Death Deeds For Real Estate

Description

How to fill out Arizona Transfer On Death Or TOD - Beneficiary Deed - Individual Grantor To Three Individuals?

Creating legal documents from the ground up can occasionally be overwhelming.

Certain situations may require extensive research and substantial expenses.

If you’re looking for a more straightforward and cost-effective method of preparing Death Deeds For Real Estate or any other documents without unnecessary complications, US Legal Forms is always here to assist you.

Our online collection of over 85,000 current legal forms covers almost every aspect of your financial, legal, and personal needs.

However, before proceeding to download Death Deeds For Real Estate, please consider these suggestions: Review the form preview and descriptions to ensure you've identified the correct document. Confirm that the template you choose adheres to the regulations of your state and county. Select the most appropriate subscription plan to purchase the Death Deeds For Real Estate. Download the file, then complete, verify, and print it out. US Legal Forms is well-regarded and boasts over 25 years of experience. Join us today and make document preparation easy and efficient!

- With just a few clicks, you can swiftly acquire state- and county-specific forms expertly assembled for you by our legal experts.

- Utilize our platform whenever you require dependable and trustworthy services to quickly find and download the Death Deeds For Real Estate.

- If you’re familiar with our website and have set up an account previously, simply Log In to your account, find the form and download it or re-download it anytime from the My documents section.

- Don’t have an account? No problem. It takes minimal time to register and browse the catalog.

Form popularity

FAQ

The best way to transfer real estate upon death often involves using a transfer on death deed. This method allows you to retain ownership during your lifetime while designating a beneficiary to receive the property automatically upon your death. Death deeds for real estate can help you avoid probate, making the process smoother and quicker for your loved ones. To implement this effectively, you can utilize resources from US Legal Forms to draft the necessary documents.

You do not necessarily need a lawyer to file a transfer on death deed, but having legal assistance can simplify the process. Death deeds for real estate allow you to designate a beneficiary who will receive the property upon your passing, but the requirements can vary by state. A legal professional can help ensure that the deed is properly executed and recorded, reducing the risk of future disputes. If you prefer a DIY approach, consider using platforms like US Legal Forms to access templates and guidance.

The time limit for property transfer after death can vary based on state laws and the probate process. Generally, you should aim to complete the transfer within six months to a year after the death, but this may extend depending on the complexity of the estate. It’s crucial to act promptly and file the appropriate death deeds for real estate to avoid complications. For assistance, consider using resources from US Legal Forms to help you navigate the time-sensitive aspects of the property transfer.

To obtain a deed to a house from a deceased person, you first need to determine if the property went through probate. If so, the executor will handle the transfer of the deed as part of the estate settlement process. You may also need to file death deeds for real estate to complete this transfer. Utilizing US Legal Forms can provide you with the necessary legal forms and instructions to ensure you follow the correct procedures.

To transfer property after death, you typically need to follow the probate process. This process involves validating the deceased person’s will, if one exists, and appointing an executor to manage the estate. You will also need to obtain death deeds for real estate, which legally facilitate the transfer of ownership to heirs or beneficiaries. Using platforms like US Legal Forms can simplify this process by providing the necessary documents and guidance.

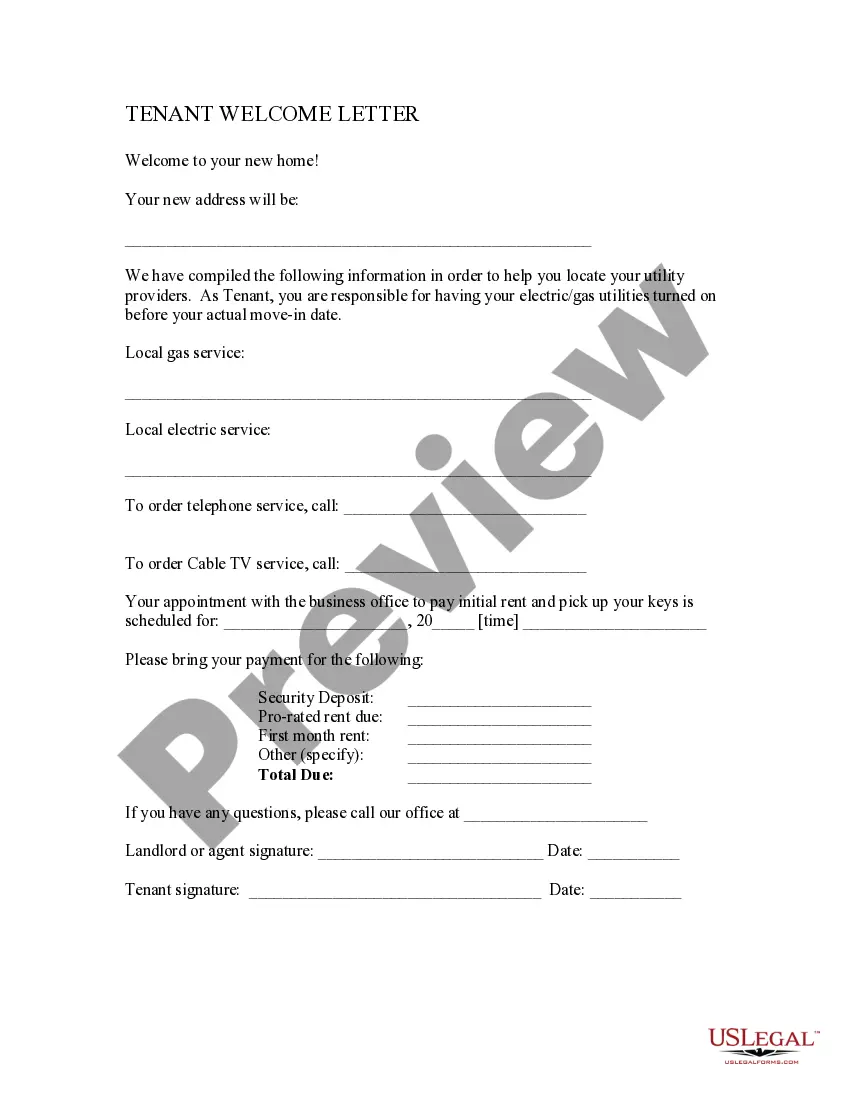

To fill out a transfer on death deed form, start by accurately entering your name and address as the property owner. Then, include the name and address of the chosen beneficiary. Make sure to provide a clear legal description of the property. Using US Legal Forms can make this process easier, as it offers user-friendly templates to help you navigate filling out the form correctly.

While you can file a transfer on death deed without a lawyer, seeking legal advice can be beneficial. A lawyer can help ensure that the death deed for real estate meets all legal requirements and is properly executed. Using a platform like US Legal Forms can simplify the process, as it provides templates and guidance tailored to your state.

Filling out a transfer on death deed involves several key steps. First, you must provide the legal description of the property and your information as the owner. Next, you will designate the beneficiary who will receive the property upon your death. It is essential to follow state-specific requirements to ensure the death deed for real estate is valid.

Using a transfer on death deed can be a beneficial estate planning tool for many individuals. It simplifies the process of passing on property to your chosen beneficiary without going through probate. However, every situation is unique, and weighing the pros and cons is vital before making a decision. For personalized assistance, US Legal Forms offers a variety of resources to help you navigate the world of death deeds for real estate.

A transfer on death deed does not inherently avoid inheritance tax. While it allows for a smooth transfer of property, tax obligations may still apply based on federal and state laws. It's essential to consult a tax professional to understand the implications of using death deeds for real estate in your specific situation. US Legal Forms can assist in providing the right resources and guidance regarding these matters.