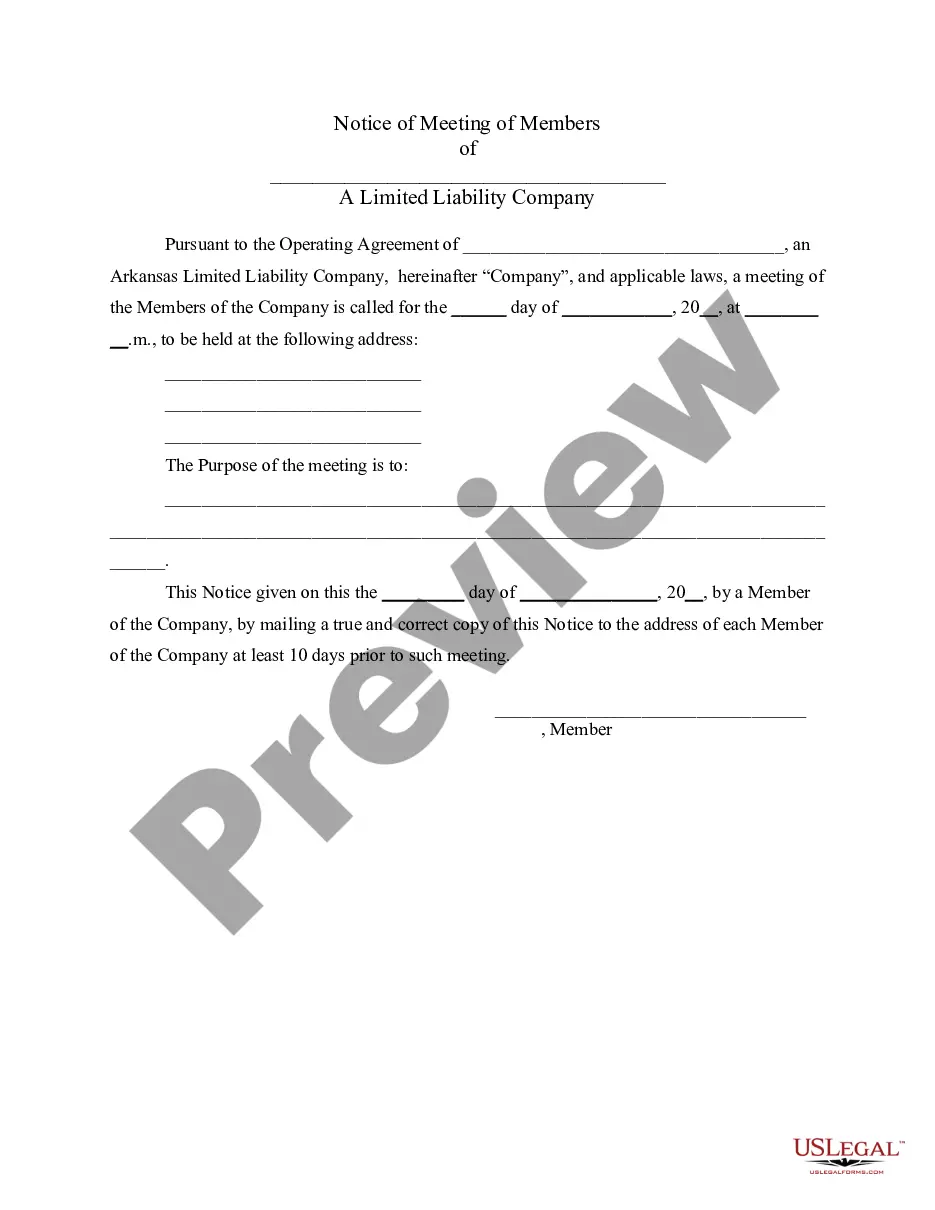

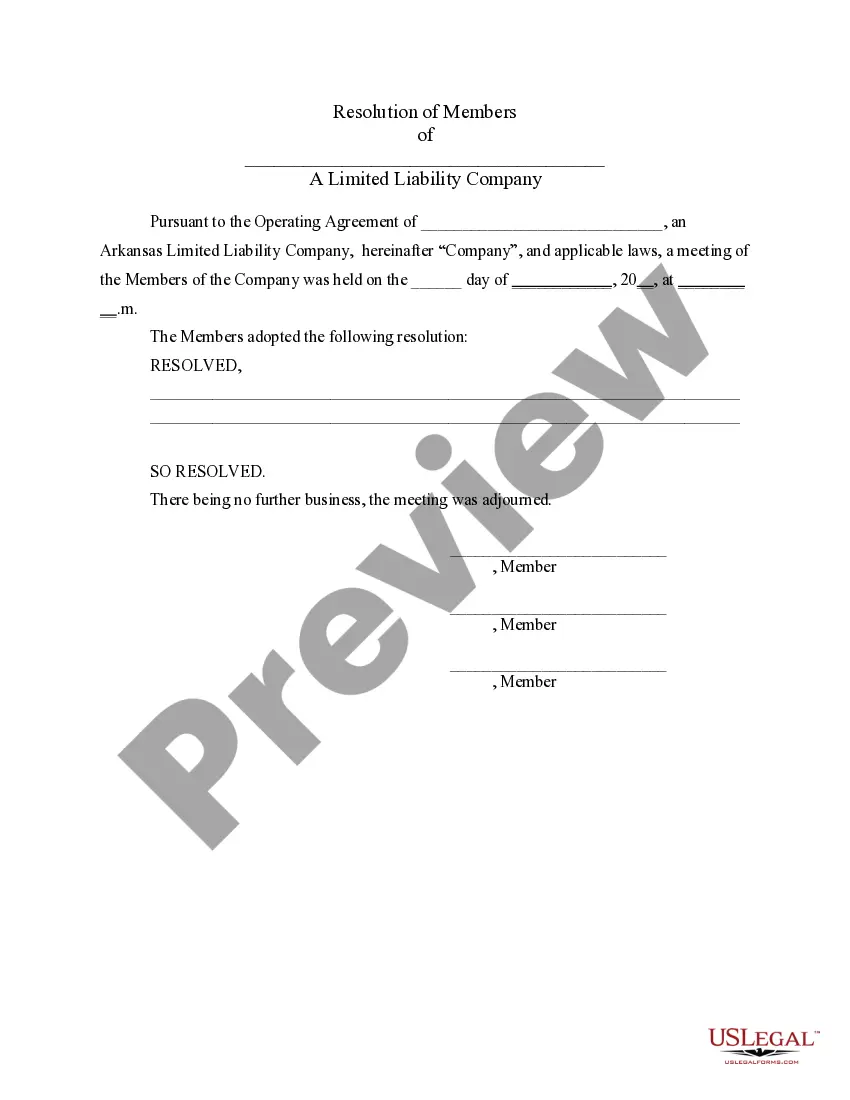

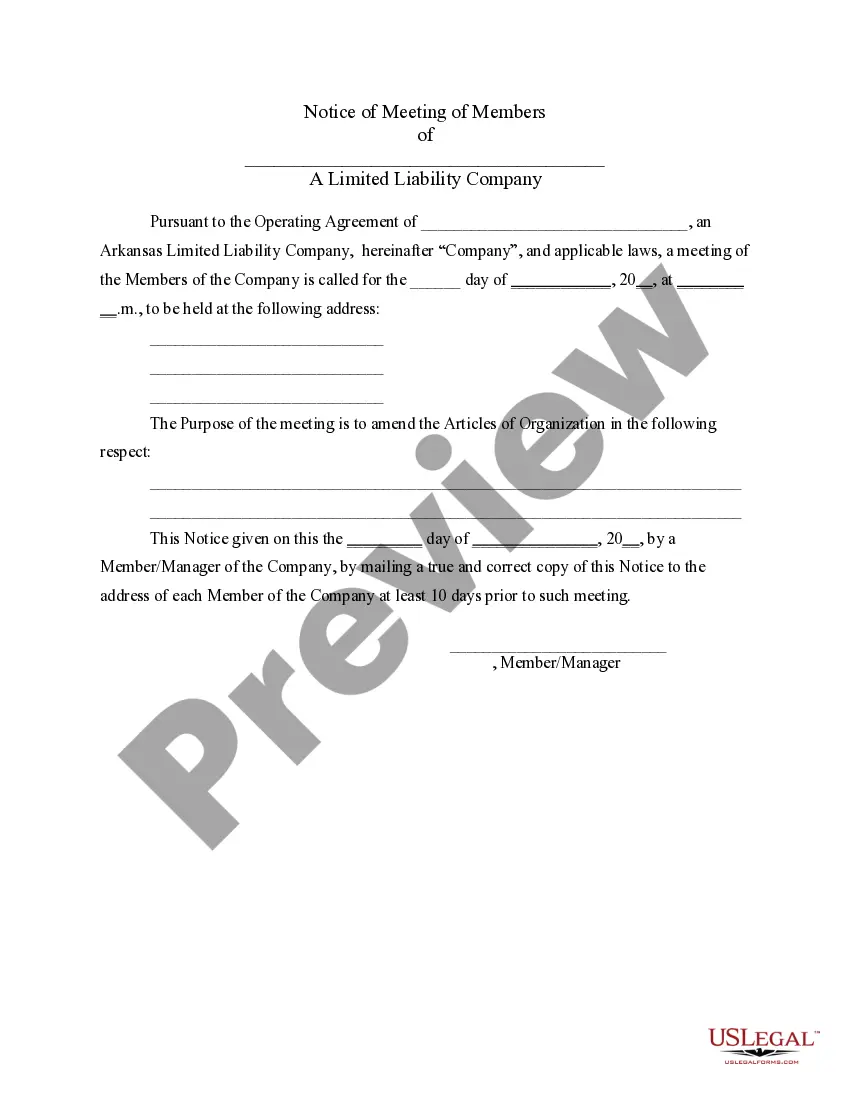

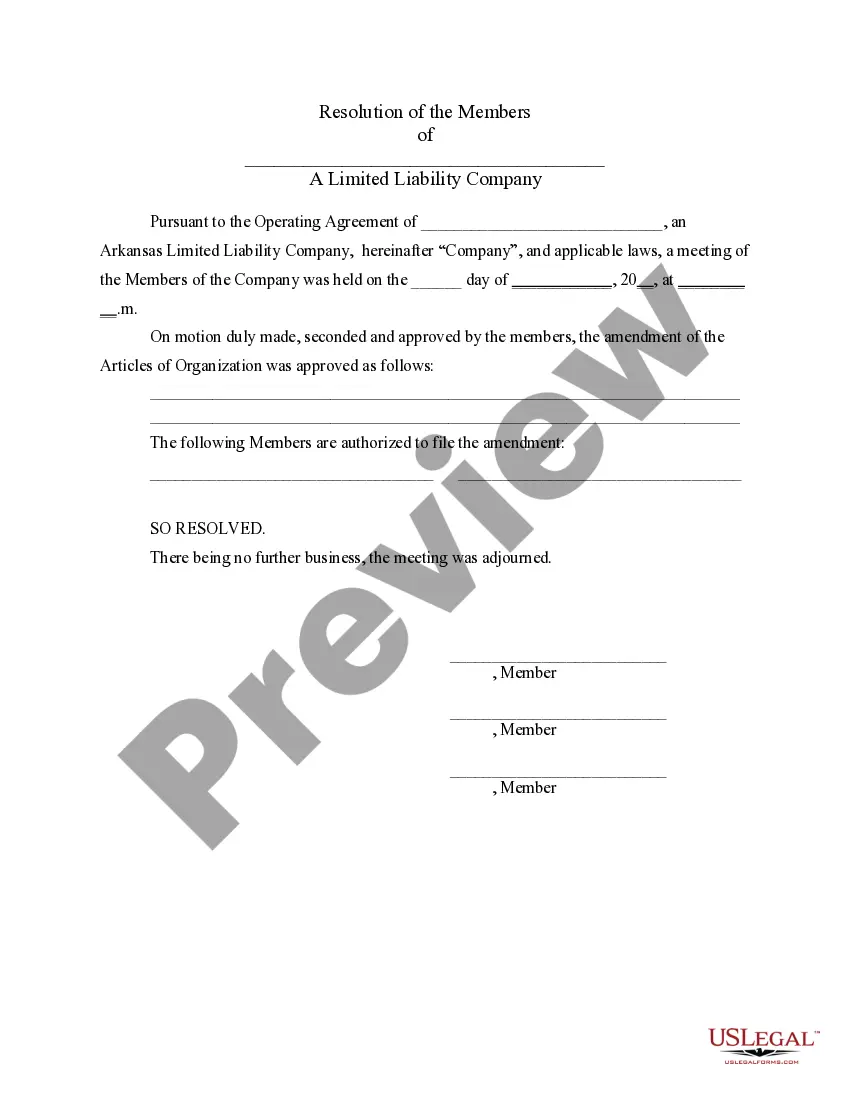

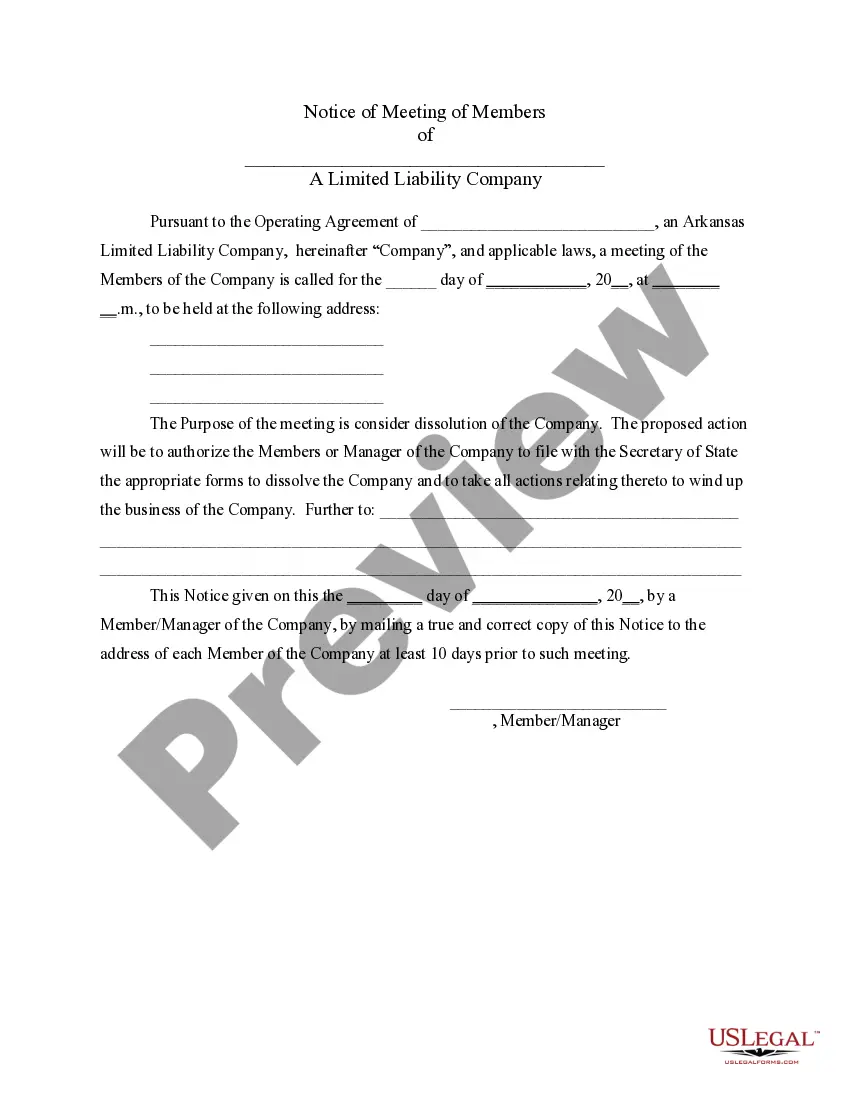

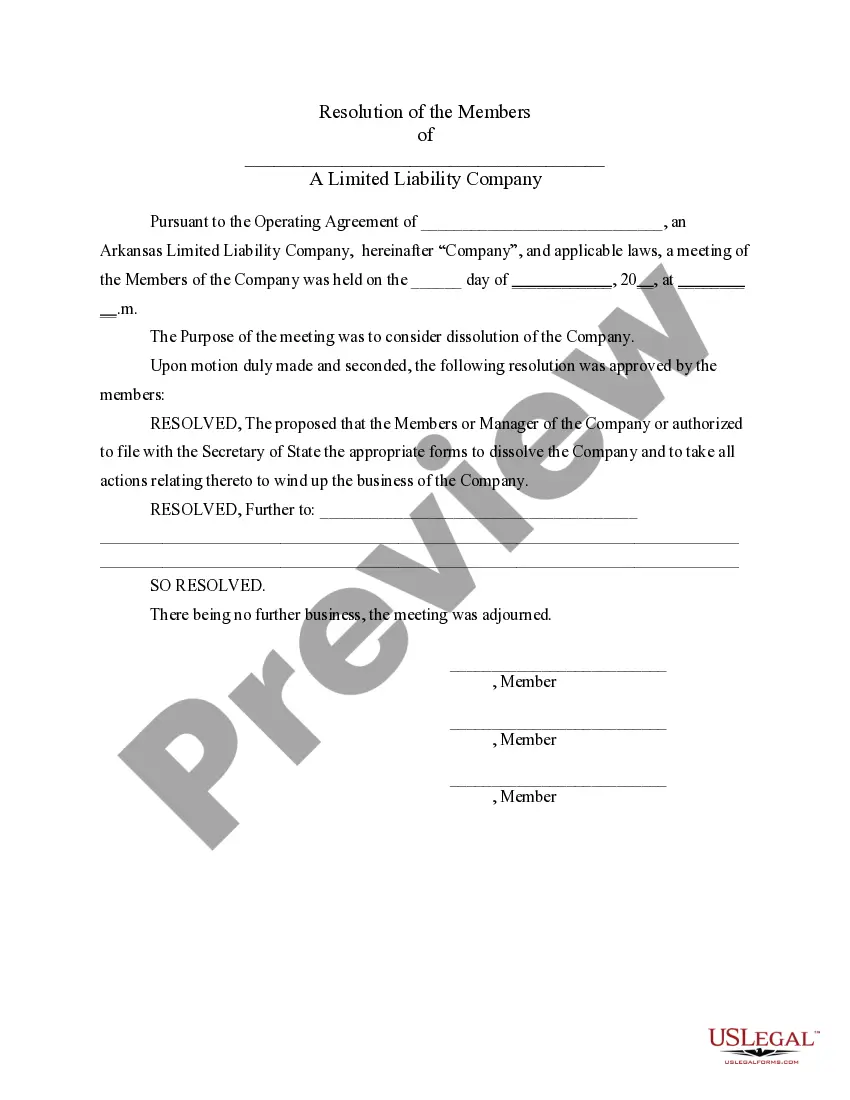

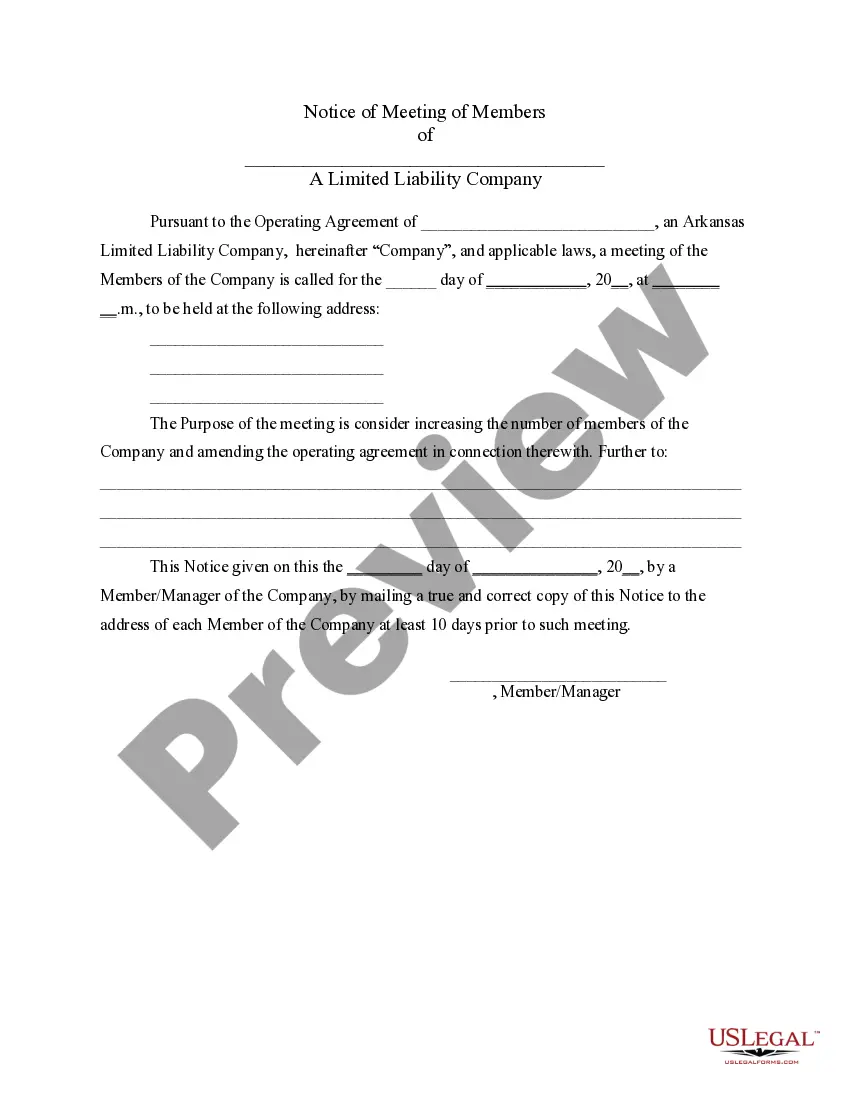

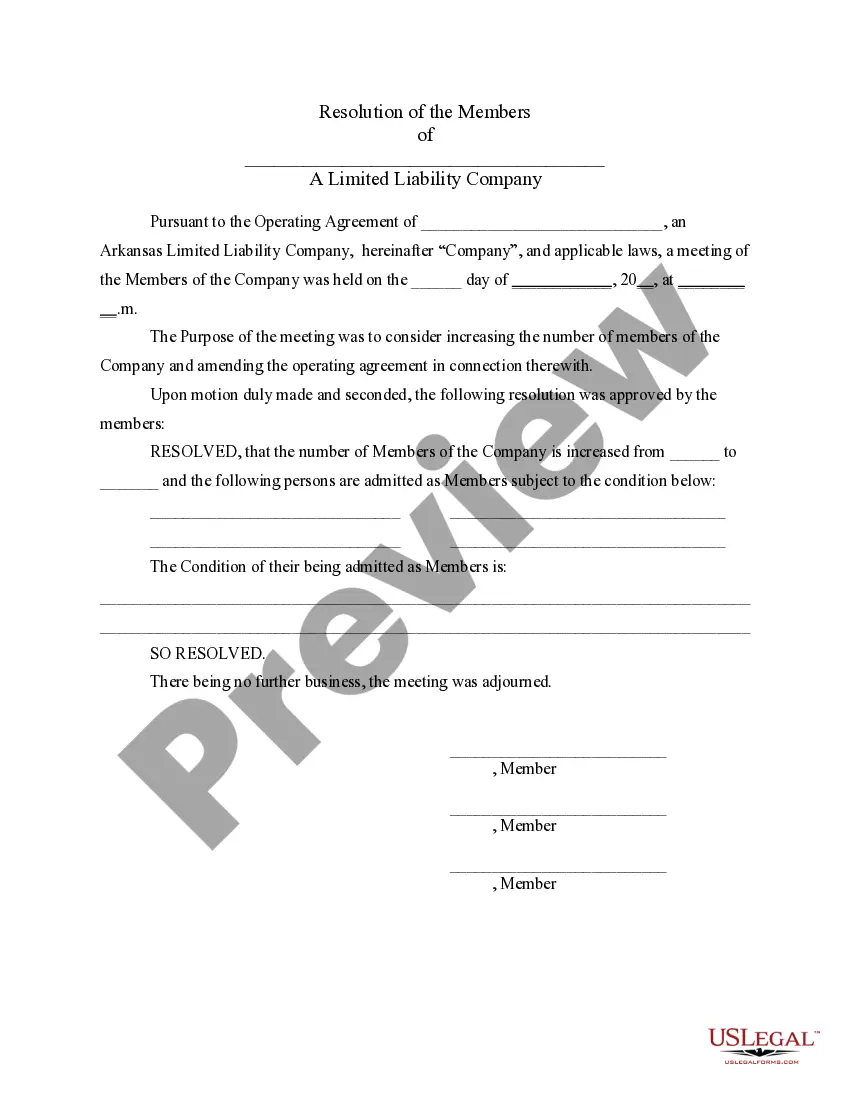

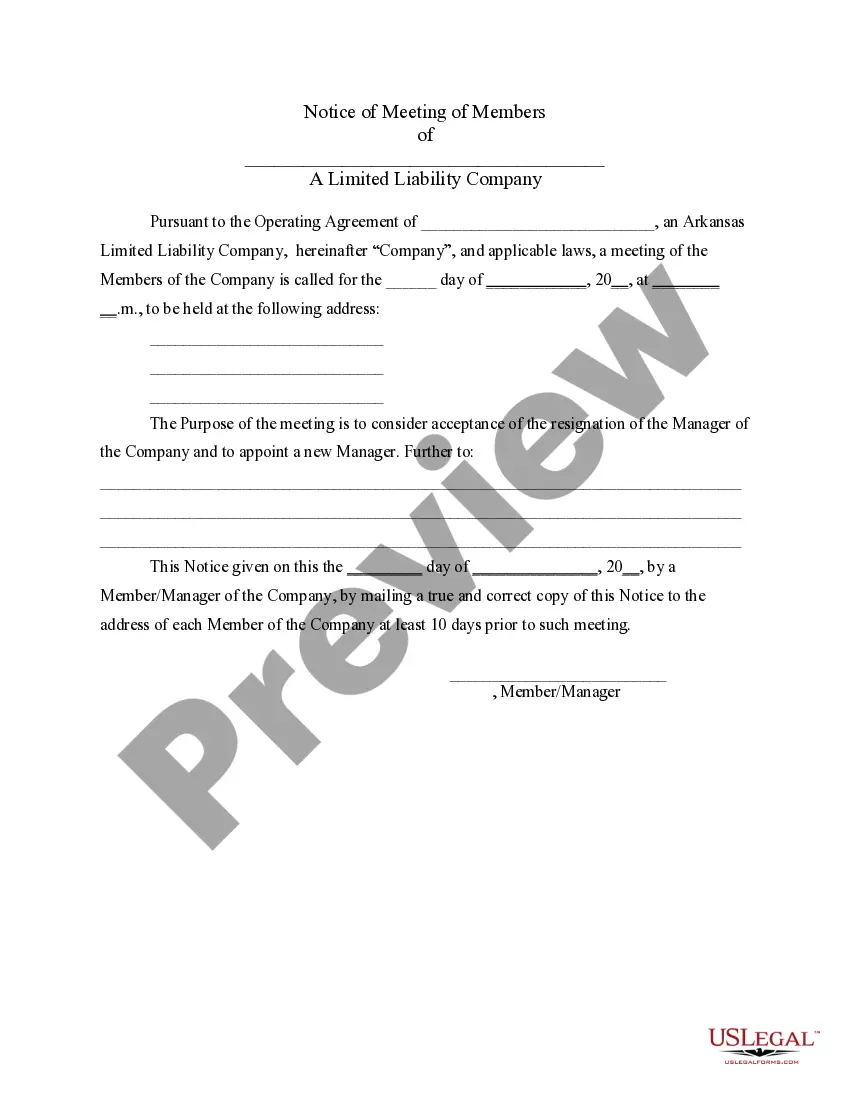

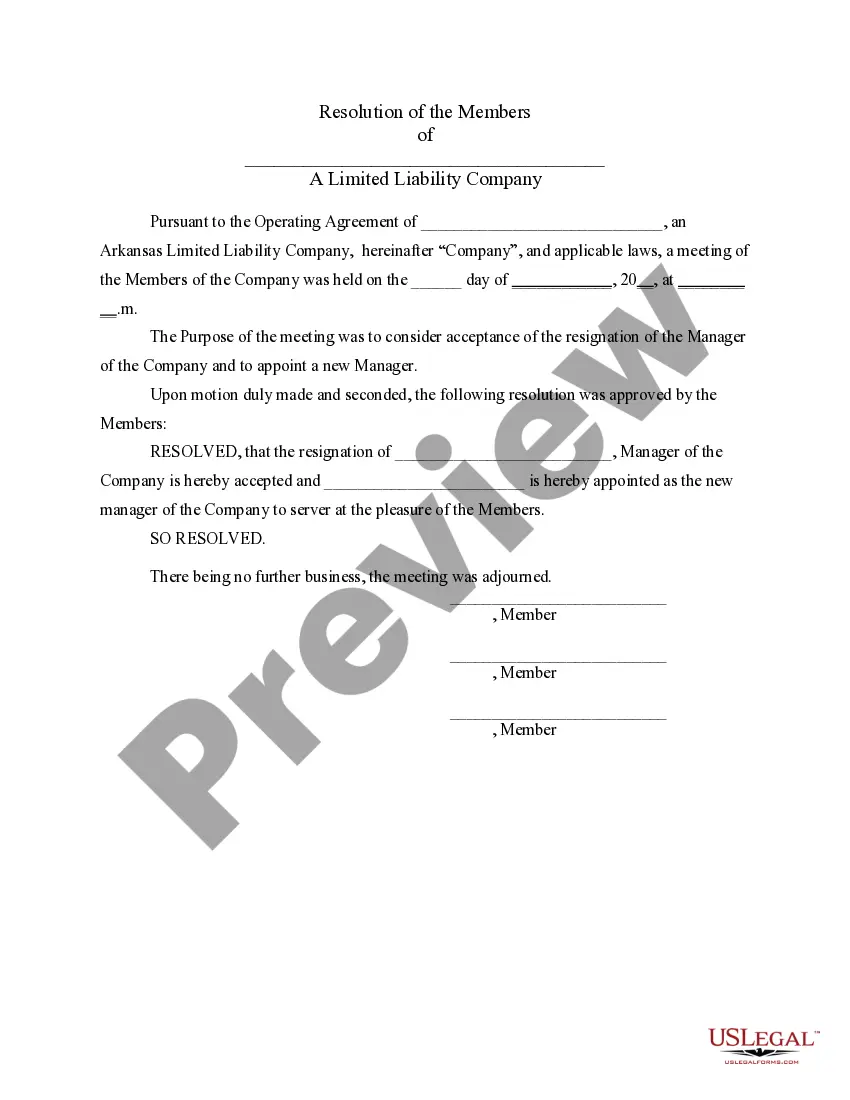

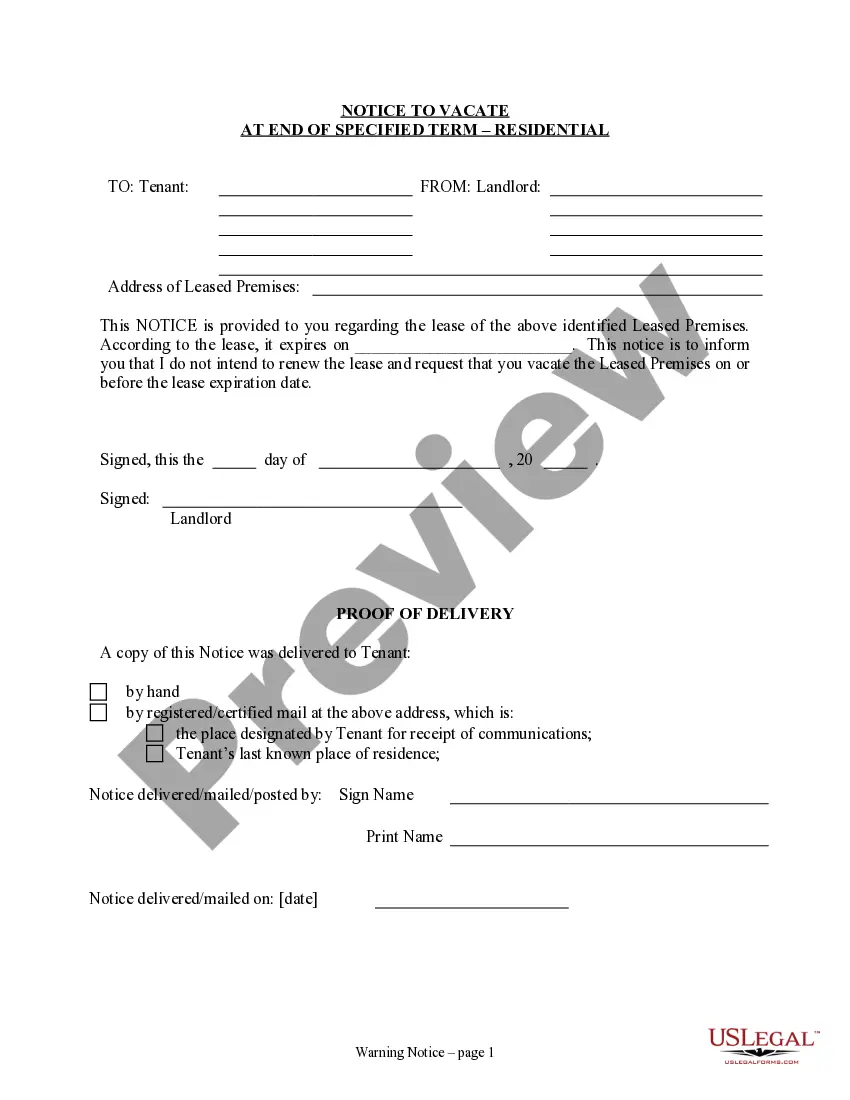

This LLC Notices, Resolutions and other Operations Forms Package contains over 15 forms for use in connection with the operation of a LLC, including the following: (1) Notice of Meeting for General Purpose, (2) Resolution of Meeting for General Purpose, (3) Notice of Meeting to Amend Articles of Organization, (4) Resolution to Amend Articles of Organization, (5) Notice of Meeting to Consider Dissolution, (6) Resolution Regarding Dissolution, (7) Notice to Admit New Members, (8) Resolution Concerning Admitting New Members, (9) Notice of Meeting Concerning Accepting Resignation of Manager, (10) Resolution Accepting Resignation of Manager, (11) Notice of Meeting to Remove Manager, (12) Resolution Concerning Removal of Manager, (13) Notice of Meeting to Consider Disbursements to Members, (14) Resolution Concerning Disbursements, (15) Assignment of Member Interest, (16) Demand for Indemnity by Member/Manager and (17) Application for Tax Identification Number.

Arkansas Limited Liability Company With Shares

Description

How to fill out Arkansas LLC Notices, Resolutions And Other Operations Forms Package?

Whether for business purposes or for individual matters, everyone has to deal with legal situations at some point in their life. Completing legal paperwork requires careful attention, beginning from picking the right form sample. For instance, if you pick a wrong edition of the Arkansas Limited Liability Company With Shares, it will be declined when you send it. It is therefore essential to get a reliable source of legal papers like US Legal Forms.

If you need to get a Arkansas Limited Liability Company With Shares sample, stick to these simple steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Examine the form’s information to make sure it matches your case, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong document, get back to the search function to locate the Arkansas Limited Liability Company With Shares sample you require.

- Get the template if it meets your needs.

- If you already have a US Legal Forms profile, click Log in to gain access to previously saved files in My Forms.

- In the event you don’t have an account yet, you may obtain the form by clicking Buy now.

- Pick the proper pricing option.

- Complete the profile registration form.

- Choose your transaction method: you can use a credit card or PayPal account.

- Pick the document format you want and download the Arkansas Limited Liability Company With Shares.

- When it is saved, you are able to complete the form with the help of editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time looking for the appropriate template across the web. Utilize the library’s straightforward navigation to find the proper template for any situation.

Form popularity

FAQ

LLCs do not have shareholders. They have members who share in the profits of the business. The members' share of the profits is taxable as income. The company itself has no tax liability.

A unit is a record and indication of ownership in a limited liability company (LLC). In that sense, it's like the more familiar terms ?stock? or ?shares? (the two terms are synonymous), each of which indicate ownership in a corporation. Units give their owners certain rights in LLCs.

The IRS rules restrict S corporation ownership, but not that of limited liability companies. IRS restrictions include the following: LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners).

A limited liability company (LLC) is a business entity type that can have more than one owner. These owners are referred to as ?members? and can include individuals, corporations, other LLCs, and foreign entities.

Does an LLC have shares? No. Only businesses structured as a corporation issue shares. With a limited liability company, ownership is expressed by percentage and membership units.