Legal Separation In Arkansas Cost

Description

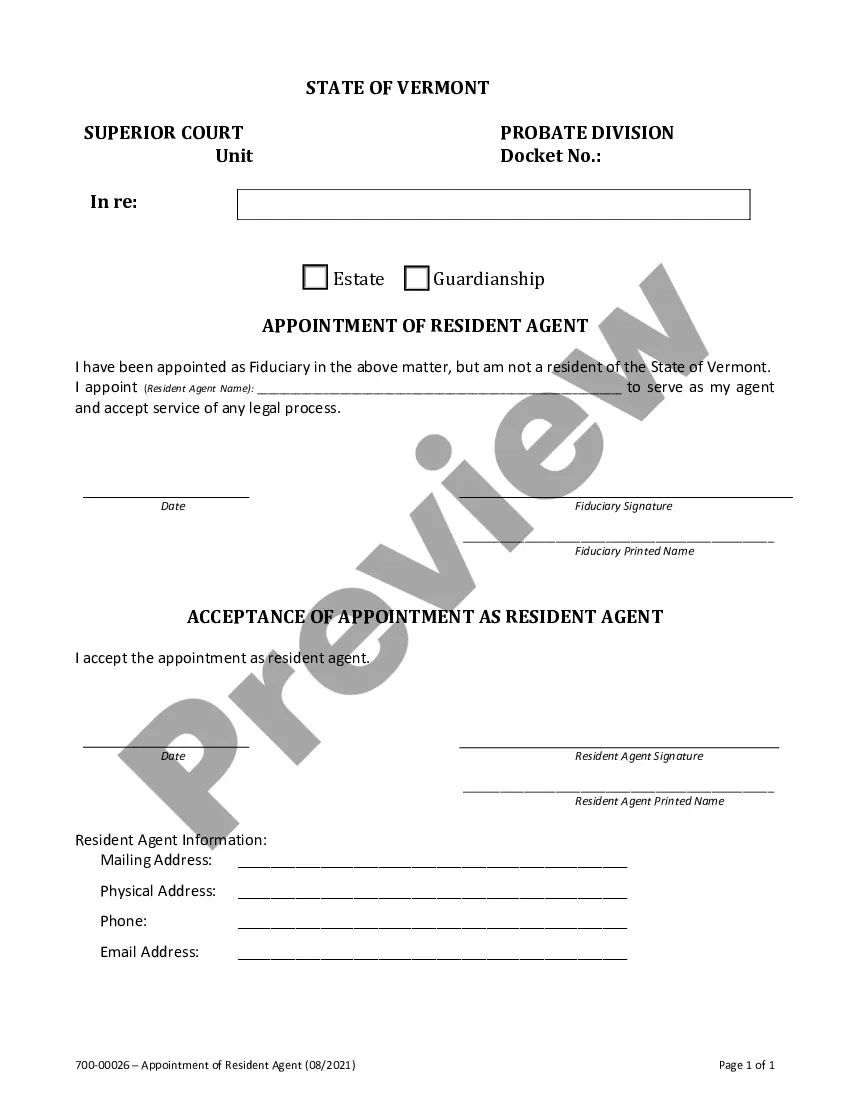

How to fill out Arkansas Marital Legal Separation And Property Settlement Agreement Where Minor Children And No Joint Property Or Debts That Is Effective Immediately?

Obtaining a primary location to access the latest and most suitable legal templates is a significant part of dealing with red tape.

Selecting the correct legal documents requires precision and meticulousness, which is why it's crucial to obtain Legal Separation In Arkansas Cost samples only from trustworthy sources, such as US Legal Forms.

Eliminate the complications associated with your legal documentation. Explore the comprehensive US Legal Forms library where you can discover legal templates, assess their applicability to your situation, and download them right away.

- Utilize the catalog navigation or search field to locate your template.

- Review the form’s details to verify if it meets your state and local requirements.

- Examine the form preview, if available, to confirm that it is indeed the one you need.

- Return to the search to look for the appropriate template if the Legal Separation In Arkansas Cost does not fulfill your needs.

- If you are confident about the form’s suitability, proceed to download it.

- As a registered user, click Log in to verify and access your selected templates in My documents.

- If you don’t have an account yet, click Buy now to acquire the template.

- Select the pricing option that best fits your requirements.

- Continue with the registration to complete your purchase.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Legal Separation In Arkansas Cost.

- Once the form is on your device, you can modify it using the editor or print it to fill it out manually.

Form popularity

FAQ

Persons interested in obtaining Alabama bankruptcy records may request the Bankruptcy Clerk records in the court that filed or heard the case. Interested parties may also request bankruptcy court records electronically through the Multi-Court Voice Case Information System (McVCIS).

Bankruptcy will eliminate most of your debts, such as unsecured debts including credit card bills, medical bills, and payday loans. You may still be required to pay your secured debts, such as your mortgage or motor vehicle loan.

Unless a bankruptcy court orders otherwise, there are no limits on the number of bankruptcy cases you can file in Alabama. If your debts were discharged in a previous bankruptcy, you must wait a certain amount of time in Alabama before you will be entitled to a discharge again.

A notice of bankruptcy case and court-issued notices are sent to the creditors of the individual, corporation, or other entity that has filed for bankruptcy protection. Entities can use the Bankruptcy Noticing Center (BNC) to have notices delivered either: Electronically, or. By mail.

Filing bankruptcy without an attorney is called "Pro Se" - meaning to represent oneself in legal proceedings. With limited exceptions, Section 109(h) of the Bankruptcy Code requires that all individual debtors receive credit counseling from an approved provider within 180 days before the bankruptcy filing.

A chapter 13 bankruptcy is also called a ?wage earner's plan? and allows the debtor to keep property and pay all or part of his debts over time, usually three to five years. An individual who is self-employed or operating an unincorporated business is also eligible for chapter 13.

1-866-222-8029 To access the system you will need the court district (Southern District of Alabama) and the debtor's name, bankruptcy case number, or Social Security number.

How to Get Georgia Bankruptcy Records. Bankruptcy records are available through the PACER (Public Access Court Electronic Records) system, and interested persons must register and login to gain access.