Beneficiary Deed For Arizona

Description

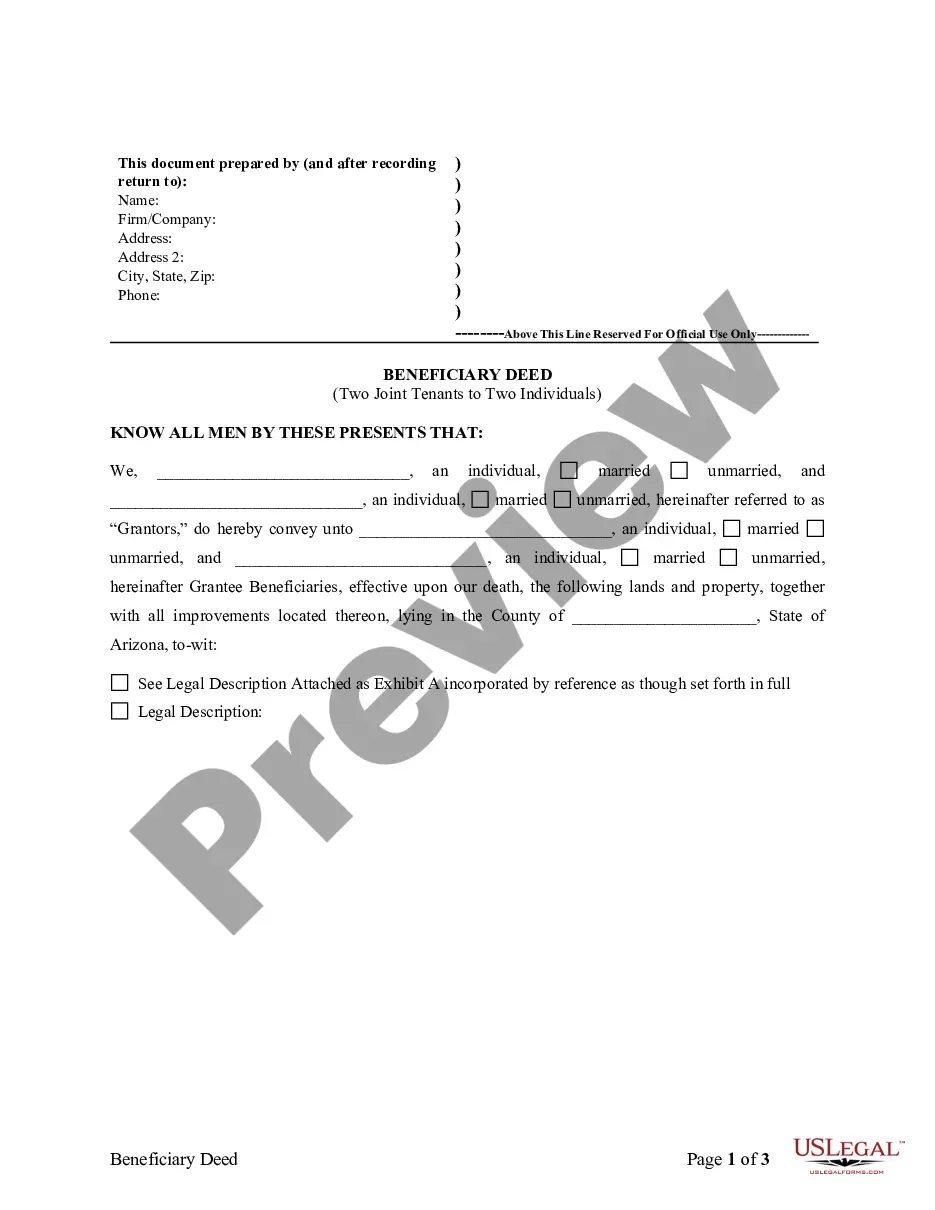

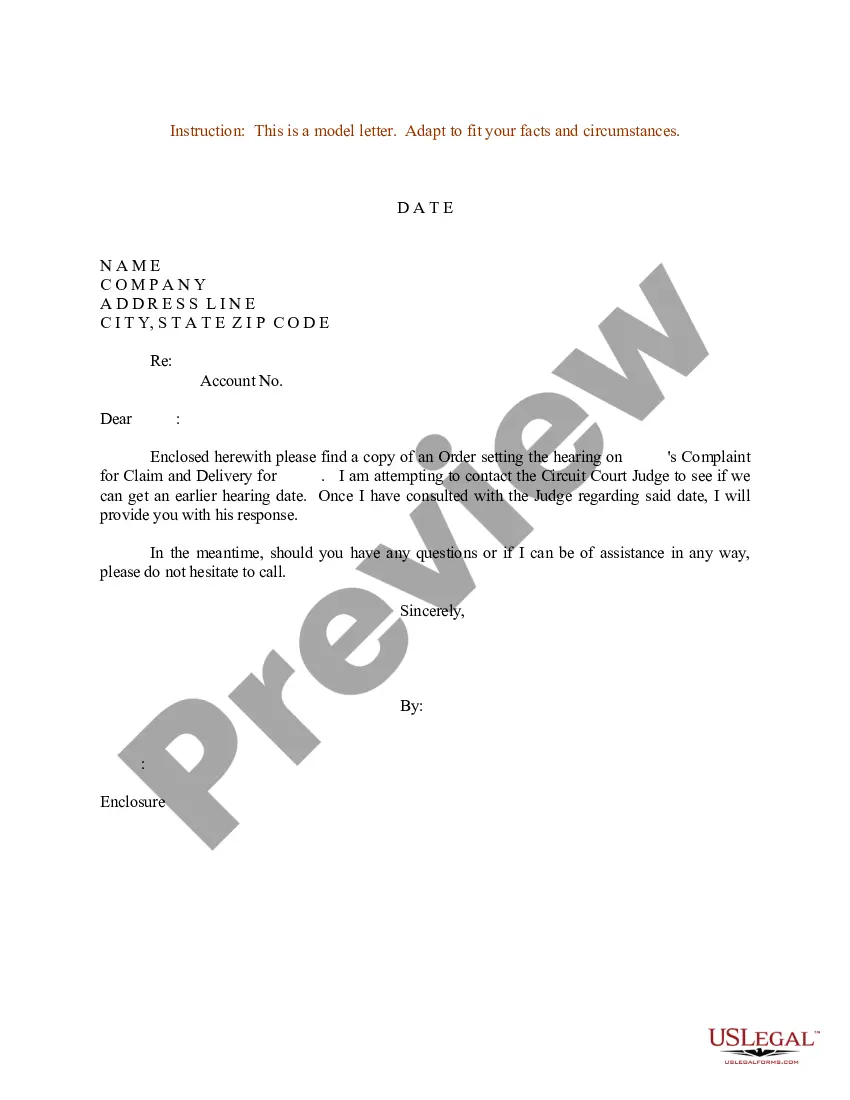

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed For Two Joint Tenants To Two Individuals?

There's no longer a necessity to allocate time searching for legal forms to conform to your local state statutes. US Legal Forms has compiled all of them in one location and made them easily accessible.

Our platform provides over 85,000 templates for various business and individual legal situations organized by state and area of application. All forms are properly formulated and verified for legitimacy, ensuring you acquire a current Beneficiary Deed For Arizona.

If you are acquainted with our service and already possess an account, you should verify that your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. You can also return to all saved documents whenever necessary by opening the My documents tab in your profile.

Print your form to complete it manually or upload the template if you prefer to edit it in an online editor. Preparing legal documents under federal and state regulations is quick and straightforward with our library. Try US Legal Forms now to maintain your documentation in order!

- If you have not yet engaged with our service, the procedure will entail a few more steps to finalize.

- Here's how new users can acquire the Beneficiary Deed For Arizona from our catalog.

- Examine the page content meticulously to ensure it contains the template you need.

- Utilize the form description and preview options if available for guidance.

- Use the search bar above to find another template if the current one is not suitable.

- Click Buy Now next to the template title once you discover the right one.

- Select the most fitting subscription plan and either register for an account or Log In.

- Make a payment for your subscription using a credit card or through PayPal to proceed.

- Choose the file format for your Beneficiary Deed For Arizona and download it to your device.

Form popularity

FAQ

Arizona’s beneficiary laws allow individuals to designate beneficiaries for real estate through a beneficiary deed. These laws are designed to simplify the transfer of property and reduce the need for probate. Understanding these laws is crucial for effective estate planning, as it helps you set clear intentions for property transfer after your passing. For detailed guidance, consider using resources available on platforms like USLegalForms to ensure compliance with Arizona's legal standards.

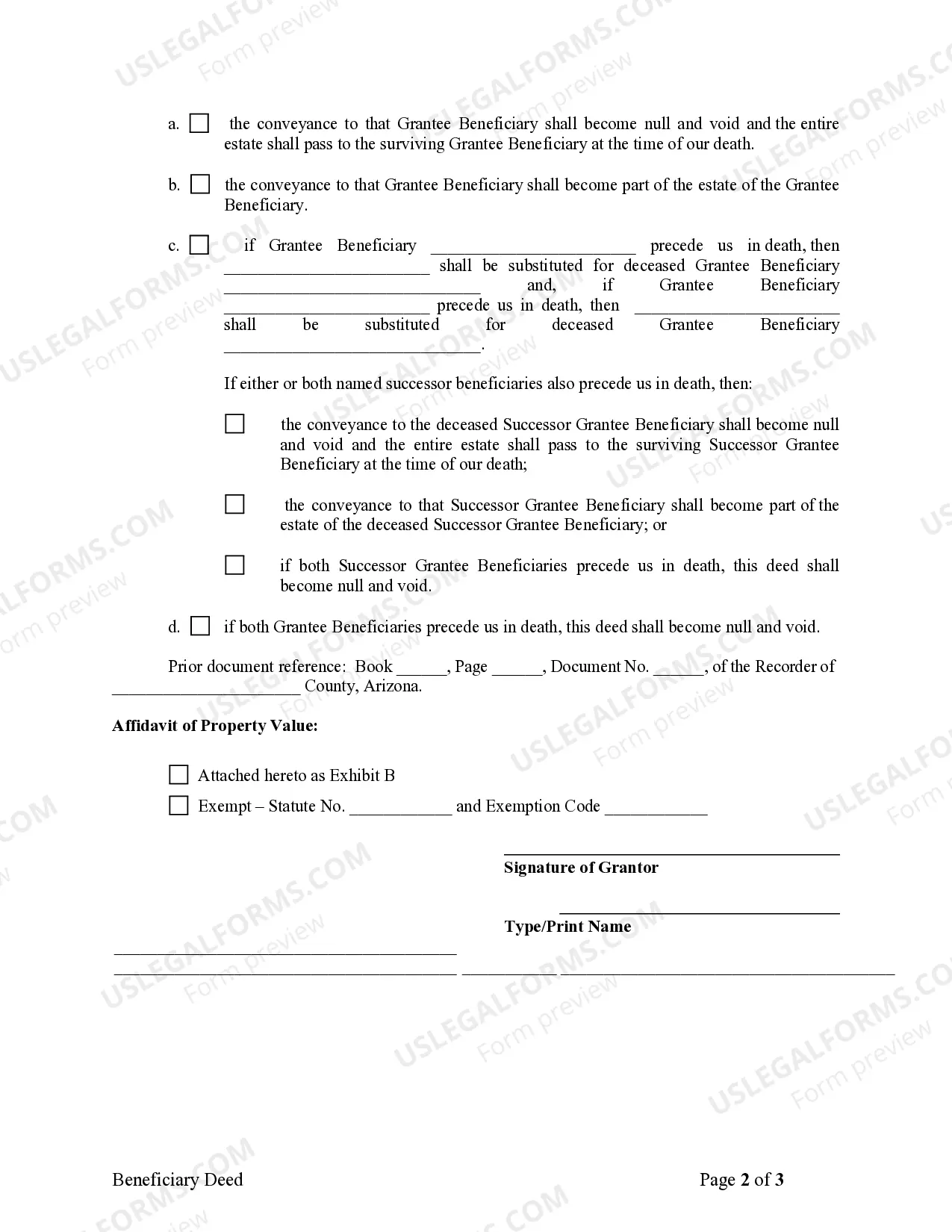

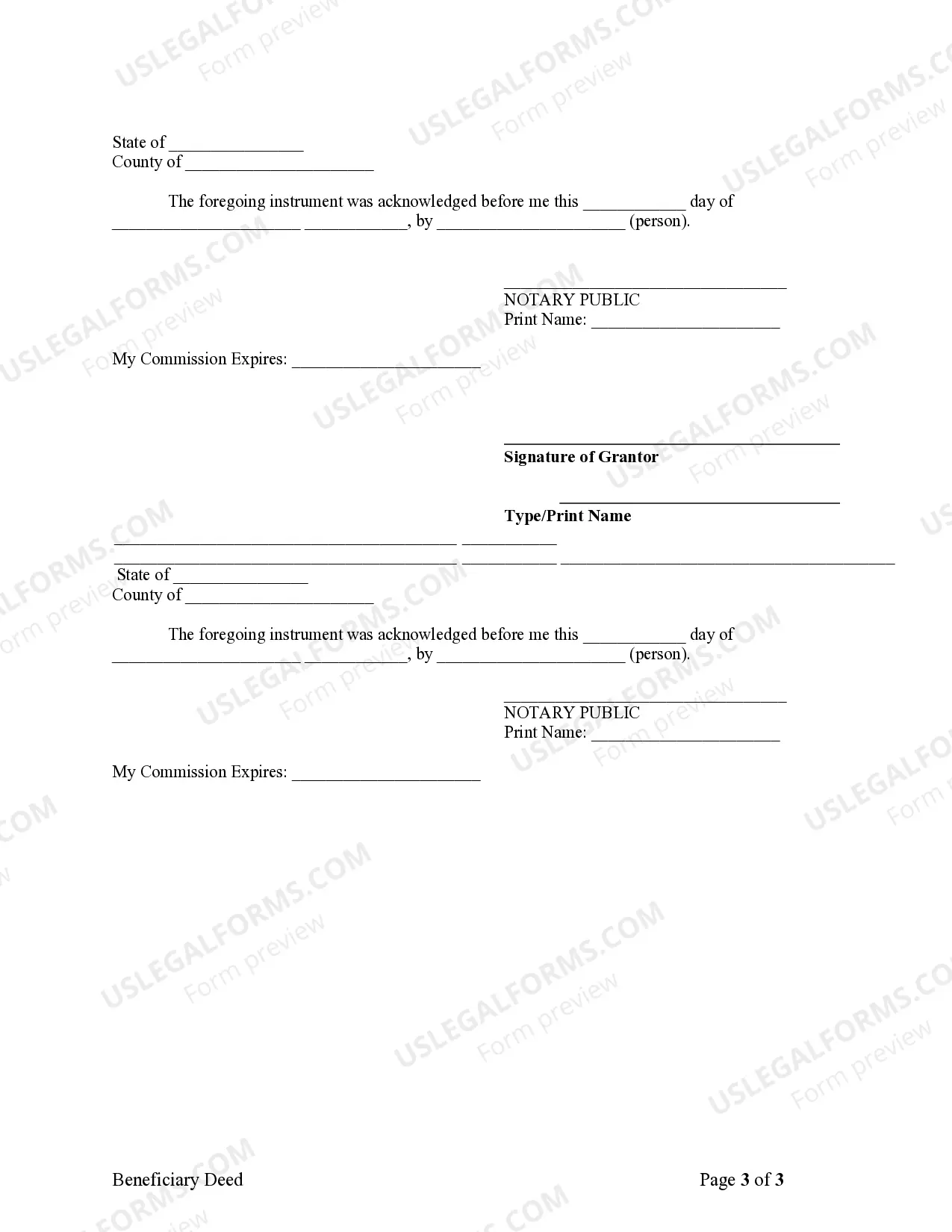

To obtain a beneficiary deed in Arizona, you can start by drafting the document that meets state requirements. It is advisable to consult with a legal professional or use a reliable platform like USLegalForms to assist you in creating an effective beneficiary deed for Arizona. Once the deed is drafted, you must sign it in front of a notary public and record it with your local county recorder's office. Properly executing these steps ensures your deed is legally valid.

Yes, Arizona does allow for a beneficiary deed. This legal document enables property owners to transfer their real estate to designated beneficiaries upon their passing. It is a straightforward way to ensure your property goes to the intended person without delay. Utilizing a beneficiary deed for Arizona can simplify estate planning and provide peace of mind.

To set up a beneficiary deed for Arizona, start by obtaining the appropriate form, which is often available through legal documentation services or state websites. Fill out the form with property details and the beneficiaries’ information, then have it notarized. Finally, record the deed with the county recorder's office where the property is located. Utilizing platforms like USLegalForms can simplify this process, offering templates and guidance to ensure accuracy and compliance.

When you add someone to a deed in Arizona, it can have various tax implications. The property may be subject to gift tax if the value exceeds the annual exclusion limit set by the IRS. Moreover, the added individual may face property tax reassessment, which could lead to increased tax obligations. It’s essential to consult a tax professional to navigate these implications effectively.

A beneficiary deed for Arizona allows property owners to transfer their property to designated beneficiaries upon their death without going through probate. This deed remains revocable, meaning the property owner can change beneficiaries or revoke the deed at any time during their lifetime. This feature provides property owners with flexibility and peace of mind regarding their estate planning. By setting up a beneficiary deed, you simplify the transfer of asset ownership while maintaining control.

Yes, a beneficiary deed for Arizona must be notarized to ensure its validity. The notarization process involves a licensed notary public witnessing the signing of the deed. This step adds an extra layer of protection and confirms that the grantor has willingly signed the document. Notarizing your beneficiary deed helps prevent potential disputes or legal challenges in the future.

Creating a beneficiary deed in Arizona involves drafting the document to specify the property and the intended beneficiaries clearly. You can utilize online platforms like US Legal Forms to access templates and guidance for this task. Once you complete the deed, have it notarized to ensure its validity. This method allows you to effectively establish a beneficiary deed for Arizona, facilitating the transfer of property upon your passing.

To file a beneficiary deed in Arizona, begin by completing the necessary document, which you'll find on legal websites. It is essential to sign the deed in front of a notary public. After notarization, you must submit the deed to the county recorder's office in the county where the property is located. This straightforward process ensures that the beneficiary deed for Arizona is legally recognized.

In Arizona, transferring a deed after death typically involves recording the beneficiary deed with the county recorder's office. Your designated beneficiary will need to present a certified copy of the death certificate along with the recorded beneficiary deed. It is advisable to consult with a legal professional or use resources from USLegalForms. Their platform offers guidance and document templates to assist beneficiaries during this process.