Arizona Death Deed Beneficiary Without Social Security Number

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals?

Managing legal documents can be exasperating, even for the most proficient professionals.

When searching for an Arizona Death Deed Beneficiary Without Social Security Number and lacking the opportunity to find the correct and updated version, the process can be overwhelming.

Access a valuable resource library of articles, guides, and materials relevant to your circumstances and needs.

Save effort and time in searching for the forms you require, and take advantage of US Legal Forms’ enhanced search and Review tool to locate Arizona Death Deed Beneficiary Without Social Security Number and download it.

Experience the US Legal Forms online library, backed by 25 years of expertise and trustworthiness. Transform your daily document management into a seamless and user-friendly process today.

- If you possess a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Examine your My documents tab to view forms you've previously downloaded and manage your folders as needed.

- If it is your initial visit to US Legal Forms, create an account for unlimited access to all the benefits of the library.

- Once you have downloaded the required form, check that it is the correct version by previewing it and reviewing its description.

- Confirm that the template is valid in your state or county.

- Click Buy Now when you are ready.

- Select a monthly subscription plan.

- Choose the format you need, and Download, complete, eSign, print, and send your document.

- Access state- or county-specific legal and business forms.

- US Legal Forms caters to any requirements you may have, from personal to business paperwork, all in one location.

- Utilize advanced features to complete and manage your Arizona Death Deed Beneficiary Without Social Security Number.

Form popularity

FAQ

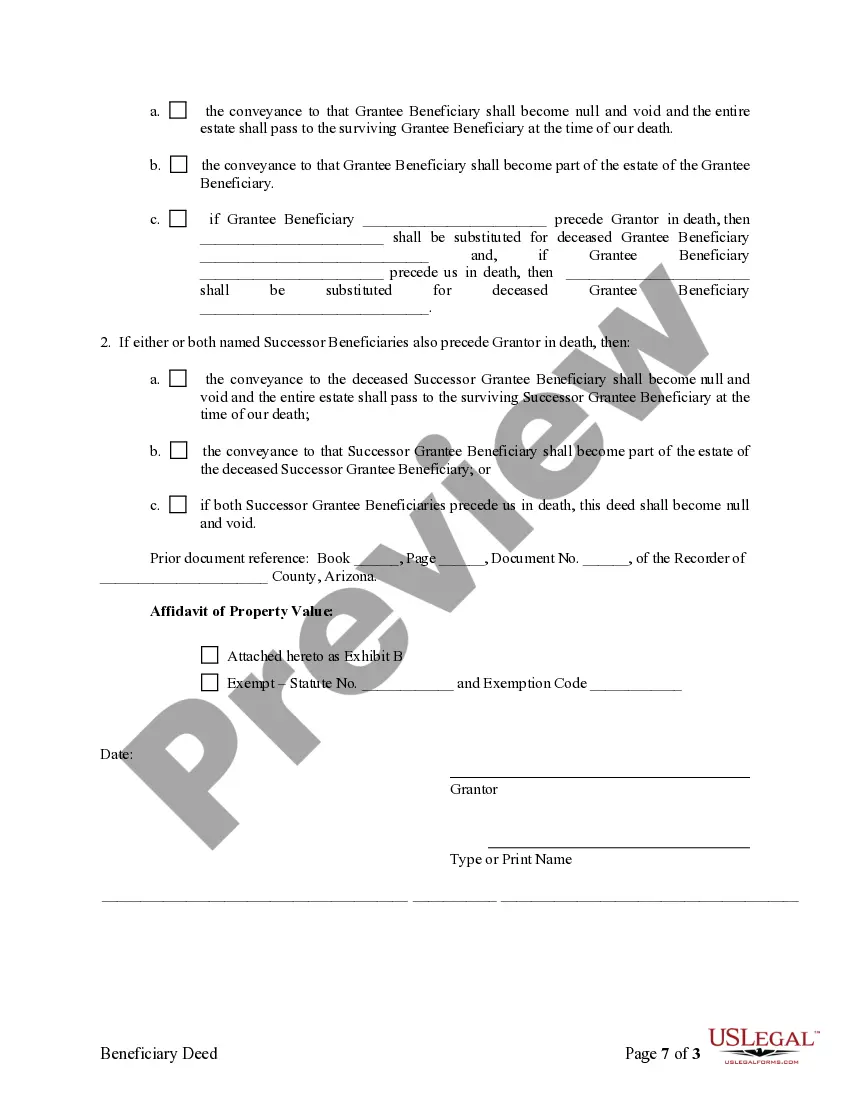

What do I need to do to ensure the beneficiary deed is valid? A beneficiary deed has to be signed by the property owner and notarized, recorded in the county where the property is located during the owner's lifetime, and must accurately state the property's legal description.

To establish a beneficiary deed in Arizona, the deed must: Grant the real estate property to a beneficiary designated by the owner of said property. Be recorded in the office of the county where the property is located. Be recorded in the county office before the property owner's death.

BENEFICIARY DEEDS §33-405 (statute includes a sample form) available from the Arizona Legislature Website. ? Beneficiary deeds are filed in the Maricopa County Recorder's Office.

An Arizona beneficiary deed form?also known as an Arizona transfer-on-death deed form or Arizona TOD deed form?is a type of deed authorized by statute to pass Arizona real estate to designated beneficiaries on the death of an owner.

In Arizona, establishing a TOD provision often involves filling out a form provided by the financial institution that holds your assets. For real estate, a Beneficiary Deed must be filled out and recorded with the county recorder's office.