Quitclaim Deed For Inherited Property

Description

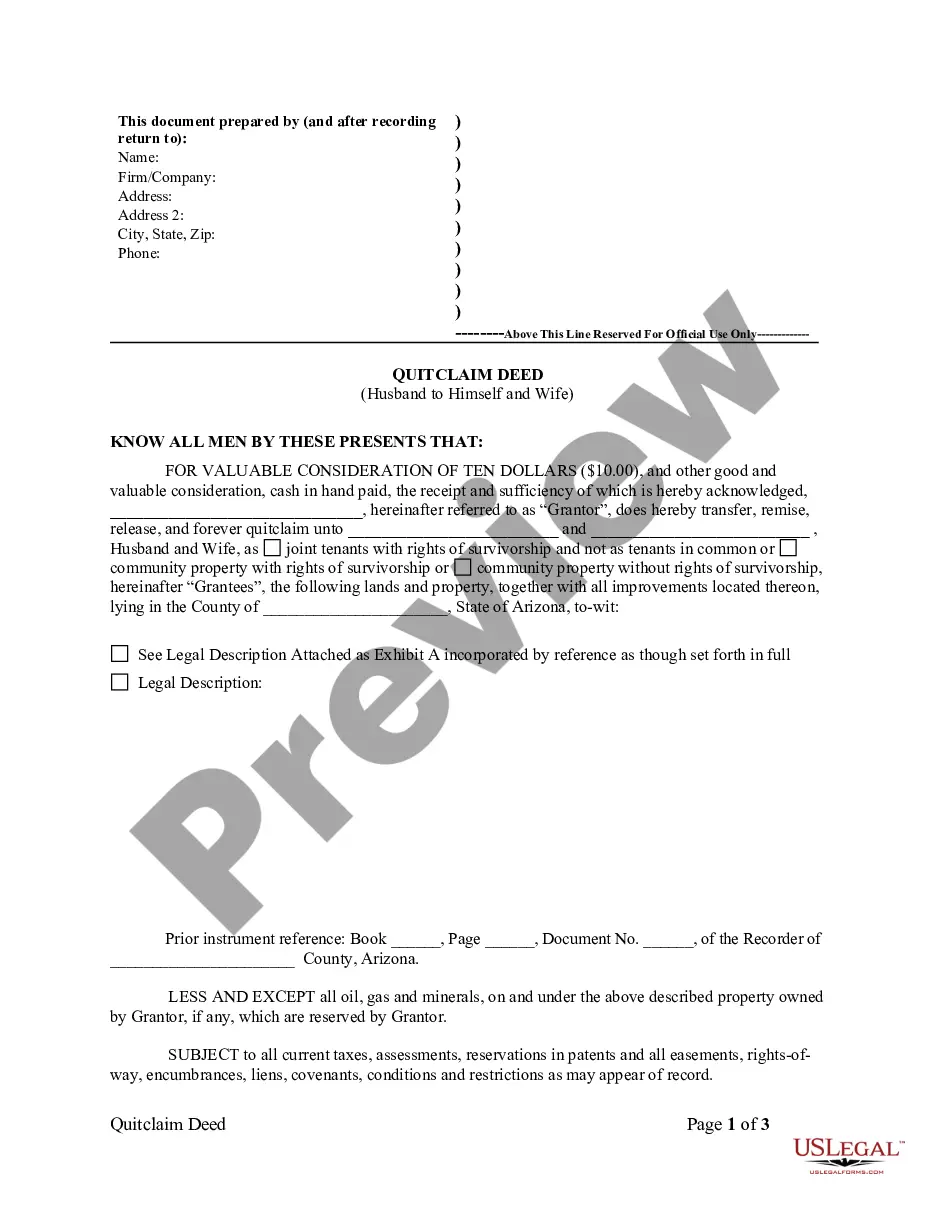

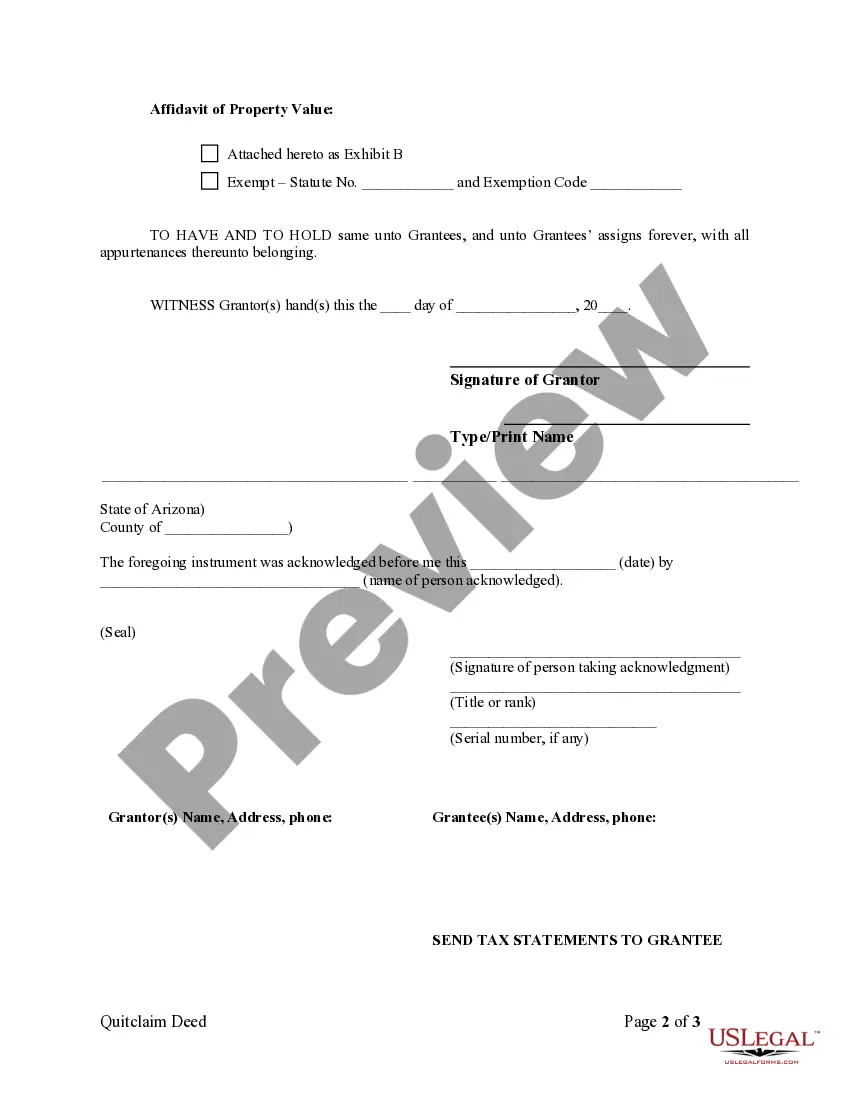

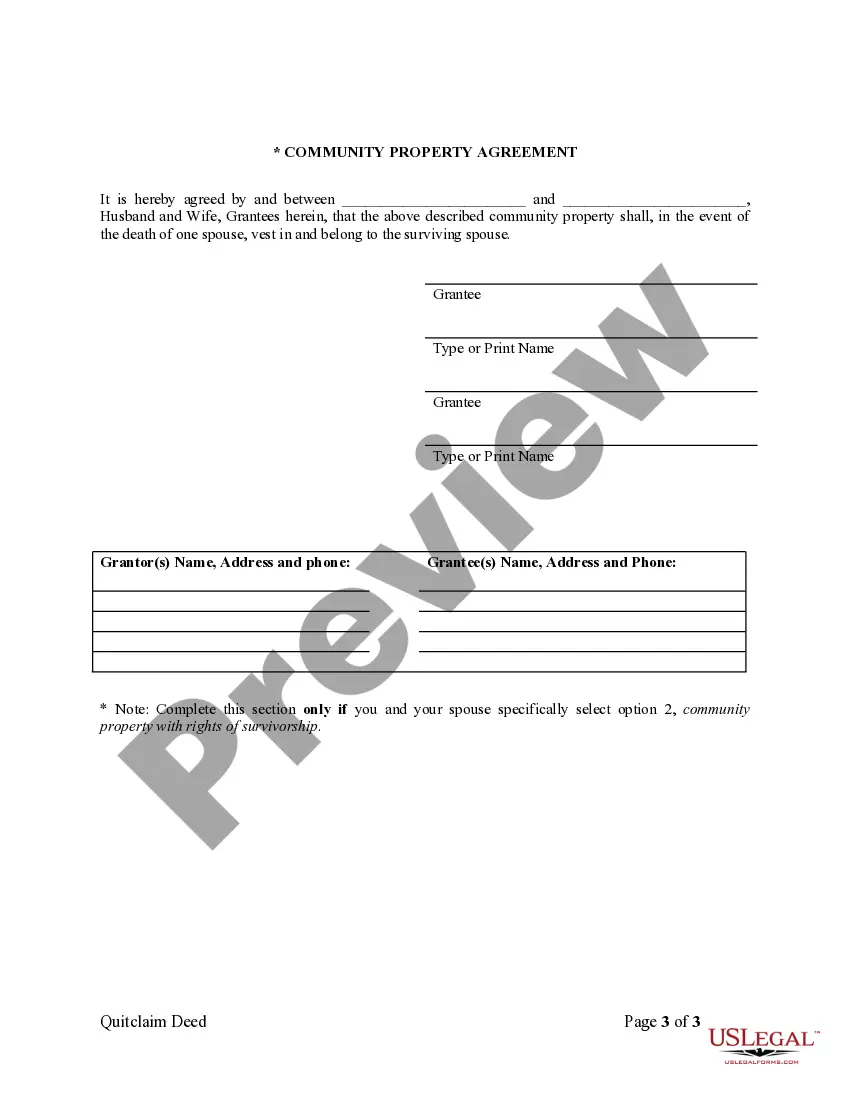

How to fill out Arizona Quitclaim Deed From Husband To Himself And Wife?

- Log into your US Legal Forms account if you are a returning user. Ensure your subscription is active for seamless access.

- For first-time users, begin by reviewing the available templates. Use the Preview mode to verify that the quitclaim deed meets your specific needs and complies with local laws.

- If necessary, search for additional templates using the Search tab to find the correct document.

- Purchase the required quitclaim deed by clicking the Buy Now button and selecting your preferred subscription plan.

- Complete your purchase using credit card or PayPal. Ensure that your registration is confirmed for access to a vast collection of resources.

- After the purchase, download your quitclaim deed form and save it on your device. You can access it at any time through the My Forms section of your account.

With US Legal Forms, you gain access to a comprehensive library that boasts over 85,000 editable legal forms. This service empowers both individuals and attorneys to efficiently create legally valid documents.

Ready to simplify your property transfer? Visit US Legal Forms today and take the first step toward securing your quitclaim deed for inherited property.

Form popularity

FAQ

Individuals who inherit property often benefit from a quitclaim deed for inherited property. This simple document allows them to transfer their interest quickly and efficiently, especially among family members. Additionally, those looking to clarify ownership among co-owners find quitclaim deeds helpful. Overall, it streamlines the process, reducing potential legal complications.

Quitclaim deeds for inherited property can be viewed critically because they lack the protections provided by other types of deeds. Since they transfer ownership without any title guarantees, recipients may find themselves facing unexpected challenges, such as rights claims or outstanding debts. This uncertainty makes many people hesitate to use quitclaim deeds, as they expose individuals to potential risks. It’s advisable to assess your situation carefully and consider alternatives or legal advice.

While a quitclaim deed for inherited property serves many purposes, it does come with some disadvantages. This type of deed does not offer any guarantees about the property title; it simply transfers whatever interest the signer has. This lack of protection can potentially expose the new owner to risks, especially if there are issues with the property title. Therefore, getting legal advice or using platforms like uslegalforms can provide clarity and assistance when opting for a quitclaim deed.

Typically, a quitclaim deed for inherited property does not go through probate if it effectively transfers ownership prior to the owner's death. If the property is solely in the name of the deceased and no quitclaim deed was prepared, then probate is necessary to transfer the property. Thus, it is crucial to plan ahead and utilize quitclaim deeds appropriately. Working with services like uslegalforms can simplify your planning process.

Using a quitclaim deed for inherited property may help bypass probate, depending on how it was set up. If the property owner included beneficiaries in the quitclaim deed, those beneficiaries can receive the property directly without going through probate. This can speed up the transfer process and reduce delays related to the probate court. Consulting uslegalforms can provide guidance on how to set up a quitclaim deed correctly.

A quitclaim deed for inherited property can still be valid after someone's death, as long as it was executed correctly before their passing. When a property owner dies, the quitclaim deed transfers ownership rights to the beneficiaries named in the document. However, it’s essential to consult legal advice to confirm that all necessary steps were taken. Ensuring this can help prevent any disputes regarding the property's ownership.

The best way to transfer property title between family members is often through a Quitclaim deed for inherited property. This method allows for a straightforward transfer without the need for title insurance or lengthy processes. It’s important to have the deed notarized and recorded with the local authority to ensure the change is official. Consider using US Legal Forms to access user-friendly resources that guide you through the title transfer process.

In Texas, you do not necessarily need a lawyer to transfer a deed; you can use a Quitclaim deed for inherited property to make the transfer yourself. However, if the property involves complex issues or disputes, consulting with a real estate attorney is advisable. Ensuring that all forms are correctly filled out and filed is crucial, and services like US Legal Forms can provide the necessary documents to make this process smoother.

The timeframe to transfer a deed after someone passes away can vary by state, but generally, it should be done as soon as possible. Typically, the estate must go through probate, which can take several months. Once you have the necessary legal approvals, you can utilize a Quitclaim deed for inherited property to complete the transfer effectively. For assistance, consider using platforms like US Legal Forms to ensure compliance with local laws.

To change the deed on your inherited property, you'll typically need to complete a Quitclaim deed for inherited property. This form allows you to transfer ownership without any title search or warranty. After filling out the deed, you must sign it in front of a notary and file it with the county office where the property is located. Using a service like US Legal Forms can simplify this process by providing you with the necessary forms and guidance.