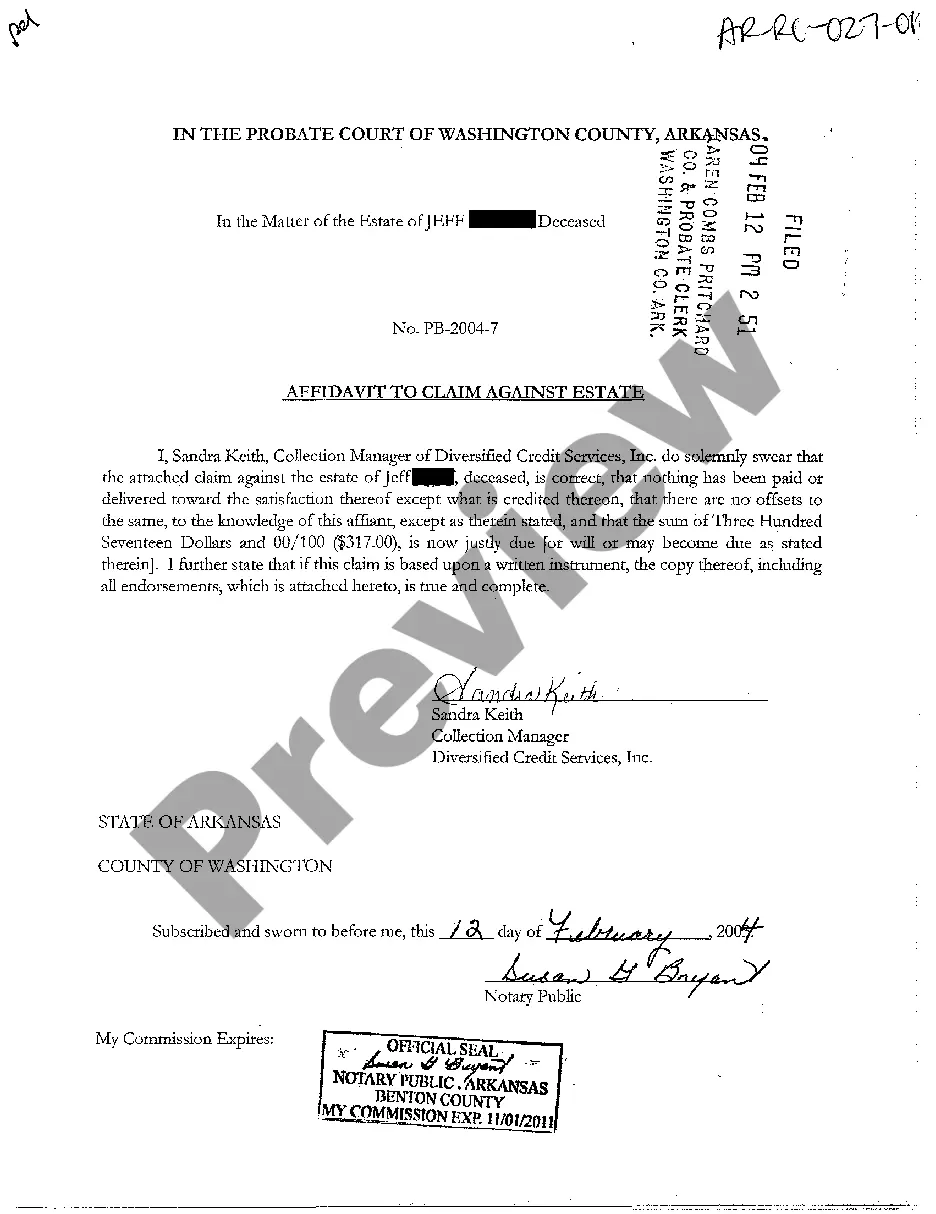

Affidavit To Claim Against Estate For Arkansas Withholding

Description

How to fill out Arkansas Affidavit To Claim Against Estate?

Precisely formulated official documentation is one of the essential assurances for preventing complications and legal disputes, but acquiring it without the help of an attorney may require time.

Whether you need to swiftly locate a current Affidavit To Claim Against Estate For Arkansas Withholding or any other forms related to employment, family, or business events, US Legal Forms is consistently here to assist.

The procedure is even simpler for existing users of the US Legal Forms repository. If your subscription is current, you just need to Log In to your account and click the Download button next to the desired file. Furthermore, you can access the Affidavit To Claim Against Estate For Arkansas Withholding later anytime, as all documents ever acquired on the platform remain accessible within the My documents tab of your profile. Save time and expenses on preparing official documentation. Try US Legal Forms today!

- Ensure that the template aligns with your needs and location by reviewing the description and preview.

- Search for another example (if necessary) via the Search bar in the page header.

- Click on Buy Now when you find the appropriate template.

- Choose a pricing plan, Log In to your account, or create a new one.

- Select your preferred payment method to acquire the subscription plan (using a credit card or PayPal).

- Choose PDF or DOCX file format for your Affidavit To Claim Against Estate For Arkansas Withholding.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

The estate executor must attach a copy and pay a $25 filing fee to file the affidavit in the probate court clerk's office. If the decedent owned property, a death notice and affidavit must be published in a local, widely-distributed newspaper within 30 days of the filing.

Form AR-TX is a form you should receive from your employer. Use the information on the form to complete the Texarkana portion of the Arkansas interview. Go into your Arkansas return and continue to the Border City Exemption page.

All new employees for your business must complete a federal Form W-4. New employees also should complete one of two related Arkansas forms: Form AR4EC, Employee's Withholding Exemption Certificate, or Form AR4ECSP,Employee's Special Withholding Exemption Certificate.

File Form AR941A. File AR941, Employers Annual Report for Income Tax Withheld and pay any tax due for the previous calendar year.

EFile your Arkansas tax return now We last updated Arkansas Form AR1000ADJ in January 2022 from the Arkansas Department of Revenue. This form is for income earned in tax year 2021, with tax returns due in April 2022.