Affidavit Of Affixation Form With Irs

Description

How to fill out Arkansas Affidavit Of Affixation Of Manufactured Home To Land?

The Affidavit Of Affixation Form With Irs you see on this page is a reusable legal template drafted by professional lawyers in compliance with federal and local laws. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, easiest and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Affidavit Of Affixation Form With Irs will take you only a few simple steps:

- Search for the document you need and review it. Look through the sample you searched and preview it or check the form description to verify it fits your requirements. If it does not, utilize the search option to get the right one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Pick the format you want for your Affidavit Of Affixation Form With Irs (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the document. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Make use of the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

3. Form 1099-S Instructions - A complete overview In Box 1, the filer must enter the date of closing for the property. In Box 2, enter the gross proceeds, this is the cash amount that the transferor will receive in exchange for the property. In Box 3, enter the address and/or legal description of the property.

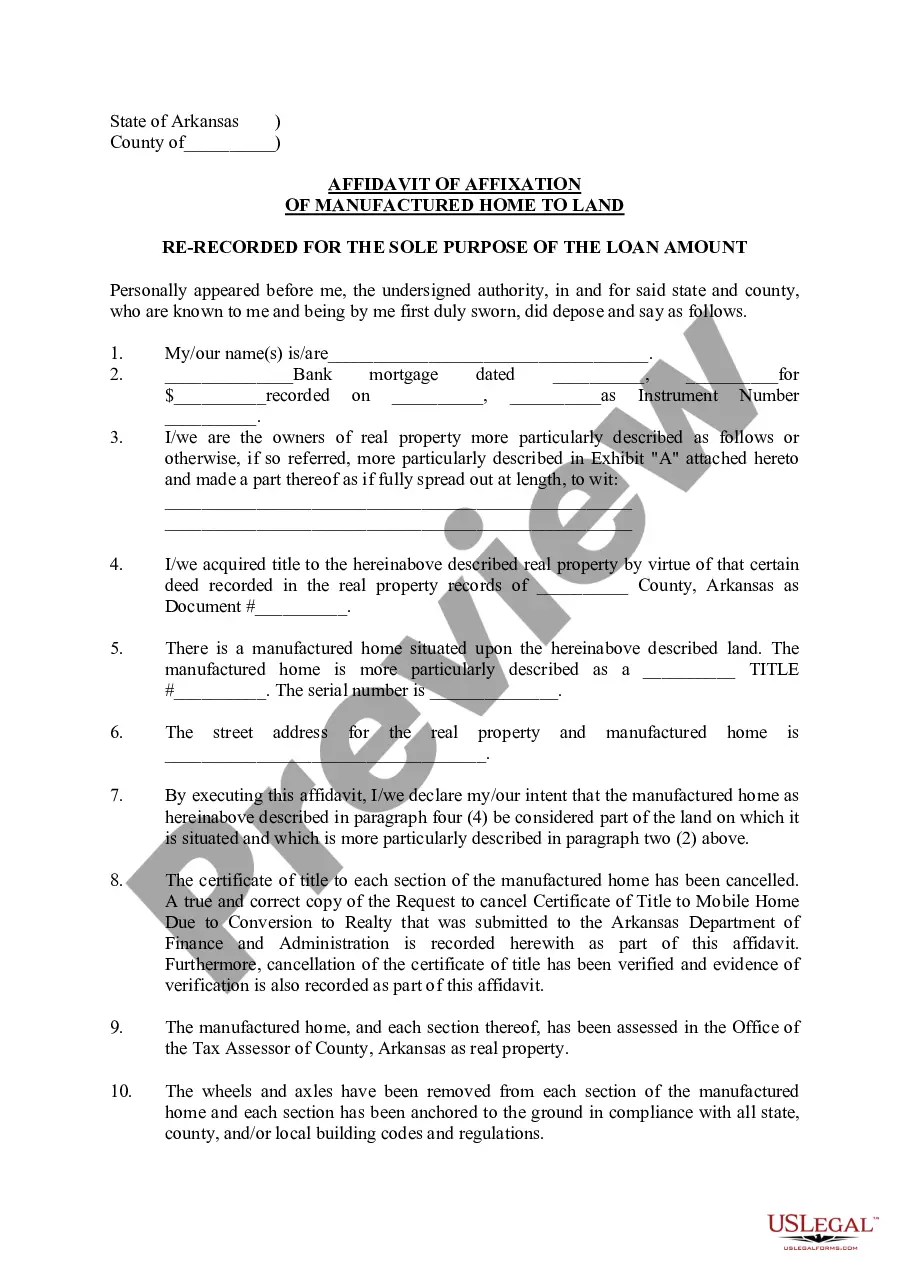

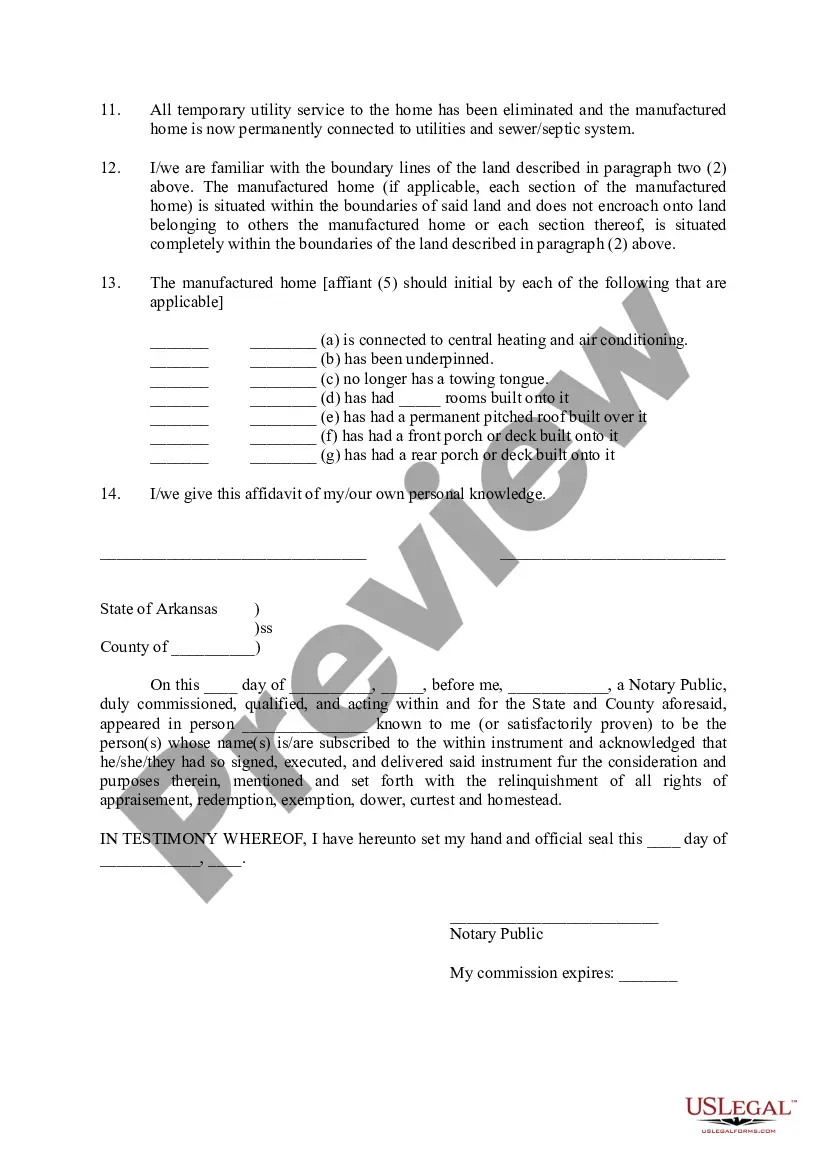

The recording of an Affidavit of Affixation in the register of deeds' office will be prima facie evidence that the manufactured home is affixed to real property as an improvement to the property, so that lenders will be able to rely on the affidavit to file and properly perfect their liens, and bankruptcy judges may ...

Ing to the IRS, the person who must file the Form 1099-S reporting the sale is the person responsible for closing the transaction. This means that if you used a title company or attorney to close your transaction they are generally responsible for completing and filing the form on your behalf.

The sales price is the gross proceeds you received in giving up the property. That's the amount that was paid down or paid off, plus any other consideration you received in the transaction. Compute your gain or loss in the usual way ? Sales price minus your adjusted basis in the property.