Grantor Corporation Forever For The Future

Description

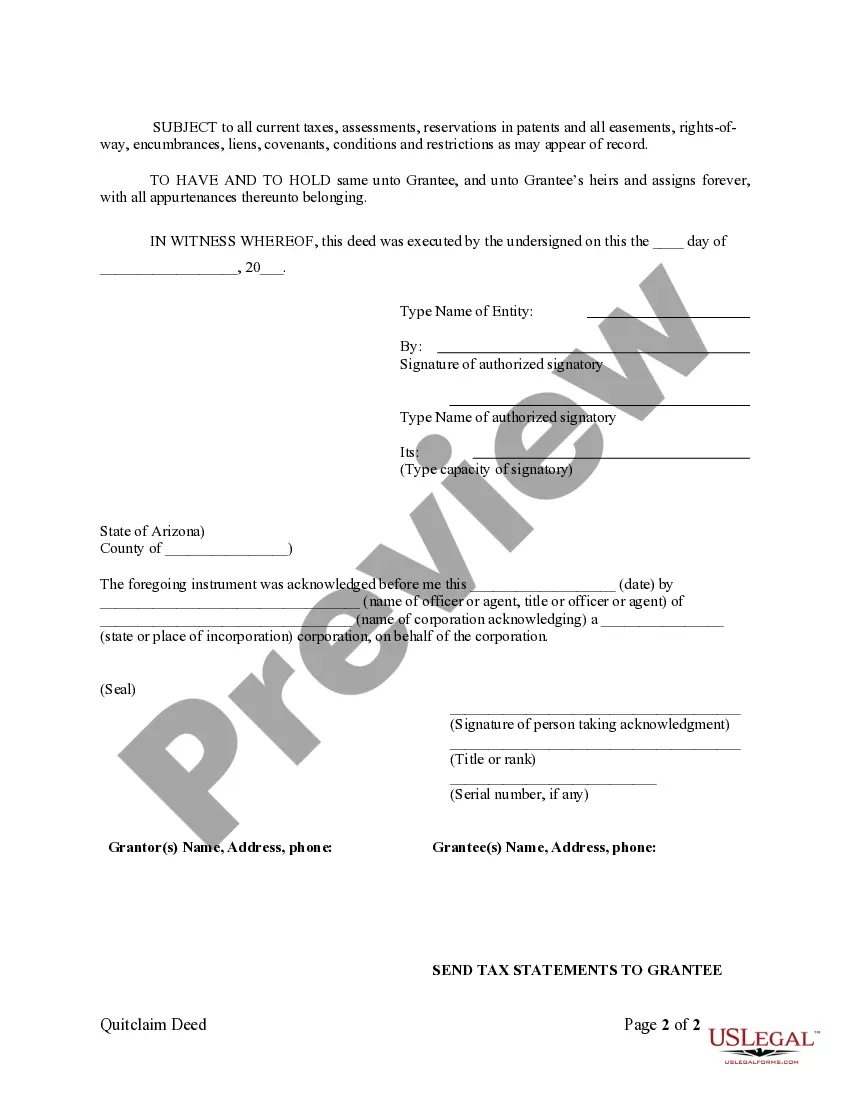

How to fill out Arizona Quitclaim Deed From Corporation To Corporation?

- If you are a returning user, log in to your account and download your desired form by clicking the Download button. Verify your subscription remains active, and renew it if necessary.

- For first-time users, start by browsing the Preview mode and description of the form. Ensure it aligns with your legal requirements and jurisdiction.

- If you require a different template, utilize the Search tab to locate additional options. Confirm that the selected form meets your needs before proceeding.

- Proceed to purchase the document by clicking the Buy Now button, selecting your preferred subscription plan, and creating an account for library access.

- Complete your transaction by entering your payment details through credit card or PayPal.

- Download your form and save it to your device. You can access it anytime via the My Forms section of your profile.

With US Legal Forms, you gain access to an expansive library of over 85,000 customizable legal documents and the advice of premium experts, ensuring accuracy and compliance.

Don't wait to secure your future—visit US Legal Forms today and start building your grantor corporation for lasting protection!

Form popularity

FAQ

An irrevocable trust can indeed last forever, provided it is structured correctly. Once established, the trust typically cannot be changed or revoked, which helps ensure that the assets within it remain protected for future generations. When you use a grantor corporation forever for the future, you can create an effective mechanism for long-lasting asset management that benefits your heirs, reinforcing financial stability over time.

Future interest is often referred to as a reversionary interest or remainder interest depending on the specific circumstance. These terms describe rights that will activate under certain conditions or after a period of time. In the context of a grantor corporation forever for the future, understanding these interests allows you to plan effectively for asset distribution, ensuring alignment with your long-term goals.

Future interest in property refers to the rights to the property that will come into effect in the future. This means someone may not have immediate ownership but will gain rights once certain conditions are met. When establishing a grantor corporation forever for the future, outlining future interests ensures clarity in asset distribution, helping to prevent disputes among beneficiaries.

In legal terms, a future interest held by someone other than the grantor typically refers to a remainder interest. This means that another party will receive benefits from the property upon the occurrence of a specific event. Understanding these concepts is key when setting up a grantor corporation forever for the future, as it helps to clearly delineate who holds the rights to the property in the long term.

Yes, you can create a trust that lasts forever through specific legal structures. A well-crafted trust can ensure your assets are managed according to your wishes indefinitely. With a grantor corporation forever for the future, you establish a framework to support ongoing benefits for your beneficiaries. This allows for peace of mind regarding the long-term distribution of your wealth.

An Intentionally Defective Grantor Trust (IDGT) does not file its own tax return. Instead, the grantor is responsible for reporting all income generated by the trust on their personal tax return. This can simplify the tax process, as all income is taxed at the grantor's individual rate. If you’re looking for ways to manage your IDGT efficiently, consider the guidance available through US Legal Forms, which supports your asset management in a grantor corporation forever for the future.

Form 1041 must be filed annually if the grantor trust generates income that exceeds the IRS threshold. This form reports the income and deductions of the trust, ensuring compliance with federal law. Not filing may lead to penalties, so it's crucial to stay on top of your tax obligations. By understanding the rules surrounding Form 1041 and utilizing resources like US Legal Forms, you can navigate this process smoothly in your grantor corporation forever for the future.

Yes, a grantor trust can indeed be irrevocable. When you establish such a trust, you may choose to make it irrevocable as part of your estate planning strategy. This ensures that the assets within the grantor trust are protected and managed according to your wishes for generations. By utilizing a grantor corporation forever for the future, you enhance your estate’s stability and control.

Setting up a grantor trust involves creating a legal document that outlines the trust's terms, assets, and the roles of the grantor and beneficiaries. You'll want to specify how the assets are managed and what happens upon the grantor's passing. Consulting with a legal or tax professional can provide guidance on the necessary steps and implications. Establishing a grantor corporation forever for the future can streamline this process.

Form 3520-A should be filed with the Internal Revenue Service at the address specified in the form’s instructions. This form is crucial for reporting certain foreign trusts and their activities to remain compliant with U.S. tax laws. Timely filing helps prevent penalties and ensure transparency. Knowing how the grantor corporation forever for the future interacts with different forms like 3520-A aids in comprehensive tax planning.