Az Deed Beneficiary With Distribution

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals?

Acquiring legal templates that comply with federal and local laws is essential, and the internet provides numerous choices available.

However, what is the benefit of spending time searching for the right Az Deed Beneficiary With Distribution example online when the US Legal Forms online library has already assembled such templates in one location.

US Legal Forms is the largest digital legal repository with over 85,000 editable templates created by attorneys for any professional and personal scenario. They are easy to navigate, with all documents categorized by state and intended use. Our experts stay updated with legal modifications, ensuring that your form remains current and compliant when obtaining an Az Deed Beneficiary With Distribution from our site.

Click Buy Now once you’ve identified the suitable form and choose a subscription plan. Create an account or Log In and complete the payment via PayPal or a credit card. Select the format for your Az Deed Beneficiary With Distribution and download it. All documents you find through US Legal Forms are reusable. To re-download and complete previously saved forms, access the My documents tab in your account. Take advantage of the most comprehensive and user-friendly legal documentation service!

- Acquiring an Az Deed Beneficiary With Distribution is fast and straightforward for both existing and new users.

- If you already have an account with an active subscription, Log In and download the document sample you require in the appropriate format.

- If you are unfamiliar with our website, follow the steps below.

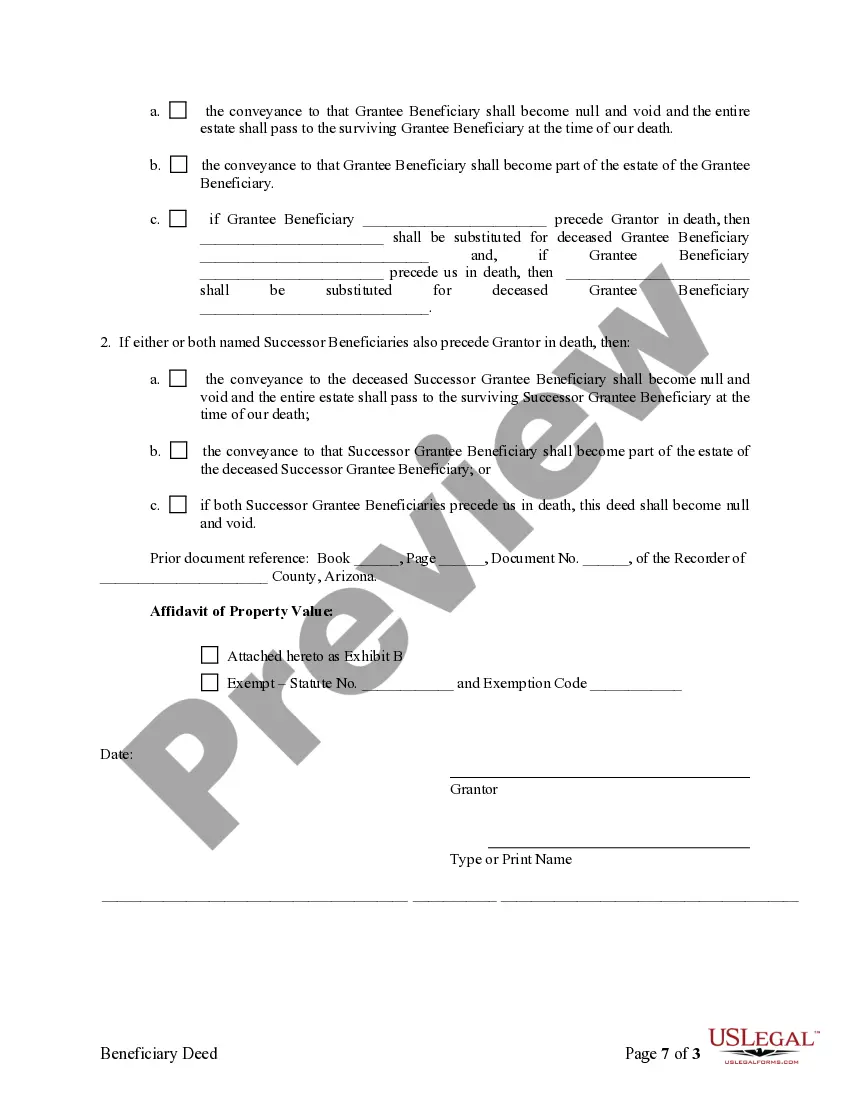

- Review the template using the Preview option or through the text outline to verify it fulfills your requirements.

- Use the search feature at the top of the page to find an alternative sample if necessary.

Form popularity

FAQ

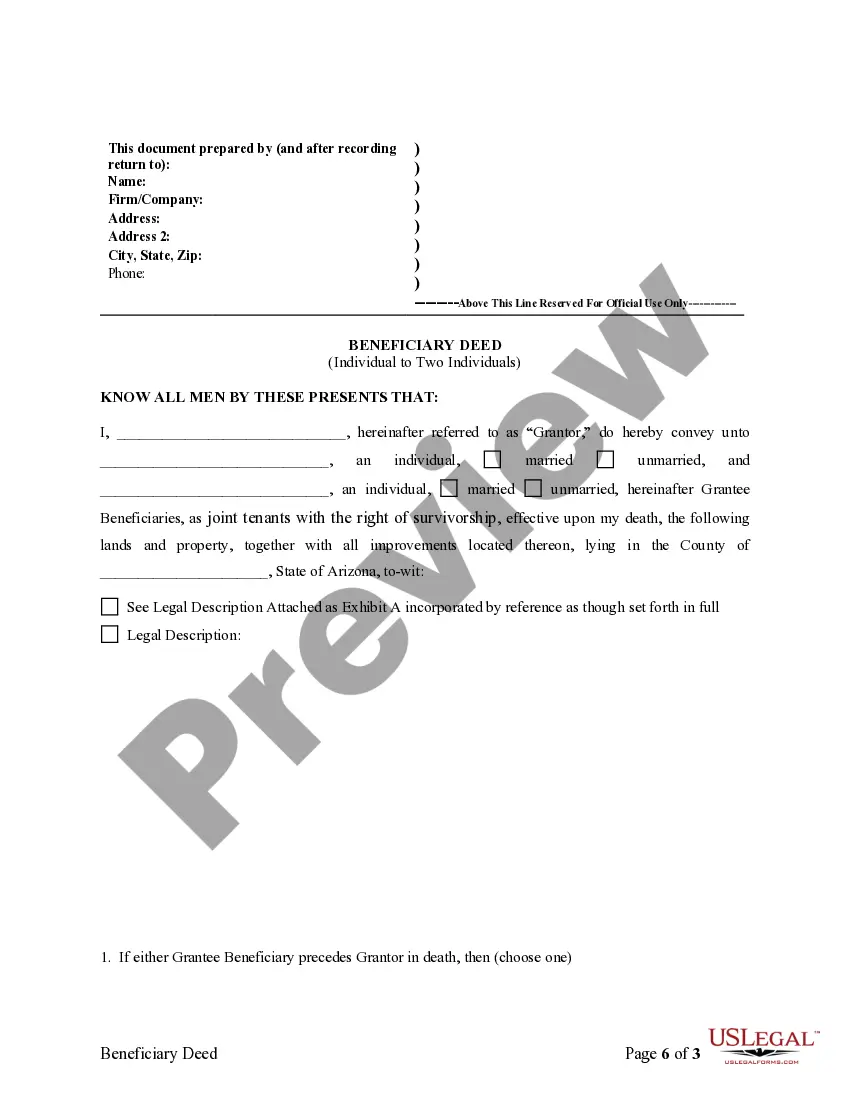

An Arizona beneficiary deed form?also known as an Arizona transfer-on-death deed form or Arizona TOD deed form?is a type of deed authorized by statute to pass Arizona real estate to designated beneficiaries on the death of an owner.

Arizona Beneficiary Deed Example 3 A Beneficiary Deed must also be properly recorded before the death of the owner or the last surviving owner. Example 3: John & Mary are married and own their home as community property with right of survivorship.

An Arizona Beneficiary Deed is much simpler than creating and administering a trust. In addition, the owner retains complete control over the property with an Arizona Beneficiary Deed. No gift tax liability. Since an Arizona Beneficiary Deed does not transfer property as a ?gift,? it is not subject to gift taxes.

At your death, ownership passes automatically to the beneficiary named in the deed. Any mortgage or debt attached to the land goes along with it. To retitle the real estate in the new owner's name, the new owner should record a sworn statement (affidavit) and a copy of the death certificate.

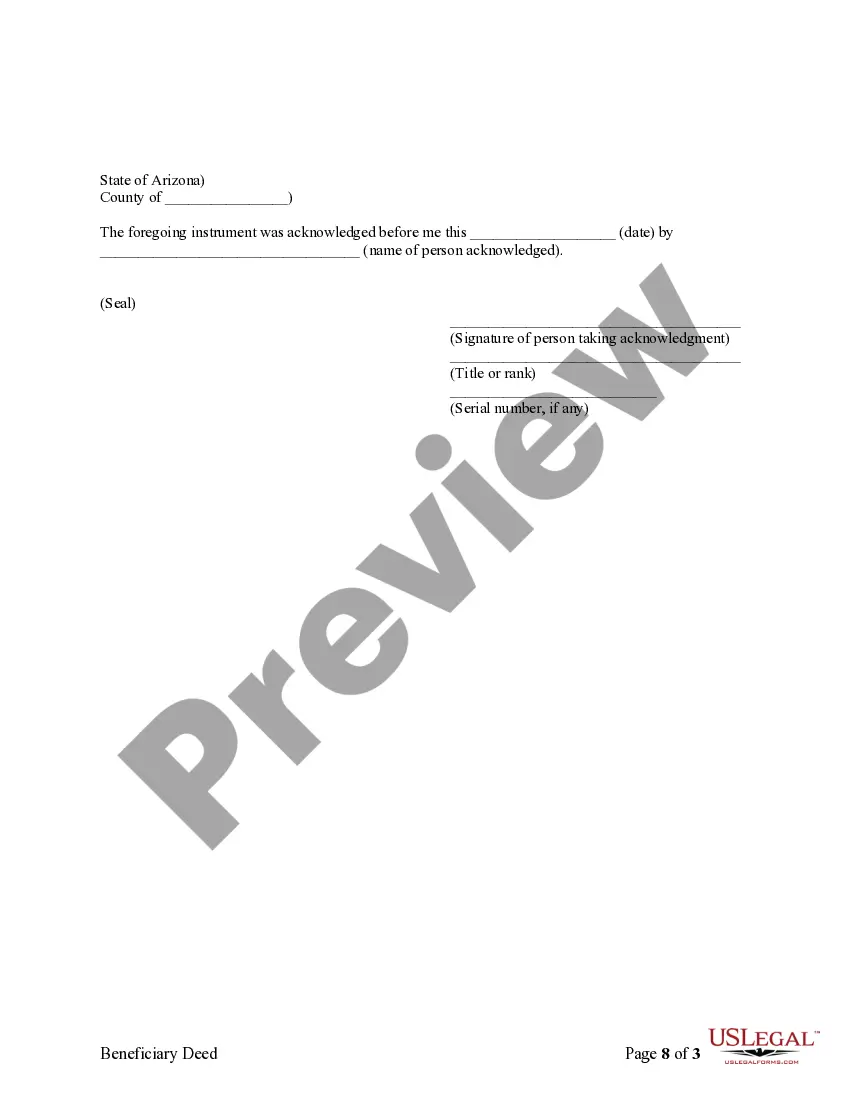

You must sign the deed and get your signature notarized, and then record (file) the deed with the recorder's office before your death. Otherwise, it won't be valid. You can make an Arizona beneficiary deed with WillMaker.