Answer To Writ Of Garnishment Arkansas Form 4

Description

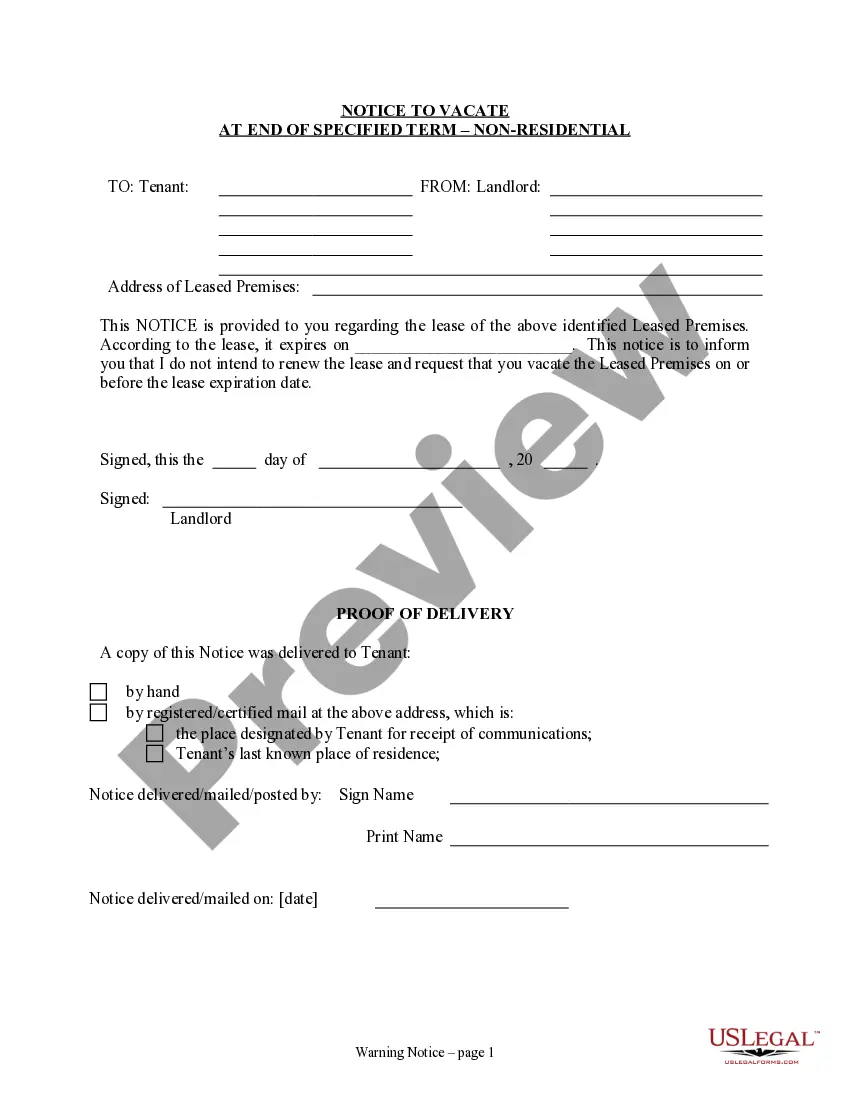

How to fill out Arkansas Garnishee's Answer To Writ Of Garnishment?

Obtaining legal templates that comply with federal and state laws is a matter of necessity, and the internet offers a lot of options to pick from. But what’s the point in wasting time searching for the right Answer To Writ Of Garnishment Arkansas Form 4 sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and personal situation. They are easy to browse with all files collected by state and purpose of use. Our specialists stay up with legislative updates, so you can always be confident your form is up to date and compliant when getting a Answer To Writ Of Garnishment Arkansas Form 4 from our website.

Getting a Answer To Writ Of Garnishment Arkansas Form 4 is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, adhere to the instructions below:

- Analyze the template utilizing the Preview option or through the text outline to ensure it meets your needs.

- Look for a different sample utilizing the search function at the top of the page if needed.

- Click Buy Now when you’ve located the suitable form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Answer To Writ Of Garnishment Arkansas Form 4 and download it.

All documents you find through US Legal Forms are reusable. To re-download and complete previously purchased forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

At a minimum, your written objection to the garnishment should include the following information: the case number and case caption (ex: "XYZ Bank vs. John Doe") the date of your objection. your name and current contact information. the reasons (or "grounds") for your objection, and. your signature.

Amounts. Under the Consumer Credit Protection Act, the maximum amount allowed to be garnished from disposable earning income may NOT exceed 25%. Therefore, in order for wages to be garnished, you must make 30% of minimum wage for a 40-hour week.

By the time the collection process has reached the point of garnishment, most creditors are unwilling to work out any kind of payment plan. The only effective way to legally stop this collection process is by exercising your right under federal law to file either Chapter 7 or Chapter 13 bankruptcy.

In Arkansas, state wage garnishment law is essentially the same as the federal law governing wage garnishment. A wage garnishment should not leave you unable to live, so there are limits to how much can be taken from your pay. In general, garnishments can't exceed 25 percent of your disposable (after deductions) wages.

The Writ of Garnishment or Writ of Execution delivered to you with this Notice means that wages, money, or other property belonging to you has been garnished in order to pay a court judgment against you. HOWEVER, YOU MAY BE ABLE TO KEEP YOUR MONEY OR PROPERTY FROM BEING TAKEN, SO READ THIS NOTICE CAREFULLY.