Dissolve Irrevocable Trust For House

Description

Form popularity

FAQ

The IRS has recently updated its guidelines regarding the treatment of irrevocable trusts in tax matters. This includes stricter regulations on distributions and reporting requirements that could impact beneficiaries. It might be beneficial to review how these changes affect your trust, including considering how to dissolve an irrevocable trust for house if that aligns with your financial goals. Using platforms like US Legal Forms can provide essential guidance in navigating these changes.

Selling a house that is held in an irrevocable trust can be complicated, as it often requires approval from the trustee. If these conditions are met, the sale can proceed, but it is important to understand the implications. Some individuals choose to dissolve an irrevocable trust for house as a means to simplify ownership before selling.

The IRS has the authority to seize property in an irrevocable trust to satisfy tax debts. This action usually happens only after all other options have been exhausted. If your property is subject to such actions, it is wise to consider the steps involved in dissolving an irrevocable trust for house to protect your assets.

Yes, the IRS can place a lien on a home held within an irrevocable trust if there are outstanding federal tax obligations. This lien can affect the value and title of the property, complicating any future transactions. If you face such issues, consulting with a legal expert can help you explore options, including how to dissolve an irrevocable trust for house if required.

The federal government generally cannot directly seize an irrevocable trust; however, it can pursue assets held within the trust under certain circumstances. If you owe federal taxes, the government may seek to access the property or finances tied to the irrevocable trust. Therefore, it is crucial to understand how to properly manage your trust assets. You may also want to consider how to dissolve an irrevocable trust for house if necessary.

Lenders often hesitate to work with irrevocable trusts due to the potential complexities involved in asset ownership and responsibility. They prefer to lend to individuals who can provide a personal guarantee. When you wish to dissolve an irrevocable trust for a house, ensuring clear communication with your lender is vital to avoid complications.

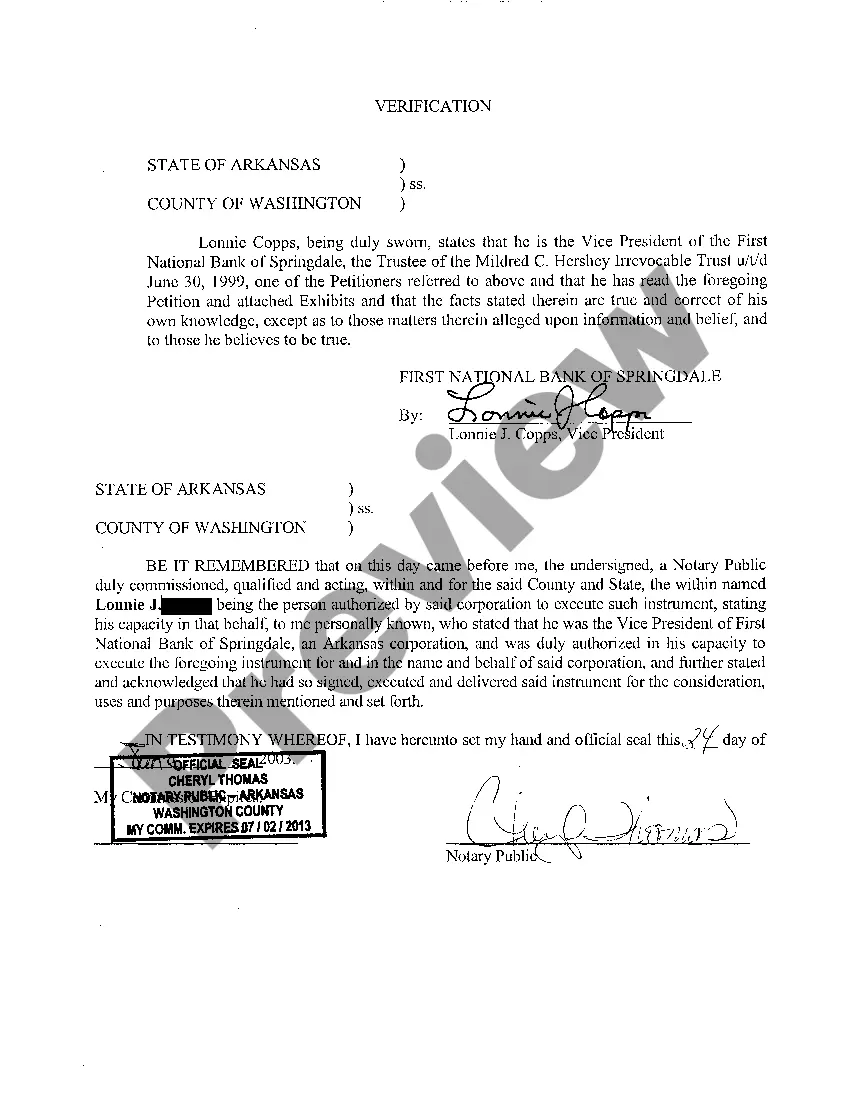

Dissolving an irrevocable trust for a house typically requires the agreement of all beneficiaries and the establishment of specific legal procedures. This often means consulting with a legal professional to navigate the complexities of trust laws. It's important to assess the financial implications and ensure that the dissolution aligns with your long-term goals.

People often place their house in an irrevocable trust to protect their assets from creditors and avoid probate. This strategy can also help with estate planning by ensuring that the property is distributed according to the grantor's wishes after their passing. By doing so, you can secure a smooth transition of ownership and potentially reduce estate taxes.

The 5-year rule refers to the timeline established for Medicaid eligibility concerning assets in an irrevocable trust. If the house is placed in the trust, it may be subject to a five-year look-back period before qualifying for benefits. If you're navigating the implications of this rule while looking to dissolve an irrevocable trust for a house, understanding your financial options is crucial.

Removing a house from an irrevocable trust is generally difficult since the terms of the trust are binding. You would typically need the agreement of all beneficiaries or a court order to facilitate the removal. If you’re considering ways to dissolve an irrevocable trust for house purposes, seeking tailored legal advice is recommended.