Arizona Deed Beneficiary Without Will

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals?

Legal documents handling can be perplexing, even for the most seasoned experts.

When you are searching for an Arizona Deed Beneficiary Without Will and don’t have the opportunity to invest in locating the suitable and current version, the processes may be overwhelming.

US Legal Forms accommodates any needs you may have, from personal to corporate paperwork, all in one location.

Utilize sophisticated tools to complete and handle your Arizona Deed Beneficiary Without Will.

Here are the steps to follow after downloading the form you need: Verify that this is the correct form by previewing it and reading its description. Ensure that the template is sanctioned in your state or county. Select Buy Now once you are prepared. Choose a subscription plan. Select the format you need, and Download, complete, eSign, print, and send your document. Take advantage of the US Legal Forms online library, backed by 25 years of experience and trustworthiness. Change your routine document management into a straightforward and user-friendly process today.

- Access a valuable repository of articles, tutorials, and guides related to your circumstances and needs.

- Save time and effort in searching for the documents you require, and utilize US Legal Forms’ advanced search and Review tool to find Arizona Deed Beneficiary Without Will and obtain it.

- For those with a subscription, Log In to the US Legal Forms account, find the form, and retrieve it.

- Check your My documents tab to view the documents you have previously stored as well as to organize your folders as you see fit.

- If this is your first time with US Legal Forms, create an account and gain unlimited access to all the benefits of the library.

- A robust online form collection could be a transformative tool for anyone who aims to handle these matters efficiently.

- US Legal Forms is a frontrunner in digital legal documents, with more than 85,000 state-specific legal forms accessible to you at any moment.

- Utilize state- or county-specific legal and business documents.

Form popularity

FAQ

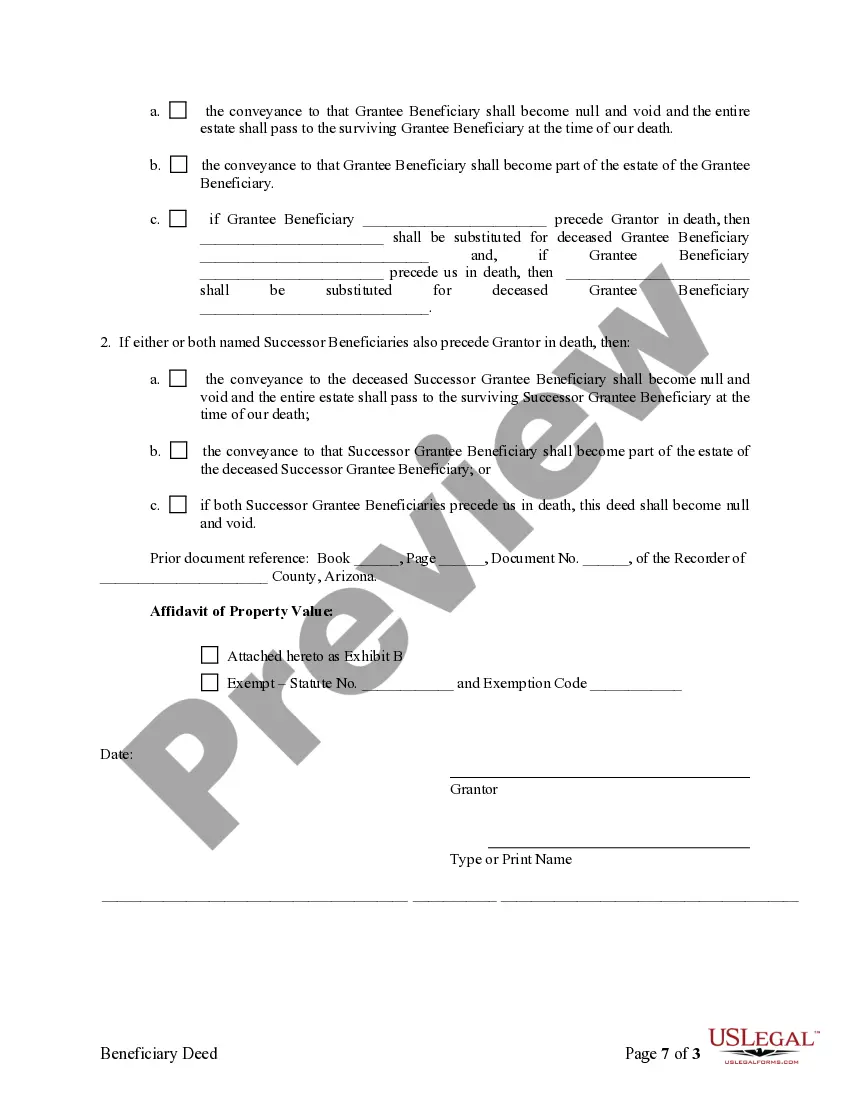

To obtain a beneficiary deed in Arizona, you need to complete the form with accurate property details and the beneficiary's information. This process is simplified by using platforms like US Legal Forms, which provide step-by-step guidance. After completing the form, you must sign it in front of a notary and then record it with your county’s recorder's office. This will ensure that your Arizona deed beneficiary without will is legally recognized.

You can find a beneficiary deed form for Arizona on various legal document websites, including US Legal Forms. This platform offers easy access to customizable forms specifically designed for your needs. By using a reliable source, you can ensure that your Arizona deed beneficiary without will is correctly documented. Always check for the latest updates to ensure compliance with Arizona laws.

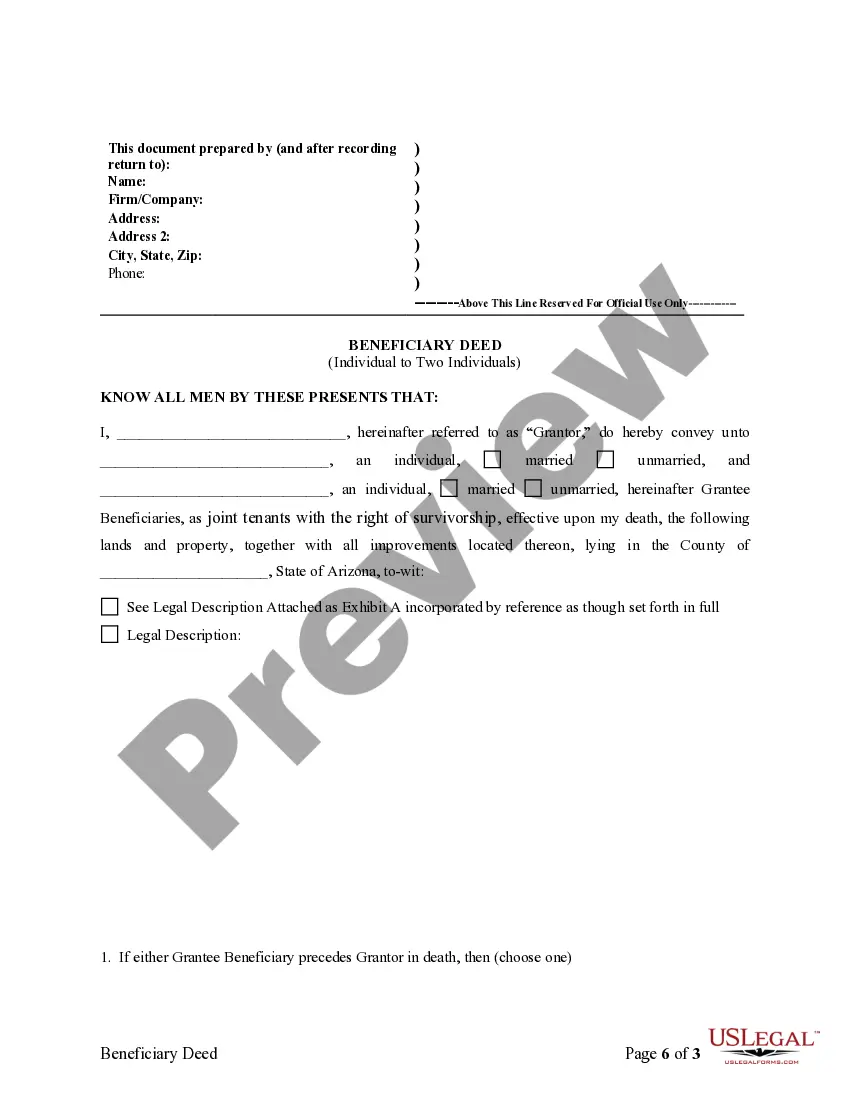

To create a valid beneficiary deed in Arizona, you need specific information. This includes the legal description of the property, the property owner's name, and the beneficiary's name. Additionally, both parties must sign the document in front of a notary public. Using USLegalForms can provide the necessary templates and guidance to ensure compliance with Arizona law.

In Arizona, when a person dies without a will, the state's intestacy laws determine inheritance. Generally, the surviving spouse and children inherit the estate first. If there are no children, parents and siblings may be next in line. Understanding this process is essential for anyone considering Arizona deed beneficiary without will.

To fill out a beneficiary deed in Arizona, start by downloading the correct form from a trusted source. Clearly list the property description, including the legal description and address. You must also indicate the beneficiary's name and relationship to you. This straightforward process becomes easier with the guidance of platforms like USLegalForms.

Filling out a beneficiary deed form requires careful attention to detail. Begin by providing the property owner's information, including their name and address. Next, include the beneficiary's details, ensuring you specify their relationship to the owner. Utilizing USLegalForms can help streamline this process and ensure that all necessary information is accurately captured.

While a beneficiary deed offers benefits, it also has disadvantages. One significant concern is that it may not protect the property from creditors. Additionally, if you choose to revoke the deed, you must follow a specific procedure, which can be cumbersome. For those navigating the Arizona deed beneficiary without will, understanding these limitations is crucial.

Yes, a beneficiary deed must be recorded in Arizona to be effective. This process ensures that the property transfer occurs upon the owner's death, and it clearly identifies the beneficiary. Without recording the deed, the intended transfer may not happen, leaving the property subject to probate. Using a reliable platform like USLegalForms can simplify the recording process for you.

Filing a beneficiary deed in Arizona requires you to prepare the deed and sign it in front of a notary public. After that, you must record the signed deed with the county recorder's office where the property is located. This action ensures that the beneficiary is legally recognized as the new owner upon your death, avoiding probate. For guidance, USLegalForms provides resources to help you file an Arizona deed beneficiary without will correctly.

To create a beneficiary deed, you need a properly drafted document that names the property and the intended beneficiary. The deed must be signed by the property owner and recorded with the county recorder's office in Arizona. This process allows the property to transfer to the beneficiary upon the owner's death, bypassing probate. Using a platform like USLegalForms can help ensure you have the correct documents ready for an Arizona deed beneficiary without will.