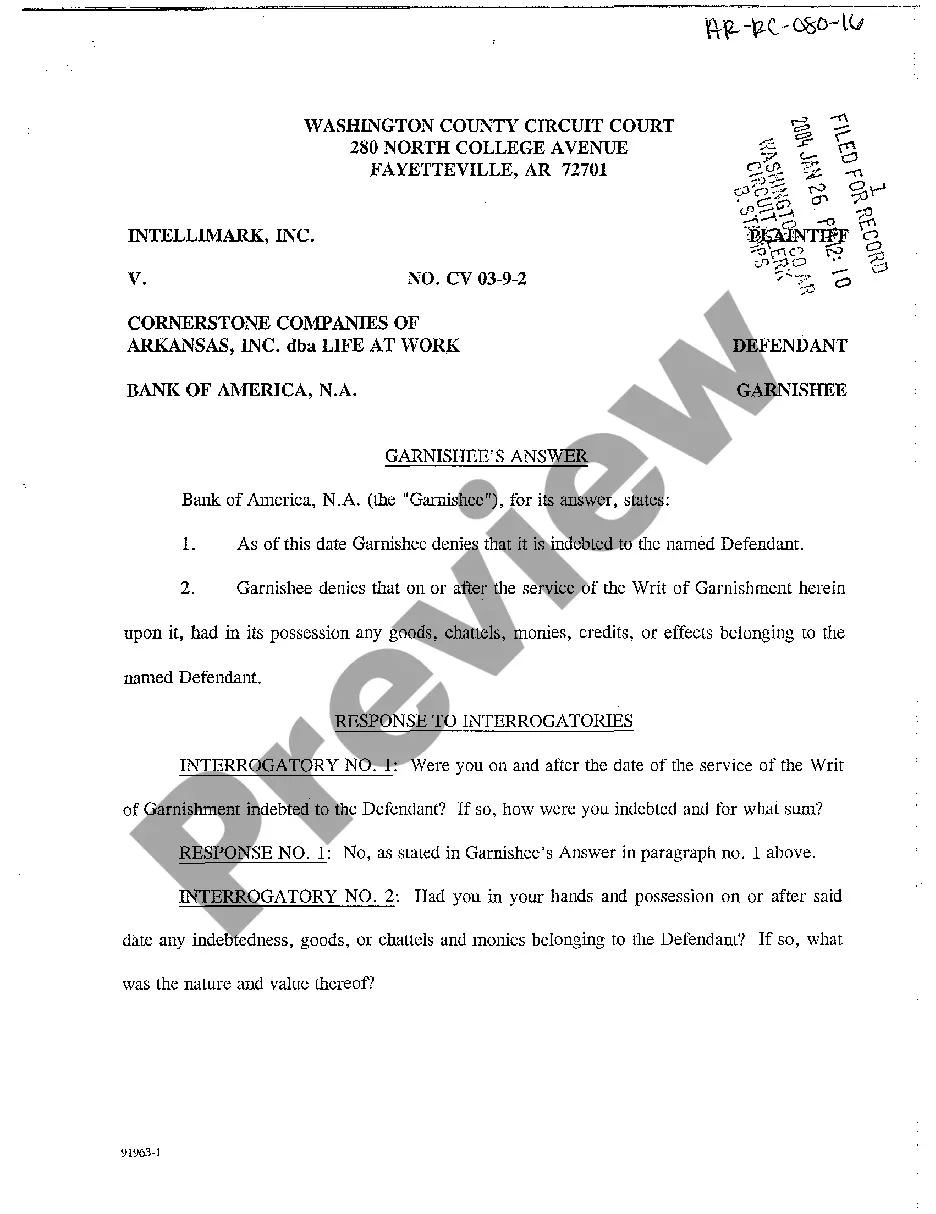

Answer To Writ Of Garnishment Arkansas For Continuing Lien On Earnings

Description

How to fill out Arkansas Garnishee's Answer To Writ Of Garnishment?

Drafting legal documents from scratch can sometimes be a little overwhelming. Some cases might involve hours of research and hundreds of dollars invested. If you’re looking for a an easier and more cost-effective way of preparing Answer To Writ Of Garnishment Arkansas For Continuing Lien On Earnings or any other paperwork without jumping through hoops, US Legal Forms is always at your fingertips.

Our online collection of over 85,000 up-to-date legal forms covers virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can quickly access state- and county-specific forms carefully put together for you by our legal professionals.

Use our website whenever you need a trusted and reliable services through which you can easily find and download the Answer To Writ Of Garnishment Arkansas For Continuing Lien On Earnings. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to register it and navigate the library. But before jumping directly to downloading Answer To Writ Of Garnishment Arkansas For Continuing Lien On Earnings, follow these tips:

- Review the document preview and descriptions to ensure that you have found the document you are searching for.

- Make sure the template you select conforms with the requirements of your state and county.

- Choose the right subscription option to purchase the Answer To Writ Of Garnishment Arkansas For Continuing Lien On Earnings.

- Download the form. Then complete, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of expertise. Join us now and turn form execution into something easy and streamlined!

Form popularity

FAQ

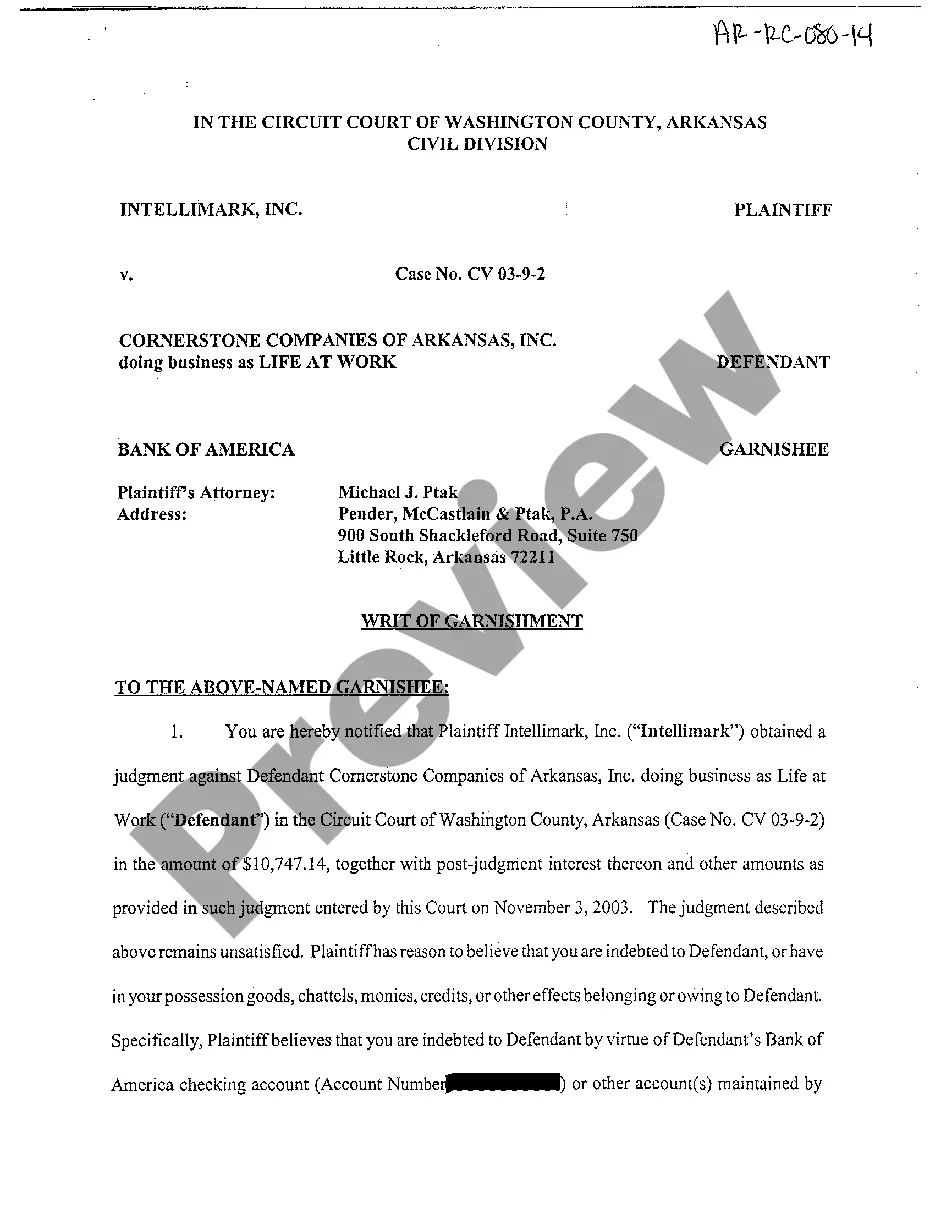

For a writ of garnishment form, and instructions on how to proceed with a writ of garnishment, contact the district court clerk. At a minimum you will need the following information: The defendant's place of employment and the address and name of his or her bank if you are garnishing his or her bank account.

By the time the collection process has reached the point of garnishment, most creditors are unwilling to work out any kind of payment plan. The only effective way to legally stop this collection process is by exercising your right under federal law to file either Chapter 7 or Chapter 13 bankruptcy.

In Arkansas, state wage garnishment law is essentially the same as the federal law governing wage garnishment. A wage garnishment should not leave you unable to live, so there are limits to how much can be taken from your pay. In general, garnishments can't exceed 25 percent of your disposable (after deductions) wages.

Amounts. Under the Consumer Credit Protection Act, the maximum amount allowed to be garnished from disposable earning income may NOT exceed 25%. Therefore, in order for wages to be garnished, you must make 30% of minimum wage for a 40-hour week.

The Writ of Garnishment or Writ of Execution delivered to you with this Notice means that wages, money, or other property belonging to you has been garnished in order to pay a court judgment against you. HOWEVER, YOU MAY BE ABLE TO KEEP YOUR MONEY OR PROPERTY FROM BEING TAKEN, SO READ THIS NOTICE CAREFULLY.