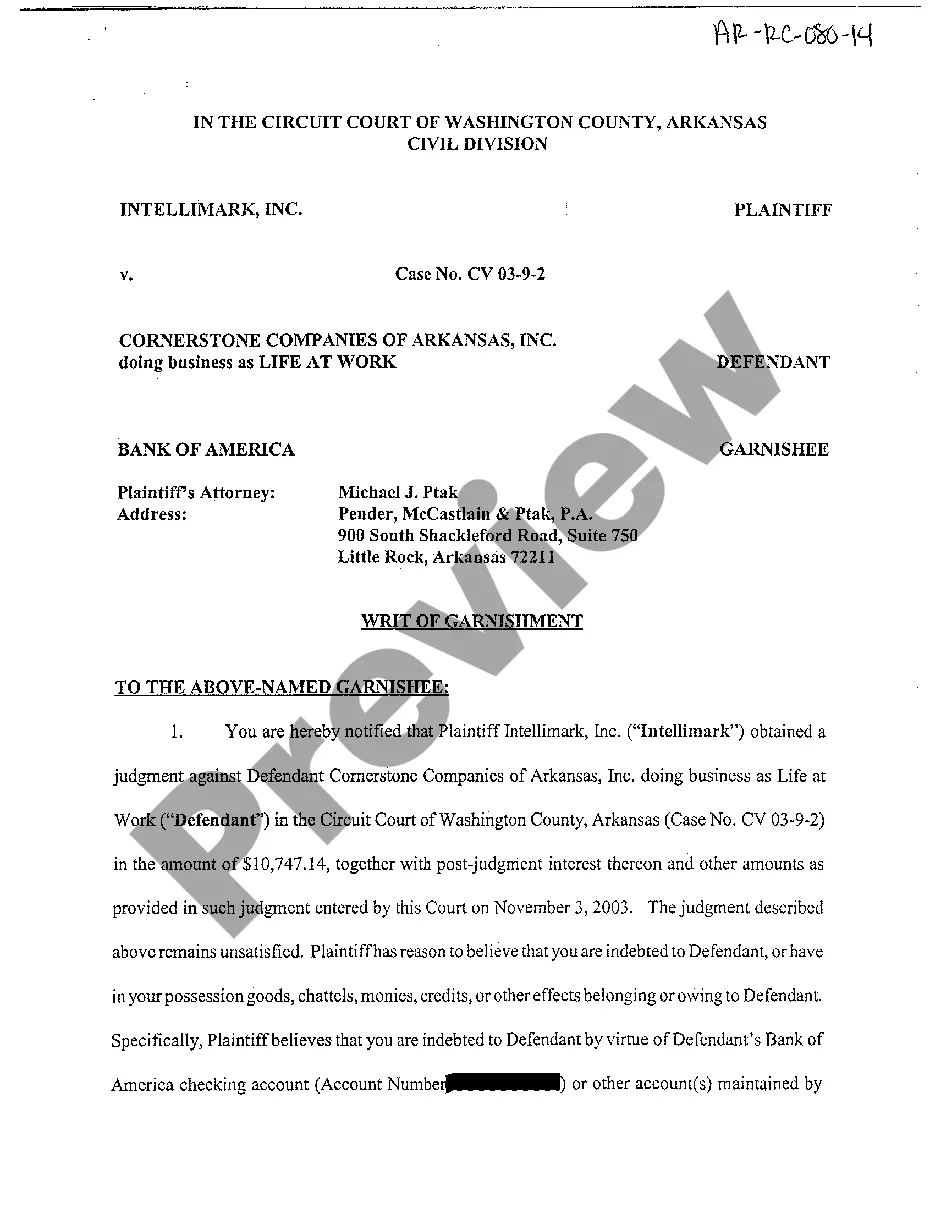

Arkansas Garnishment Exemption Form For Wage

Description

How to fill out Arkansas Writ Of Garnishment?

Regardless of whether for commercial objectives or personal issues, each individual must confront legal circumstances eventually in their life.

Filling out legal paperwork requires meticulous care, starting with selecting the correct form template.

Once it's saved, you can fill in the form using editing software or print it out and complete it by hand. With an extensive US Legal Forms catalog available, you never need to waste time searching for the suitable template online. Utilize the library’s user-friendly navigation to find the right template for any situation.

- Acquire the template you need via the search bar or catalog browsing.

- Review the form’s description to ensure it corresponds with your needs, state, and county.

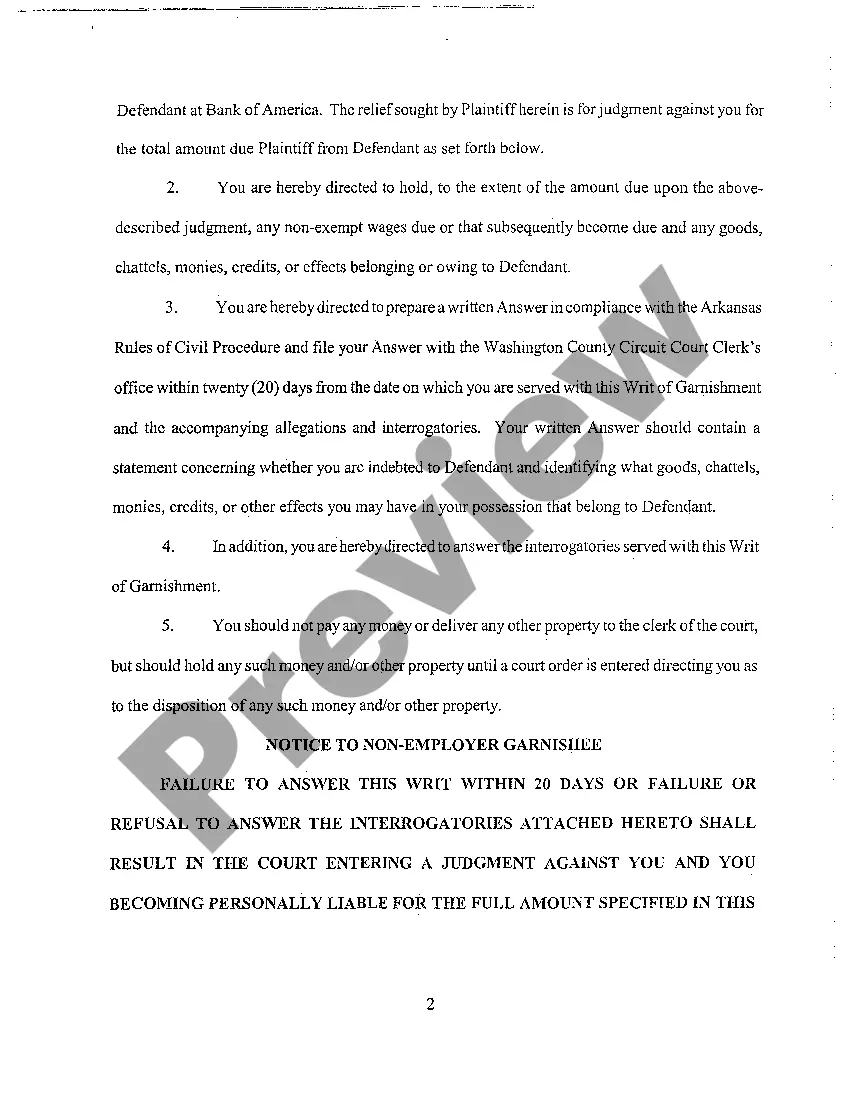

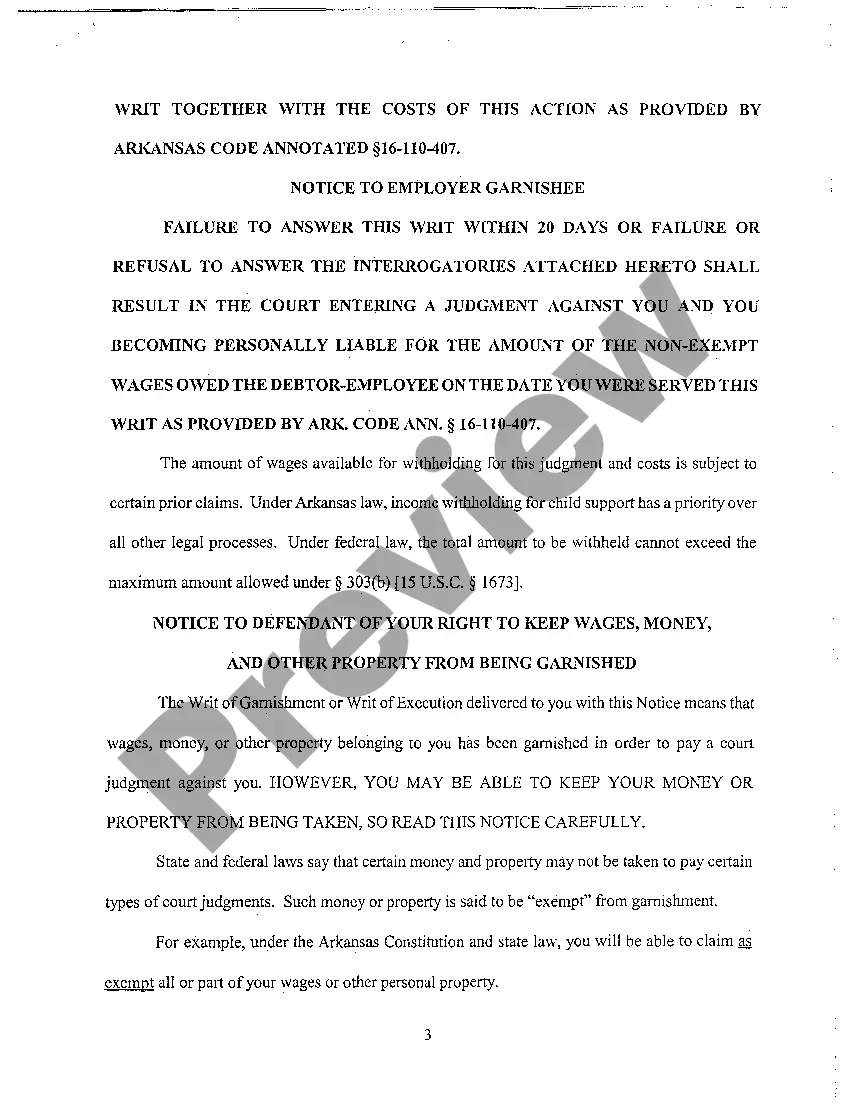

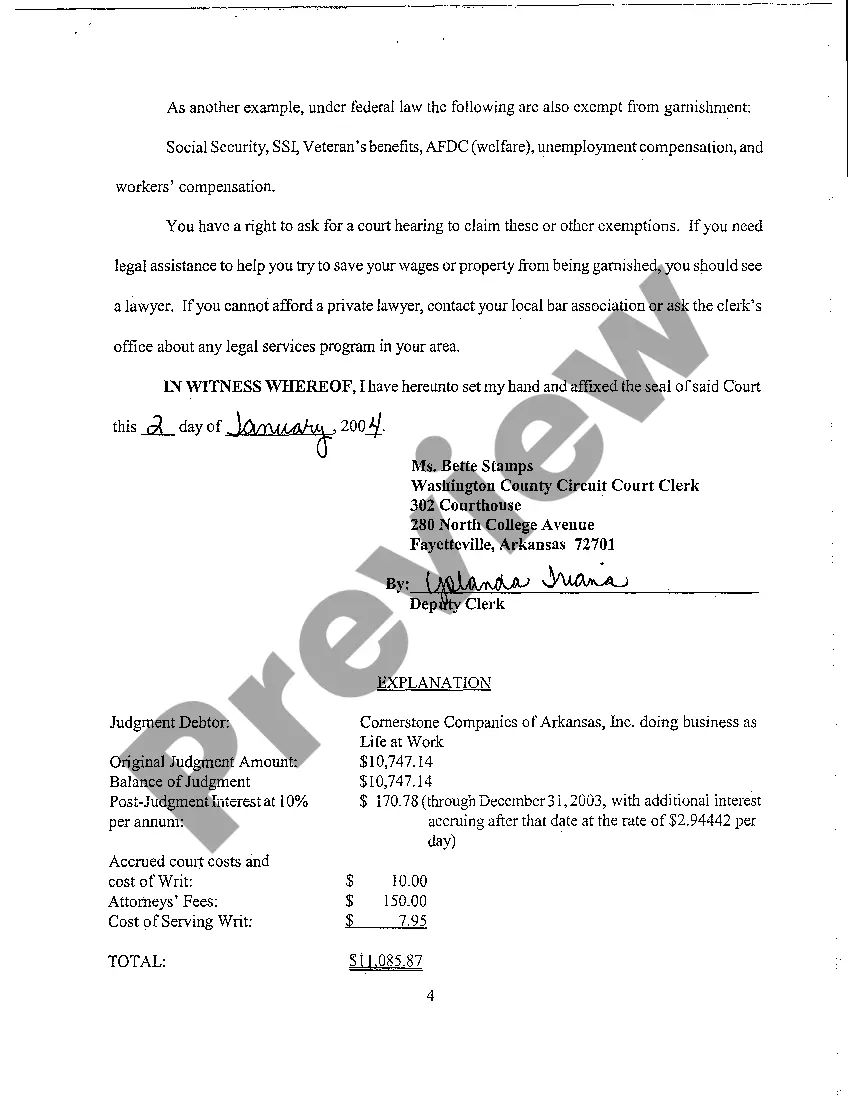

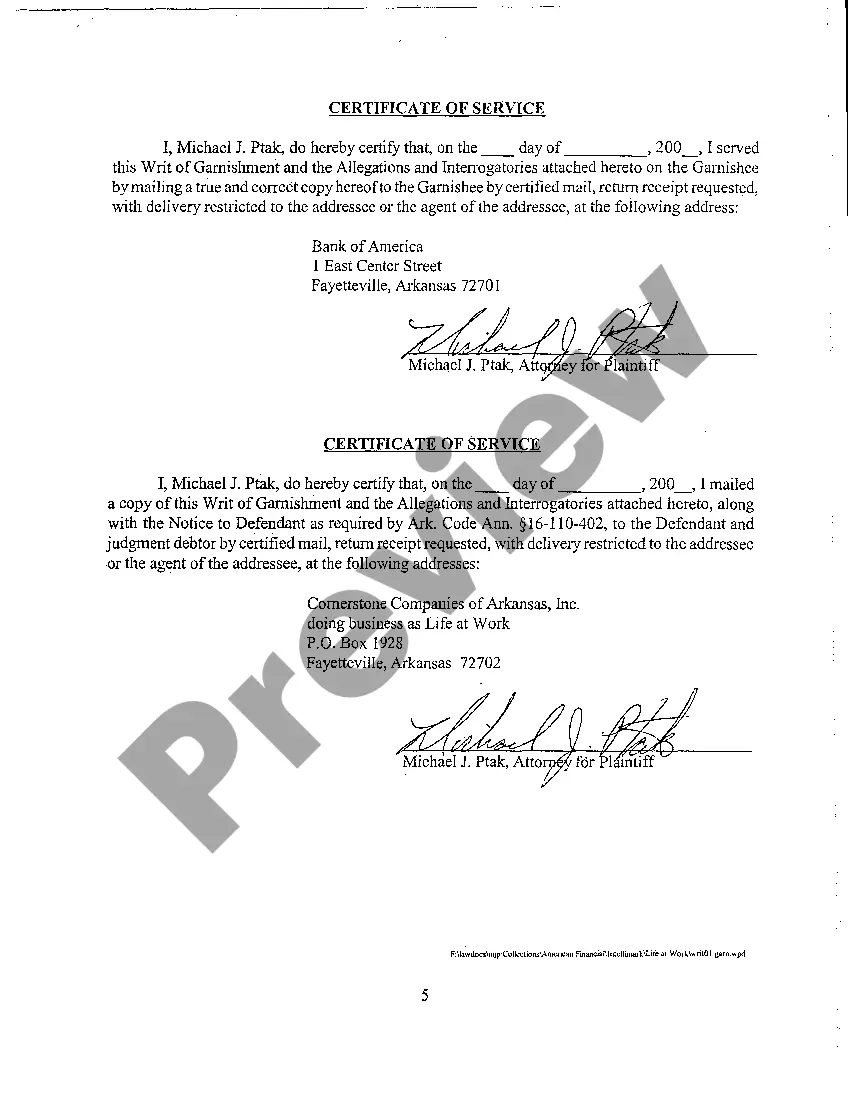

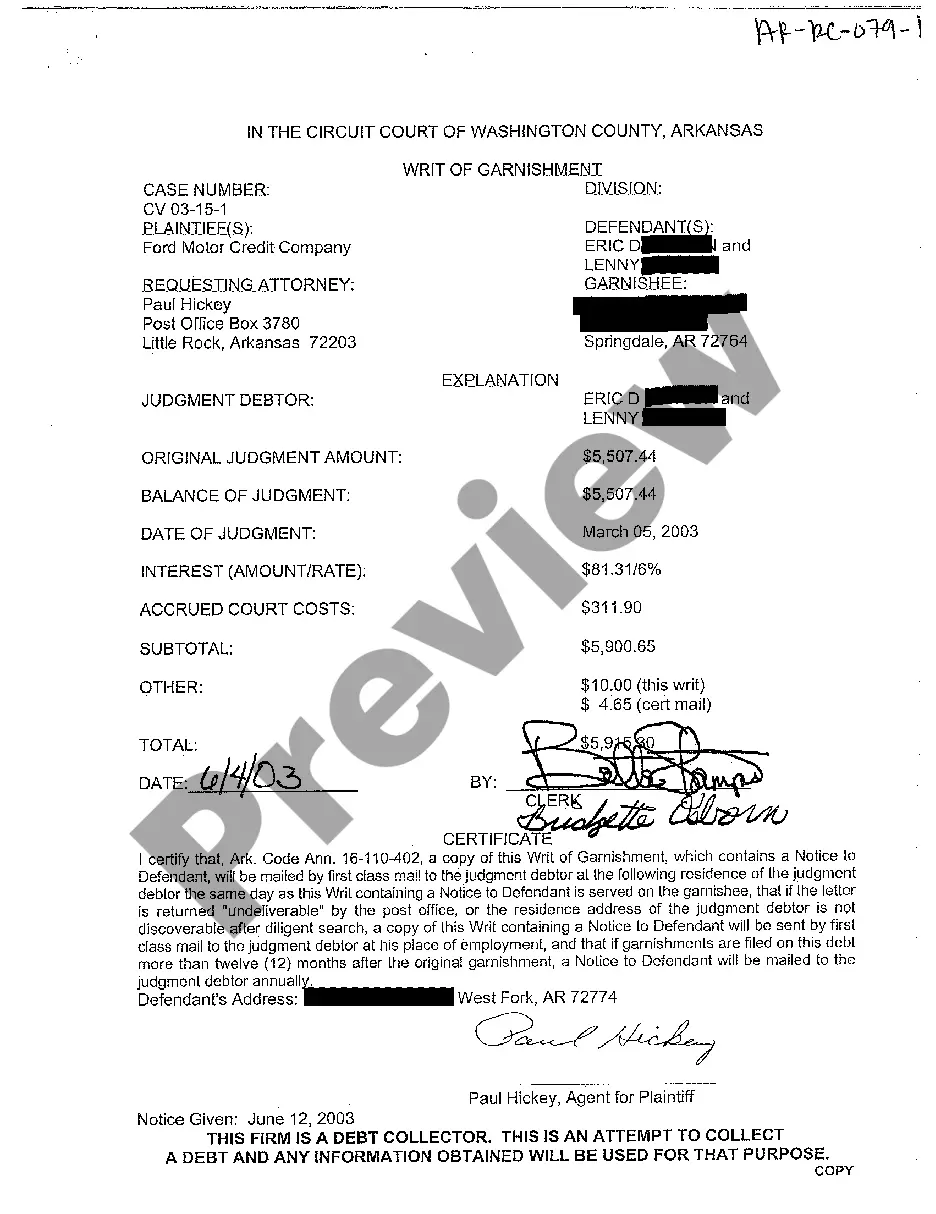

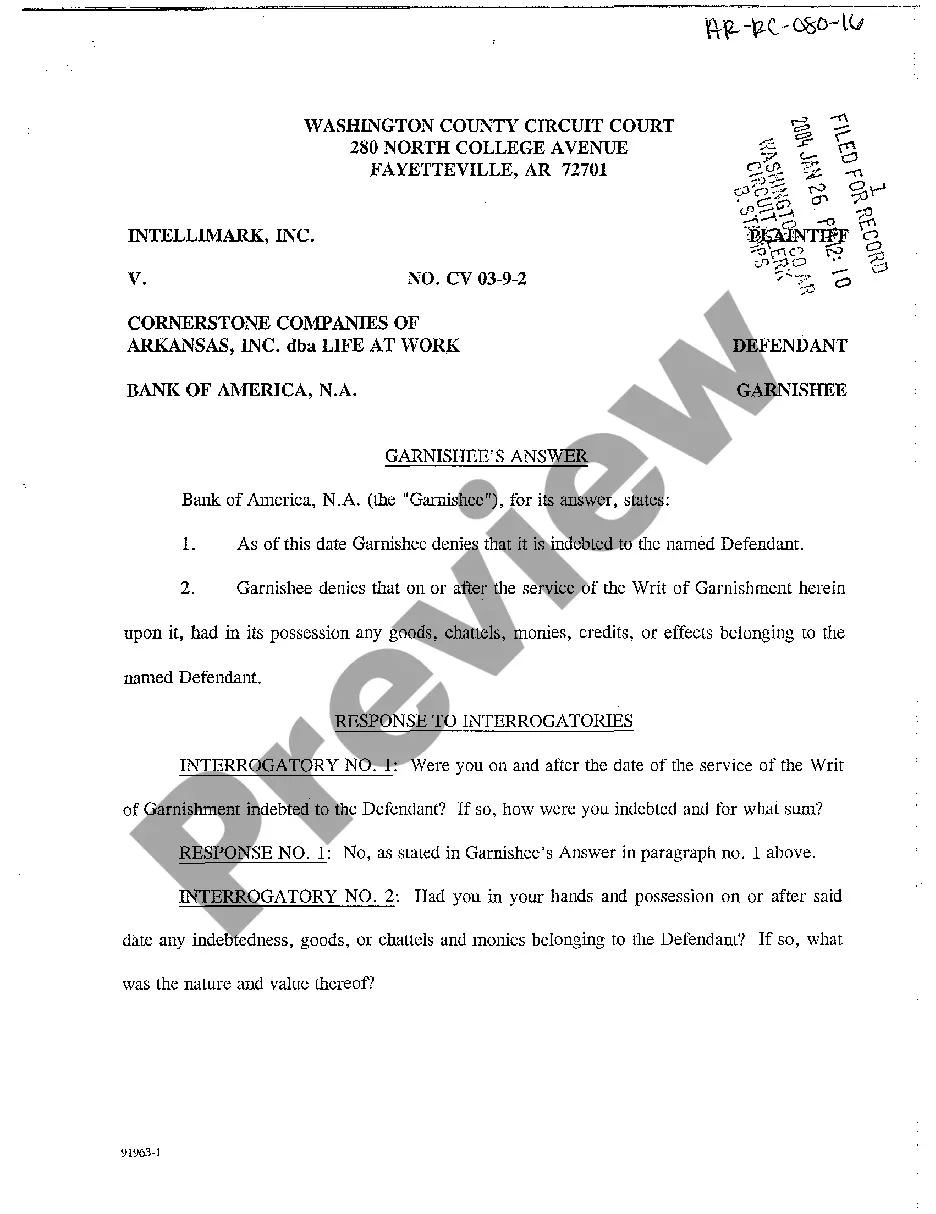

- Select the form’s preview to examine it.

- If it is not the correct document, return to the search feature to find the Arkansas Garnishment Exemption Form For Wage template you require.

- Obtain the file if it aligns with your specifications.

- If you already possess a US Legal Forms account, simply click Log in to view previously stored templates in My documents.

- If you do not yet have an account, you can download the form by selecting Buy now.

- Select the appropriate pricing choice.

- Complete the account sign-up form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the document format you wish and download the Arkansas Garnishment Exemption Form For Wage.

Form popularity

FAQ

To revive or reinstate your Hawaii LLC, you'll need to submit the following to Hawaii's BREG: a completed Hawaii Application for Reinstatement (Form X-4) a tax clearance certificate issued by the Hawaii Department of Taxation. any missing annual reports (including delinquent costs and fees) a $25 filing fee.

You may file a reinstatement application online at ecorp.sos.ga.gov. Should you wish to file your reinstatement application by mail or hand-delivery to our office, you must print the reinstatement application form, complete it and mail it in with a check or money order for payment of the fee.

Copies and certified copies of documents filed with the Department can be purchased online through Hawaii Business Express. To do this, search under business name, open the selected record, and go to the last tab titled, ?Buy Available Docs.? Requests can also be made by phone, email, fax, mail, or in person.

To revive a New Hampshire LLC, you'll need to file the reinstatement application with the New Hampshire Secretary of State. You'll also have to fix the issues that led to your New Hampshire LLC's dissolution and (in some cases) obtain a Tax Compliance Certificate from the New Hampshire Department of Revenue.

It will cost you $50 to register your LLC in Hawaii with the Hawaii Department of Commerce and Consumer Affairs Business Registration Division, plus an additional $1 State Archives fee. Filing online is the fastest way to complete the paperwork.

Hawaii doesn't have a general business license at the state level, so there are no fees there. But your required Hawaii Tax ID Number registration with the Department of Taxation has a $20 filing fee.

Copies and certified copies of documents filed with the Department can be purchased online through Hawaii Business Express. To do this, search under business name, open the selected record, and go to the last tab titled, ?Buy Available Docs.? Requests can also be made by phone, email, fax, mail, or in person.

The cost of a DBA in Hawaii is $50. After five years in Hawaii, a DBA expires and is $50 to renew. You can pay your Hawaii DBA filing fees by cash or credit card.