Lady Bird Deed For Texas

Description

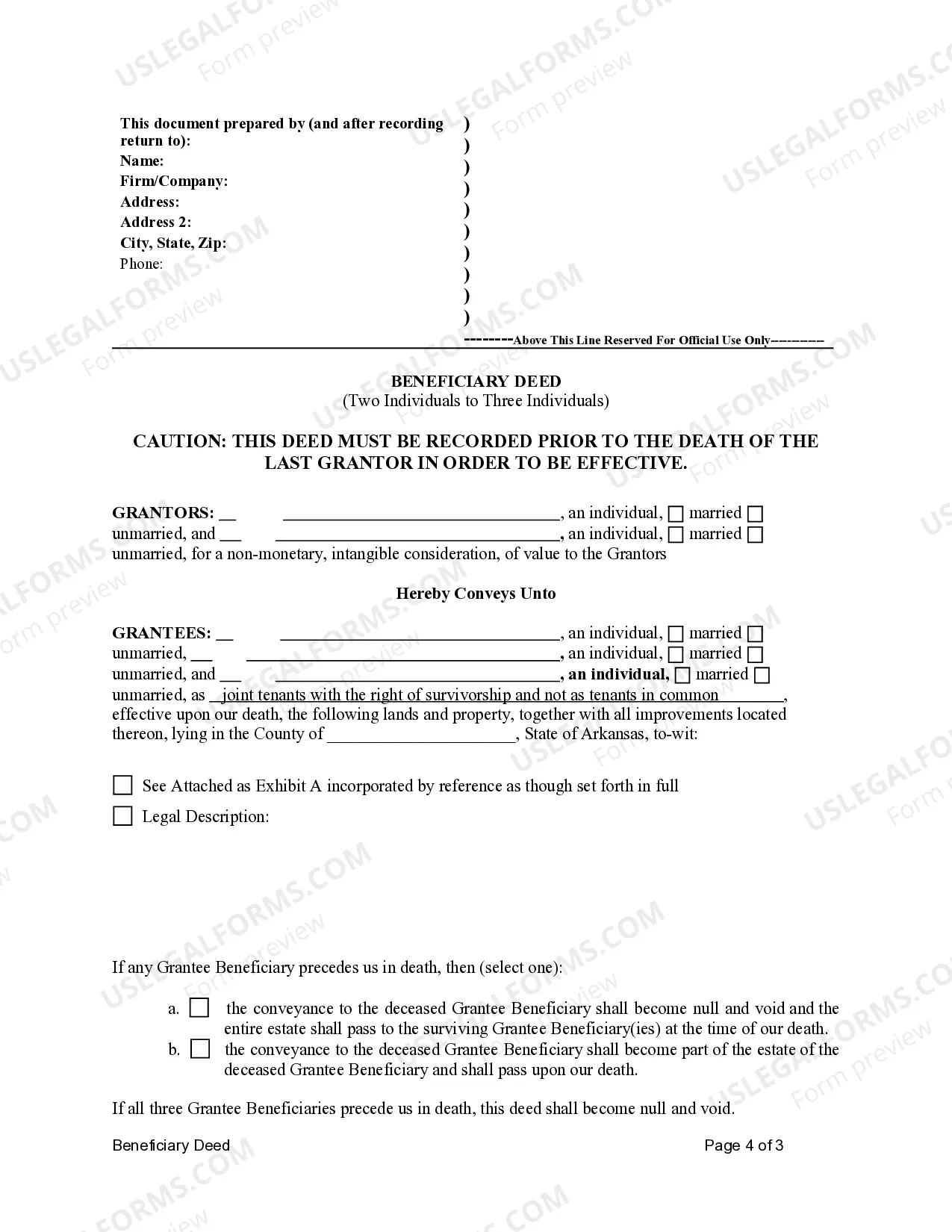

How to fill out Arkansas Beneficiary / Transfer On Death Deed From Two Individuals To Three Individuals?

Whether you handle paperwork frequently or occasionally need to submit a legal document, it is crucial to find a reliable resource where all the samples are interconnected and current.

The first step you must take with a Lady Bird Deed For Texas is to ensure that it is indeed the most recent version, as this determines its submitability.

If you wish to streamline your search for the most up-to-date document examples, look for them on US Legal Forms.

To obtain a form without creating an account, execute the following steps: Utilize the search feature to locate the necessary form. Review the Lady Bird Deed For Texas preview and description to confirm it is the exact document you are looking for. After verifying the form, simply click Buy Now. Choose a subscription plan that suits you. Register an account or Log In to your existing one. Use your credit card information or PayPal account to finalize the purchase. Select the document format for download and confirm your choice. Say goodbye to confusion when handling legal documents. All your templates will be organized and authenticated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that encompasses nearly every document template you may need.

- Search for the forms you need, assess their applicability instantly, and learn more about their usage.

- With US Legal Forms, you gain access to approximately 85,000 document templates across various fields.

- Obtain the Lady Bird Deed For Texas samples in just a few clicks and store them at any time in your account.

- A US Legal Forms account will provide you with all the samples you need with added convenience and reduced hassle.

- Simply click Log In in the site header and navigate to the My documents section where all the forms you require are readily available, eliminating the need to spend time searching for the right template or verifying its authenticity.

Form popularity

FAQ

After your passing, the lady bird deed in Texas directly transfers property ownership to your designated beneficiaries without going through probate. Your beneficiaries should record the death certificate and the original deed with the county clerk’s office to complete the process. This simplifies the transfer of assets and helps your loved ones avoid additional legal hurdles. Using a lady bird deed ensures a smooth transition of property after death.

Yes, you can prepare your own lady bird deed in Texas. However, it is crucial to ensure that the deed complies with Texas state laws. While many resources are available, using a service like USLegalForms can make the process easier by providing templates and guidance. This ensures that your lady bird deed meets all legal requirements and protects your interests.

Writing a gift deed in Texas involves certain steps to ensure it is legally binding. Start by including the names of both the grantor and the grantee, along with a clear description of the property being transferred. You should also state that the transfer is a gift and include any conditions of the gift. For accuracy and to avoid legal complications, consider using USLegalForms to assist you in drafting a compliant document.

The lady bird deed in Texas can provide significant tax advantages. When you transfer your property using a lady bird deed, it typically avoids immediate gift taxes. Additionally, the property maintains its tax basis, which may help your heirs avoid capital gains taxes when they sell it. Overall, using a lady bird deed can be a tax-efficient way to manage your estate.

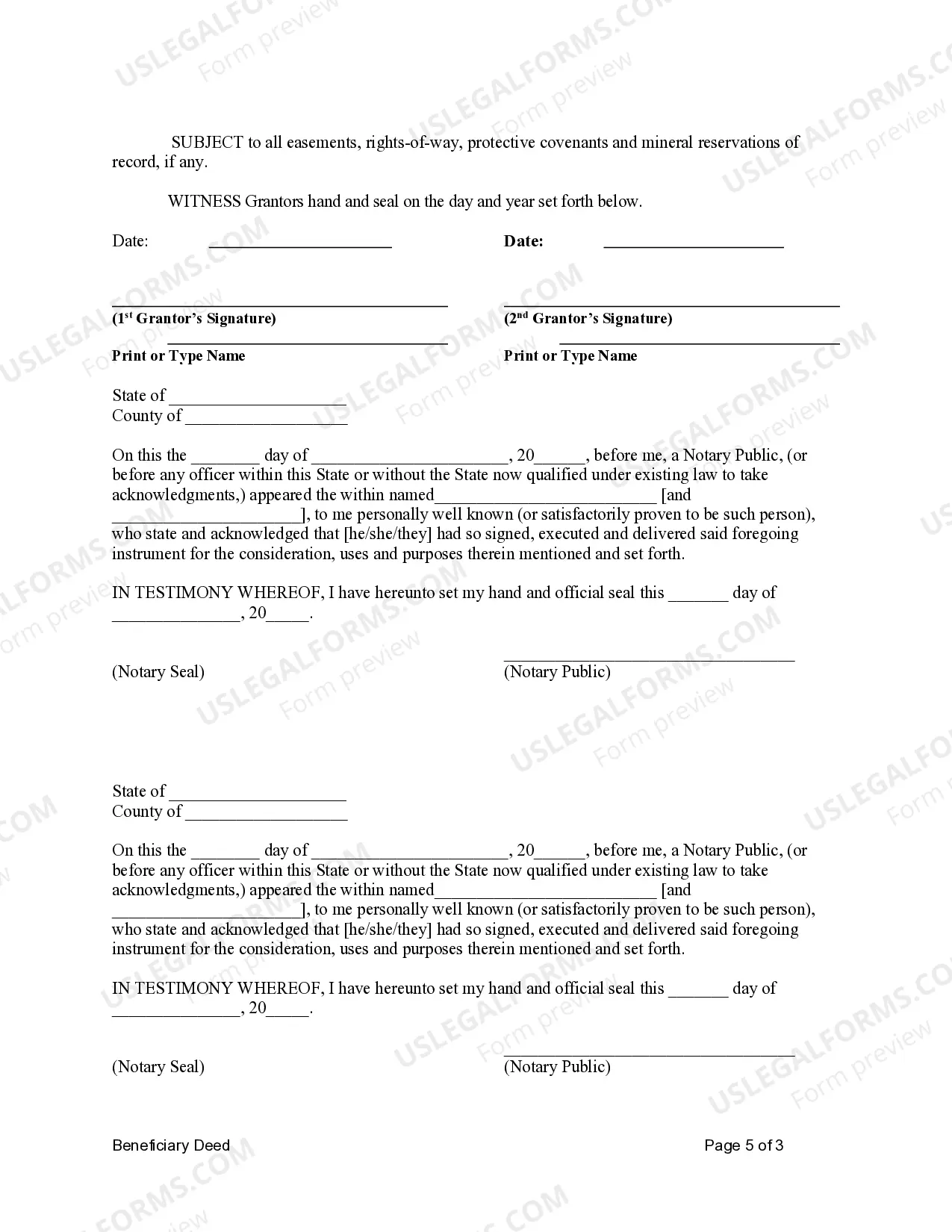

Filing a property deed in Texas involves preparing the deed, signing it in front of a notary, and then submitting it to the local county clerk's office for recording. If you opt for a Lady Bird deed for Texas, you will enjoy additional benefits, such as retaining control while simplifying inheritance. After filing, it's important to obtain a copy of the recorded deed for your records. USLegalForms offers assistance to ensure this process is straightforward and compliant.

To add your wife to your deed in Texas, you will need to prepare a new deed that includes both your names. You can create a Lady Bird deed for Texas to achieve this easily, allowing for a smooth transfer of property rights. Once you draft this deed, you must file it with the county clerk's office. USLegalForms can guide and provide the necessary documents to ensure everything is done properly.

In Texas, anyone can prepare a deed, including individuals, real estate agents, or attorneys. However, for a Lady Bird deed for Texas, it is often wise to consult with a qualified attorney to ensure all legal requirements are met. This way, you can avoid potential issues in the future. Moreover, USLegalForms offers services to assist you in preparing a deed efficiently.

Filing a deed in Texas typically takes a few days to a few weeks, depending on the county and the current workload of the clerk's office. Once you submit your Lady Bird deed for Texas, it will be recorded in the public records. You may want to check with your local clerk for specific timelines. Using USLegalForms can help streamline this process by providing the correct forms and guidance.

A lady bird deed for Texas is often considered one of the best options to avoid probate. It allows property owners to retain control while ensuring a smooth transition to heirs upon death. If you're looking for a practical solution for your estate planning needs, platforms like USLegalForms offer resources to help you create a lady bird deed effortlessly.

While a lady bird deed for Texas offers many advantages, there are disadvantages to consider. One issue is that it may not provide creditor protection for the property during your lifetime. Additionally, heirs must be mindful of potential tax implications when inheriting property through this method.