Arizona Deed Beneficiary With The Inheritance Payment

Description

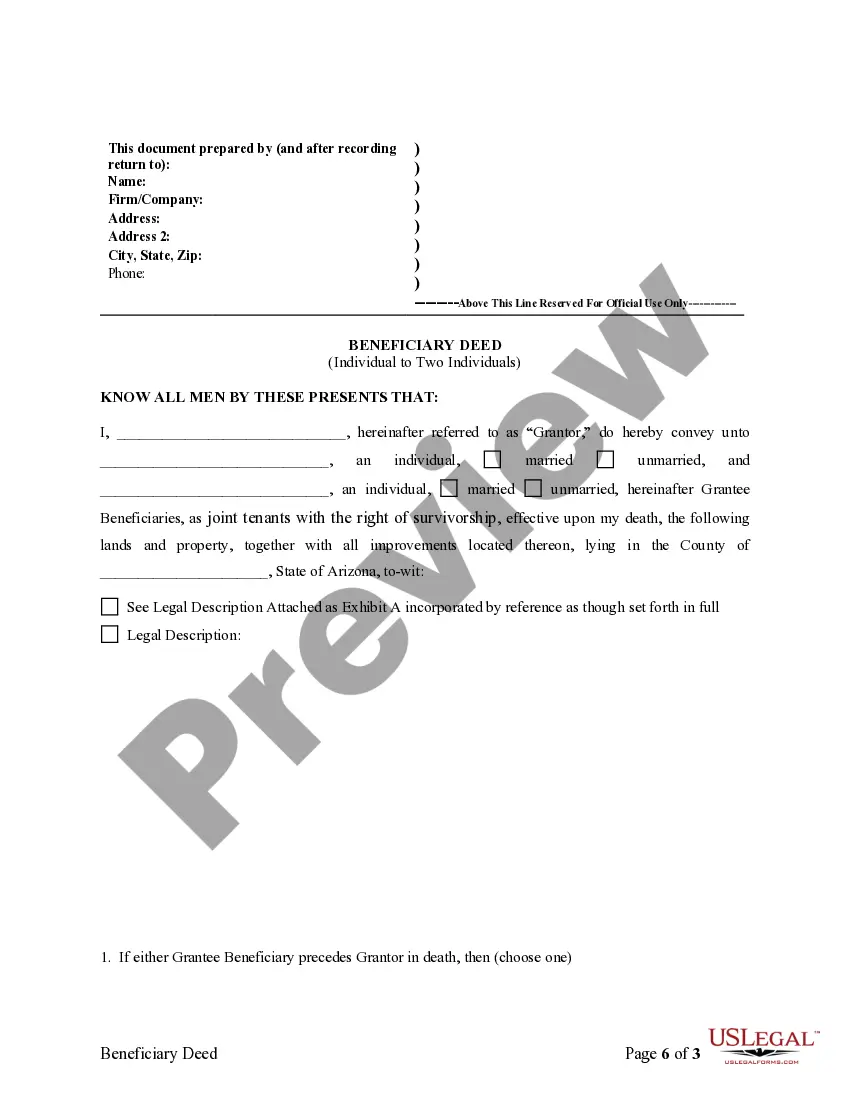

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals?

It’s well-known that you cannot transform into a legal specialist instantly, nor can you swiftly learn how to draft the Arizona Deed Beneficiary With The Inheritance Payment without a specialized background.

Creating legal documents is a lengthy process that necessitates specific education and expertise. So why not entrust the preparation of the Arizona Deed Beneficiary With The Inheritance Payment to the experts.

With US Legal Forms, one of the most extensive legal template repositories, you can discover anything from court documents to templates for internal corporate communication.

You can revisit your forms from the My documents tab at any time. If you’re an existing customer, you can simply Log In and locate and download the template from the same tab.

Regardless of the purpose of your documentation—be it financial, legal, or personal—our platform has you covered. Give US Legal Forms a try now!

- Locate the form you require using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine if the Arizona Deed Beneficiary With The Inheritance Payment is what you seek.

- Restart your search if you need another form.

- Create a free account and select a subscription plan to acquire the template.

- Select Buy now. Once the transaction is completed, you can download the Arizona Deed Beneficiary With The Inheritance Payment, complete it, print it, and send it by mail to the designated individuals or organizations.

Form popularity

FAQ

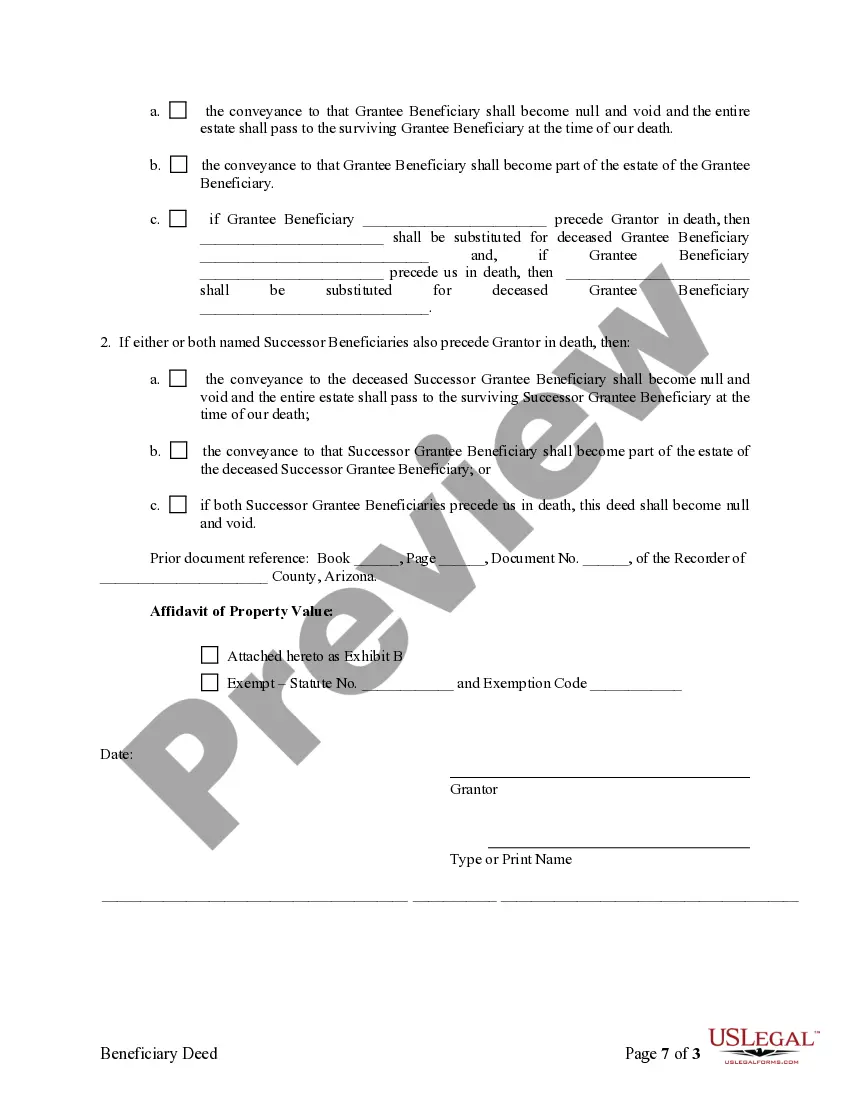

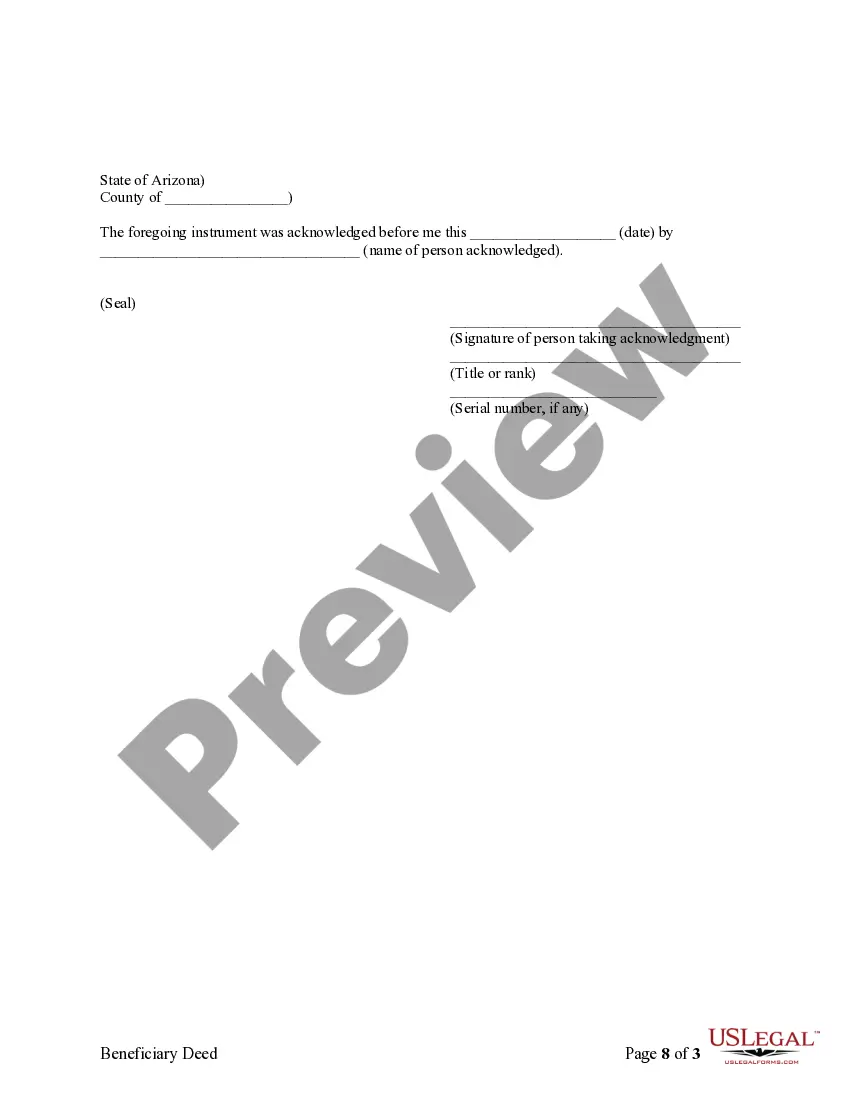

You must sign the deed and get your signature notarized, and then record (file) the deed with the recorder's office before your death. Otherwise, it won't be valid. You can make an Arizona beneficiary deed with WillMaker.

In the event that your mother recorded the beneficiary deed, the home likely became yours immediately upon her death, and it should not be subject to the terms of her will.

An Arizona Beneficiary Deed is much simpler than creating and administering a trust. In addition, the owner retains complete control over the property with an Arizona Beneficiary Deed. No gift tax liability. Since an Arizona Beneficiary Deed does not transfer property as a ?gift,? it is not subject to gift taxes.

An Arizona beneficiary deed, referred to as a transfer on death deed in other states, is a legal document used to transfer real property to descendants outside of probate proceedings. For this deed to be valid in Arizona, it must be signed before a notary and recorded with the respective county recorder's office.

Arizona Beneficiary Deed Example 3 A Beneficiary Deed must also be properly recorded before the death of the owner or the last surviving owner. Example 3: John & Mary are married and own their home as community property with right of survivorship.