Life Estate Deed Explained

Description

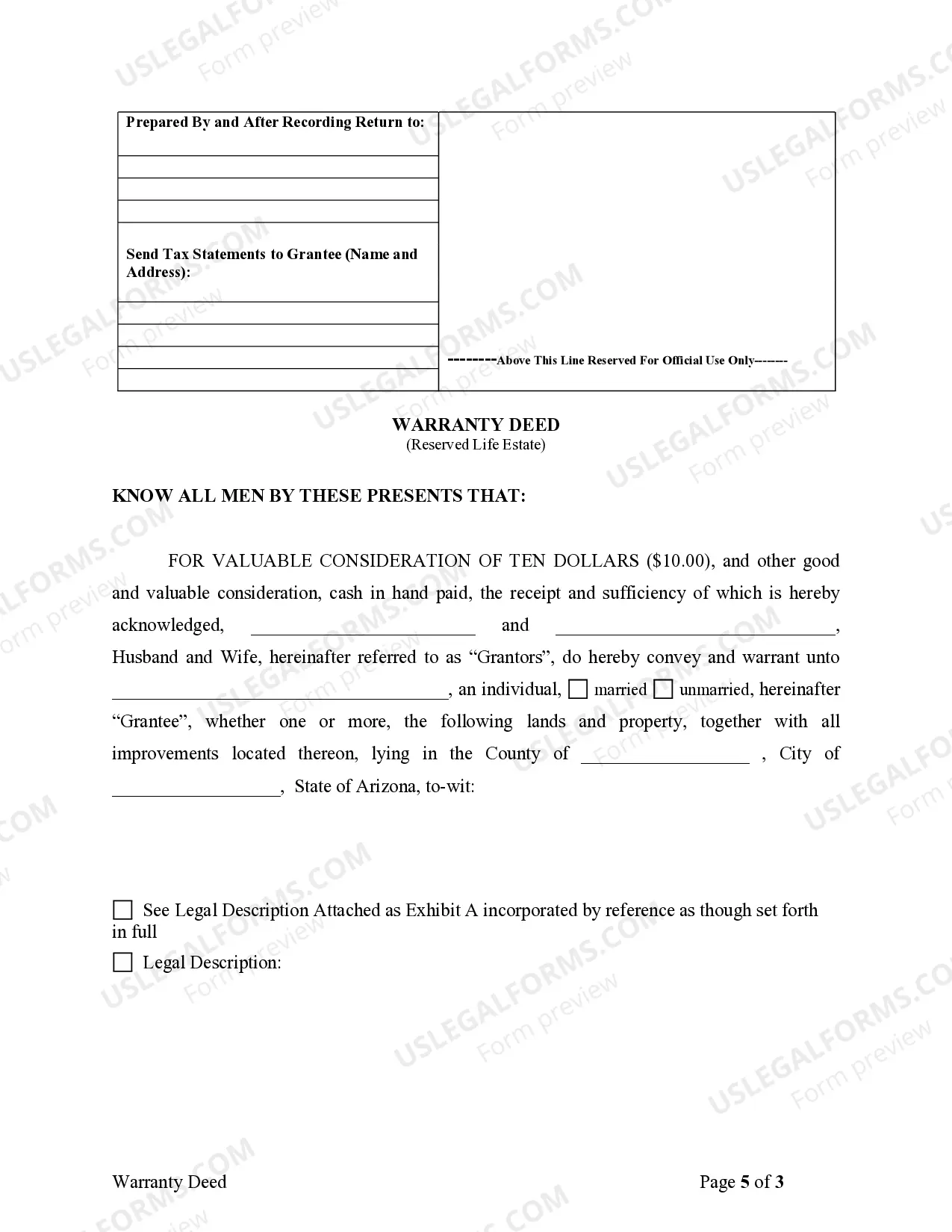

How to fill out Arizona Warranty Deed To Child Reserving A Life Estate In The Parents?

Securing a reliable source for obtaining the most up-to-date and pertinent legal samples constitutes a significant portion of navigating bureaucracy. Locating the proper legal documentation requires accuracy and meticulousness, which highlights the importance of acquiring Life Estate Deed Explained samples solely from trusted providers, like US Legal Forms. An incorrect template can squander your time and hinder the progress of your situation. With US Legal Forms, you can have minimal concerns. You can access and review all pertinent information regarding the document’s applicability and relevance for your specific circumstances and location.

Consider the following steps to complete your Life Estate Deed Explained.

Eliminate the complexities associated with your legal documentation. Explore the extensive US Legal Forms collection to discover legal samples, verify their relevance to your situation, and download them instantly.

- Utilize the library navigation or search feature to locate your sample.

- Check the form’s details to confirm it meets the standards of your state and locality.

- Examine the form preview, if available, to verify that the form is indeed the one you seek.

- Continue your search to find the appropriate document if the Life Estate Deed Explained does not satisfy your requirements.

- If you are confident in the form’s suitability, proceed to download it.

- As an authorized user, click Log in to verify your identity and access your selected forms in My documents.

- If you do not yet have an account, click Buy now to acquire the template.

- Choose the pricing option that best meets your needs.

- Complete the registration process to finalize your acquisition.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Select the document format for downloading Life Estate Deed Explained.

- Once you have the form on your device, you can edit it with the editor or print it and complete it manually.

Form popularity

FAQ

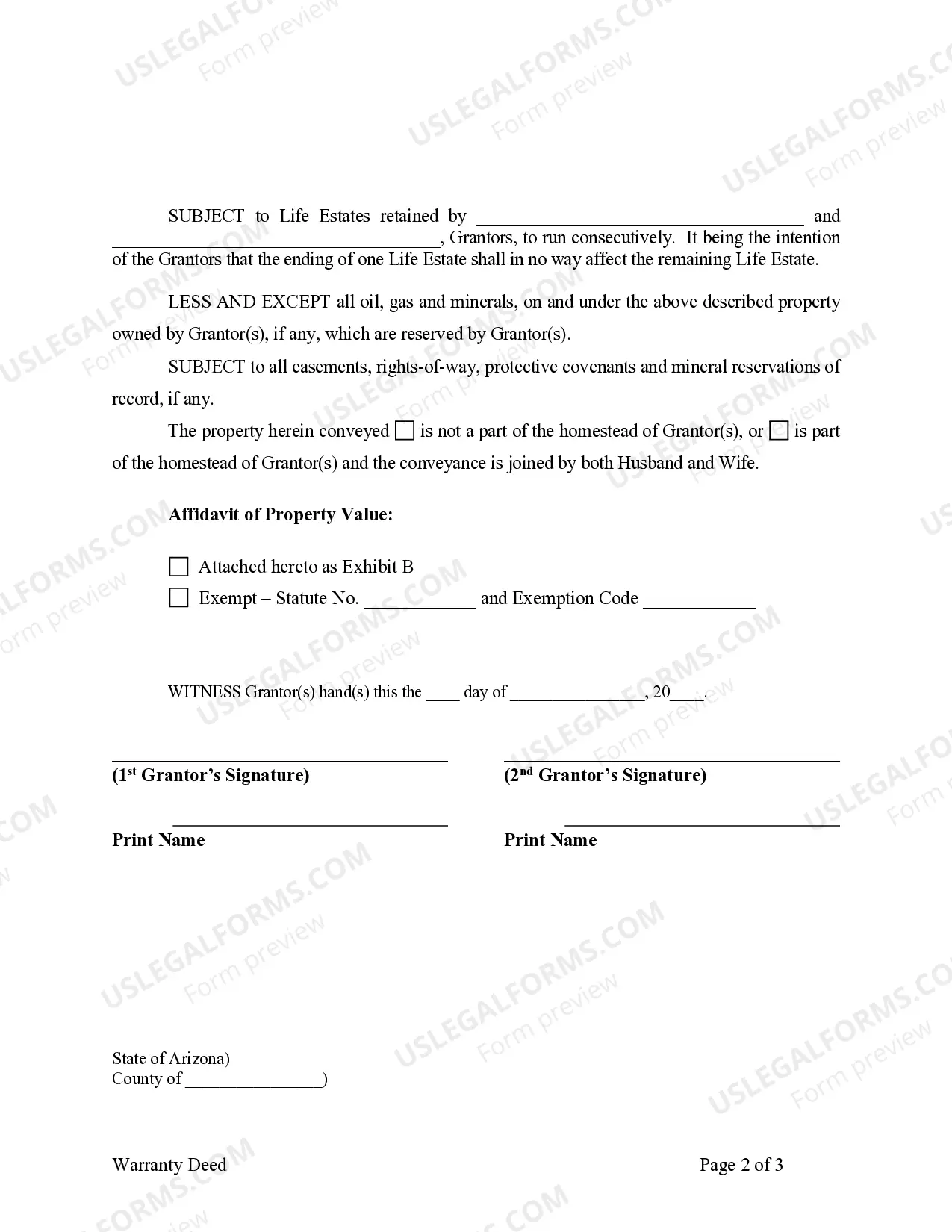

If you hold the life estate your obligated to make repairs that are essential to the preservation of the property, your obligated to pay the interest on any outstanding mortgages and Property taxes.

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.

The life tenant is the property owner for life and is responsible for costs such as property taxes, insurance, and maintenance. Additionally, the life tenant also retains any tax benefits of homeownership.

In addition, life estates allow the owner to control the property in all respects, except that they cannot sell or mortgage the property without the consent of their heirs. If created in a timely manner, a life estate can even help its creator qualify for Medicaid assistance.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.