Arkansas Child Support Chart Withholding

Description

How to fill out Arkansas Weekly Family Support Chart?

Individuals typically link legal documentation with something intricate that only an expert can handle.

In some respects, this is accurate, as creating the Arkansas Child Support Chart Withholding requires considerable knowledge of subject matter, including state and county laws.

However, thanks to US Legal Forms, the process has become more user-friendly: pre-prepared legal documents for any personal or business circumstance relevant to state regulations are compiled in one digital library and are now accessible to all.

Create an account or Log In to proceed to the payment section. Process your subscription payment through PayPal or using a credit card. Choose the format for your document and click Download. Print your file or upload it to an online editor for quicker completion. All templates in our collection are reusable: once bought, they remain stored in your profile and can be accessed whenever necessary via the My documents section. Explore all the benefits of using the US Legal Forms platform. Sign up today!

- US Legal Forms presents over 85,000 current documents organized by state and purpose, making it quick to find the Arkansas Child Support Chart Withholding or any specific template.

- Returning users with an active subscription must Log In to their account and click Download to retrieve the document.

- New users will need to sign up for an account and obtain a subscription before they can download any legal documents.

- Follow this step-by-step guide to acquire the Arkansas Child Support Chart Withholding.

- Carefully review the page content to confirm it meets your requirements.

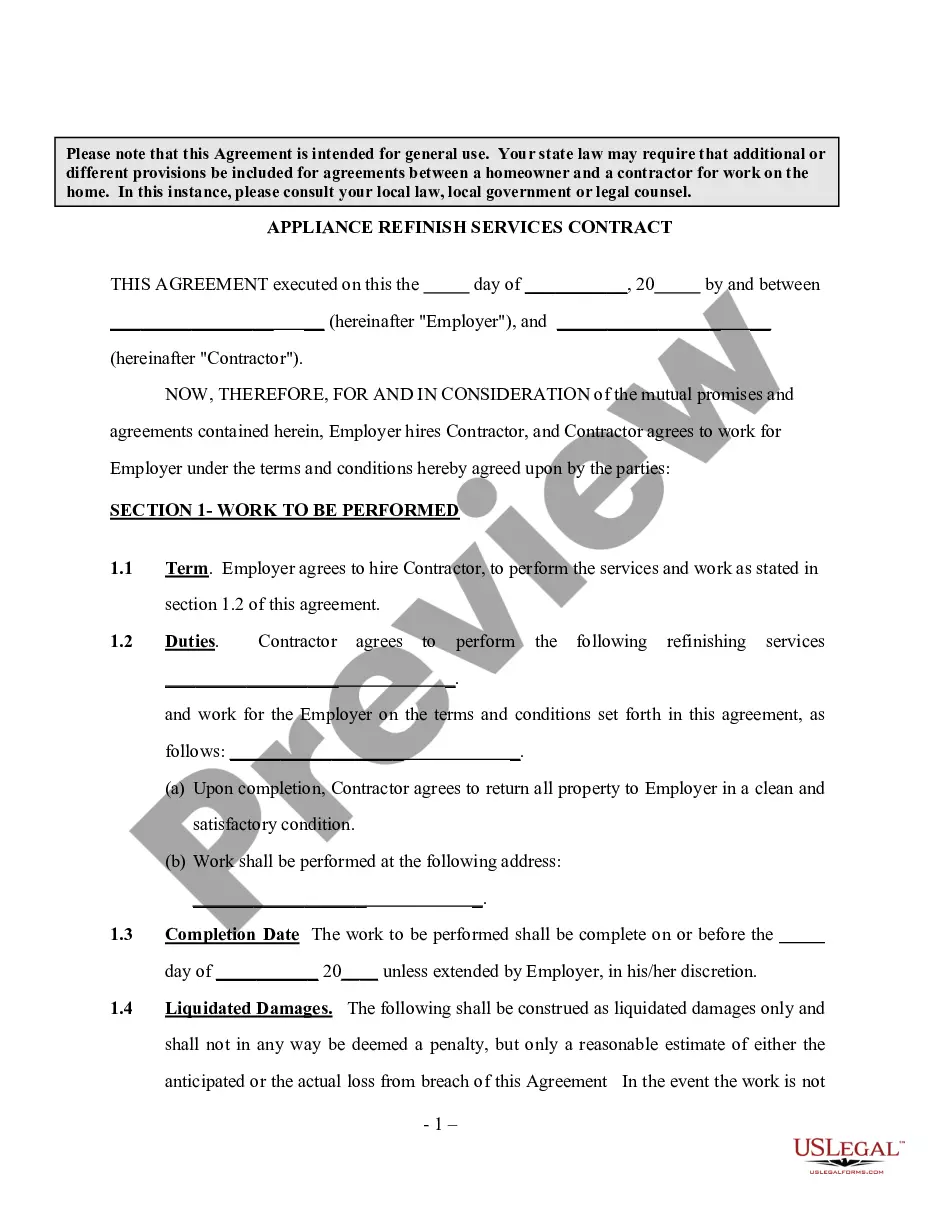

- Examine the form description or view it through the Preview function.

- If the former does not meet your needs, search for another copy in the Search field above.

- When you identify the right Arkansas Child Support Chart Withholding, click Buy Now.

- Select a subscription plan that fits your needs and financial situation.

Form popularity

FAQ

The duration of the child support process in Arkansas can vary, depending on the complexity of your case and court schedules. Generally, it may take several weeks to a few months to finalize. Referencing the Arkansas child support chart withholding can help you set realistic expectations regarding payment timelines. For support in managing your case, consider using US Legal Forms for guidance and clarity.

Filing for child support in Arkansas involves filling out specific court forms and submitting them to the appropriate court. The Arkansas child support chart withholding will assist you in determining the right amount to request based on your financial circumstances. If you need guidance, local legal aid organizations often provide resources, and US Legal Forms can streamline this process with the necessary documentation.

To file for child support in Arkansas, you must complete the necessary forms and submit them to your local court. Detailed instructions can be found using the Arkansas child support chart withholding as a guideline to help you understand payment expectations. You should also prepare any required documentation reflecting your financial situation and the child’s needs. Utilizing US Legal Forms can simplify this process significantly.

Under Arkansas law, the maximum amount that can be withheld for child support is generally limited by federal guidelines. The Arkansas child support chart withholding provides a clear outline of these limits based on your income. Be sure to consult this chart and the necessary legal resources to determine the exact figures applicable to your situation. US Legal Forms can help you navigate this process effectively.

You can report child support income to the Arkansas Child Support Enforcement Unit. They provide detailed instructions on how to disclose your income based on the Arkansas child support chart withholding guidelines. It’s important to follow the correct procedures to ensure that the child support payments are accurately recorded. For more assistance, you might want to explore the resources available on the US Legal platform.

Filling out a check for child support is straightforward. Write the recipient's name, which is usually the custodial parent, along with the correct date. Specify the amount in both numbers and words, followed by a note indicating that it's for child support to avoid confusion. Additionally, using the Arkansas child support chart withholding will ensure you send the correct amount as required by the court. US Legal Forms offers easy-to-follow guidelines for these transactions to help you get it right.

Worksheet A and B serve different purposes in North Carolina's child support calculations. Worksheet A is typically used for calculating support obligations when parents share joint custody, while Worksheet B is utilized when one parent has sole physical custody. The distinctions are vital for determining the appropriate amount, similar to how the Arkansas child support chart withholding functions to provide clarity on financial responsibilities. To navigate these nuances effectively, consider utilizing resources available on US Legal Forms.

When child support payments are deducted from a paycheck, you will see a specific line item labeled as such, detailing the amount withheld. This deduction corresponds directly to the calculation provided by the Arkansas child support chart withholding, reflecting the agreed-upon amount for financial support. It's designed to ensure that you consistently contribute to your child's needs while maintaining transparency in your finances. Using US Legal Forms can provide you with sample paychecks to better understand how these deductions appear.

The child support worksheet is a crucial document used to calculate the child support obligations in Arkansas, incorporating relevant financial details from both parents. By using the Arkansas child support chart withholding, parents can determine their contribution based on their income and the needs of the child. This worksheet ensures a fair assessment of responsibilities, helping parents understand their financial commitments. To make the process easier, you can access resources through US Legal Forms to guide you in filling out this worksheet.

In Arkansas, the Arkansas child support chart withholding outlines specific percentages that govern how much can be deducted from a paycheck for child support. Typically, the amount may range from 20% to 50%, depending on various factors, including the number of children involved and the parent's income. Understanding these percentages is crucial for both custodial and non-custodial parents to ensure fair contributions. You can find detailed information and calculations on these withholding amounts through resources like uslegalforms.