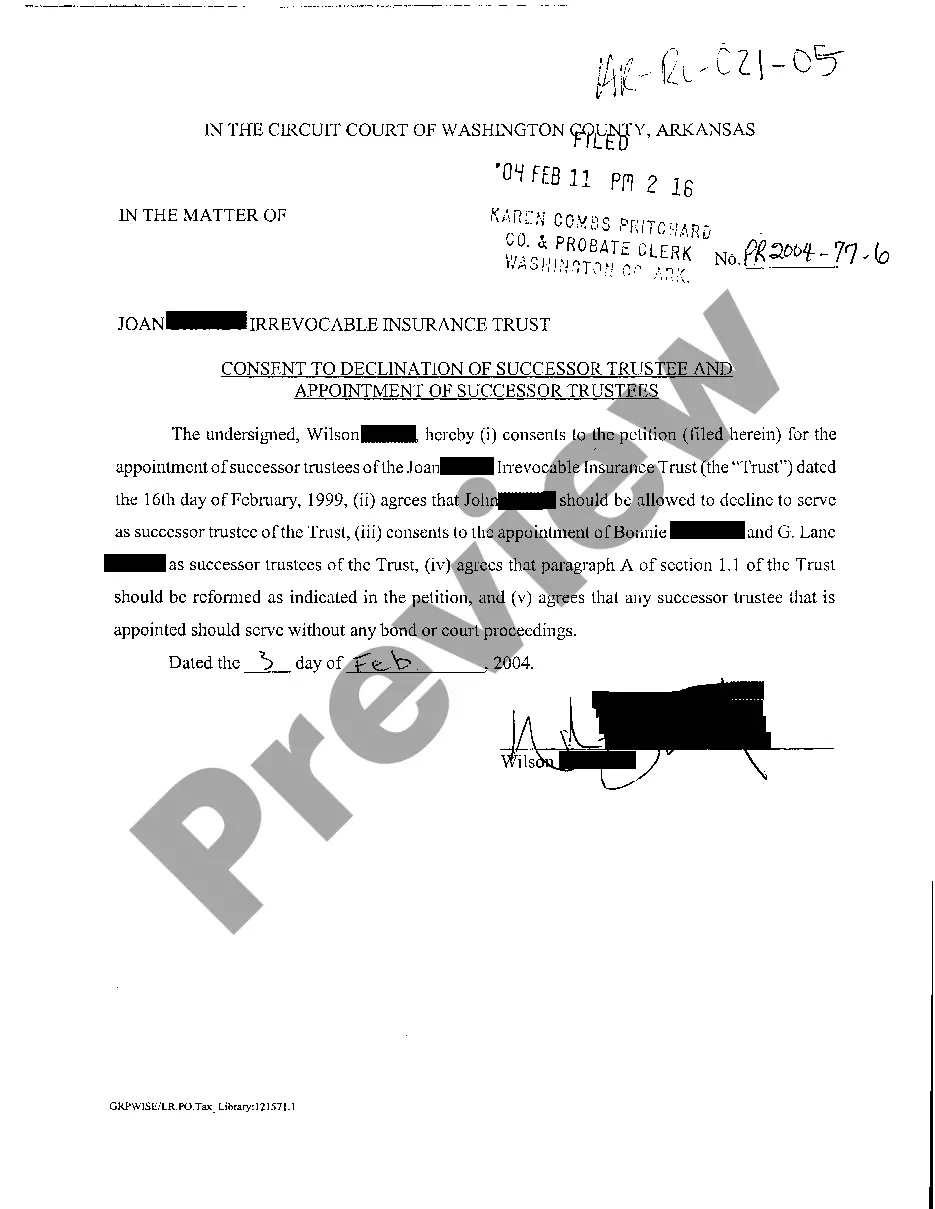

Arkansas Trusts Sample Case 1 Form

Description

Form popularity

FAQ

You can find a trust amendment form online through various legal resources and document platforms. Websites such as uslegalforms offer a variety of templates, including the Arkansas trusts sample case 1 form and its amendment. These resources make it easier for you to modify existing trusts without needing extensive legal assistance. This flexibility ensures your trust remains up-to-date with your wishes.

To create a trust in Arkansas, you must first choose the type of trust that meets your needs. Next, you can prepare the required documents, such as the Arkansas trusts sample case 1 form, to establish the trust legally. You will then need to fund the trust by transferring assets into it. Remember, clarity during this process helps ensure your trust operates according to your wishes.

Yes, you can set up a trust without an attorney in Arkansas. However, creating a trust involves legal terms and conditions that must be met to ensure its validity. Using the Arkansas trusts sample case 1 form can help simplify the process, making it more accessible for you. You can also find templates and guides online to assist you further.

1 form, specifically Schedule K1 (Form 1041), reports income, deductions, and credits allocated to beneficiaries of a trust. Each beneficiary receives their own K1, which they use when filing their personal tax returns. For detailed insights into using K1 forms, including practical examples, the Arkansas trusts sample case 1 form serves as an effective reference.

The primary IRS form for filing a trust is Form 1041. It accounts for the income earned by the trust, expenses, and any distributions made to beneficiaries. To streamline the filing process, consider referring to the Arkansas trusts sample case 1 form, which can provide examples and instructions.

To file a trust, you generally need IRS Form 1041, which is the income tax return for estates and trusts. If your trust distributes income, you will also need to provide K-1 forms to beneficiaries. The Arkansas trusts sample case 1 form can be a useful resource to ensure you have the right forms and information.

Form 8453 is known as the 'U.S. Individual Income Tax Declaration for an IRS e-File Return.' Although it is typically used by individual taxpayers, certain trusts may need to use it for e-filing purposes. For more specific guidance, you can refer to the Arkansas trusts sample case 1 form that outlines relevant filing requirements.

Not all trusts need to file Form 1041. A trust must file this form only if it has gross income of $600 or more, or if it has any taxable income. If you're unsure whether your trust qualifies, using the Arkansas trusts sample case 1 form can help clarify your filing obligations.

Trusts may need to file Form 709 if they make taxable gifts. This form is used to report gifts that exceed the annual exclusion amount. If your trust is involved in transactions that require reporting, the Arkansas trusts sample case 1 form can guide you in ensuring compliance with tax regulations.

To file a trust in Arkansas, you will need to create a trust document that outlines the terms and conditions. After drafting the trust, you must ensure it complies with Arkansas state laws. Utilizing resources like the Arkansas trusts sample case 1 form can simplify this process, ensuring that key details are properly addressed.