Quitclaim

Description

How to fill out Arkansas Quitclaim Deed From Husband And Wife To LLC?

- Log into your existing US Legal Forms account. If you have never used the service before, create a new account to get started.

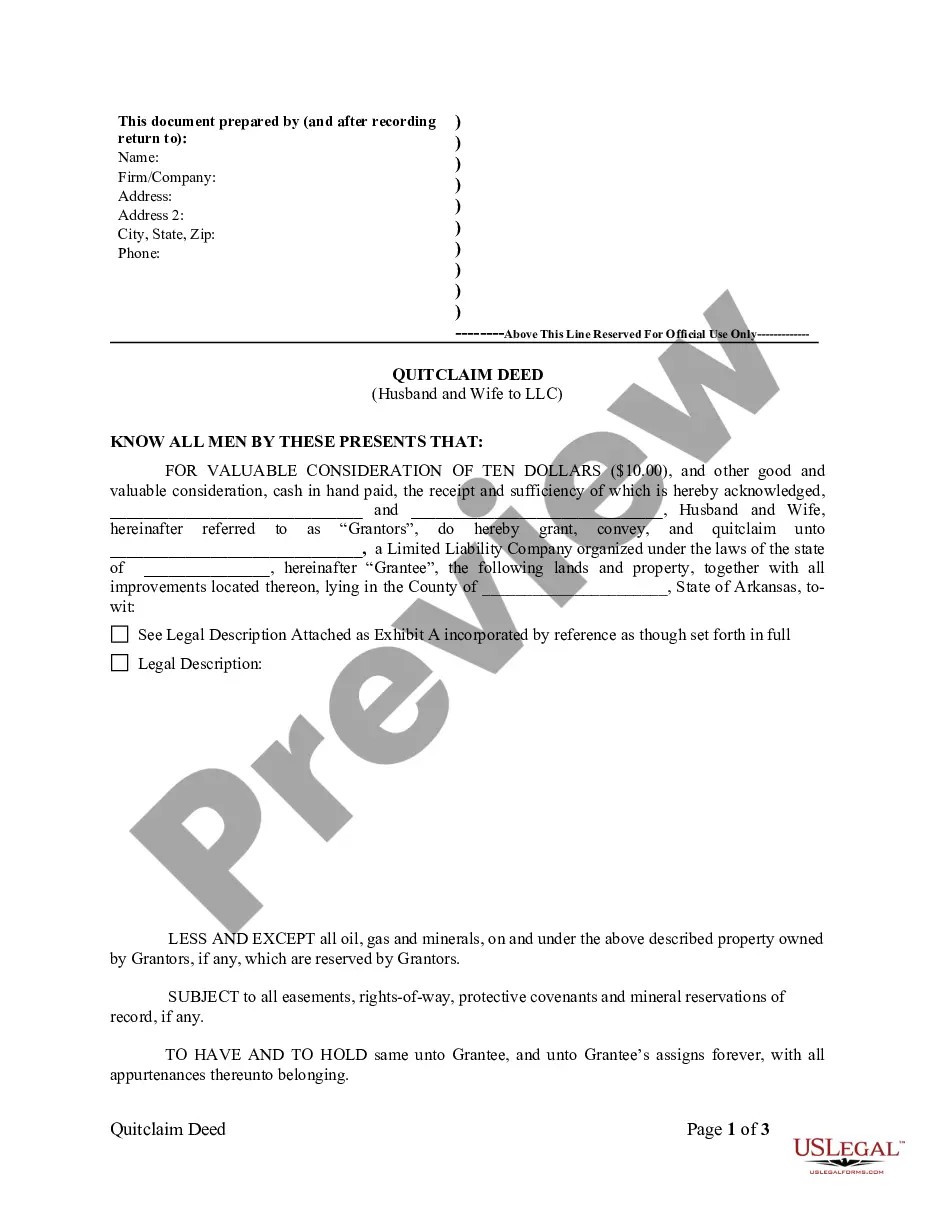

- Explore the extensive library and find the appropriate quitclaim form. Use the Preview mode to review details and ensure it aligns with your local regulations.

- If you encounter any discrepancies, utilize the search function to locate the exact form that meets your requirements.

- Proceed to purchase the form by clicking the Buy Now button. Choose a subscription plan that fits your needs.

- Complete your transaction using a credit card or PayPal to finalize your subscription.

- Immediately download your quitclaim form. It will also be accessible in the My Forms section of your account for future use.

By following these steps, you can effortlessly acquire a quitclaim form tailored to your specific situation. US Legal Forms offers a robust collection of over 85,000 legal documents, ensuring that you can find exactly what you need.

Don’t hesitate—get started today and simplify your legal document management with US Legal Forms!

Form popularity

FAQ

The most common use of a quitclaim deed is for transferring property between family members, such as during an inheritance or when simplifying ownership. This type of deed is often preferred when the parties know each other and trust the property's title status. Additionally, quitclaim deeds are used when clearing up title issues before selling or refinancing a property. For comprehensive solutions, visit US Legal Forms to find resources tailored to your quitclaim needs.

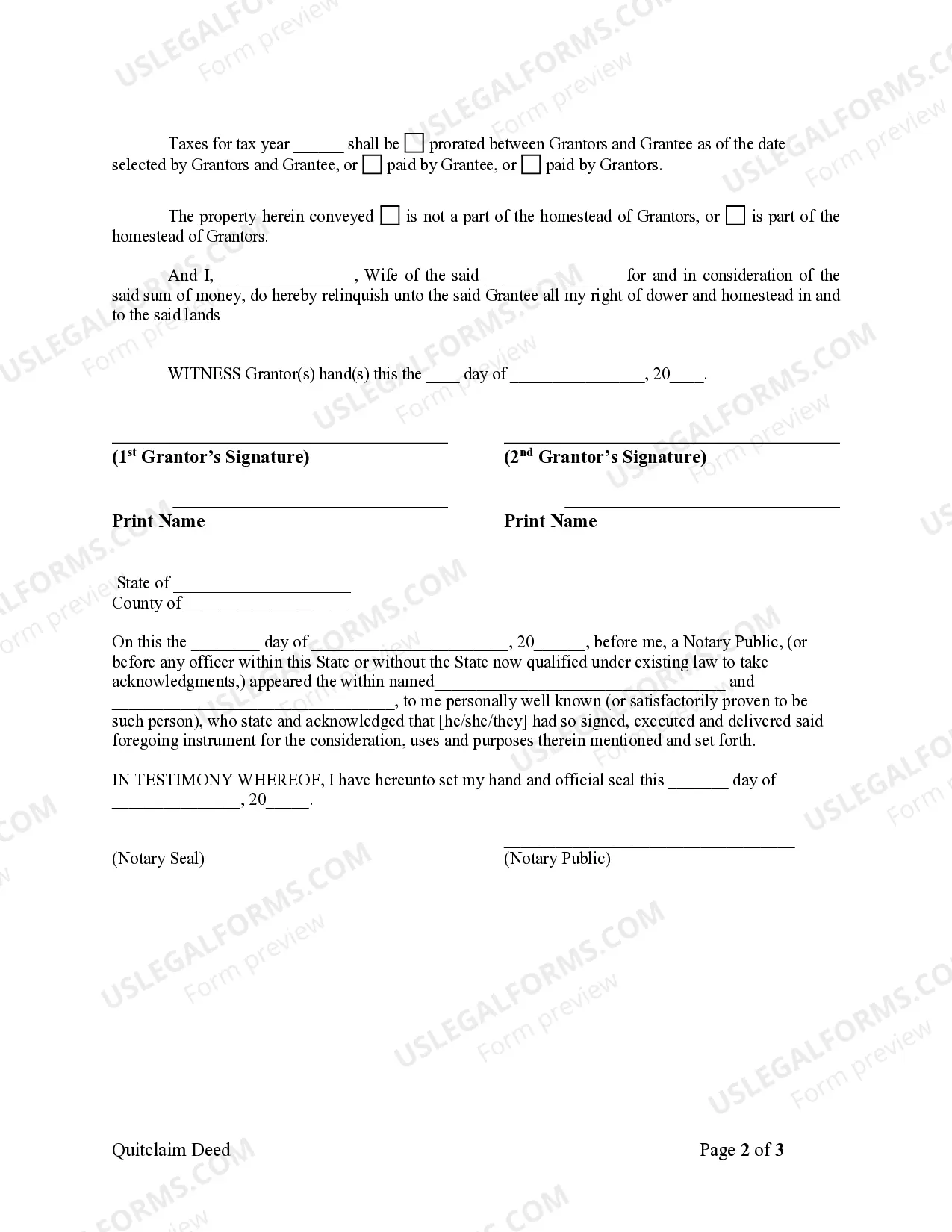

To properly fill out a quitclaim deed, you first need to identify the parties involved, including the grantor, who is the one transferring the property, and the grantee, who is receiving it. Next, describe the property clearly, including its address and any legal descriptions provided in previous deeds. Finally, ensure that the deed is signed by the grantor and notarized to make it legally valid. US Legal Forms offers easy-to-use templates to assist you in completing your quitclaim deed accurately.

A quitclaim deed transfers ownership of property without guaranteeing the title. For instance, if a parent gives their child a house using a quitclaim, the child receives whatever interest the parent has in that property. This is beneficial when the owner wishes to convey their rights quickly and simply. Using US Legal Forms can help you obtain the correct quitclaim form to ensure a smooth transaction.

Yes, you can handle a quitclaim deed without professional help, provided you understand your state's laws. Ensuring that all details are correct is key to a successful deed transfer. If you want to avoid mistakes, consider utilizing US Legal Forms, which offers straightforward templates and instructions to guide you through the process.

Quitclaims are often viewed with caution because they offer no warranties regarding the property's title. This can lead to complications if previous owners had disputes or if there are outstanding debts associated with the property. Many prefer other deed types that provide more security, though quitclaims can still be useful for specific situations like transferring property between family members.

Yes, you can complete a quitclaim deed on your own. However, it's important to ensure you follow your state's specific requirements for the deed. You may need to include accurate property descriptions and have the document notarized. To simplify the process, consider using resources like US Legal Forms, which provide templates and guidance.

The primary purpose of a quitclaim deed is to convey whatever interest or rights the grantor has in the property, without guaranteeing that these rights are valid. This deed serves as a practical tool in situations like gifting property or clearing up title issues, as it simplifies the transfer process. It is important to remember that a quitclaim deed does not protect against future claims, so users should approach this method with a clear understanding of its implications. For reliable assistance in drafting a quitclaim deed, consider using US Legal Forms for guided support.

A quitclaim deed is most commonly used to transfer ownership rights in property without making any promises about the title's status. This means it can quickly convey property to a new owner, making it a popular choice during family transactions or divorce settlements. Users often appreciate this simplicity, as they can utilize quitclaim deeds without the need for extensive legal processes. For those looking to create a quitclaim deed easily, platforms like US Legal Forms provide a straightforward solution.

Individuals in personal relationships, such as family members or friends, typically benefit the most from a quitclaim deed. This deed aids those looking to quickly transfer property rights without the complexities of a traditional sale. It is particularly useful when someone wishes to help a relative or friend secure ownership of a property. For comprehensive information and resources on using quitclaim deeds, check out US Legal Forms for your needs.

While a quitclaim deed is simple, it does come with risks. One major disadvantage is that it does not guarantee that the grantor has clear title to the property, which can lead to legal issues down the road. Additionally, since a quitclaim does not provide warranties, the grantee is left vulnerable to claims from creditors or disputes over ownership. To mitigate these risks, using the resources available on the US Legal Forms platform can provide you with the necessary protections.