Llc Operating Agreement Arizona With S Corp Election

Description

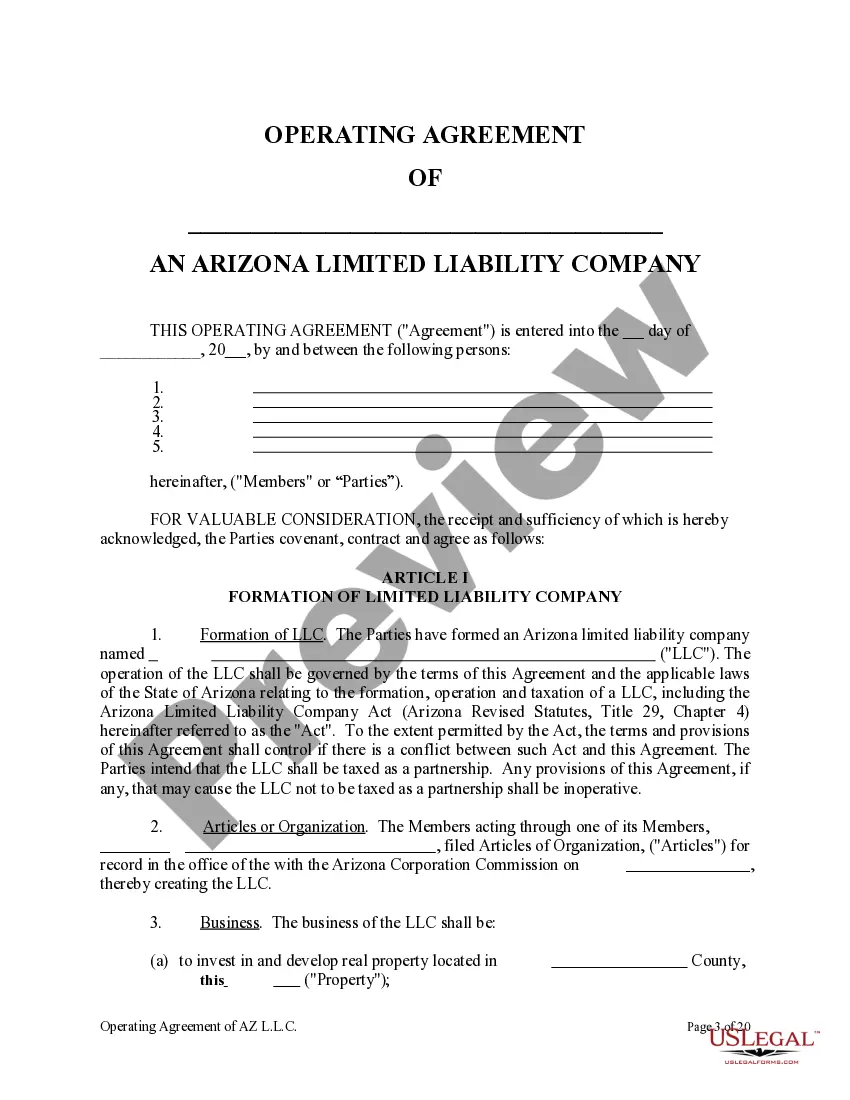

How to fill out Arizona Limited Liability Company LLC Operating Agreement?

Finding a go-to place to take the most recent and relevant legal templates is half the struggle of handling bureaucracy. Finding the right legal documents calls for precision and attention to detail, which is why it is vital to take samples of Llc Operating Agreement Arizona With S Corp Election only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and check all the details concerning the document’s use and relevance for the situation and in your state or region.

Consider the listed steps to complete your Llc Operating Agreement Arizona With S Corp Election:

- Use the library navigation or search field to locate your sample.

- View the form’s information to see if it matches the requirements of your state and region.

- View the form preview, if available, to make sure the form is definitely the one you are searching for.

- Resume the search and find the appropriate template if the Llc Operating Agreement Arizona With S Corp Election does not fit your requirements.

- If you are positive regarding the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Pick the pricing plan that suits your needs.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by choosing a payment method (bank card or PayPal).

- Pick the file format for downloading Llc Operating Agreement Arizona With S Corp Election.

- Once you have the form on your device, you may modify it with the editor or print it and complete it manually.

Eliminate the inconvenience that accompanies your legal documentation. Discover the comprehensive US Legal Forms catalog to find legal templates, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

To have your Arizona LLC taxed as an S-corp, you will need to file Form 2553 with the Internal Revenue Service (IRS). S-corp tax election is available for LLCs or corporations, and must be approved by the IRS.

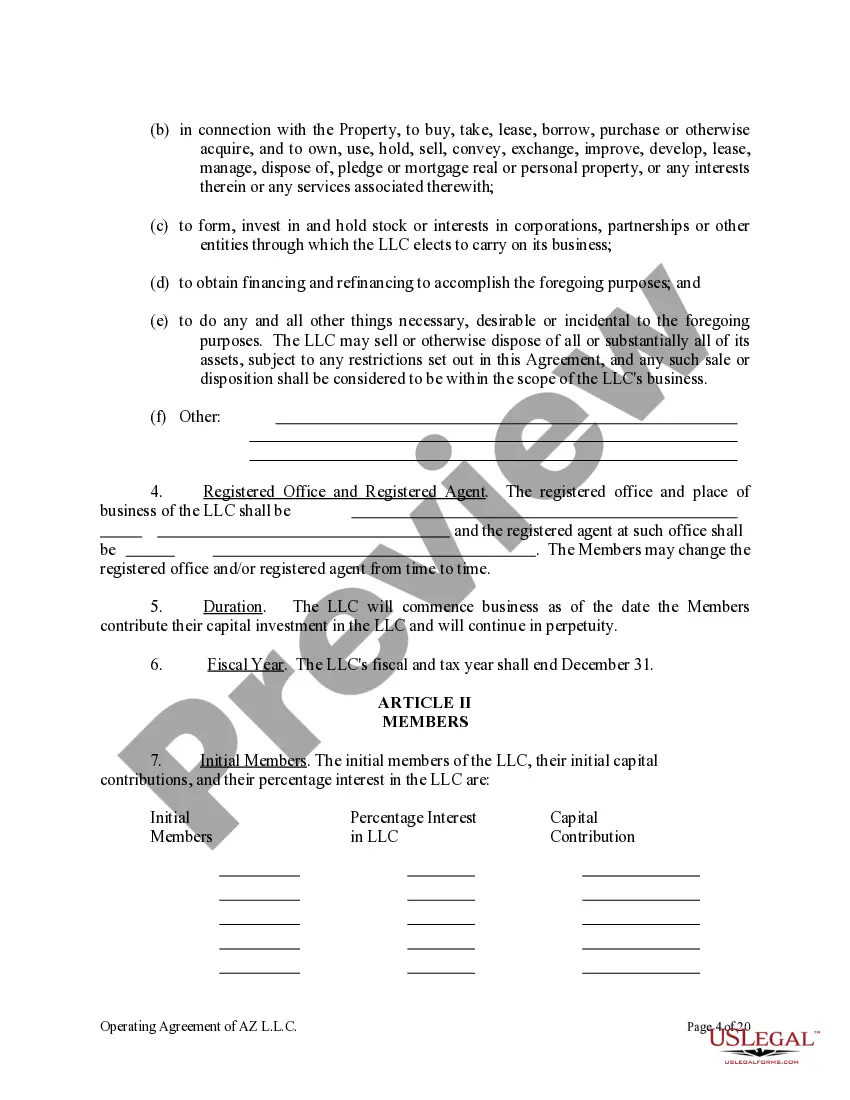

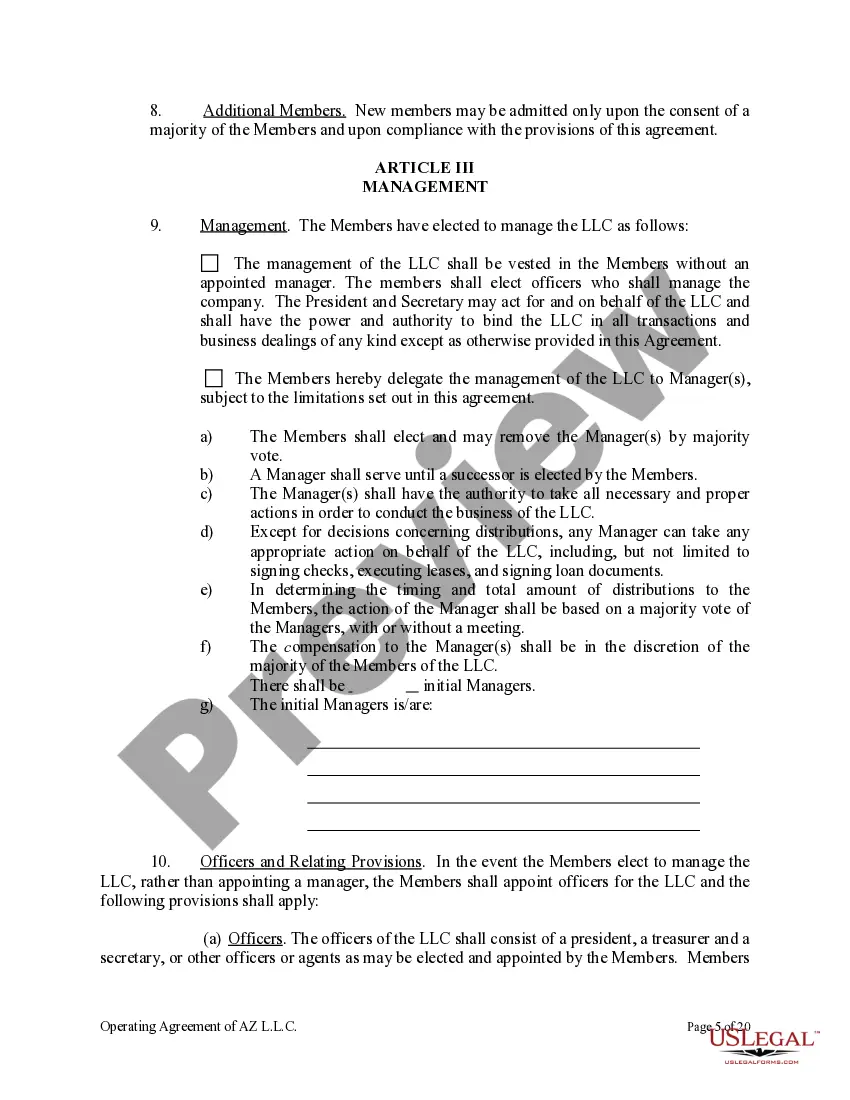

Draft the Operating Agreement These documents should include the roles and rights of the shareholders, how decisions are made, and how profits and losses are distributed. Additionally, the agreement should contain provisions to handle changes in ownership, dissolution, and dispute resolution.

The default federal tax status for a single-member limited liability company (SMLLC) is disregarded entity. However, the owner of an SMLLC can elect to have the business taxed as either a traditional C corporation or as an S corporation. An S corporation is a special type of small, closely-held corporation.

Instead of using an operating agreement, which is specific to an LLC, an S corporation will rely on its corporate bylaws and articles of incorporation. All states require S corporations to use articles of incorporation. However, corporate bylaws are not required in every state.

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders. See the Instructions for Form 2553PDF for all required information and to determine where to file the form.