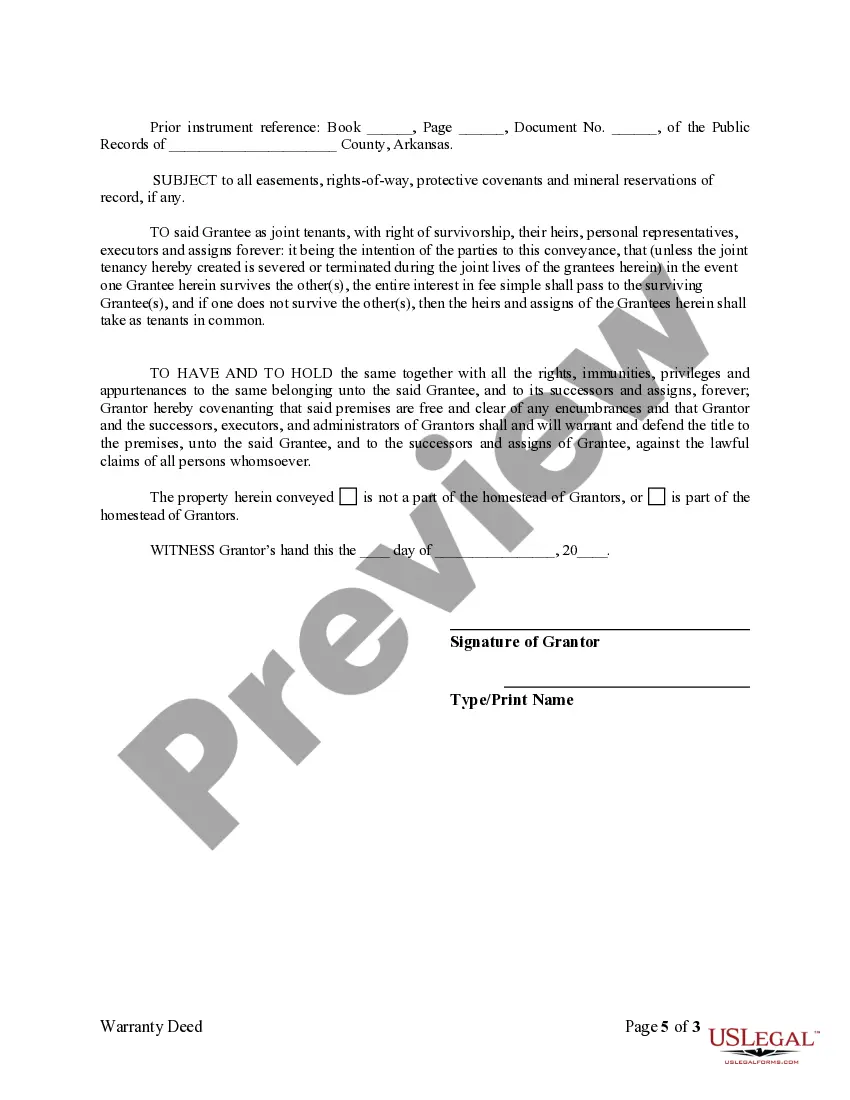

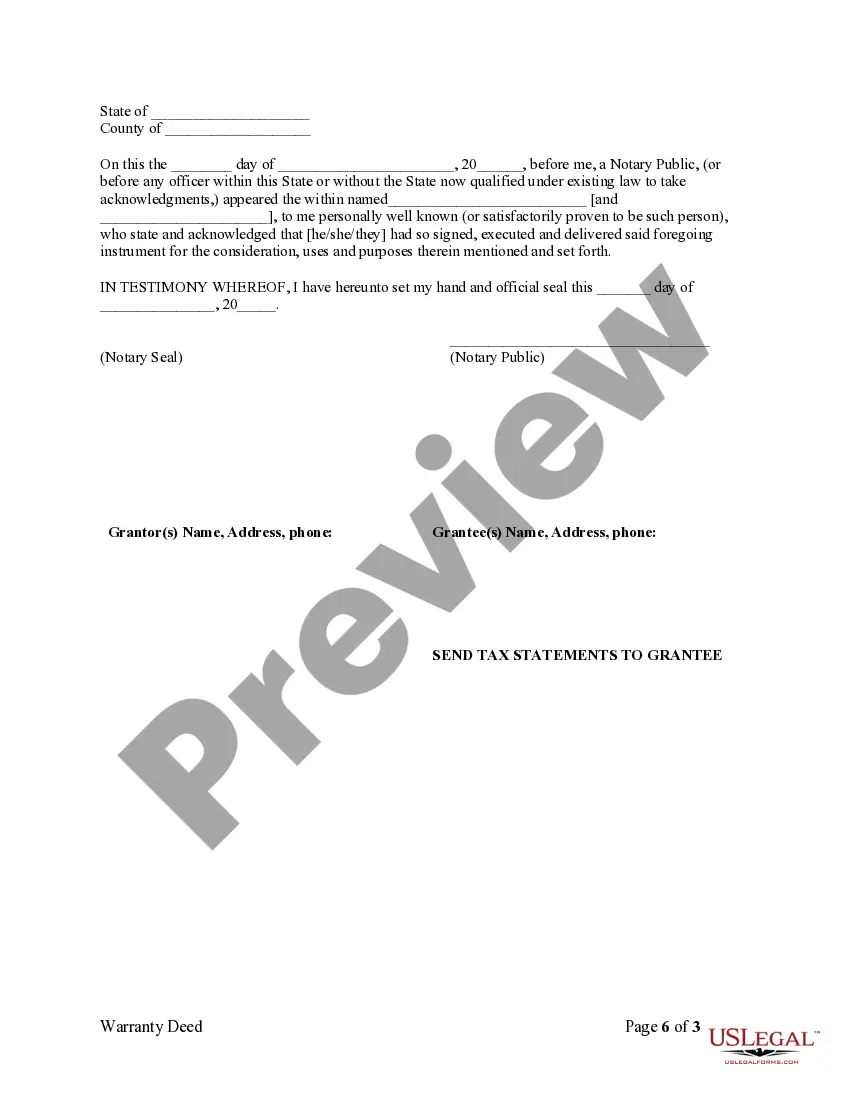

This form is a Warranty Deed where a wife transfers ownership of property to herself and her husband.

Both Joint Tenants With Entirety

Description

Form popularity

FAQ

The best way for married couples to hold title is through both joint tenants with entirety. This form of ownership provides several benefits, including equal rights and automatic inheritance. It protects each spouse's interest and prevents outside claims from disrupting ownership rights. If you need assistance with this arrangement, uslegalforms can guide you through the process efficiently.

The most common vesting for married couples is indeed both joint tenants with entirety. This legal structure is popular because it allows for seamless transitions of property ownership. In the event of a spouse's death, the surviving spouse automatically receives full ownership without the need for probate. This straightforward process can greatly simplify estate matters.

Most married couples choose to be joint tenants rather than tenants in common, favoring the both joint tenants with entirety option. This choice strengthens their bond in ownership, ensuring equal rights to the property. Additionally, joint tenancy with the right of survivorship adds an important layer of security for both partners. It minimizes potential conflicts in property distribution upon one partner's death.

The best deed for a married couple is often a deed that establishes both joint tenants with entirety. This arrangement allows both partners to share ownership equally. It also includes rights of survivorship, meaning that if one partner passes away, the other automatically inherits their share. This choice can simplify estate planning and provide peace of mind.

The best tenancy for a married couple often hinges on their unique circumstances. Many choose both joint tenants with entirety for its protection against creditors and the right of survivorship. However, other options exist, such as joint tenancy or community property, depending on state laws. Consulting platforms like USLegalForms can provide tailored insights to identify the most suitable option for your needs.

Tenancy by the entirety carries specific disadvantages that couples should explore. For instance, both joint tenants with entirety cannot divide the property without mutual consent, which may restrict individual flexibility. Additionally, if one spouse passes away, the surviving spouse automatically retains ownership, which may not align with some estate planning goals. Therefore, it’s essential to weigh these factors carefully.

While tenancy by the entirety offers many benefits for couples, it has downsides that require consideration. Both joint tenants with entirety must agree on actions regarding the property, which can complicate decisions during disputes. Furthermore, if one spouse incurs debt, creditors may target the property under certain conditions. Thus, understanding these elements is crucial before choosing this arrangement.

Both joint tenants with entirety refers to a specific way of holding property, primarily for married couples. This legal arrangement allows both partners to own an equal share of the property, ensuring that if one spouse passes away, the other automatically inherits the entire interest without going through probate. It offers benefits such as protection from creditors and a simplified estate transfer. If you seek to create or manage such ownership structures, uslegalforms can help guide you through the necessary documentation and legal processes.