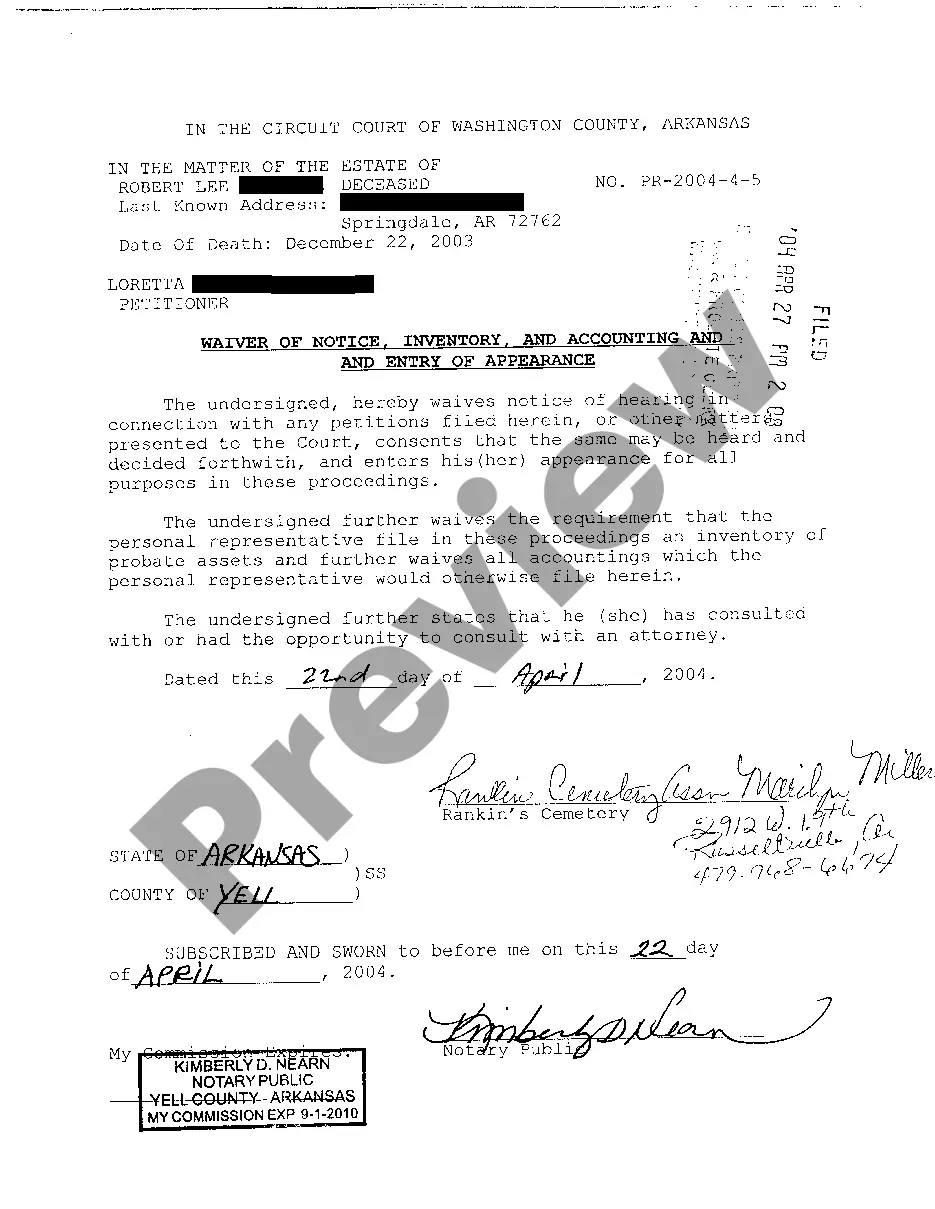

Waiver Of Inventory And Accounting Within A Corporation

Description

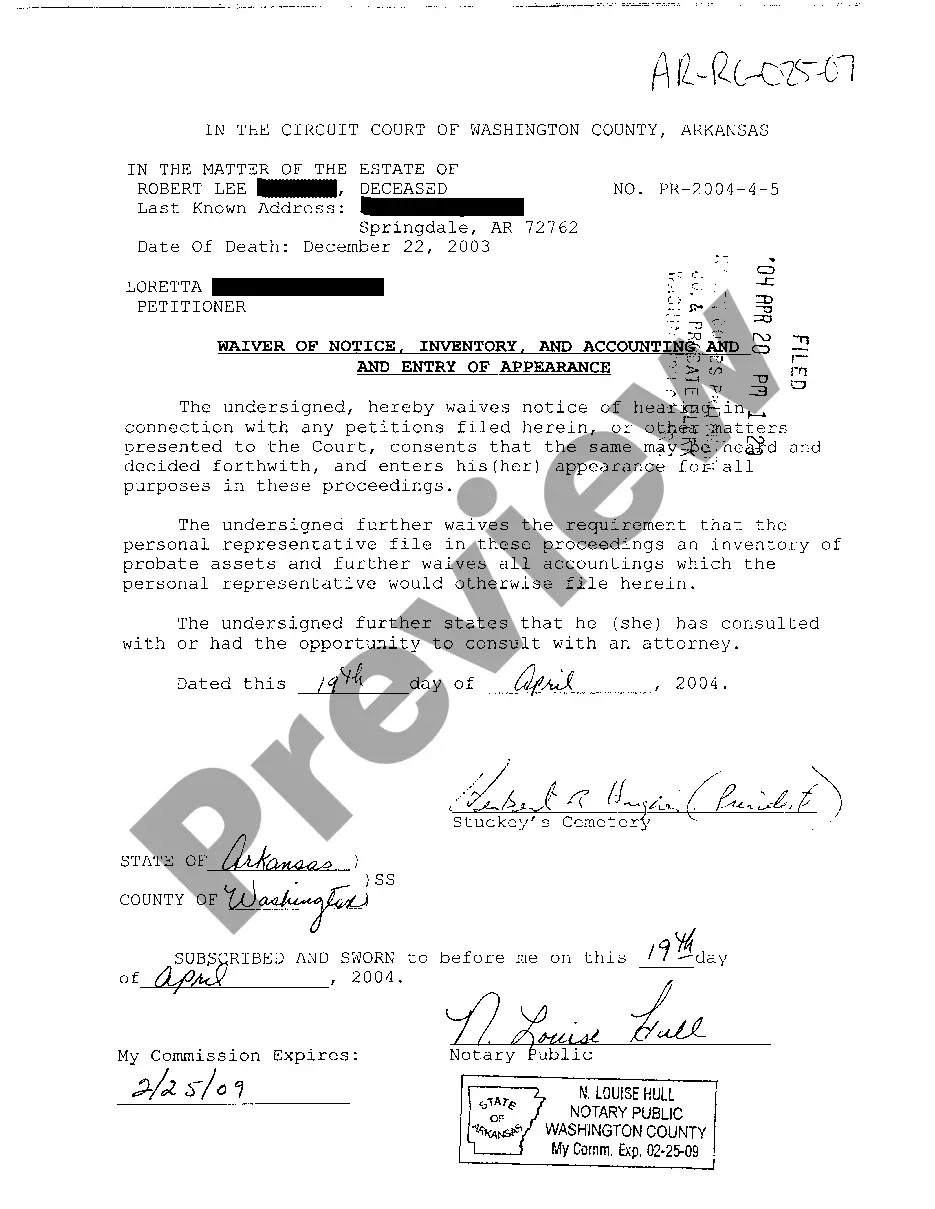

How to fill out Arkansas Waiver Of Notice, Inventory, And Accounting And Entry Of Appearance?

The Waiver Of Inventory And Accounting Within A Corporation you see on this page is a reusable legal template drafted by professional lawyers in line with federal and local laws. For more than 25 years, US Legal Forms has provided people, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, simplest and most reliable way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Waiver Of Inventory And Accounting Within A Corporation will take you just a few simple steps:

- Browse for the document you need and review it. Look through the sample you searched and preview it or review the form description to ensure it satisfies your needs. If it does not, utilize the search option to find the right one. Click Buy Now when you have found the template you need.

- Subscribe and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Select the format you want for your Waiver Of Inventory And Accounting Within A Corporation (PDF, DOCX, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a eSignature.

- Download your papers one more time. Make use of the same document again anytime needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

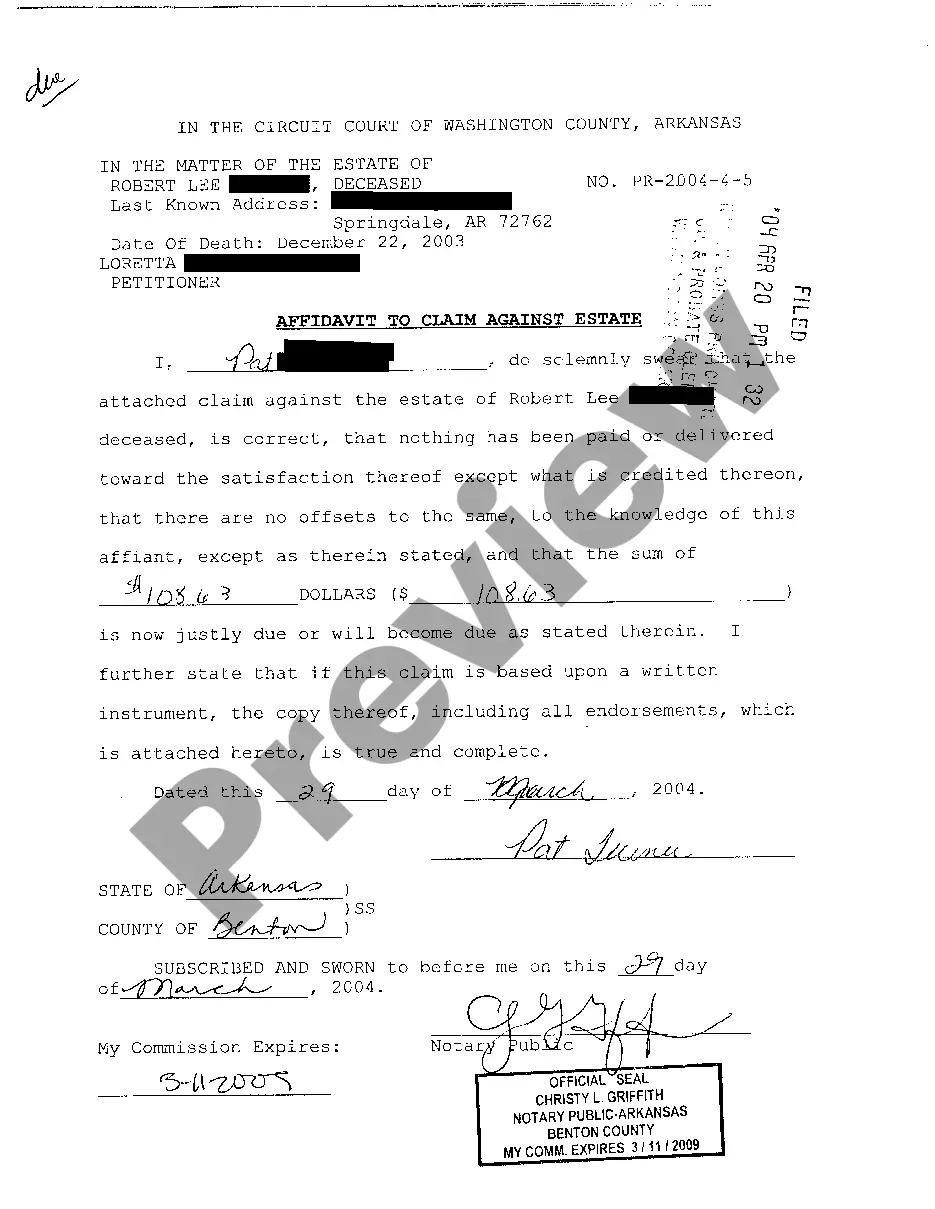

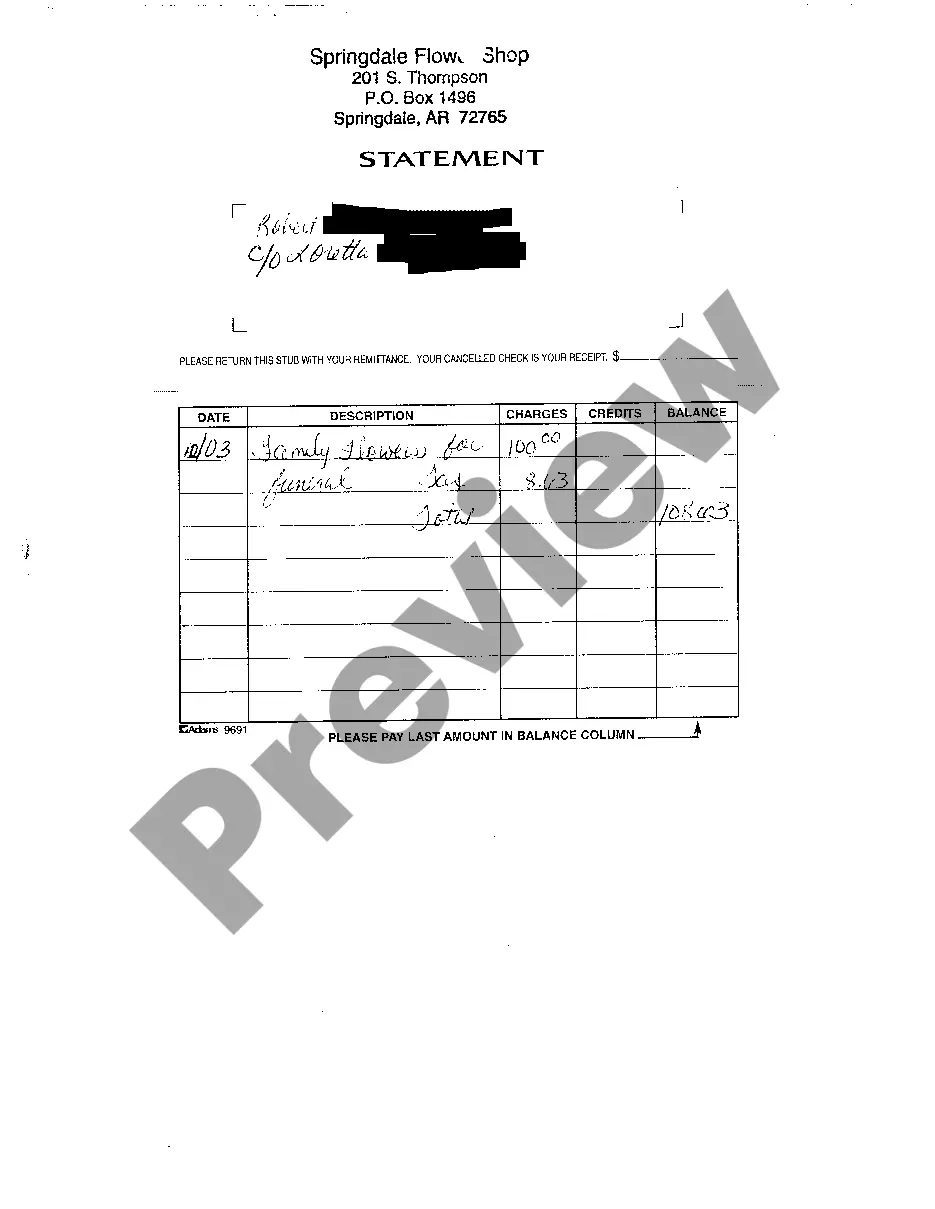

A waiver of accounting is a voluntary waiver by all heirs and beneficiaries that eliminates a very time-consuming and expensive accounting process by the Personal Representative. In order for a probate estate to be closed, the court requires the filing of a petition for final distribution.

All beneficiaries do not need to formally approve estate accounts; however, it is best practice for the Executor(s) and main beneficiaries to sign the estate accounts to show a legal agreement across all parties. Nevertheless, the beneficiaries are entitled to receive a copy of them and review the information.

Once all the estate is distributed you can prepare the final estate accounts. These should be approved and signed by you and the main beneficiaries.

Until the 30-day period reserved for objections has not passed and the final accounting is accepted by all the parties involved, the estate will not be closed. A Waiver of Accounting is a document that allows both the personal representative and the beneficiaries to circumvent this impediment.

Georgia Law typically requires the executor to file an inventory and annual returns with the probate court. This keeps the probate process transparent and accounts for all the assets in the estate. However, there are cases where the will itself might exempt the executor from this requirement.