust with income, the trustee manages the income generated and oversees its distribution to beneficiaries as outlined in the trust document. Clear communication among beneficiaries can help prevent misunderstandings during this process.

Beneficiary income refers to the payments or distributions that a beneficiary receives from a trust's assets. In the context of a beneficiary deed trust with income, this income can come from various sources, such as rental income or interest earnings. Understanding how this income is calculated and distributed is essential for effective financial planning.

A life income beneficiary is someone who receives income from a trust for their lifetime. In a beneficiary deed trust with income, this means the beneficiary benefits from the income generated by the trust until they pass away, at which point the trust assets may transfer to other beneficiaries. This arrangement can provide financial stability for the beneficiary.

To obtain a trust deed, you typically need to draft one that meets legal requirements, which can be complex. Using platforms like US Legal Forms can simplify this process, offering templates tailored for various situations, including a beneficiary deed trust with income. Consulting with an attorney may also help ensure your trust deed aligns with state laws.

Yes, you can designate yourself as a beneficiary of a trust, allowing you to benefit from its assets during your lifetime. This strategy is often used in a beneficiary deed trust with income, ensuring you receive steady income while you are alive. However, it is important to consider the implications this might have on your estate and taxes.

The income beneficiary receives the income generated by the trust's assets, such as interest or dividends, while the capital beneficiary gains access to the trust assets upon its termination. In the context of a beneficiary deed trust with income, this distinction helps you understand who receives what, and when. Knowing how these roles interact is crucial for effective estate planning.

Foreign trusts can be subject to specific tax rules when they involve UK taxpayers. Generally, the income and gains from a foreign trust may need to be reported to HMRC. If you're considering a Beneficiary deed trust with income that crosses international borders, be mindful of the tax implications that may arise. Engaging a tax professional with expertise in cross-border trusts will help you stay compliant and plan effectively.

To avoid inheritance tax with a trust in the UK, you need to consider establishing a trust that qualifies for tax exemptions. A Beneficiary deed trust with income can provide strategic advantages in estate planning, particularly if you structure it to fall within certain allowances. Additionally, ensure you're aware of the seven-year rule, which affects how gifts are treated for tax purposes. Consulting with a tax expert will help you navigate the complexities.

Yes, you can take income from a gift trust, but it depends on the type of trust you establish. In particular, a Beneficiary deed trust with income is designed to allow income distributions to beneficiaries while preserving the principal. It's crucial to understand the specific terms of your trust, as these will dictate how and when income can be accessed. Consulting a financial advisor will help clarify your options.