Transfer On Death Deed For Florida

Description

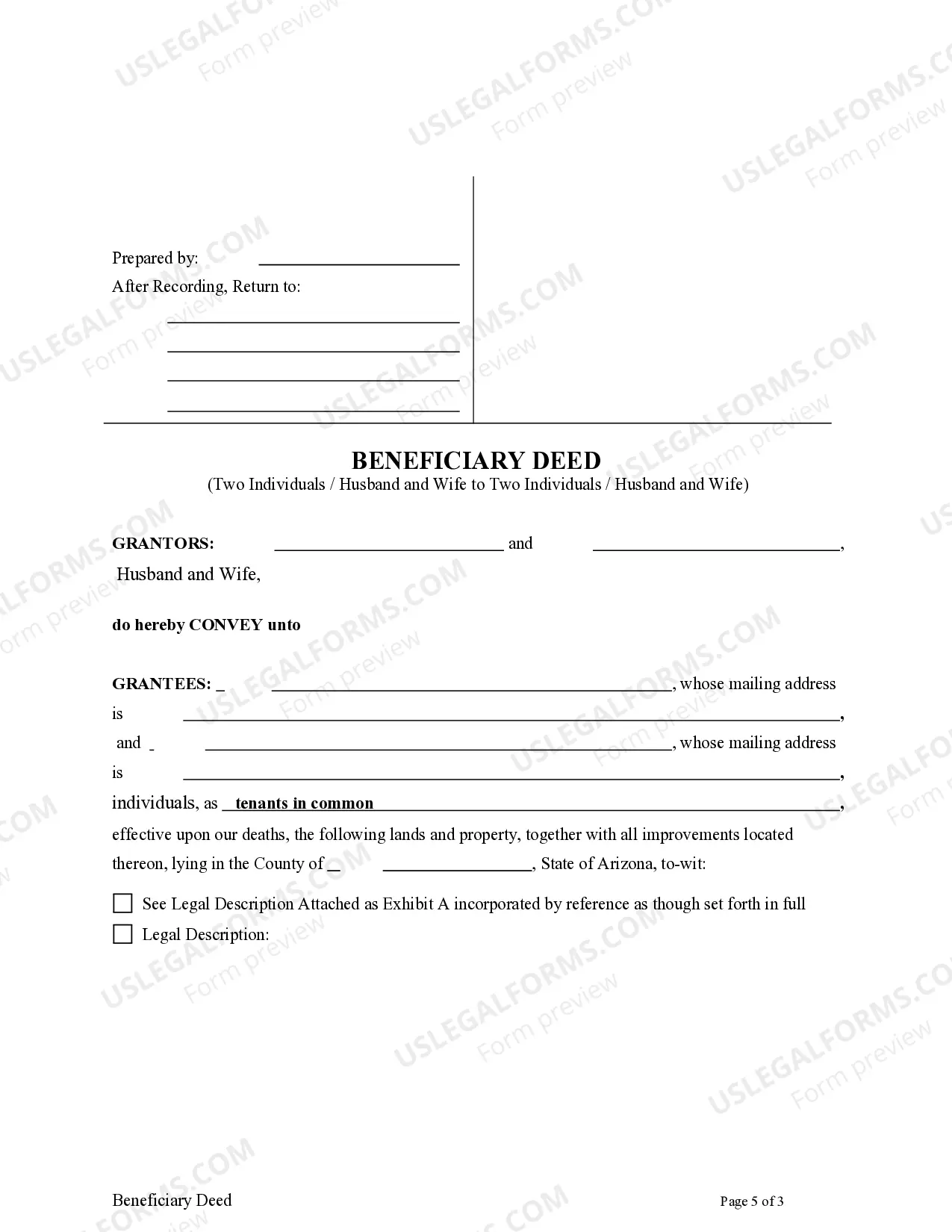

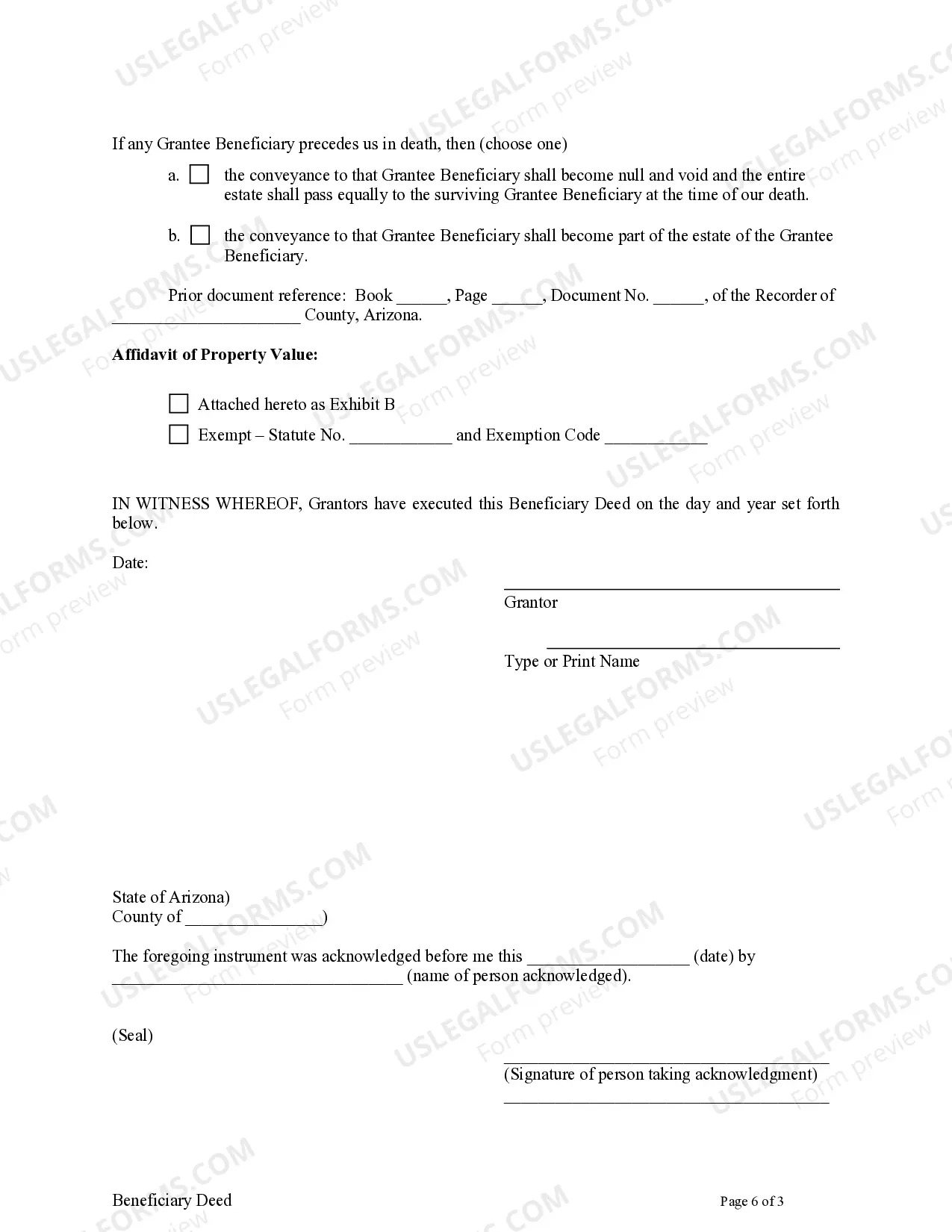

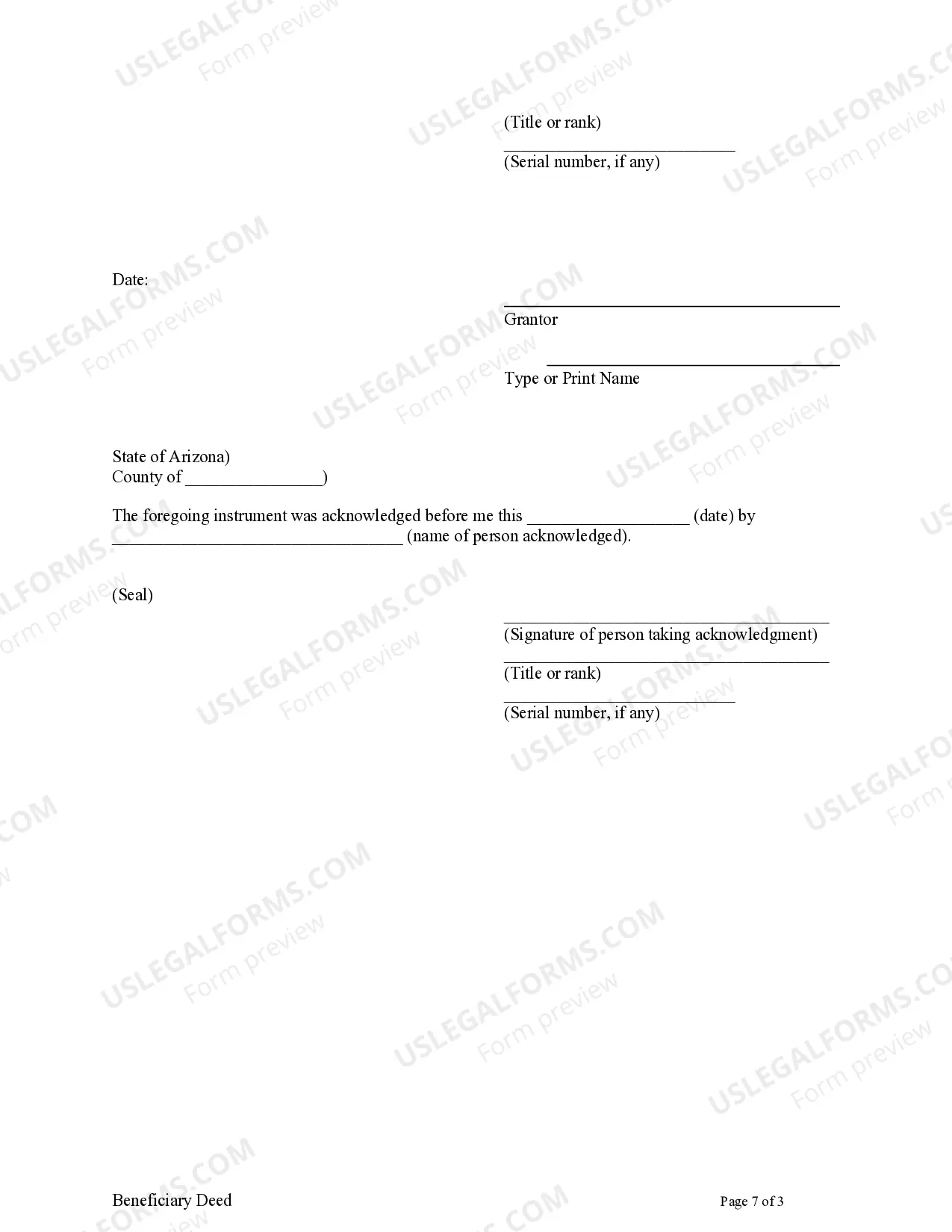

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed For Two Individuals To Two Individuals?

- If you're a returning user, log in to your account and download the necessary form template by clicking 'Download'. Ensure your subscription is active; renew it if needed.

- For first-time users, start by reviewing the preview mode and form description. Verify that you've selected the correct form that aligns with Florida's requirements.

- If adjustments are necessary, utilize the Search tab to find an alternative template that fits your jurisdiction.

- Proceed to purchase the document by clicking the 'Buy Now' button and select your desired subscription plan. You will be required to create an account to access the legal library.

- Complete your purchase securely by providing payment details through credit card or PayPal.

- Download your TOD form and save it on your device. You can re-access your document anytime in the My Forms section of your profile.

US Legal Forms offers an extensive collection of over 85,000 customizable legal forms and packages, providing unmatched value and convenience.

Don’t wait—empower yourself with the legal tools you need today. Start your journey with US Legal Forms and ensure your documents are precise and legally compliant!

Form popularity

FAQ

The best way to transfer property after death in Florida is to utilize a Transfer on Death Deed for Florida. This deed allows property owners to name beneficiaries who will receive the property automatically upon the owner's death. This method avoids probate and facilitates a straightforward transfer process. Always consider consulting with a legal professional to ensure everything is properly handled.

To transfer a title from a deceased person in Florida, first, verify if a Transfer on Death Deed for Florida was executed. If so, the beneficiary simply needs to file the death certificate and the deed with the county records. If no deed exists, you may need to initiate probate proceedings to transfer the title legally. It’s essential to ensure all legal documentation is in order for a smooth transition.

To change property ownership after death in Florida, you can use a Transfer on Death Deed for Florida. This type of deed allows the property to pass directly to beneficiaries without going through probate. You must complete and file the deed with the county clerk before the owner's death. Using this method simplifies the transfer process and ensures your wishes are followed.

Yes, you can create a transfer on death deed in Florida, providing a way to designate who will receive your property upon your death. This deed must be properly drafted and filed to be valid. With uslegalforms, you can find the resources and templates that help you set up a transfer on death deed for Florida efficiently and correctly, ensuring your wishes are honored.

To transfer a title after death in Florida, you typically need to present the original death certificate along with the appropriate paperwork to the relevant authority. If a transfer on death deed for Florida was in place, this process might be simpler since the property automatically transfers to the designated beneficiary. Utilizing the services of uslegalforms can guide you through the necessary steps and paperwork needed for this transition.

Yes, Florida allows transfers on death deeds, making it easier for property owners to transfer their assets directly to beneficiaries upon their passing. This process avoids probate, which can be lengthy and costly. A transfer on death deed for Florida enables property owners to retain control of their property during their lifetime, ensuring a straightforward transition after death.

To change ownership of a property after someone has passed in Florida, you'll typically need to follow the terms outlined in the deceased’s will or look to the Transfer on Death deed if one exists. If probate is necessary, the court will oversee the property distribution according to the will or state laws. Utilizing legal forms and information from reliable sources like US Legal Forms can simplify navigating this process.

While you can create a Transfer on Death deed without a lawyer, consulting one may provide you with essential guidance. A legal professional can help ensure that the deed meets all state requirements and accurately reflects your wishes. Additionally, they can address any specific concerns you have about your estate planning. If you prefer a straightforward solution, consider exploring the US Legal Forms resources for assistance.

One disadvantage of a Transfer on Death deed is that it does not cover all types of property. For instance, it may not apply to certain jointly owned properties or properties with existing liens. Moreover, if the beneficiary predeceases the owner, there could be complications in asset distribution. Understanding these limitations is crucial, and resources on the US Legal Forms platform can provide further guidance.

A Transfer on Death deed operates by designating beneficiaries for your property. When the owner passes away, the property automatically transfers to the named beneficiaries, bypassing the often lengthy probate process. The deed remains revocable during the owner's lifetime, meaning they can change the beneficiaries or revoke the deed entirely if needed. This efficiency makes the Transfer on Death deed for Florida a popular choice among property owners.