Transfer Deed When Someone Dies

Description

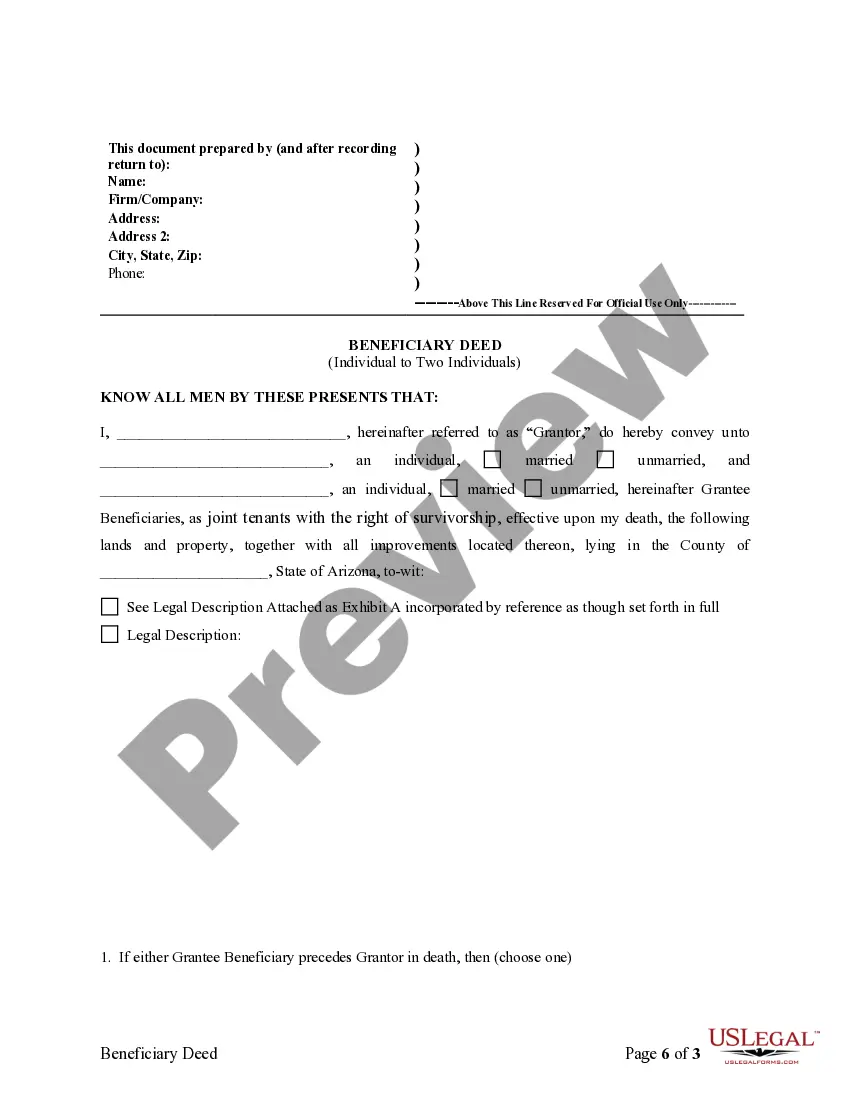

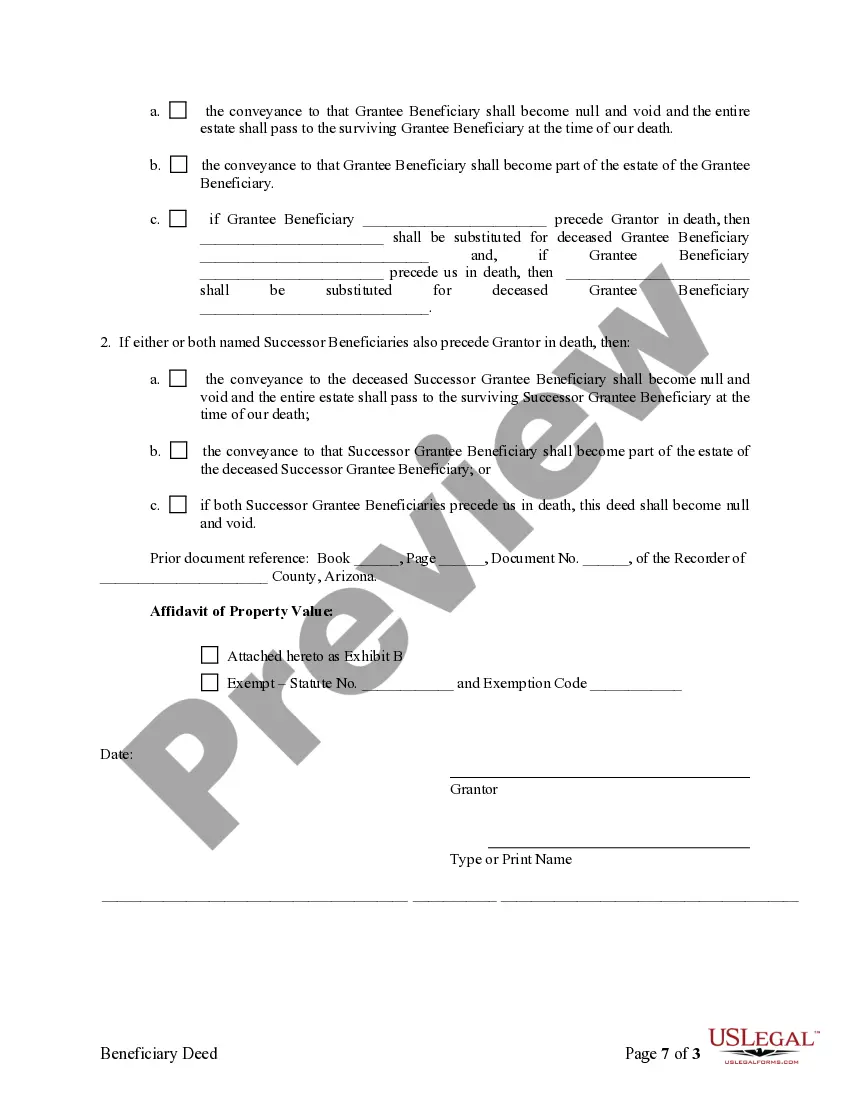

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals?

Drafting legal documents from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more affordable way of preparing Transfer Deed When Someone Dies or any other paperwork without jumping through hoops, US Legal Forms is always at your fingertips.

Our online collection of over 85,000 up-to-date legal forms addresses almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-compliant templates diligently put together for you by our legal professionals.

Use our website whenever you need a trustworthy and reliable services through which you can quickly find and download the Transfer Deed When Someone Dies. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the form and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to register it and explore the library. But before jumping straight to downloading Transfer Deed When Someone Dies, follow these recommendations:

- Check the form preview and descriptions to make sure you are on the the document you are searching for.

- Make sure the template you select complies with the requirements of your state and county.

- Choose the right subscription option to purchase the Transfer Deed When Someone Dies.

- Download the form. Then fill out, certify, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us today and transform document completion into something easy and streamlined!

Form popularity

FAQ

Meanwhile, our fee to prepare a Transfer on Death Deed is $195. Good to know: Since the Transfer upon Death Deed conveys property outside of Probate, it avoids incurring costs to transfer the property to your beneficiaries upon your death.

How to Minimize Capital Gains Tax on Inherited Property Sell the inherited property quickly. ... Make the inherited property your primary residence. ... Rent the inherited property. ... Qualify for a partial exclusion. ... Disclaim the inherited property. ... Deduct Selling Expenses from Capital Gains.

After one year, if the executor doesn't complete their duties, beneficiaries may demand payment (possibly with interest) by taking the executor to court.

A transfer on death (TOD) bank account is a popular estate planning tool designed to avoid probate court by naming a beneficiary. However, it doesn't avoid taxes.

The deed could get complicated, and its validity contested if it is not recorded correctly or if the legal criteria are not met. If there is no provision for a contingent beneficiary, the transfer on the death deed is rendered ineffective if the named beneficiary passes away before the property owner.