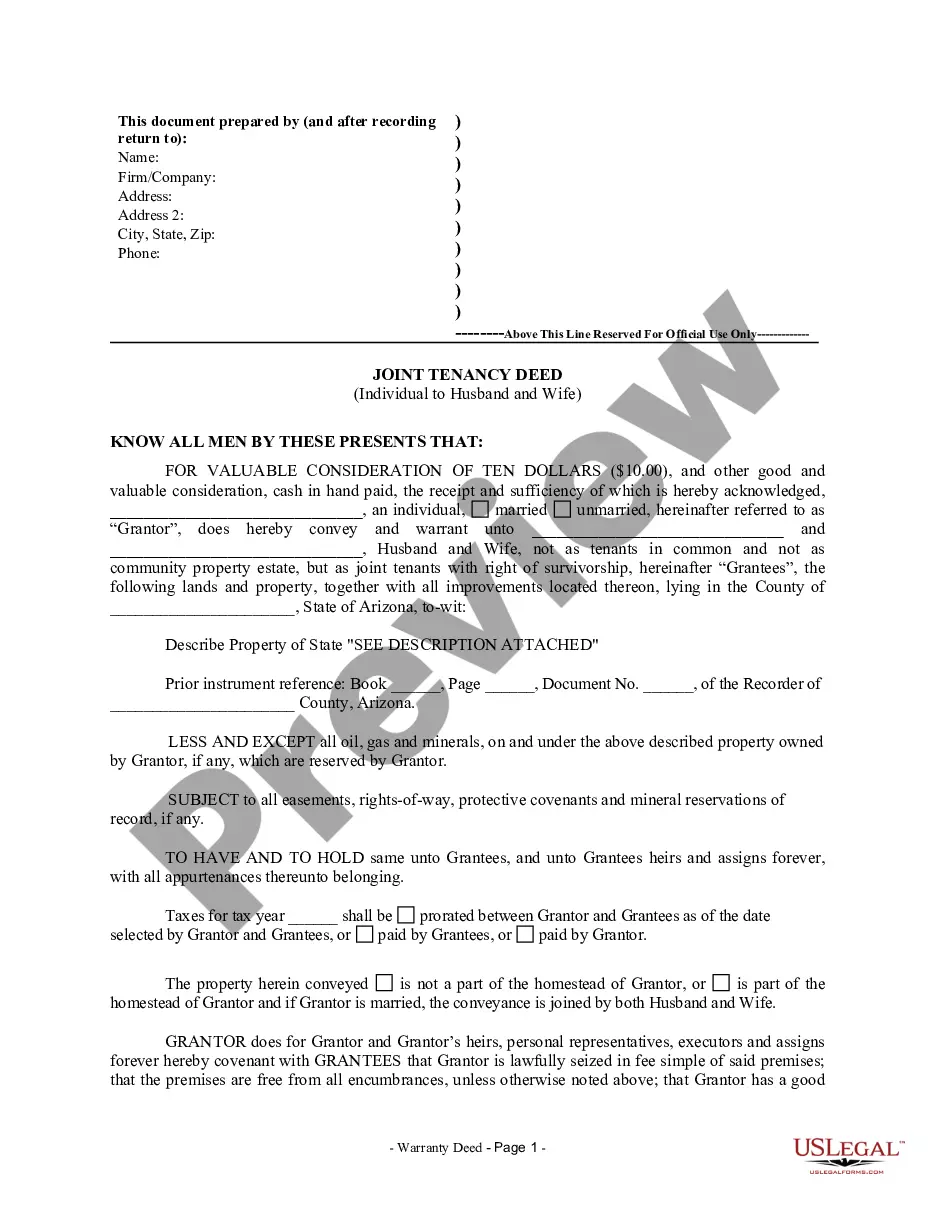

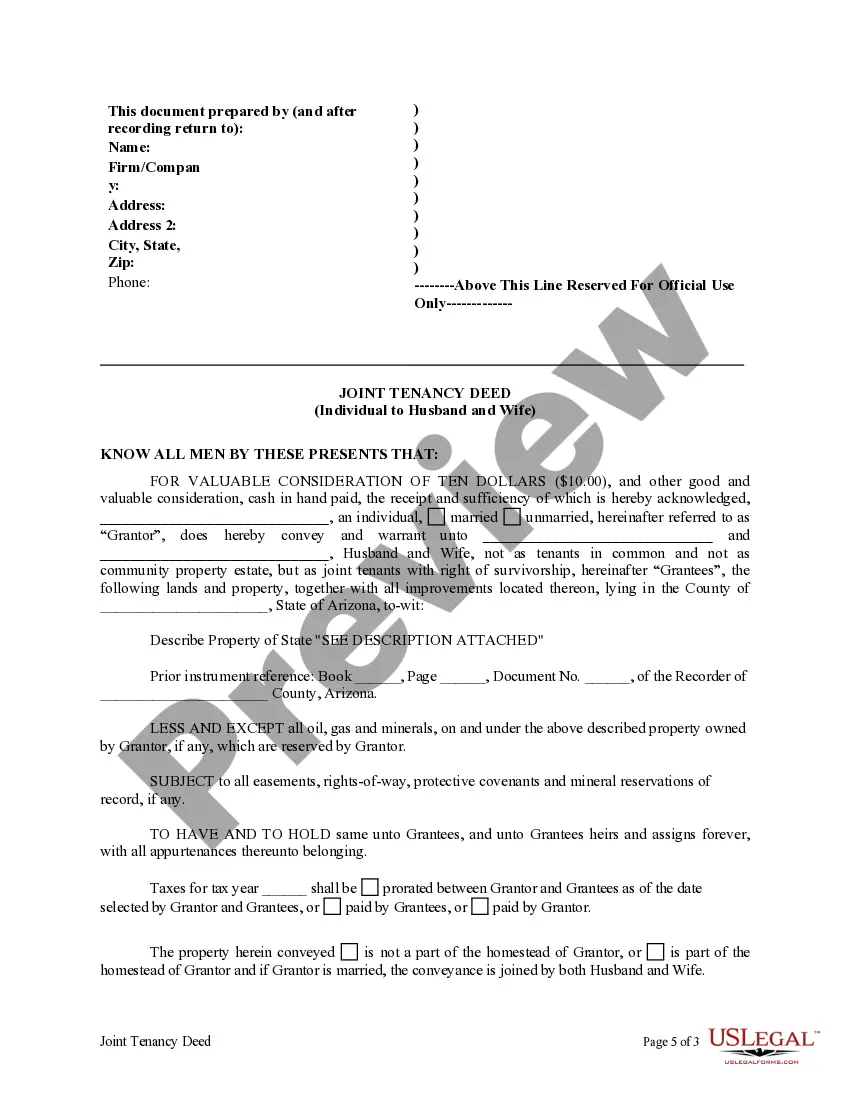

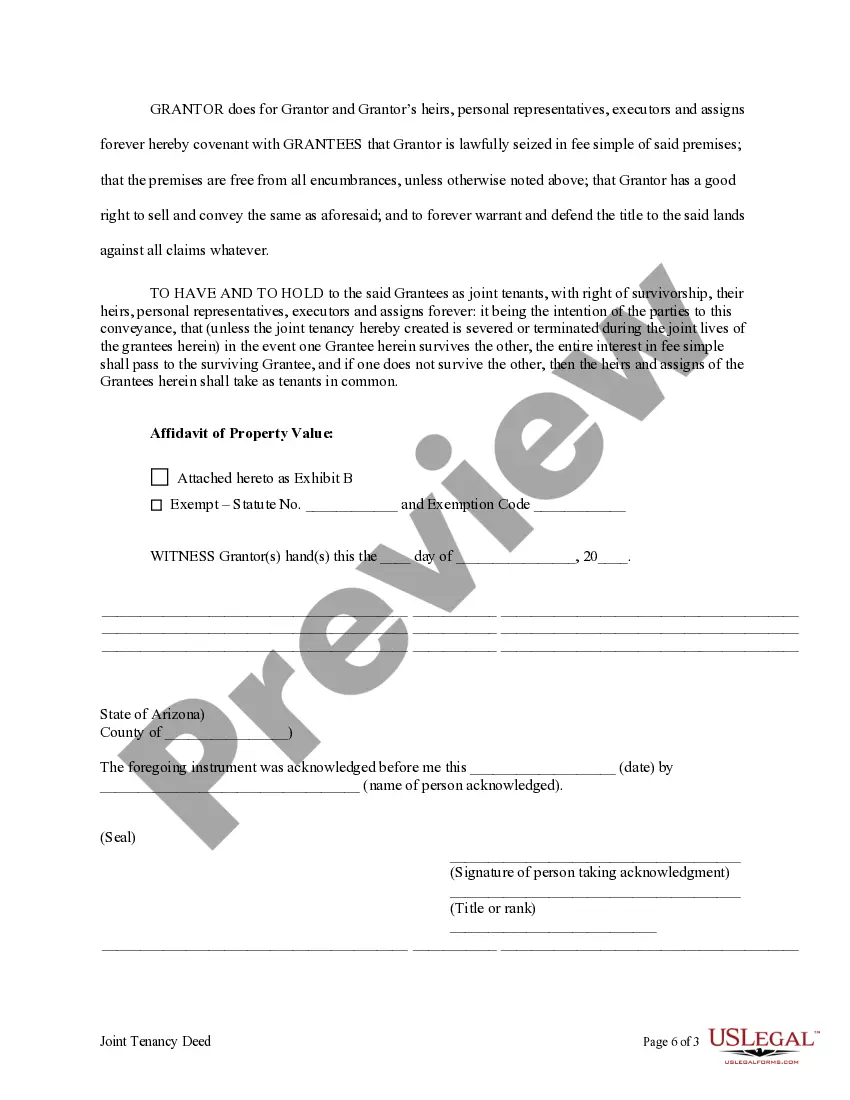

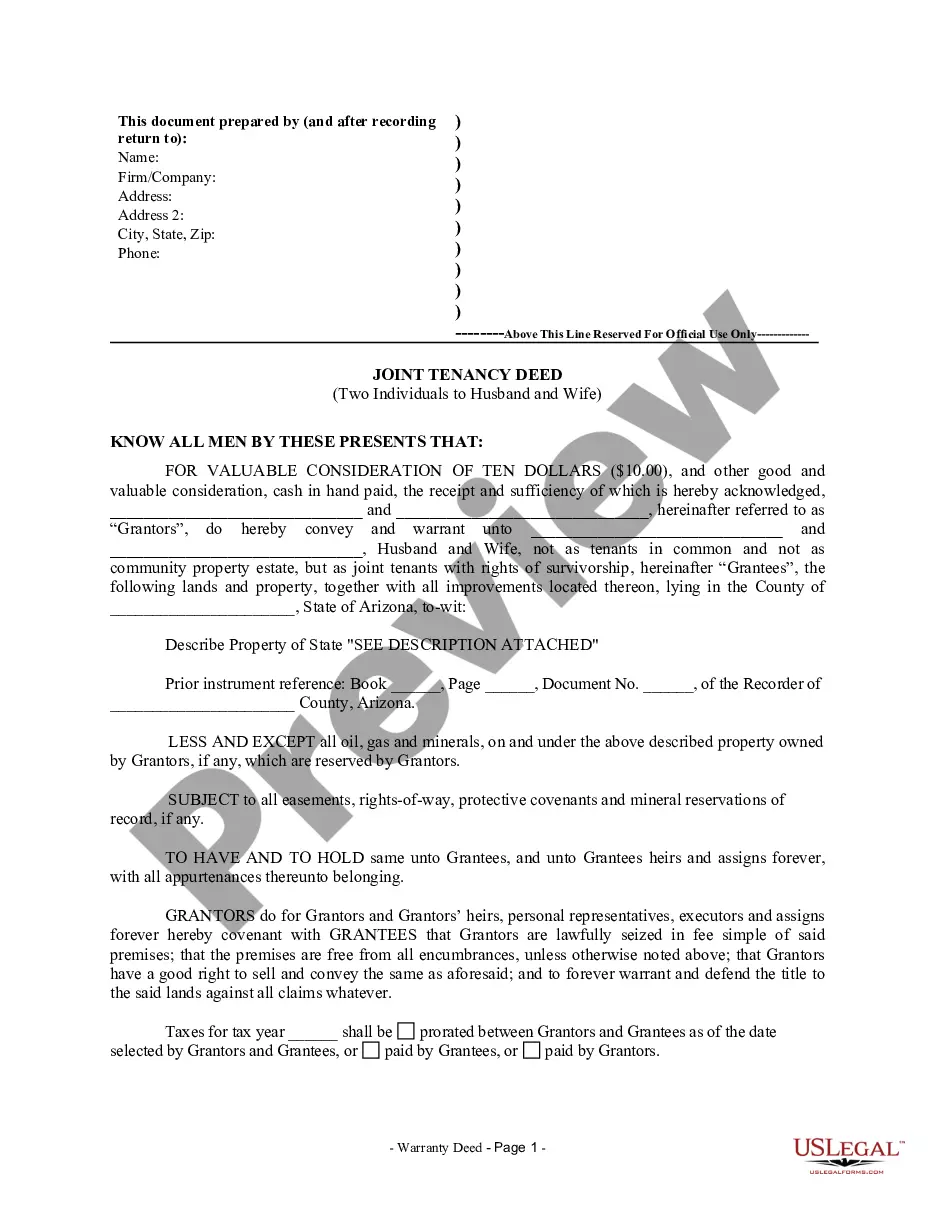

This form is a Joint Tenancy Deed where the grantor is an individual and the grantees are husband and wife.

Joint Tenants With Right Of Survivorship Deed With California

Description

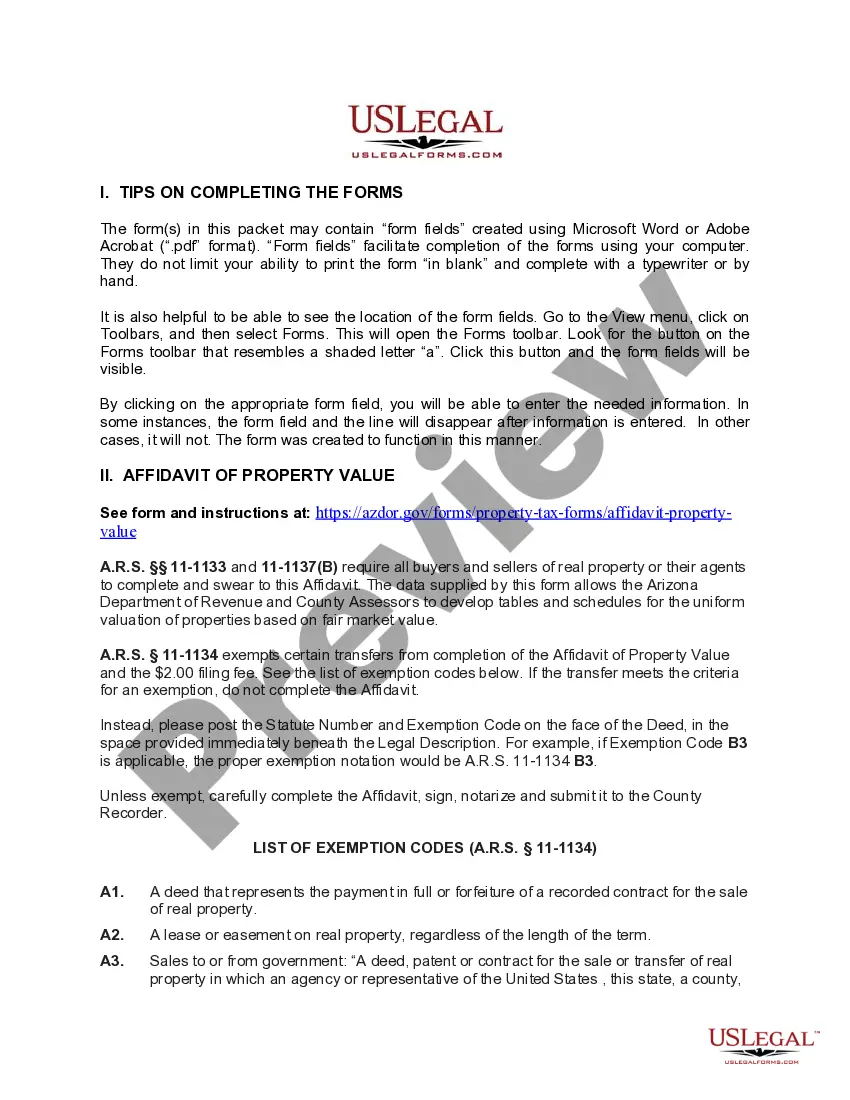

How to fill out Arizona Joint Tenancy Deed From Individual To Husband And Wife?

Using legal templates that comply with federal and regional regulations is crucial, and the internet offers a lot of options to choose from. But what’s the point in wasting time looking for the right Joint Tenants With Right Of Survivorship Deed With California sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and life situation. They are simple to browse with all files arranged by state and purpose of use. Our experts keep up with legislative updates, so you can always be confident your form is up to date and compliant when acquiring a Joint Tenants With Right Of Survivorship Deed With California from our website.

Obtaining a Joint Tenants With Right Of Survivorship Deed With California is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, follow the steps below:

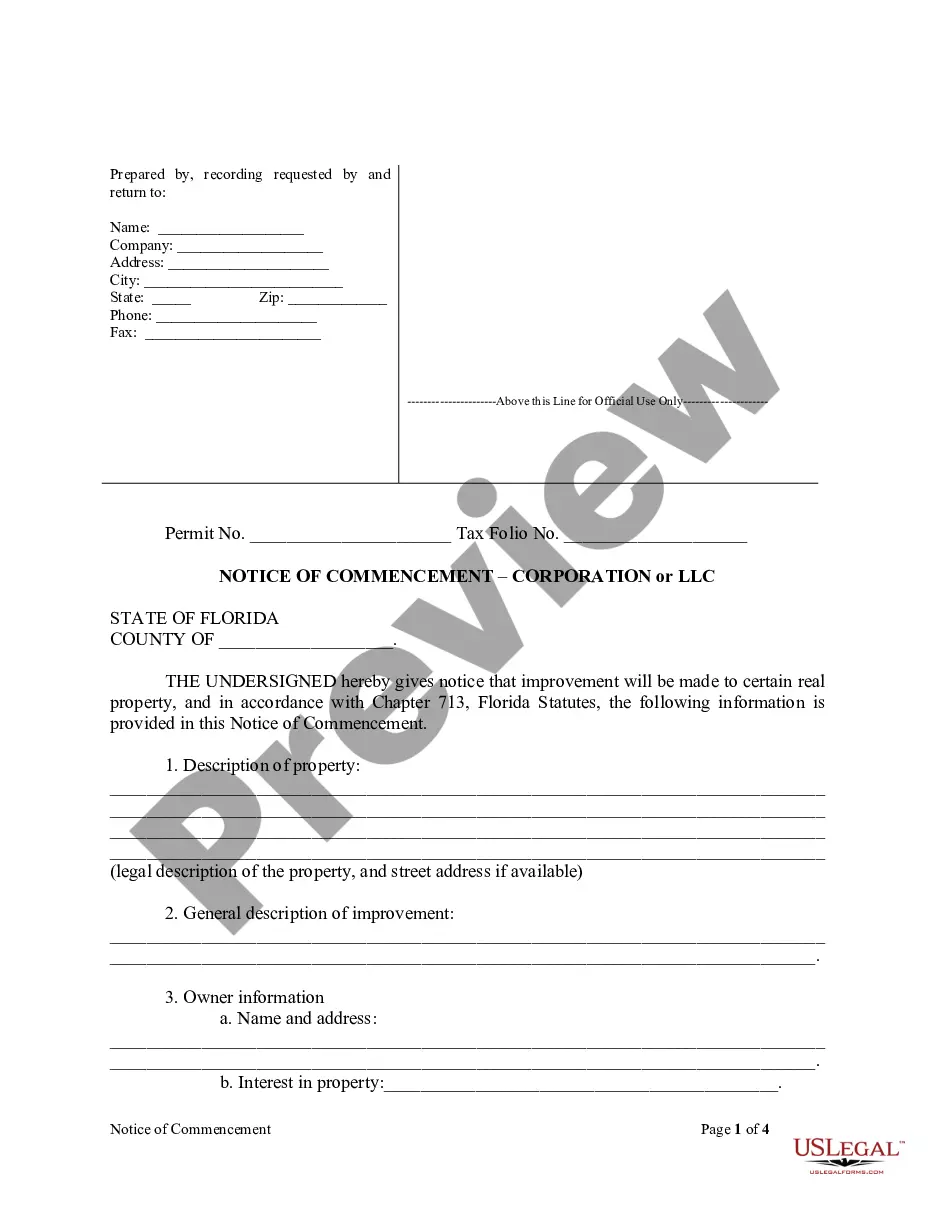

- Take a look at the template using the Preview option or through the text outline to make certain it meets your requirements.

- Browse for a different sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and choose a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Joint Tenants With Right Of Survivorship Deed With California and download it.

All documents you locate through US Legal Forms are reusable. To re-download and fill out earlier saved forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

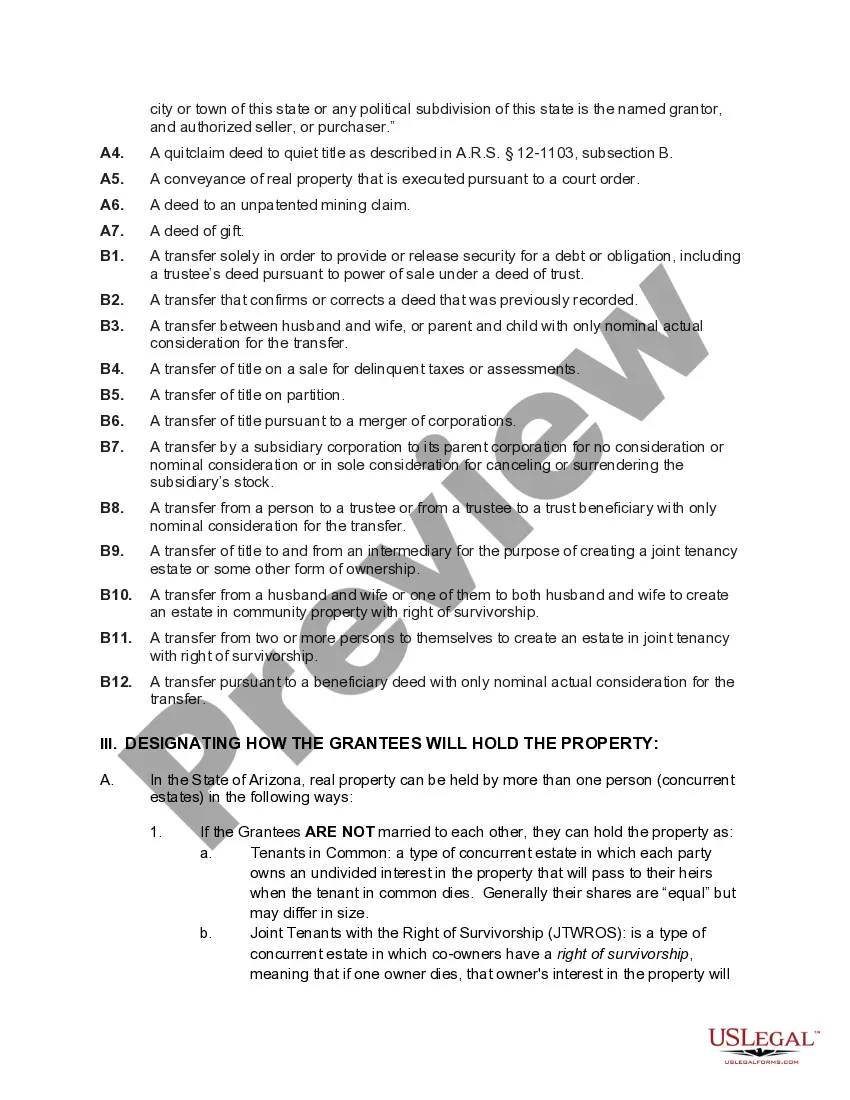

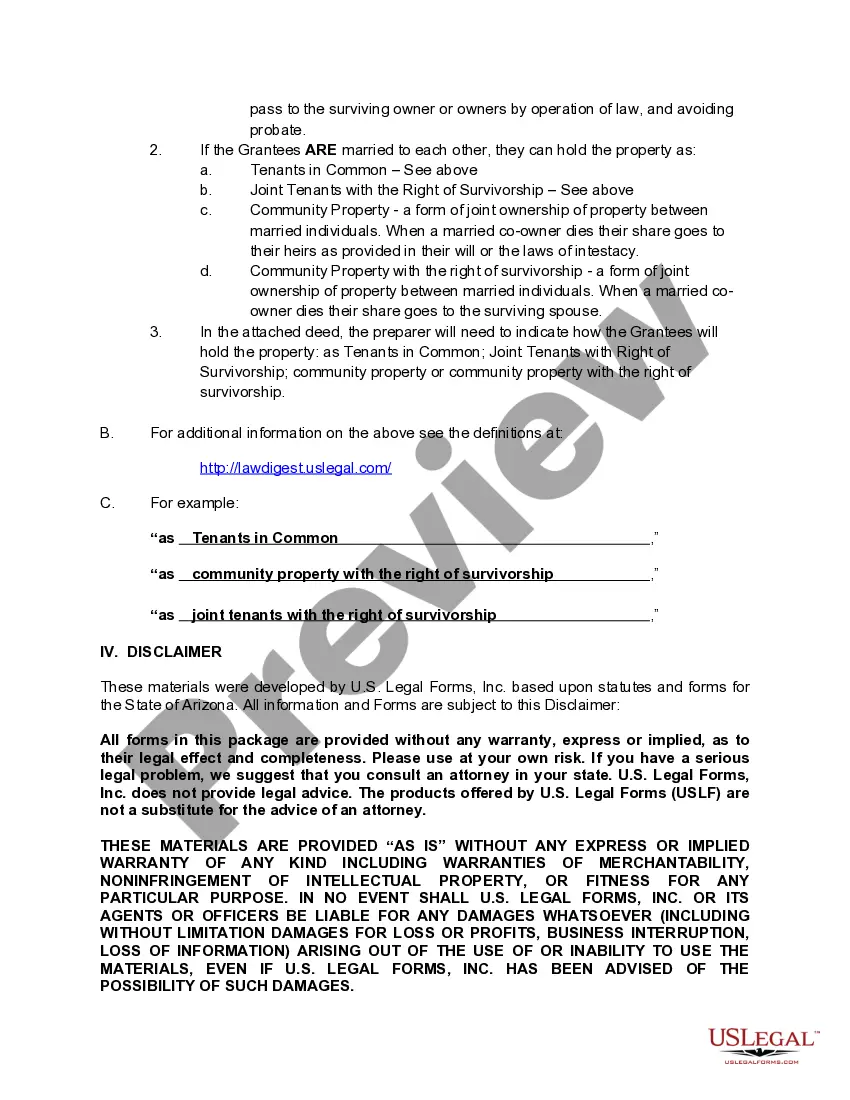

The main difference between joint tenants vs community property with right of survivorship lies in how the property is taxed after the death of a spouse. In joint tenant agreements, the proceeds from the sale of a property (after the death of a spouse) would be subject to the capital gains tax.

Joint tenancy is a special type of co-ownership recognized in California. It is commonly associated with married couples, ensuring that when one of them dies, their entire interest in the property passes to the other spouse. This is called the right of survivorship, and it is the defining trait of a joint tenancy.

For spouses: Assets in JTWROS accounts may get a step-up on cost basis when either spouse passes away. This can help reduce capital gains taxes when selling a property, but you can only step-up half of the full value of the asset. This 50% step-up represents the portion owned by the joint owner who died.

Joint Tenancy Has Some Disadvantages They include: Control Issues. Since every owner has a co-equal share of the asset, any decision must be mutual. You might not be able to sell or mortgage a home if your co-owner does not agree.

Key Takeaways. Some of the main benefits of joint tenancy include avoiding probate courts, sharing responsibility, and maintaining continuity. The primary pitfalls are the need for agreement, the potential for assets to be frozen, and loss of control over the distribution of assets after death.