The dissolution of a corporation package contains all forms to dissolve a corporation in Arkansas, step by step instructions, addresses, transmittal letters, and other information.

Dissolution Corporation Form With Decimals

Description

How to fill out Dissolution Corporation Form With Decimals?

Precisely composed formal papers serve as a crucial safeguard against complications and legal disputes, yet acquiring them without the assistance of an attorney can be time-consuming.

Whether you need to swiftly locate an up-to-date Corporation Dissolution Form With Decimals or other documents pertaining to employment, family, or business matters, US Legal Forms is always available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the selected file. Furthermore, you can access the Corporation Dissolution Form With Decimals at any time, as all documents ever obtained on the platform remain accessible within the My documents section of your profile. Save time and reduce expenses while preparing official documents. Experience US Legal Forms today!

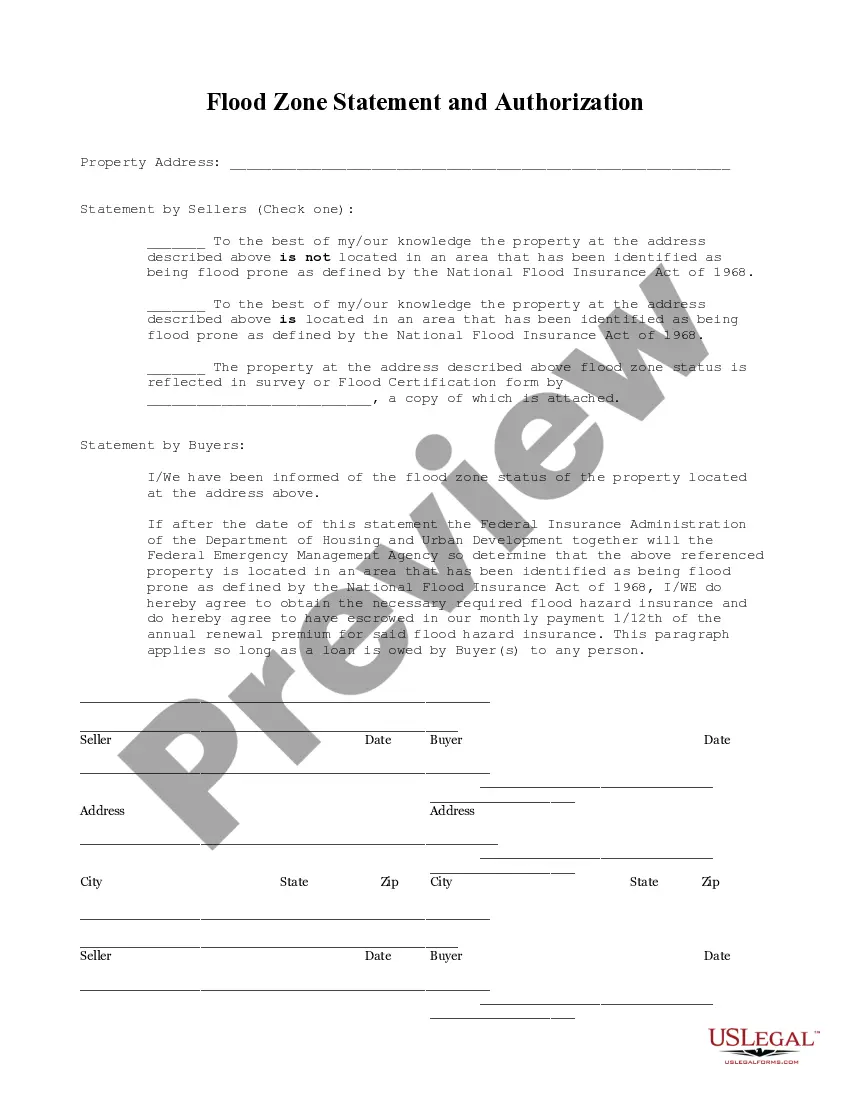

- Verify that the form fits your situation and locality by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the header.

- Select Buy Now once you find the appropriate template.

- Select your pricing option, sign in to your account, or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Corporation Dissolution Form With Decimals.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Form 966 is typically required if a corporate entity is dissolving as part of a merger or similar transition. While not every dissolution mandates this form, it is crucial in specific cases to ensure IRS compliance. Thus, reviewing your corporation's situation or consulting a professional is advisable when considering the dissolution corporation form with decimals.

To complete a corporation's dissolution, first, the board of directors should approve the decision formally. Next, submit the necessary documents, including the dissolution corporation form with decimals, to your state's business authority. Finally, resolve any outstanding debts, and notify employees and stakeholders of the dissolution.

Again, the section code for dissolution varies by state, often specified in state business corporation laws. It is important to refer to these laws to determine the correct section code and requirements for your specific situation. Ensuring you adhere to these codes is necessary when filling out a dissolution corporation form with decimals.

Form 966 for merger is used when a corporation undergoes a major organizational change, such as merging with another company. This form notifies the IRS of the merger and includes details about the entities involved. Properly completing this form is vital for compliance, especially in conjunction with the dissolution corporation form with decimals.

Dissolution of a corporation is the formal process of closing down a business entity. This involves filing required documents, like the dissolution corporation form with decimals, with the state where the corporation is registered. It is essential to address any outstanding obligations to ensure a smooth transition.

The code section for dissolution of a corporation generally refers to the specific provisions in your state's business corporation law. Each state may have its own legal references, so it’s crucial to check local regulations. Understanding these sections helps ensure compliance when completing a dissolution corporation form with decimals.

To fill out Form 966, start by downloading the form from the IRS website. It requires basic information about your corporation, including its name, address, and Employer Identification Number (EIN). Be sure to follow the instructions carefully, and remember that this form is essential for the dissolution corporation form with decimals.

Writing a dissolution letter involves clearly stating the intent to dissolve your corporation. Begin by addressing the letter to relevant parties, include your corporation's name, and reference the approved resolution for dissolution. It is wise to use a dissolution corporation form with decimals to ensure proper formatting and legal compliance. Templates from services like USLegalForms can provide helpful structure as you draft your letter.

A 1038 form is a specific document used in certain states for the dissolution of a corporation. It serves to officially notify the state of the corporation's intention to dissolve. To ensure compliance, it is important to use the correct dissolution corporation form with decimals, as requirements may vary by state. You can find guidance on completing this form through resources like USLegalForms.

The first step to terminate a corporation is to call a meeting with the shareholders to agree on dissolution. After securing their approval, you should complete the dissolution corporation form with decimals. This initial step is crucial, as it sets the foundation for the entire winding-up process. Once completed, you can proceed to file the form with the state.