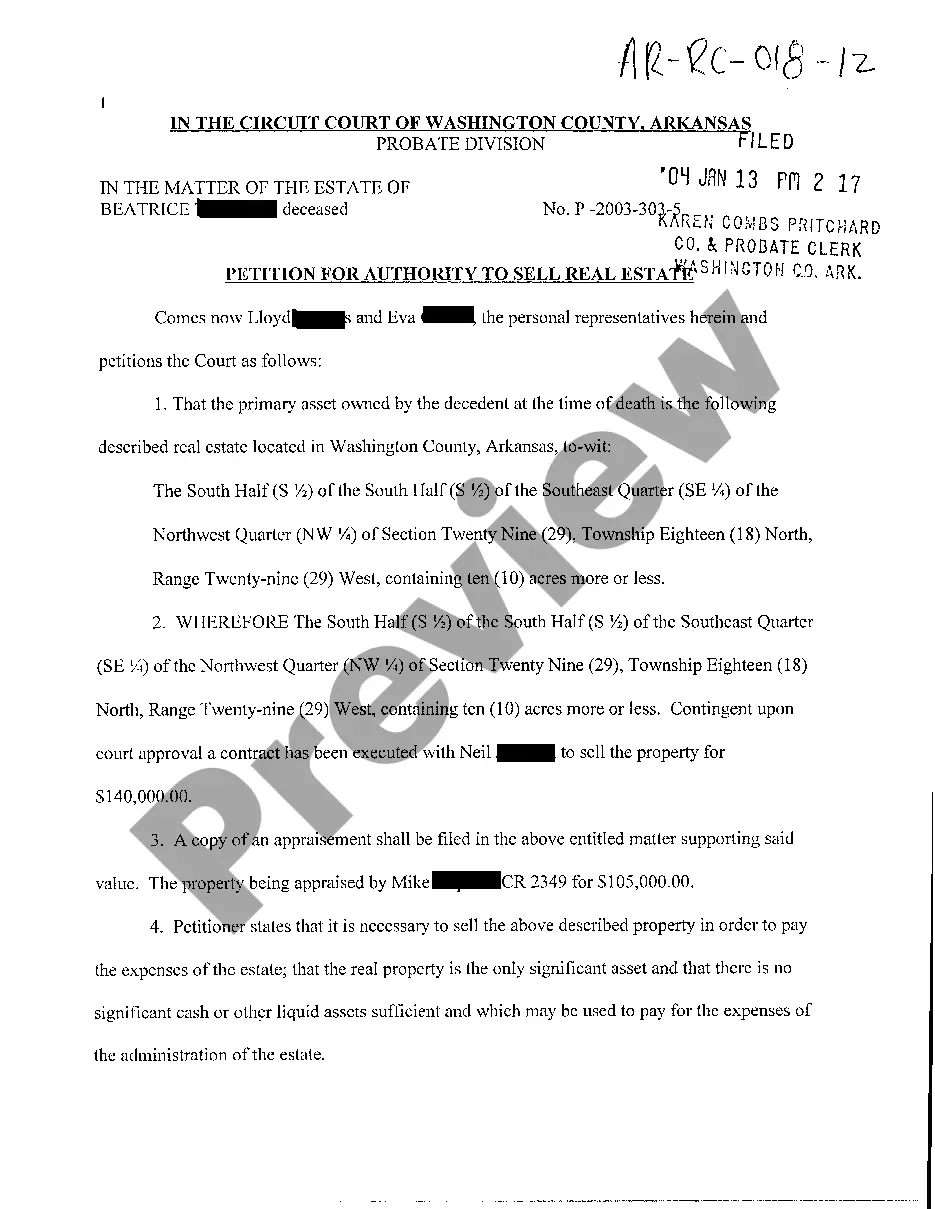

Authority To Sell With Overpriced

Description

How to fill out Arkansas Petition For Authority To Sell Real Estate?

Whether for commercial reasons or personal matters, everyone has to handle legal situations at some point in their life.

Completing legal documents requires careful consideration, starting with choosing the right form template.

With a comprehensive US Legal Forms catalog available, you never have to waste time searching for the right sample online. Take advantage of the library’s easy navigation to find the appropriate template for any occasion.

- For instance, if you choose an incorrect version of a Authority To Sell With Overpriced, it will be rejected when you submit it.

- Thus, it is essential to obtain a reliable source for legal documents like US Legal Forms.

- If you need to acquire a Authority To Sell With Overpriced template, follow these straightforward steps.

- Locate the sample you require using the search bar or catalog navigation.

- Review the form’s description to confirm it aligns with your case, state, and locality.

- Click on the form’s preview to assess it.

- If it is the wrong form, return to the search function to find the correct Authority To Sell With Overpriced sample.

- Download the file once it meets your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you prefer and download the Authority To Sell With Overpriced.

- Once it is downloaded, you can fill out the form with the assistance of editing tools or print it and complete it by hand.

Form popularity

FAQ

Wyoming Statutes § 17-29-110: Though Wyoming does not legally require an operating agreement for an LLC, having one is strongly recommended. This document includes provisions for the regulation of business affairs of the company and its members, as well as managers.

Wyoming LLCs Are Private Service:100% Anonymous Wyoming LLC FormationCost:$199Turnaround:24 HoursWhat's Included:First Year Registered Agent and Business Address, Operating Agreement, Free Bank Account

A Wyoming motor vehicle bill of sale must have the following information: Buyer and seller's names and addresses. Date of sale. Make. Model. Year of production. Title number. Purchase price. VIN.

Wyoming LLC Fees Our Wyoming LLC formation service costs $199 the the first year. This includes everything you need to take to the bank except an EIN. In future years, the annual report is $50 and our agent service is $59.

A Wyoming LLC costs $100 to file with the Secretary of State, plus any registered agent and handling charges. We charge $199 which includes the Secretary's fee. Wyoming requires an annual report for LLCs to be filed on the first day of the month in which the company is formed.

If purchased from an individual, you will need a notarized bill of sale. If purchased from an individual or not provided with a Wyoming Dealer`s Reassignment Form, at least one of the buyer`s must sign the purchaser`s application and have their signature notarized.

New Mexico This is the only state that does not require disclosure of the ownership of an anonymous LLC to the state, which means your business can expect the strongest privacy and confidentiality. Delaware, Nevada and Wyoming do require identification of owners to the state.

Along with the possible benefits of registering an anonymous LLC come some drawbacks: Anonymity is not guaranteed 100%. The state, bank, IRS, clients, partners, and vendors may be privy to the LLC owner's private information. The privacy protections given to owners of anonymous LLCs vary from state to state.