Grantor Corporation Forever For All

Description

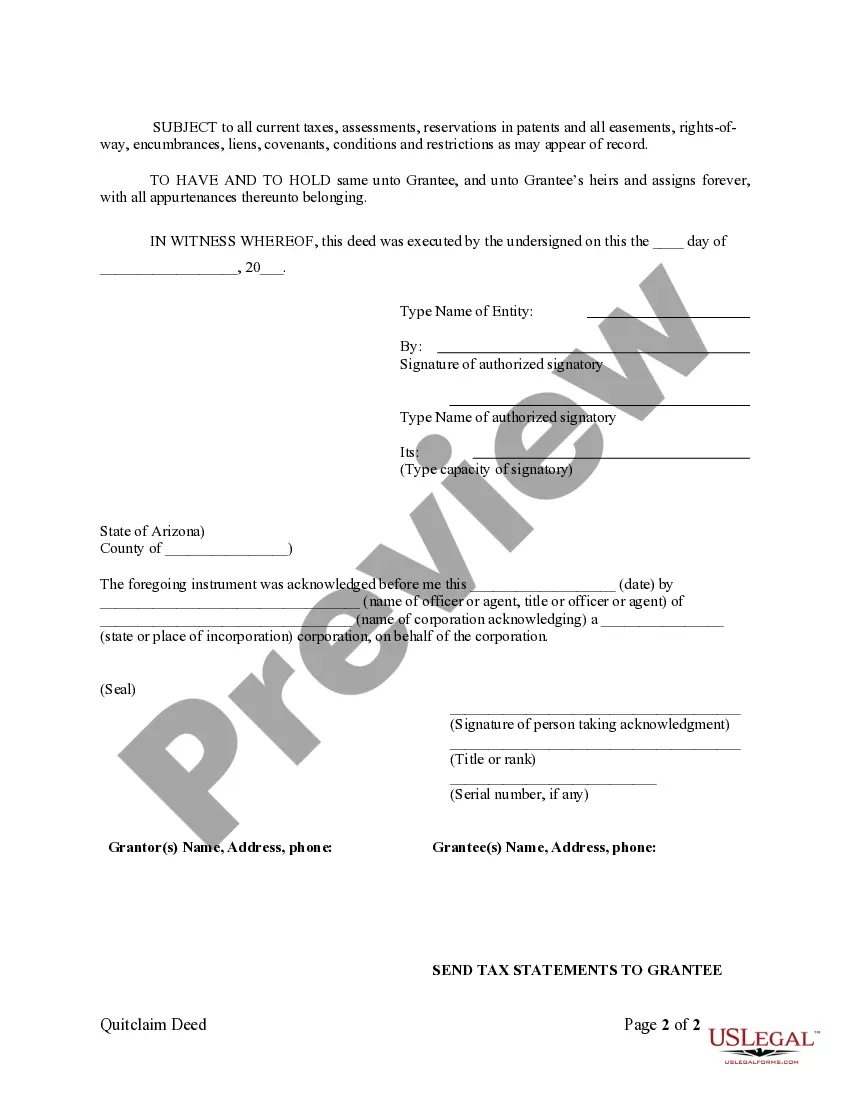

How to fill out Arizona Quitclaim Deed From Corporation To Corporation?

- Log into your US Legal Forms account if you are a returning customer. Ensure your subscription is active to access the documents you need.

- For new users, start by exploring the Preview mode for form descriptions. Verify that you select a document that aligns with your jurisdiction and requirements.

- If you can’t find the right template, use the search feature to locate additional options that suit your needs.

- Once you find the appropriate document, click the Buy Now button to select your preferred subscription plan and register for an account.

- Complete your purchase using your credit card or PayPal to finalize your subscription.

- Download the selected form and save it to your device. You can always return to recover it from the My Forms section in your profile.

In conclusion, US Legal Forms makes obtaining legal documentation quick and efficient. With access to over 85,000 editable legal forms, you can be sure that your documents are accurate and meet legal standards. Don’t hesitate to get started today!

Visit US Legal Forms now and empower yourself with the legal forms you need!

Form popularity

FAQ

To determine the residency of a trust, you should examine where the trust is managed and where the trustee resides. Legal jurisdiction can impact taxation and legal matters related to the trust. Trust residency is crucial for ensuring compliance with applicable laws and tax regulations. For more information on evaluating trust residency, visit US Legal Forms to access comprehensive guides.

Trust residency is often determined based on the location of the trustee or where the trust administration occurs. Factors like the trust's terms, governing law, and the domicile of the grantor also play a role. Understanding these factors is vital for tax purposes and legal compliance. US Legal Forms offers resources that help clarify how to assess trust residency accurately.

Yes, a corporation can indeed function as a grantor in the creation of trusts. This arrangement allows companies to manage assets or funds while retaining control and responsibility. Using a grantor corporation forever for all brings beneficial tax implications and can streamline estate planning processes. At US Legal Forms, we provide tools to help corporations navigate their role as grantors effectively.

A grantor letter is a document that clarifies the relationship between the grantor and the trust, particularly for tax reporting. This letter typically confirms that the trust’s income is reported on the grantor's personal tax return, reinforcing the control the grantor has over the trust. Understanding your obligations with a grantor letter helps you navigate tax reporting efficiently. For assistance with grantor letters, our resources at US Legal Forms can be invaluable.

One significant mistake parents make is failing to communicate their wishes and intentions clearly to their children. Without open discussions, beneficiaries may misunderstand the trust's purpose or terms. It's essential for parents to engage with their children about the trust and its management. At US Legal Forms, we offer templates and guidance to help you avoid common pitfalls when setting up a trust fund.

Yes, you can place your primary residence in a trust, making it part of your estate planning strategy. Holding your home in a trust often simplifies transfer upon death and can help avoid probate. Trusts also allow you to control how the property will be managed or distributed. Explore our offerings at US Legal Forms for simple ways to set up a trust that accommodates your primary residence.

An Employer Identification Number (EIN) may not be necessary for an irrevocable grantor trust, as the income typically gets reported on the grantor’s personal tax return. However, it is essential to consult a tax professional regarding your specific situation. If the trust generates income independent of the grantor, obtaining an EIN might be advisable. At US Legal Forms, we provide resources to ensure you understand the requirements clearly.

Examples of a grantor include individuals selling their home, companies transferring property in a real estate deal, and governmental bodies conveying land. Each of these entities plays a vital role in property transactions and must understand the implications of their actions. Familiarity with the concept of grantor corporations forever for all can simplify property transfers.

The weakest form of deed is usually the quitclaim deed. This type of deed offers no warranties about the title and merely transfers whatever interest the grantor has in the property. It is crucial for buyers to be cautious when considering a quitclaim deed, especially in the context of a Grantor corporation forever for all, as it may come with potential risks.

No, the terms grantor and owner are not the same, though they can overlap. The owner holds legal title to the property, while the grantor is the one who transfers that title to someone else. Understanding the distinction helps in formalizing property transactions, particularly when dealing with a Grantor corporation forever for all.