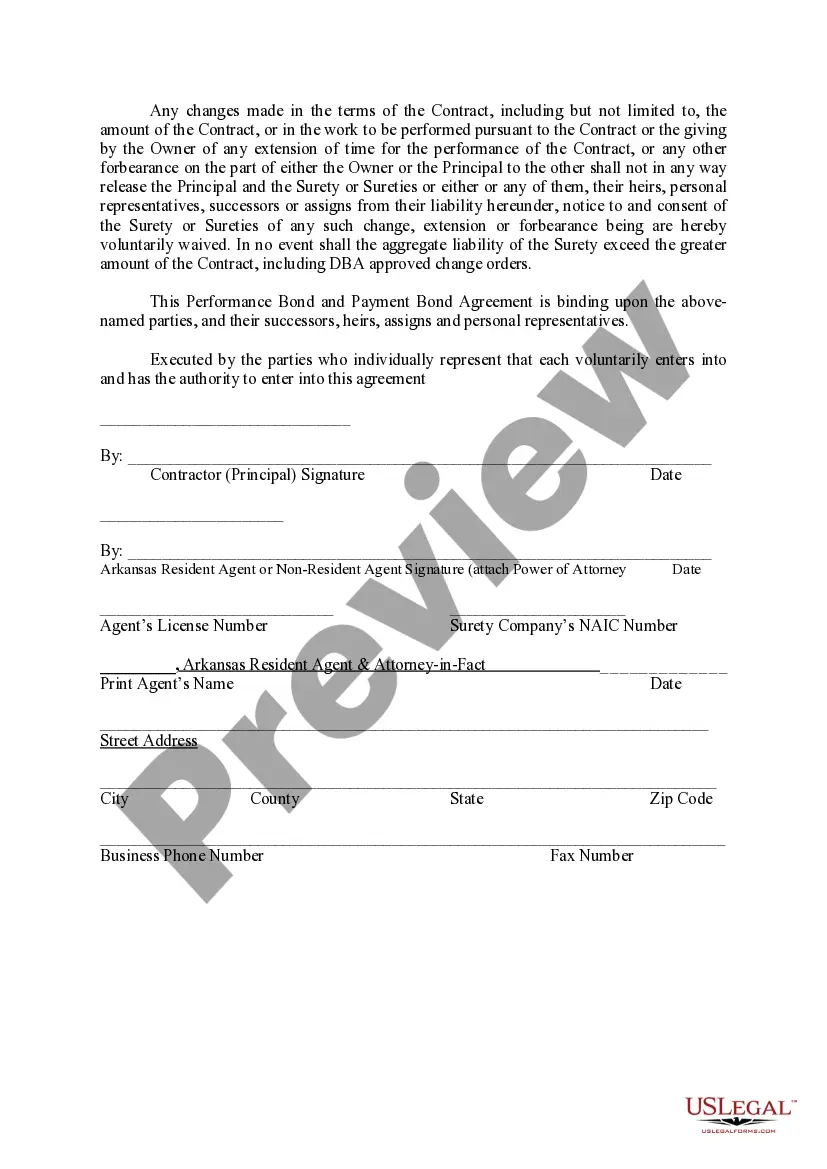

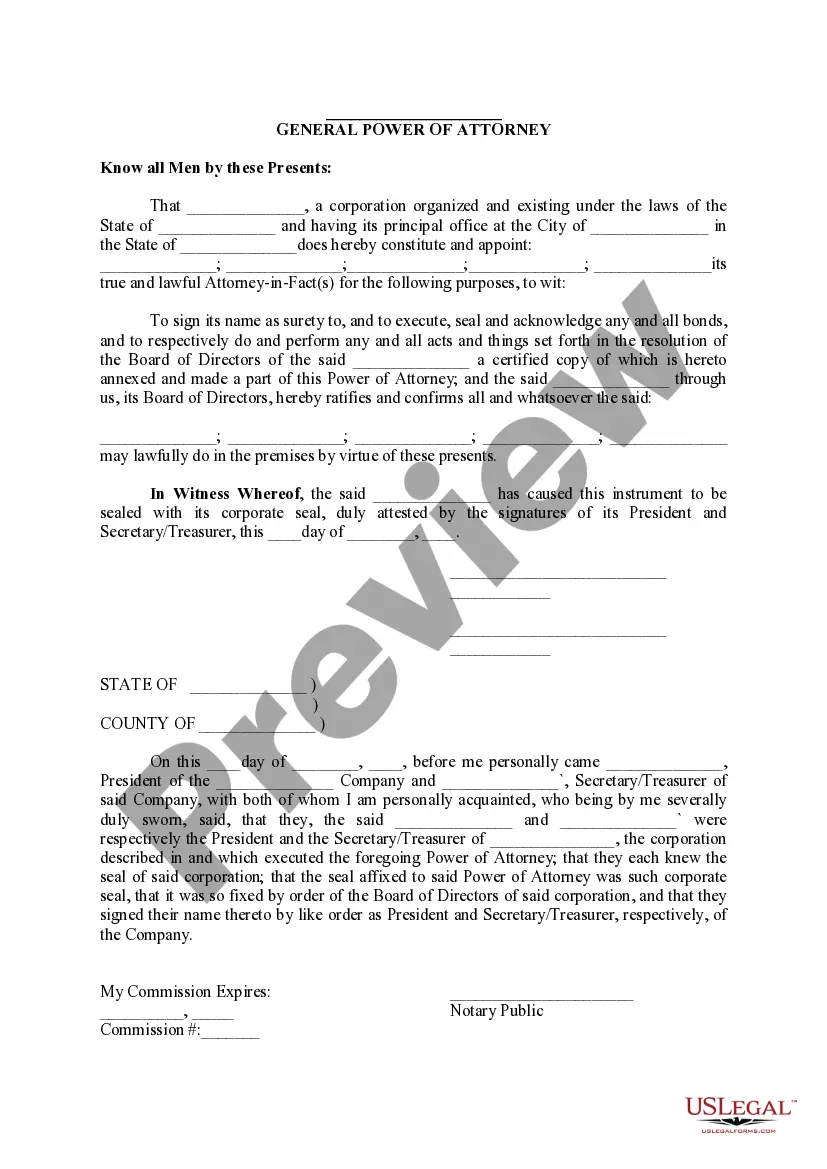

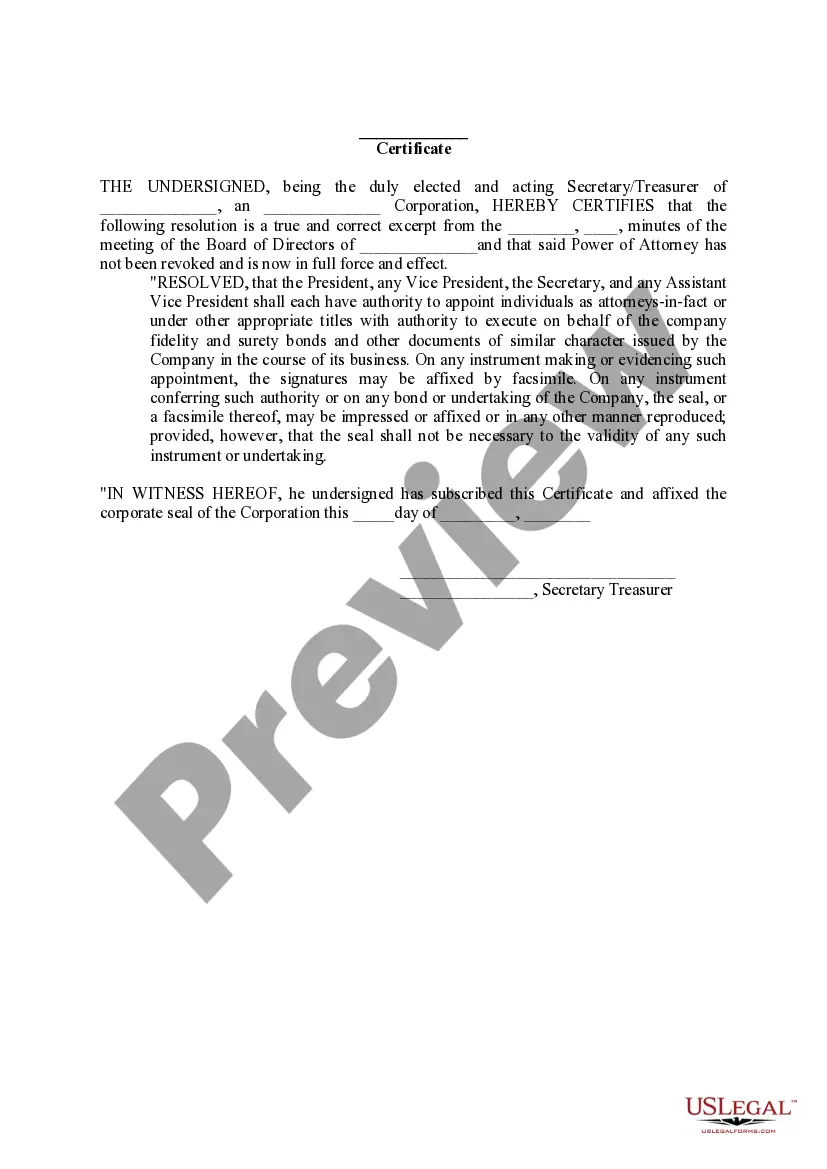

Payment Bond Of Contract

Description

How to fill out Arkansas Performance And Payment Bond?

Properly created formal documents are one of the crucial assurances for preventing issues and legal disputes, but obtaining them without the assistance of a lawyer can be time-consuming.

Whether you need to promptly locate an updated Payment Bond Of Contract or any other documents for work, family, or business scenarios, US Legal Forms is always available to assist.

The process is even simpler for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected file. Furthermore, you can access the Payment Bond Of Contract anytime, as all documents ever obtained on the platform are accessible within the My documents section of your profile. Save time and money on preparing official documents. Try US Legal Forms now!

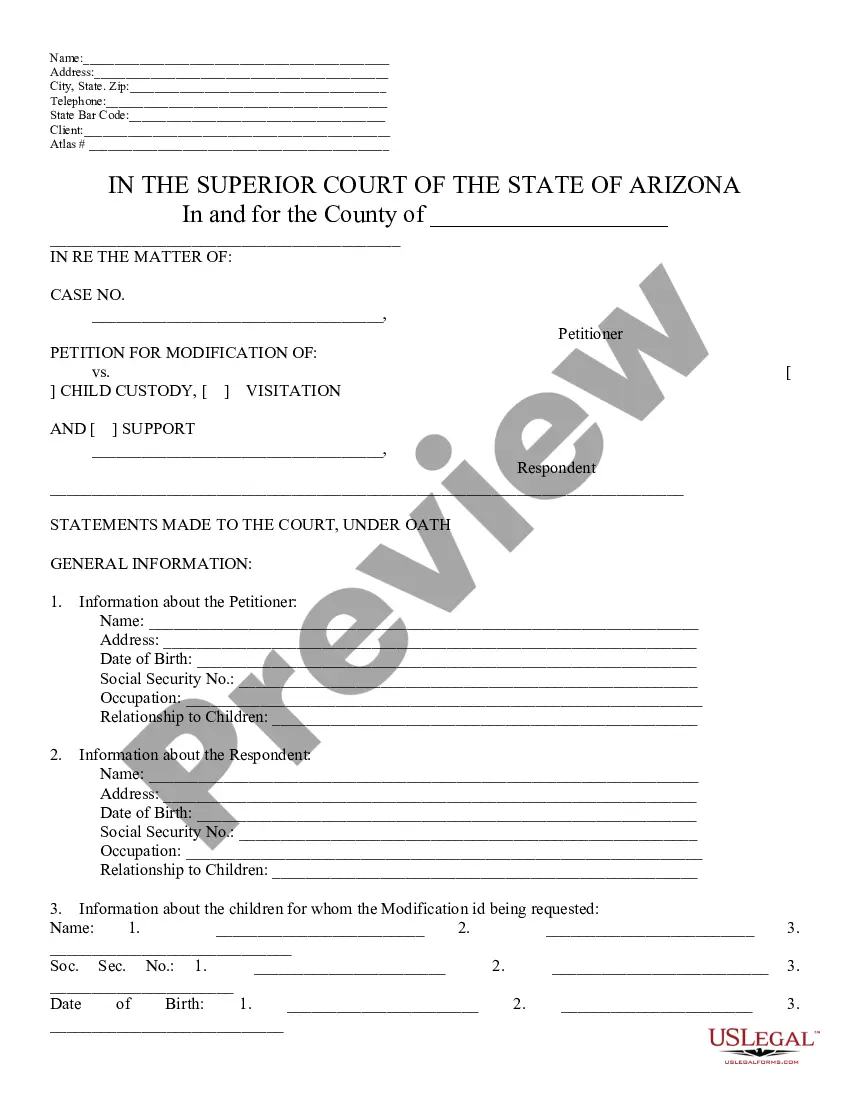

- Confirm that the form is appropriate for your situation and location by reviewing the description and preview.

- Search for another template (if necessary) using the Search bar in the header of the page.

- Click on Buy Now once you find the correct template.

- Choose the pricing plan, Log In to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Choose PDF or DOCX file format for your Payment Bond Of Contract.

- Click Download, then print the document to fill it out or include it in an online editor.

Form popularity

FAQ

Payment bond definition: A payment bond is a surety bond issued to contractors that guarantees that the contractor will pay their subcontractors, material suppliers, and laborers in a timely fashion. Payment bonds are usually obtained by contractors or subcontractors prior to the commencement of a construction project.

In contrast a subcontractor payment bond is a contractual agreement between a surety and a subcontractor for a particular project. It is designed to ensure that the cost of the labor and materials used and contracted for by the subcontractor are paid in full.

First, write the name of the obligor or project owner on line preceded by "are held and firmly bonded to." Then write down how much money is at issue in this bond. Once that's done sign your signature where requested with a notary public present who will then make sure it was signed legally.

Payment bonds are important for owners because payment bonds ensure the contractor pays their subcontractors and precludes the possibility of a subcontractor filing a lien on the owner's property.

Write the name of the obligor, or project owner, on the line preceded or followed by are held and firmly bonded to. Write the amount of money at issue in the bond on the line designated for the bond amount. Sign the bond in the presence of a notary public and have the bond notarized.