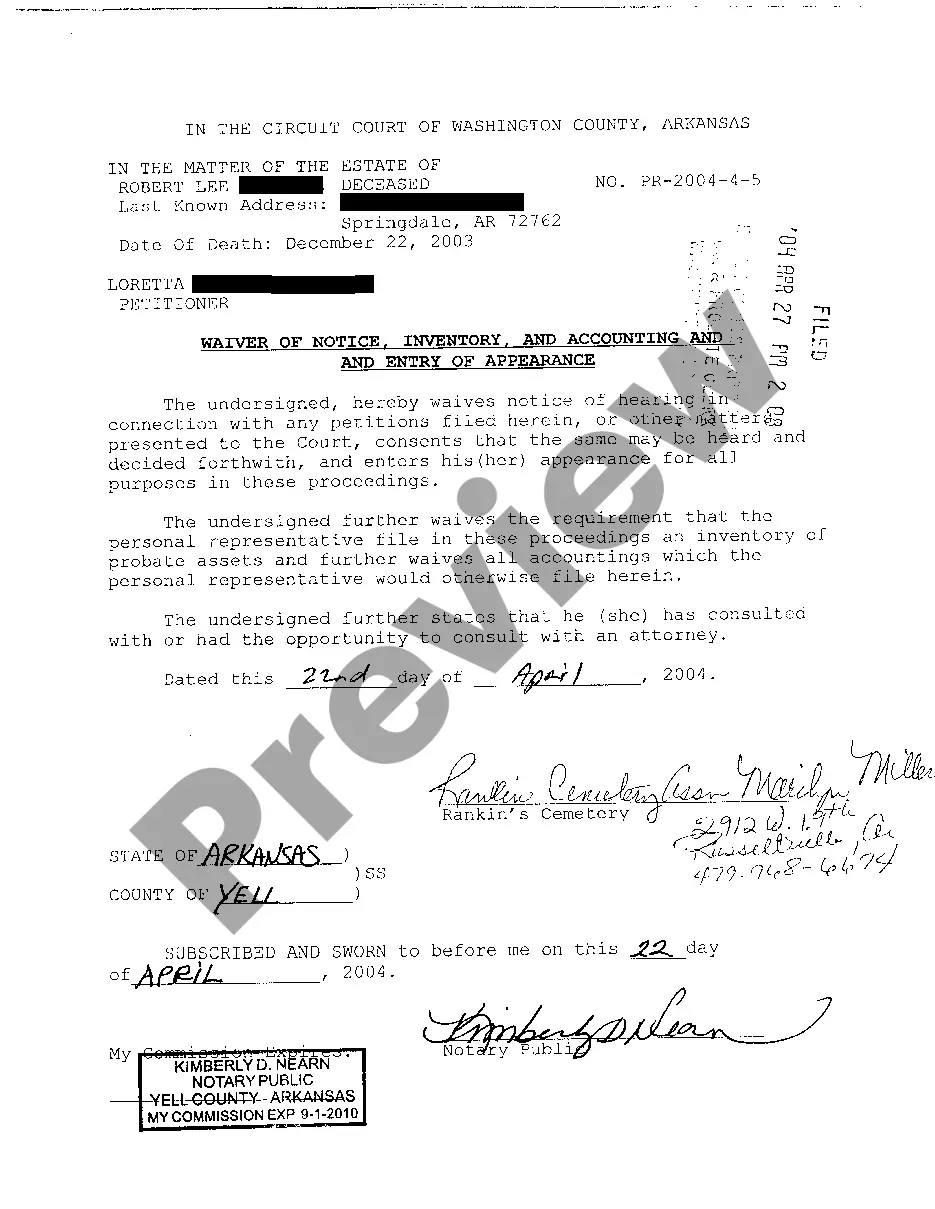

Waiver Of Inventory And Accounting Within A Company

Description

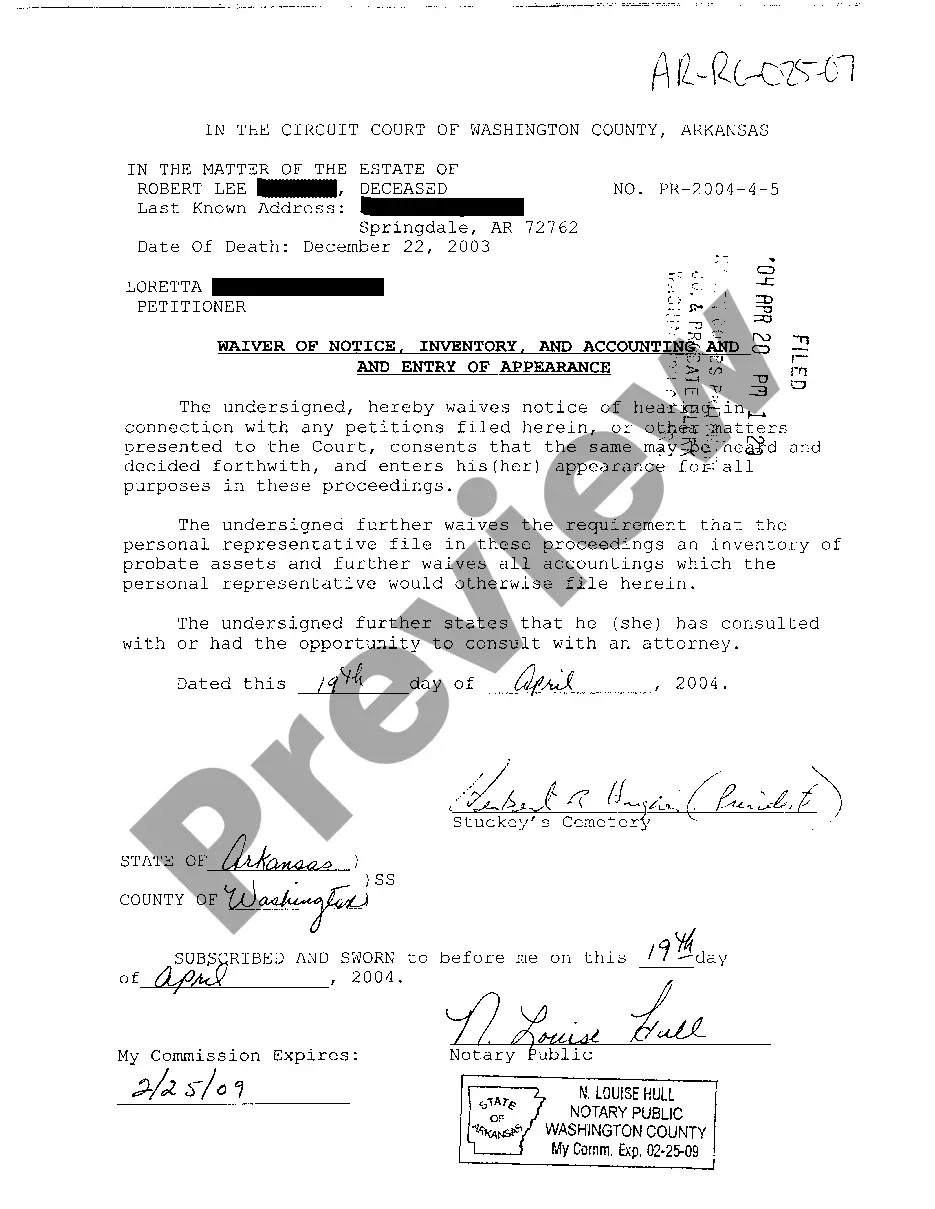

How to fill out Arkansas Waiver Of Notice, Inventory, And Accounting And Entry Of Appearance?

The Waiver Of Inventory And Accounting Within A Company you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and state laws. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, most straightforward and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Waiver Of Inventory And Accounting Within A Company will take you just a few simple steps:

- Browse for the document you need and review it. Look through the sample you searched and preview it or review the form description to verify it fits your needs. If it does not, utilize the search bar to get the correct one. Click Buy Now when you have located the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Select the format you want for your Waiver Of Inventory And Accounting Within A Company (PDF, DOCX, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your papers one more time. Use the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

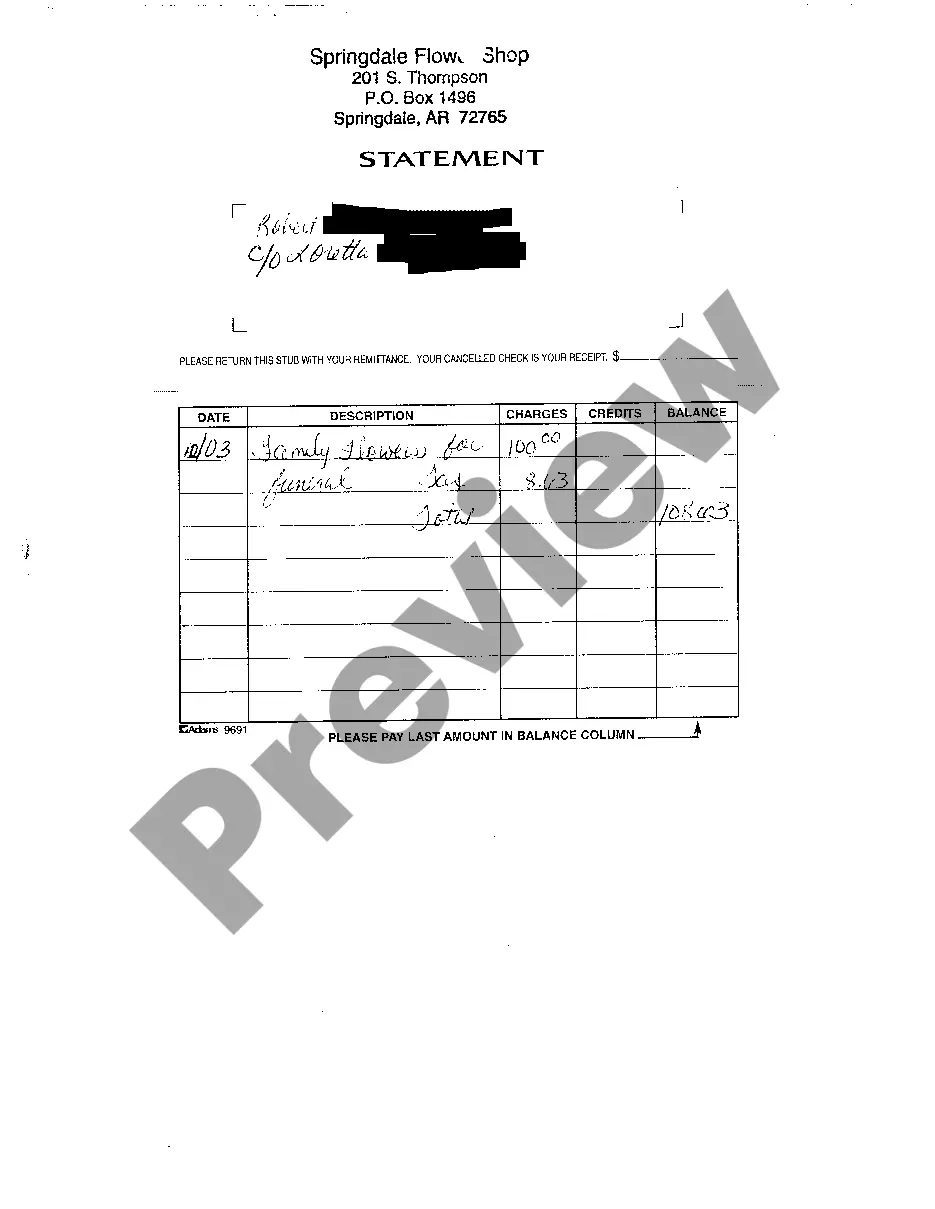

Until the 30-day period reserved for objections has not passed and the final accounting is accepted by all the parties involved, the estate will not be closed. A Waiver of Accounting is a document that allows both the personal representative and the beneficiaries to circumvent this impediment.

If a beneficiary requests access to financial institution statements and the executor refuses to provide them, the beneficiary can take legal action. They can follow the court for an order compelling the executor to reveal the requested information.

A waiver of accounting is a voluntary waiver by all heirs and beneficiaries that eliminates a very time-consuming and expensive accounting process by the Personal Representative. In order for a probate estate to be closed, the court requires the filing of a petition for final distribution.

Under Pennsylvania law, executors have a duty to provide an accounting to beneficiaries. An accounting is a detailed report that outlines the assets, liabilities, income, and expenses associated with the estate, as well as the executor's actions in managing and distributing the estate.

All beneficiaries do not need to formally approve estate accounts; however, it is best practice for the Executor(s) and main beneficiaries to sign the estate accounts to show a legal agreement across all parties. Nevertheless, the beneficiaries are entitled to receive a copy of them and review the information.