Arizona Joint Tenancy With Right Of Survivorship Form Without

Description

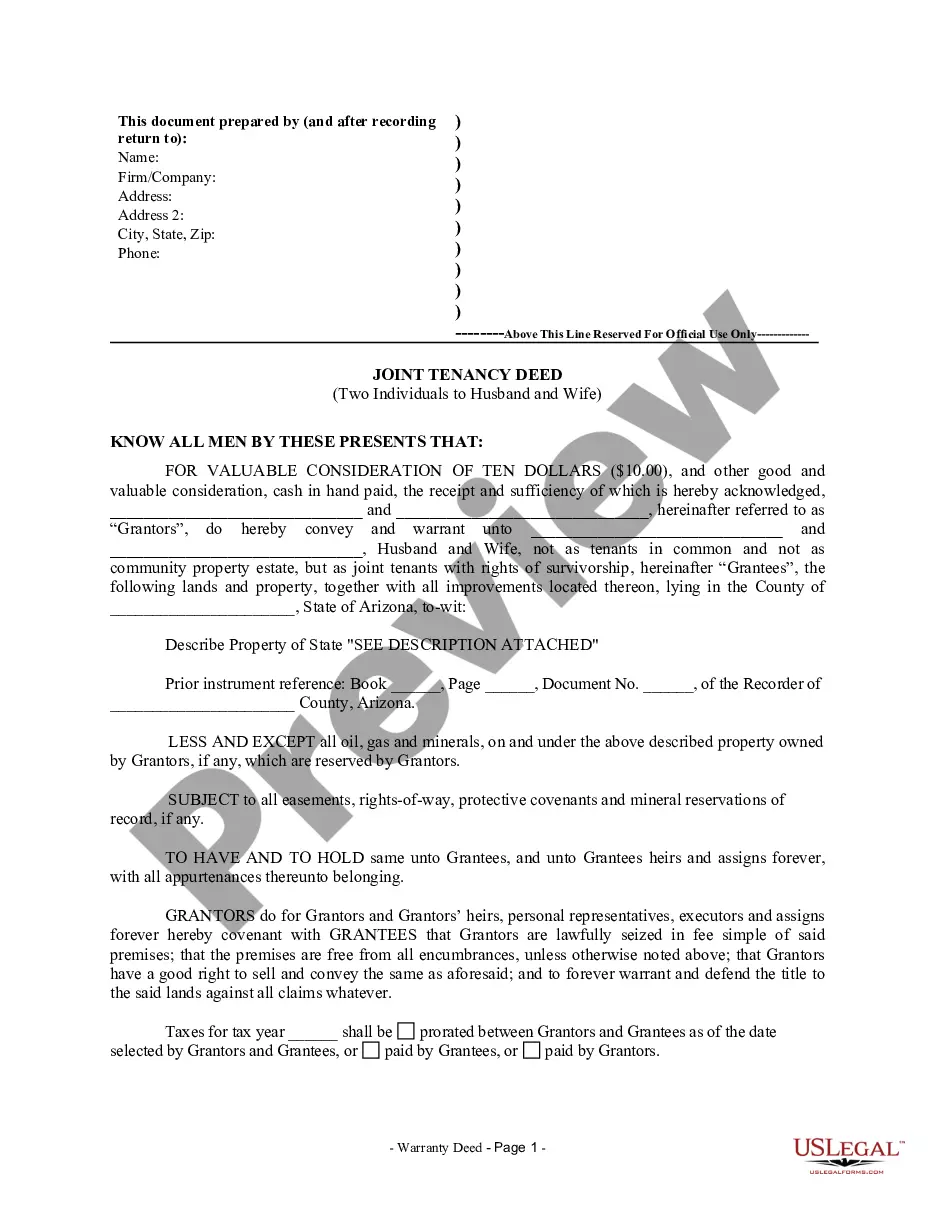

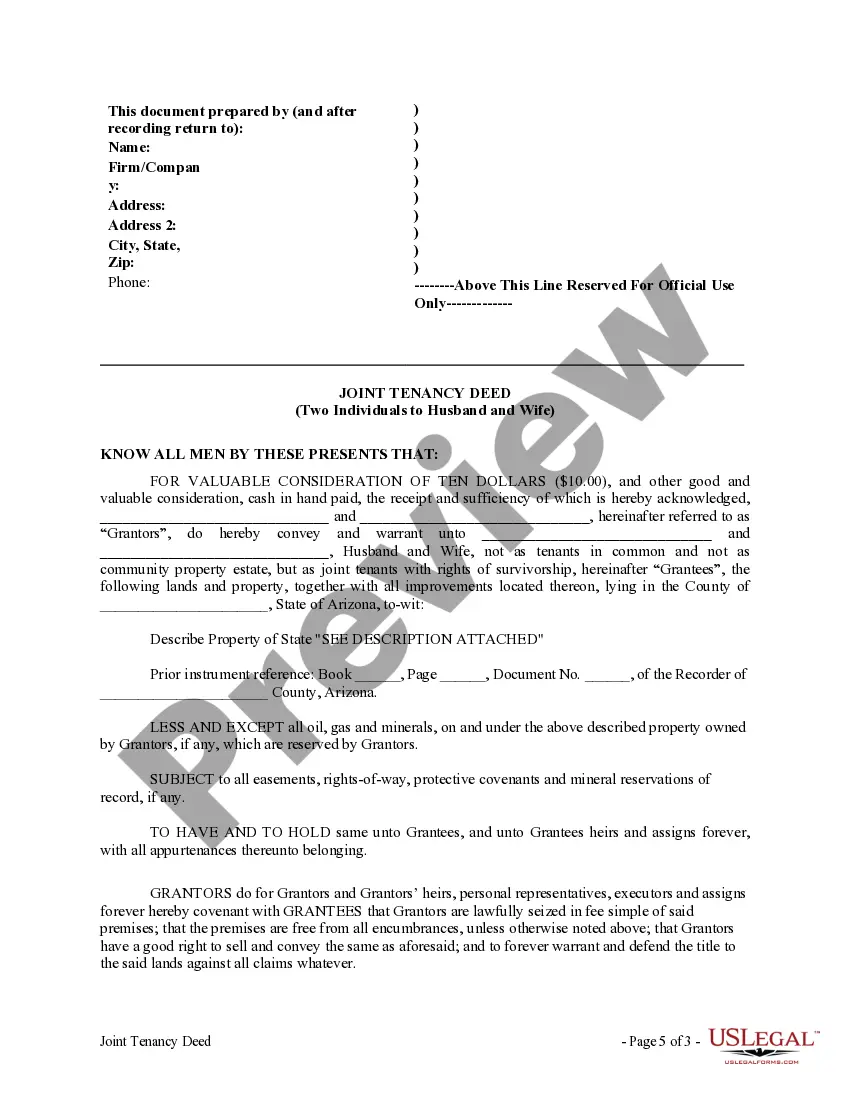

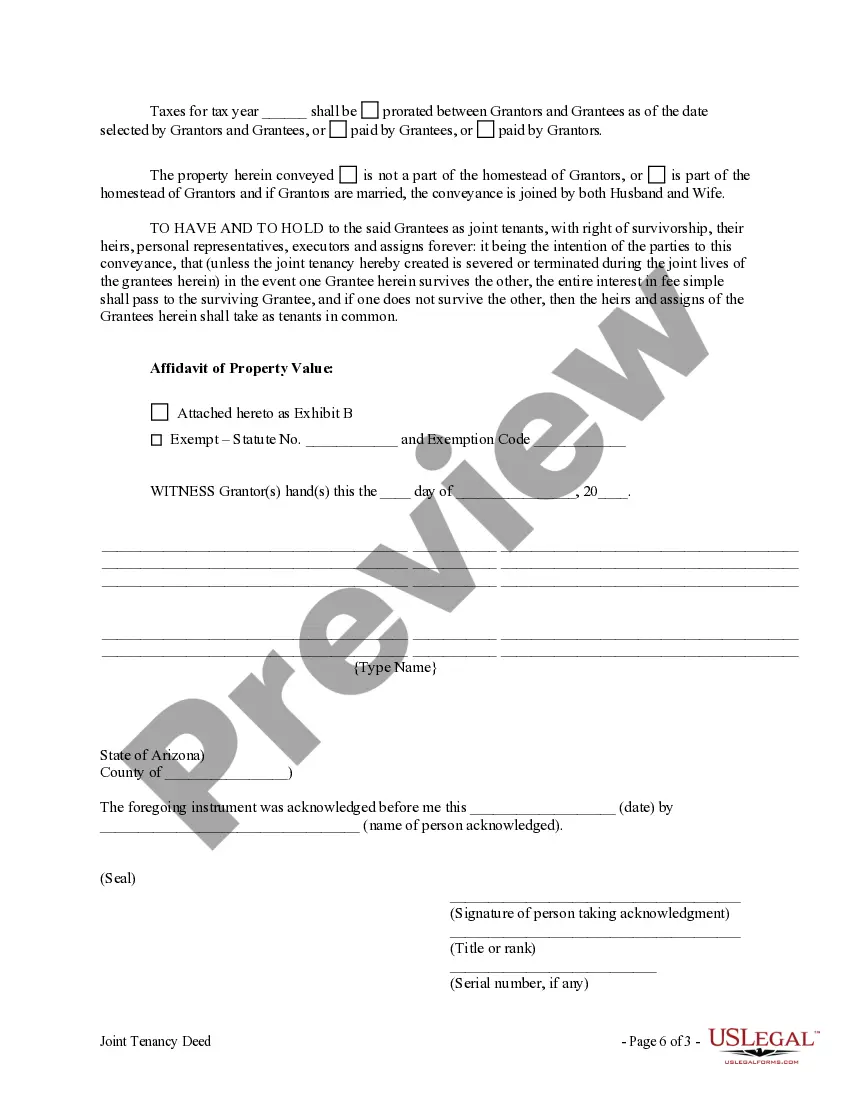

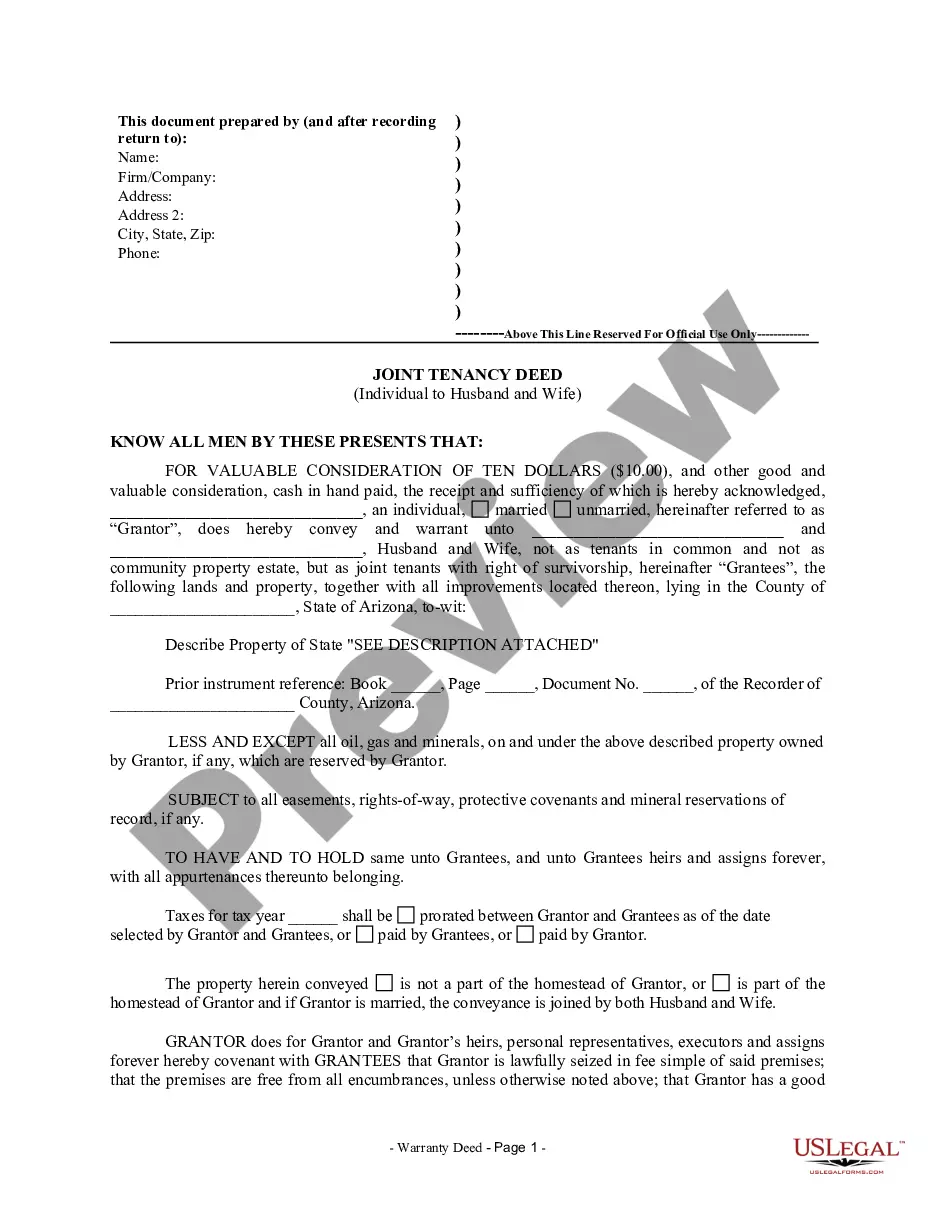

How to fill out Arizona Joint Tenancy Deed - Two Individuals To Husband And Wife?

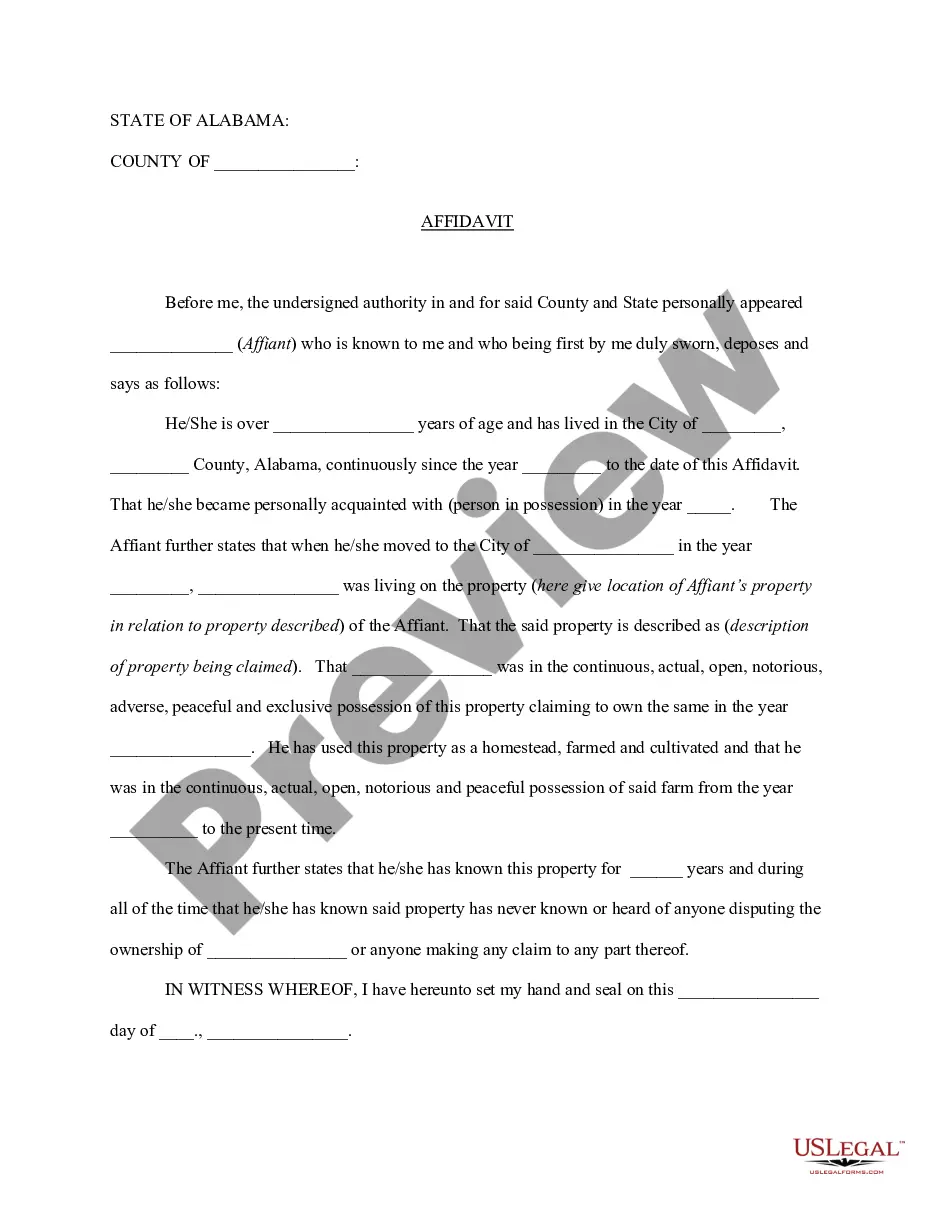

Accessing legal document samples that comply with federal and state laws is essential, and the web provides numerous options to select from.

However, why spend time sifting through the internet for the correctly formulated Arizona Joint Tenancy With Right Of Survivorship Form Without sample when the US Legal Forms online library has such templates gathered in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by attorneys for various professional and personal situations. They are user-friendly, with all documents categorized by state and intended use.

All templates you find through US Legal Forms are reusable. To re-download and fill out previously saved forms, access the My documents tab in your account. Enjoy the most comprehensive and user-friendly legal document service!

- Our specialists stay updated with legislative reforms, ensuring that your documents are current and compliant when obtaining an Arizona Joint Tenancy With Right Of Survivorship Form Without from our site.

- Acquiring an Arizona Joint Tenancy With Right Of Survivorship Form Without is quick and straightforward for both existing and new users.

- If you possess an account with an active subscription, Log In and download the document sample you need in the correct format.

- For newcomers to our platform, follow these simple steps.

- Review the template using the Preview option or via the text outline to ensure it fits your needs.

Form popularity

FAQ

Forfeited Existence - An inactive status indicating that the corporation or limited liability company failed to file its franchise tax return or to pay the tax due thereunder. Status is changed by secretary of state when certification of the delinquency is received from the comptroller of public accounts.

What needs to be done to reinstate a company in Maryland? To reinstate your Maryland entity you need to file Articles of Revival (corporations) or Certificate of Reinstatement (LLCs) with Maryland State Department of Assessments and Taxation and pay any fees, missing annual reports and penalties.

Corporations in Maryland must file personal property reports with the proper authorities before approval of dissolution can be given. If your business has been forfeited, you must file for reinstatement and submit the personal property reports before your company can be dissolved by Maryland's SDAT.

A suspended or forfeited corporation does not stop being an association, but it loses all the rights and privileges of a corporation and cannot legally act as a corporation while suspended.

To amend your Maryland corporations charter, just file Articles of Amendment by mail or in person with the Maryland State Department of Assessments and Taxation (SDAT).

How much will it cost to revive a Maryland LLC? The filing fee for a Maryland Articles or Certificate for Reinstatement is $100. The filing may be expedited for an additional $50 fee. You'll also need to pay any owed taxes.

In Maryland, the necessary paperwork will depend on the business entity type. LLCs have to file the Articles or Certificate of Reinstatement form, while corporations have to submit Articles of Revival. Additionally, you will have to file all your missing returns and pay the corresponding fees.

You can submit your revival documents to the SDAT by mail or in person. If you mail your revival documents to SDAT, include a check for fees. You can file your reinstatement documents in person for same day processing if you are in line at the Maryland SDAT counter by pm.