Arizona Contract Real Estate Withholding

Description

How to fill out Arizona Contract For Sale And Purchase Of Real Estate With No Broker For Residential Home Sale Agreement?

It’s clear that you can’t transform into a legal authority instantly, nor can you learn how to swiftly draft Arizona Contract Real Estate Withholding without possessing a specialized educational foundation.

Producing legal documents is a time-intensive endeavor that demands specific knowledge and expertise. So why not entrust the creation of the Arizona Contract Real Estate Withholding to qualified professionals.

With US Legal Forms, one of the most comprehensive legal template libraries, you can discover everything from court documents to templates for internal corporate communications.

You can revisit your documents from the My documents section at any time. If you’re a returning client, you can easily Log In, and locate and download the template from the same section.

Regardless of the aim of your forms—whether related to finance, legal matters, or personal use—our website has everything you need. Try US Legal Forms now!

- Locate the document you require using the search feature at the top of the webpage.

- Preview it (if this option is available) and examine the accompanying description to determine whether Arizona Contract Real Estate Withholding meets your needs.

- Initiate your search again if you require a different template.

- Sign up for a complimentary account and choose a subscription plan to acquire the form.

- Select Buy now. After the payment is processed, you can obtain the Arizona Contract Real Estate Withholding, complete it, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

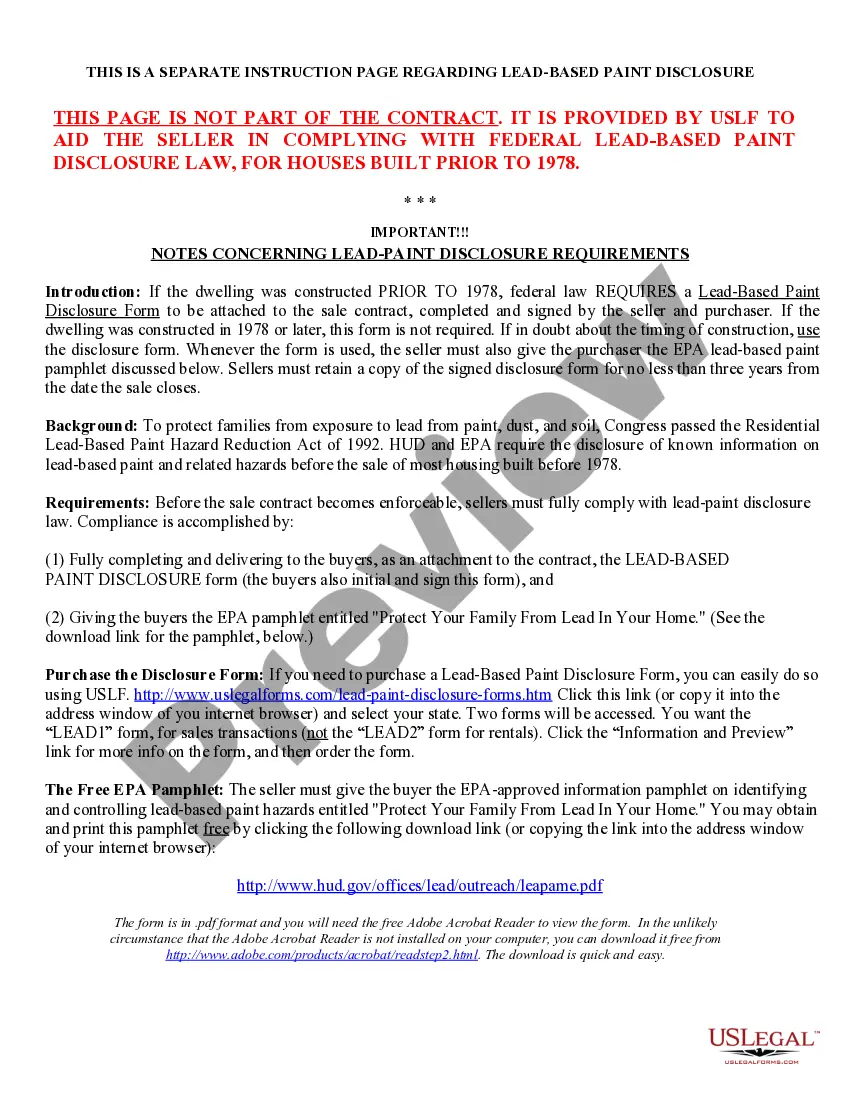

Arizona Form 5000 is utilized for reporting Arizona contract real estate withholding from the sale of real estate in the state. This form helps both buyers and sellers comply with tax obligations by ensuring that the correct amount of withholding tax is reported and remitted. Correct use of this form contributes to smooth property transactions. You can obtain this form from US Legal Forms, which simplifies the whole process for you.

AZ Form 5000 deals primarily with the withholding tax itself, whereas AZ Form 5005 is used to report the details of the property transaction. Thus, while both forms are integral to the Arizona contract real estate withholding process, they serve different purposes. Understanding this distinction helps ensure that you comply with state regulations. You can find templates for both forms on US Legal Forms to assist with your transactions.

You should file Arizona Form A1 QRT with the Arizona Department of Revenue. This form pertains to quarterly withholding tax requirements for employers, including those involved in Arizona contract real estate withholding. Filing accurately and on time is crucial to avoid penalties. Use platforms like US Legal Forms to find filing locations and necessary forms easily.

Arizona Form 5005 is essential for detailing the transaction involved in Arizona contract real estate withholding. Sellers must use this form to communicate information about the sale and any exemptions that may apply. This helps ensure compliance with state tax requirements, making it an important document in real estate transactions. You can easily access this form through US Legal Forms for a smooth experience.

IRS Form 5000 is a key document related to Arizona contract real estate withholding. This form is specifically used by buyers of real estate in Arizona to report and remit the state income tax withholding from the sale of the property. Understanding and correctly filling out this form can prevent potential issues with tax obligations. Using a reliable platform like US Legal Forms can simplify this process for you.

To receive a refund of your withholding, you will need to file the appropriate forms with the IRS, typically Form 843, requesting a refund for the over-withholding. It’s vital to provide accurate details about your transaction and include any supporting documentation. Understanding the requirements surrounding Arizona contract real estate withholding makes this process much smoother. You can also utilize US Legal Forms for guidance and simplified steps in filing for your refund.

To recover FIRPTA withholding, you must file Form 8288-B with the IRS. This form requests a withholding certificate, which, if granted, allows you to obtain a refund of the withholding amount. It's a detailed process that requires accurate documentation of the transaction, emphasizing the importance of understanding Arizona contract real estate withholding. Using technology and expert resources, like those offered by US Legal Forms, simplifies this process substantially.

The IRS holds the buyer of the real estate responsible for withholding FIRPTA taxes. In situations where the buyer fails to withhold, both the buyer and the seller may face tax liabilities. This makes it crucial to understand the ins and outs of Arizona contract real estate withholding. Leveraging resources, such as the platforms like US Legal Forms, helps ensure compliance and protects you from IRS penalties.

The penalty for failure to withhold under the Foreign Investment in Real Property Tax Act (FIRPTA) can be significant. If you fail to withhold the required amount, the IRS may impose a penalty amounting to 10 percent of the total amount that should have been withheld. This emphasizes the importance of understanding Arizona contract real estate withholding, especially for foreign sellers. Ensuring timely compliance helps avoid these unnecessary financial burdens.

To set up a withholding account in Arizona, you must first complete the required forms provided by the Arizona Department of Revenue. It’s essential to have your entity's details and federal tax identification number handy. Once you submit the forms, you can manage and monitor your Arizona contract real estate withholding account online. This setup makes compliance more manageable and helps you track your withholding obligations efficiently.