Release of Lien - Individual

Note: This summary is not intended to be an all inclusive discussion of Arkansas’s construction or mechanic’s lien laws, but does include basic provisions.

What is a construction or mechanic’s lien?

Every State permits a person who supplies labor or materials for a construction project to claim a lien against the improved property. While some states differ in their definition of improvements and some states limit lien claims to buildings or structures, most permit the filing of a document with the local court that puts parties interested in the property on notice that the party asserting the lien has a claim. States differ widely in the method and time within which a party may act on their lien. Also varying widely are the requirements of written notices between property owners, contractors, subcontractors and laborers, and in some cases lending institutions. As a general rule, these statutes serve to prevent unpleasant surprises by compelling parties who wish to assert their legal rights to put all parties who might be interested in the property on notice of a claim or the possibility of a claim. This by no means constitutes a complete discussion of construction lien law and should not be interpreted as such. Parties seeking to know more about construction laws in their State should always consult their State statutes directly.

Who can file a lien in this State?

Arkansas statute permits every contractor, or material supplier, who supplies labor, services, material, fixtures, engines, boilers, or machinery in the construction or repair of an improvement to real estate, by virtue of a contract with the owner, proprietor, contractor, or subcontractor, or agent thereof, to claim a lien against the improvement and up to one (1) acre of land upon which the improvement is situated. A.C.A. § 18-44-101. Arkansas law permits engineers and surveyors to also claim a lien for the contract price or reasonable price for their services towards the improvements of a piece of property. A.C.A. § 18-44-105.

How long does a party have to file a lien?

One hundred and twenty days (120) from the date that labor or materials were furnished. A.C.A. § 18-44-117. The original contractor may file his lien at any time, but other parties must give the property owner ten (10) days notice (see notice below) prior to filing of a lien claim. Accompanying this notice must be a affdavit of notice verifying that the notice required in A.C.A. § 18-44-114 – 116 have also been given. This ten-day provision does not apply if the underlying improvements are part of a direct sale to the property owner. A.C.A. § 18-44-114.

What kind of notice is required prior to filing a lien?

Arkansas statute requires that the form notice found in A.C.A. § 18-44-115 and contained in USlegalform AR-03-09, be served personally or by certified mail on the owner in order to proceed to claiming a lien. A.C.A. § 18-44-115. Arkansas statute also requires that a supplier of labor or materials serve on the property owner and contractor by personal service or registered mail a notice which lists the labor performed, materials provided, names and address of relevant parties, a description of the property, and the amount due. Also required is a notice set out in A.C.A. § 18-44-115(2)(B)(C)(v). This notice must be filed within seventy-five (75) days of the date that material or labor was provided. Any contractor who fails to give this notice shall be guilty of a misdemeanor and shall be punished by a fine not exceeding one thousand dollars ($1,000). A.C.A. § 18-44-115.

By what method is a lien filed in this State?

Arkansas law requires a party wishing to claim a lien to file with the clerk of the circuit court of the county in which the improvements are situated. This filing must be accomplished within one hundred and twenty (120) days of the date labor or materials was provided. The filing itself is described by statute as “a just and true account of the demand due or owing to him after allowing all credits” along with a correct description of the property, verified by affidavit. A.C.A. § 18-44-117.

How long is a lien good for?

In Arkansas, a lien is valid for fifteen (15) months after the date it is filed, unless a suit be filed within that time. A.C.A. § 18-44-119.

Are liens assignable?

Yes. A lien may be assigned to another party as long as the property owner receives notice of the assignment so as to protect himself. A.C.A. § 18-44-113.

Does this State require or provide for a notice from subcontractors and laborers to property owners?

No. Arkansas statutes do not provide for or require subcontractors and laborers to serve a notice of furnishing of labor or materials on the property owner.

Does this State require or provide for a notice from the property owner to the contractor, subcontractor, or laborers?

Arkansas statute allows for the property owner or anyone else with an interest in the property to demand that the contractor or subcontractor provide a list of all parties who provided labor or materials and the amount those parties are due. Also, an interested party can demand certification that the owner has received the required notice under A.C.A. § 18-44-115. Failure to provide this information, or falsifying this information is a misdemeanor under Arkansas law punishable by a fine not to exceed $2,500.00. A.C.A. § 18-44-108.

Does this State require a notice prior to starting work, or after work has been completed?

Yes. Arkansas statutes allow for an individual supplier or laborer to give notice to an owner and contractor that materials and/or labor has been provided and the possibility of a lien exists.

Does this State permit a person with an interest in property to deny responsibility for improvements?

No. Arkansas does not have a provision on this point.

Is a notice attesting to the satisfaction of a lien provided for or required?

Arkansas law requires a lien holder whose lien is satisfied to enter a satisfaction of the lien upon the record or in the margin thereof. Failure to do this within ten days after payment shall make the lein holder liable to any person injured as a result in addition to court costs. A.C.A. § 18-44-131.

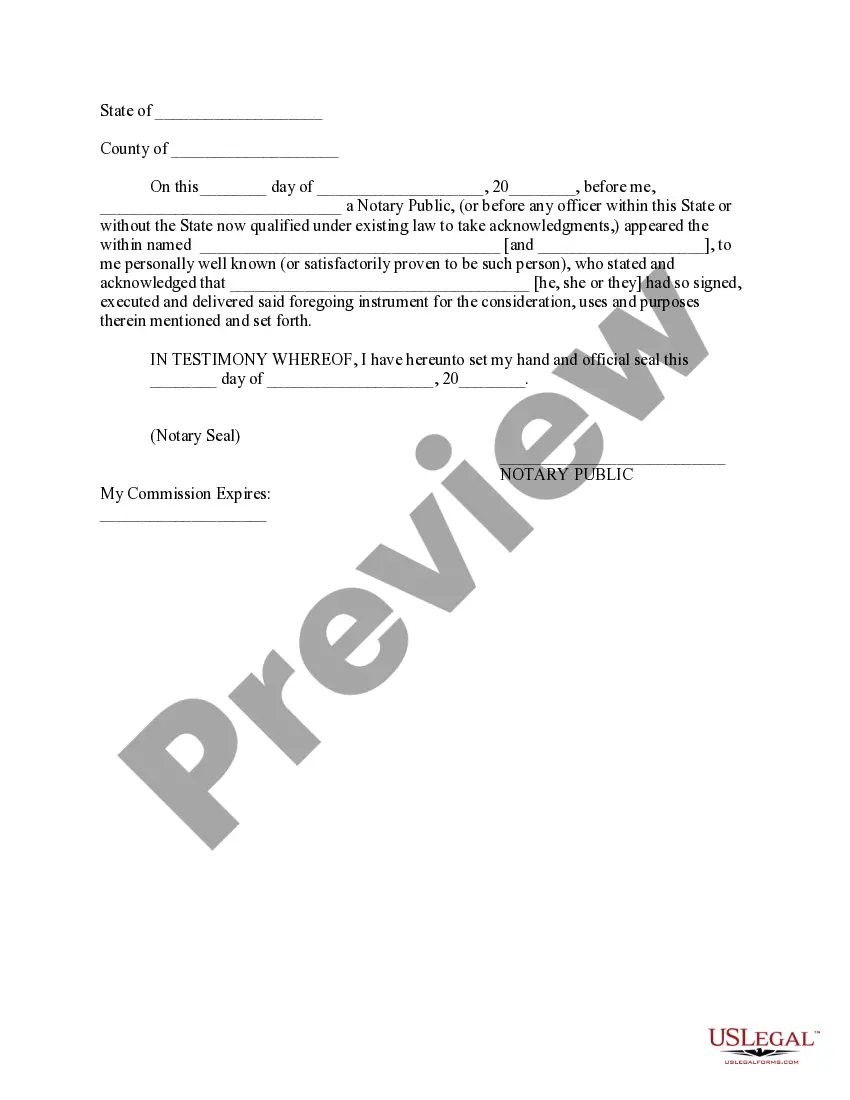

By what method does the law of this State permit the release of a lien?

Arkansas law does not specifically set out the method by which a lien my able released. However, UsLegalForm AR-06-09 is a general release form which may be used for this purpose. Also worth noting, a lien must be paid within twenty (20) days of its filing or the attorney’s fees of the party claiming the lien may be assessed against the property owner. A.C.A. § 18-44-128.

Does this State permit the use of a bond to release a lien?

Yes. Any person with an interest in the property affected by the lien may file with the circuit clerk a bond with surety in double the amount of lien claimed. The clerk is tasked with the job of notifying the lien holder of the bond. If the lien holder does not appear and question the amount of the bond or its sufficiency within three days, or the clerk finds the bond to be sufficient, the clerk shall release the lien. A.C.A. § 18-44-118.

Arkansas Code

Title 18. Property

Subtitle 4. Mortgages and Liens

Chapter 44. Mechanics’ and Materialmen’s Liens

Subchapter 1. General Provisions

Ark. Code 18-44-101 Liens on buildings, land, or boats.

(a) Every contractor, subcontractor, or material supplier as defined in § 18-44-107 who supplies labor, services, material, fixtures, engines, boilers, or machinery in the construction or repair of an improvement to real estate, or any boat or vessel of any kind, by virtue of a contract with the owner, proprietor, contractor, or subcontractor, or agent thereof, upon complying with the provisions of this subchapter, shall have, to secure payment, a lien upon the improvement and on up to one (1) acre of land upon which the improvement is situated, or to the extent of any number of acres of land upon which work has been done or improvements erected or repaired.

(b) If the improvement is to any boat or vessel, then the lien shall be upon the boat or vessel to secure the payment for labor done or materials, fixtures, engines, boilers, or machinery furnished.

Acts 1895, No. 146, § 1, p. 217; C. & M. Dig., § 6906; Acts 1923, No. 563, § 1; Pope’s Dig., § 8865; Acts 1969, No. 112, § 1; A.S.A. 1947, § 51-601; Acts 1995, No. 1298, § 1.

Ark. Code 18-44-102 Entire land subject to lien.

The entire land, to the extent stated in § 18-44-101, upon which any building, erection, or other improvement is situated including that part of the land which is not covered with the building, erection, or other improvement as well as that part of the land which is covered with it, shall be subject to all liens created by this subchapter to the extent, and only to the extent, of all the right, title, and interest owned therein by the owner or proprietor of the building, erection, or other improvement for whose immediate use or benefit the labor was done or things were furnished.

Acts 1895, No. 146, § 2, p. 217; C. & M. Dig., § 6908; Pope’s Dig., § 8867; A.S.A. 1947, § 51-604.

Ark. Code 18-44-103 Improvements on leased land.

(a) Every building or other improvement erected or materials furnished, according to the provisions of this subchapter, on leased lots or lands shall be held for the debt contracted for, or on account of it, and also the leasehold term for the lot and land on which it is erected.

(b) (1) In case the lessee shall have forfeited his or her lease, the purchaser of the building and leasehold term, or so much of it as remains unexpired, under the provisions of this subchapter, shall be held to the assignee of the leasehold term and, as such, shall be entitled to pay to the lessor all arrears of rent or other money, interest, and costs due under the lease, unless the lessor shall have regained possession of the leasehold land, or obtained judgment for the possession of it on account of the noncompliance by the lessee with the terms of the lease, prior to the commencement of the improvements thereon.

(2) In this case the purchaser of the improvements under this subchapter shall have the right only to remove the improvements within sixty (60) days after he or she shall purchase them, and the owner of the ground shall receive the rent due him or her payable out of the proceeds of the sale, according to the terms of the lease, down to the time of removing the building.

Acts 1895, No. 146, § 4, p. 217; C. & M. Dig., § 6910; Pope’s Dig., § 8869; A.S.A. 1947, § 51-606.

Ark. Code 18-44-104 Liens for drain pipe or tile.

(a) Every contractor, subcontractor, or material supplier who shall furnish to any landowner any soil or drain pipe or tile for drainage of his or her land, or who shall put in soil or drain pipe or tile for any land, shall have a lien for each tract of forty (40) acres or less of the real estate upon which the soil or drain pipe or tile is placed for the payment of the lien.

(b) (1) The lien for the soil or drain pipe or tile shall attach to the real estate and all improvements thereon in preference to any subsequent liens, encumbrance, or mortgage executed upon the land after the purchase of the soil or drain pipe or tile.

(2) The lien shall be:

(A) Subject to the notice requirements of §§ 18-44-114 and 18-44-115;

(B) Filed under § 18-44-117; and

(C) Enforced under this subchapter.

Acts 1913, No. 253, §§ 1, 2; C. & M. Dig., § 6924; Pope’s Dig., § 8886; A.S.A. 1947, §§ 51-602, 51-603; Acts 2009, No. 454, § 1.

Ark. Code 18-44-105 Lien of architect, engineer, surveyor, appraiser, landscaper, abstractor, or title insurance agent.

(a) Every architect, engineer, surveyor, appraiser, landscaper, abstractor, or title insurance agent who shall do or perform any architectural, engineering, surveying, appraisal, landscaping, or abstracting services upon any land, or who shall issue a title insurance policy or provide landscaping supplies upon any land, building, erection, or improvement upon land, under or by virtue of any written agreement for the performance of the work with the owner thereof, or his or her agent, shall have a lien upon the land, building, erection, or improvement upon land to the extent of the agreed contract price or a reasonable price for those services.

(b) (1) However, the lien does not attach to the land, building, erection, or improvement upon land unless and until the lien is duly filed of record with the circuit clerk and recorder in the county in which the land, building, erection, or improvement is located.

(2) The lien shall be:

(A) Subject to the notice requirements of §§ 18-44-114 and 18-44-115;

(B) Filed under § 18-44-117; and

(C) Enforced under this subchapter.

Acts 1971, No. 291, § 1; A.S.A. 1947, § 51-642; Acts 2009, No. 454, § 1.

Ark. Code 18-44-106 “Owner” defined.

As used in this subchapter, the “owner” of property shall include the owner of the legal title to property and any person, including all cestui que trust, for whose immediate use, enjoyment, or benefit a building, erection, or other improvement is made.

Acts 1895, No. 146, § 22, p. 217; C. & M. Dig., § 6933; Pope’s Dig., § 8895; A.S.A. 1947, § 51-623; Acts 2009, No. 454, § 1.

Ark. Code 18-44-107 Subcontractors.

As used in this subchapter:

(1) “Contractor” means any person who contracts orally or in writing directly with a person holding an interest in real estate, or such person’s agent, for the construction of any improvement to or repair of real estate;

(2) “Material supplier” means any person who supplies materials, goods, fixtures, or any other tangible item to the contractor or a subcontractor, or an individual having direct contractual privity with such persons;

(3) “Person” includes an individual, a partnership, a corporation, a limited liability organization, a trust, or any other business entity recognized by law; and

(4) “Subcontractor” means any person who supplies labor or services pursuant to a contract with the contractor, or to a person in direct privity of contract with such person.

Acts 1895, No. 146, § 24, p. 217; C. & M. Dig., § 6935; Pope’s Dig., § 8897; A.S.A. 1947, § 51-625; Acts 1995, No. 1298, § 2.

Ark. Code 18-44-108 Refusal to list parties doing work or furnishing materials.

(a) The owner or proprietor, material supplier, subcontractor, or anyone interested as mortgagee or trustee in the real estate upon which improvements are made under this subchapter may apply at any time to the contractor or subcontractor for the following:

(1) A list of all parties doing work or furnishing material for a building and the amount due to each of the parties; and

(2) Certification that the owner or agent has received the preliminary notice specified under § 18-44-115(a), if applicable.

(b) Any contractor or subcontractor who, upon request, refuses or fails within five (5) business days to give a correct list of the parties furnishing material or doing labor on the building and the amount due to each or who falsely certifies that an owner or agent has received the preliminary notice specified under § 18-44-115 shall be:

(1) Guilty of a violation and upon conviction shall be punished by a fine not exceeding two thousand five hundred dollars ($2,500); and

(2) (A) Subject to suit by an aggrieved party in the circuit court where the property is located to enforce subsection (a) of this section including, without limitation, by the contempt powers of the circuit court.

(B) The prevailing party in an action under this subdivision (b)(2) shall receive a judgment for any damages proximately caused by the violation of subsection (b) of this section, the costs of the action, and a reasonable attorney’s fee.

Acts 1895, No. 146, § 10, p. 217; C. & M. Dig., § 6921; Pope’s Dig., § 8880; A.S.A. 1947, § 51-612; Acts 1995, No. 1298, § 3; 2005, No. 1994, § 96; 2009, No. 454, § 2.

Ark. Code 18-44-109 Unlawful to use materials other than as designated.

Any contractor or subcontractor who shall purchase materials on credit and represent at the time of purchase that they are to be used in a designated building or other improvement and shall thereafter use, or cause to be used, the materials in the construction of any building or improvement other than that designated without the written consent of the person from whom the materials were purchased with intent to defraud that person shall be guilty of a violation if the materials were valued at one thousand dollars ($1,000) or more and upon conviction shall be punished by a fine not exceeding two thousand five hundred dollars ($2,500).

Acts 1895, No. 146, § 10, p. 217; C. & M. Dig., § 6921; Pope’s Dig., § 8880; A.S.A. 1947, § 51-612; Acts 1995, No. 1298, § 4; 2005, No. 1994, § 97.

Ark. Code 18-44-110 Preference over prior liens — Exception.

(a) (1) The liens for labor performed or material or fixtures furnished, as provided for in this subchapter, shall have equal priority toward each other without regard to the date of filing the account or lien or the date when the particular labor or material was performed or furnished. All such liens shall date from the time that the construction or repair first commenced.

(2) Construction or repair commences when there is a visible manifestation of activity on real estate that would lead a reasonable person to believe that construction or repair of an improvement to the real estate has begun or will soon begin, including, but not limited to, the following:

(A) Delivery of a significant amount of lumber, bricks, pipe, tile, or other building material to the site;

(B) Grading or excavating the site;

(C) Laying out lines or grade stakes; or

(D) Demolition in an existing structure.

(3) In all cases in which a sale shall be ordered and the property sold, and the proceeds arising from the sale are not sufficient to discharge in full all the liens against the property without reference to the date of filing the account or lien, the proceeds shall be paid pro rata on the respective liens.

(b) (1) (A) The liens for labor performed or materials or fixtures furnished, as provided for in this subchapter, shall attach to the improvement on which the labor was performed or the materials or fixtures were furnished in preference to any encumbrance existing on the real estate prior to the commencement of construction or repair of the improvement.

(B) In all cases in which the prior encumbrance was given for the purpose of funding construction or repair of the improvement, that lien shall have priority over all liens given by this subchapter.

(2) The liens, as provided for in this subchapter, shall be enforced by foreclosure, as further provided for in this subchapter, and the property ordered sold subject to the lien of the prior encumbrance on the real estate.

(c) The lien for labor performed and materials or fixtures furnished, as provided for in this subchapter, shall have priority over all other encumbrances that attach to the real estate or improvements thereon subsequent to commencement of construction or repair.

Acts 1895, No. 146, § 3, p. 217; C. & M. Dig., § 6909; Pope’s Dig., § 8868; A.S.A. 1947, § 51-605; Acts 1995, No. 1298, § 5.

Ark. Code 18-44-111 [Repealed.]

Ark. Code 18-44-112 [Repealed.]

Ark. Code 18-44-113 Assignment of liens.

(a) The lien given in this subchapter shall be transferable and assignable, but it shall not be enforced against the owner of the ground or buildings unless the owner of the ground or buildings shall have actual notice of the assignment or notice under subsection (b) of this section.

(b) The owner of the ground or buildings shall be considered to have actual notice if within thirty (30) days of the assignment a copy of the assignment is:

(1) Hand delivered to the owner of the ground or buildings;

(2) Mailed to the last known address of the owner of the ground or buildings and verified by a:

(A) Return receipt signed by the addressee or the agent of the addressee; or

(B) Returned envelope, postal document, or affidavit by a postal employee reciting or showing refusal of the notice by the addressee or that the item was unclaimed; or

(3) Delivered by any means that provides written, third-party verification of delivery at any place that the owner of the ground or buildings maintains an office, conducts business, or resides.

Acts 1895, No. 146, § 25, p. 217; C. & M. Dig., §§ 6907, 6936; Pope’s Dig., §§ 8866, 8898; A.S.A. 1947, § 51-626; Acts 2009, No. 454, § 3.

Ark. Code 18-44-114 Notice and service generally.

(a) Every person who may wish to avail himself or herself of the benefit of the provisions of this subchapter shall give ten (10) days’ notice before the filing of the lien, as required in § 18-44-117(a), to the owner of a building or improvement that he or she holds a claim against the building or improvement, setting forth the amount and from whom it is due.

(b) (1) The notice may be served by any:

(A) Officer authorized by law to serve process in a civil action;

(B) Person who would be a competent witness;

(C) Form of mail addressed to the person to be served, with a return receipt requested and delivery restricted to the addressee or the agent of the addressee; or

(D) Means that provides written, third-party verification of delivery at any place where the owner of the building or improvement maintains an office, conducts business, or resides.

(2) (A) (i) When served by an officer, his or her official return endorsed on the notice shall be proof of the service.

(ii) When served by any other person, the fact of the service shall be verified by affidavit of the person serving the notice.

(B) (i) When served by mail, the service shall be:

(a) Complete when mailed; and

(b) Verified by a return receipt signed by the addressee or the agent of the addressee, or a returned envelope, postal document, or affidavit by a postal employee reciting or showing refusal of the notice by the addressee or that the item was unclaimed.

(ii) If delivery of the mailed notice is refused by the addressee or the item is unclaimed:

(a) The lien claimant shall immediately send the owner of the building or improvement a copy of the notice by first class mail and may proceed to file his or her lien; and

(b) The unopened original of the item marked unclaimed or refused by the United States Postal Service shall be accepted as proof of service as of the postmarked date of the item.

Acts 1895, No. 146, § 6, p. 217; C. & M. Dig., § 6917; Pope’s Dig., § 8876; A.S.A. 1947, § 51-608; Acts 1991, No. 588, § 1; 1999, No. 1466, § 1; 2005, No. 2287, § 5; 2009, No. 454, § 3.

Ark. Code 18-44-115 Notice to owner by contractor.

(a) (1) No lien upon residential real estate containing four (4) or fewer units may be acquired by virtue of this subchapter unless the owner of the residential real estate, the owner’s authorized agent, or the owner’s registered agent has received, by personal delivery or by certified mail, a copy of the notice set out in this subsection.

(2) The notice required by this subsection shall not require the signature of the owner of the residential real estate, the owner’s authorized agent, or the owner’s registered agent in an instance when the notice is delivered by certified mail.

(3) It shall be the duty of the residential contractor to give the owner, the owner’s authorized agent, or the owner’s registered agent the notice set out in this subsection on behalf of all potential lien claimants before the commencement of work.

(4) If a residential contractor fails to give the notice required under this subsection, then the residential contractor is barred from bringing an action either at law or in equity, including without limitation quantum meruit, to enforce any provision of a residential contract.

(5) (A) Any potential lien claimant may also give notice.

(B) (i) If before commencing work or supplying goods a subcontractor, material supplier, laborer, or other lien claimant gives notice under this section, the notice shall be effective for all subcontractors, material suppliers, laborers, and other lien claimants not withstanding that the notice was given after the project commences as defined under § 18-44-110(a)(2).

(ii) If the notice relied upon by a lien claimant to establish a lien under this subchapter is given by another lien claimant under subdivision (a)(5)(B)(i) of this section after the project commences, the lien of the lien claimant shall secure only the labor, material, and services supplied after the effective date of the notice under subdivision (a)(5)(B)(i) of this section.

(C) However, no lien may be claimed by any subcontractor, laborer, material supplier, or other lien claimant unless the owner of the residential real estate, the owner’s authorized agent, or the owner’s registered agent has received at least one (1) copy of the notice, which need not have been given by the particular lien claimant.

(6) A residential contractor who fails to give the notice required by this subsection is guilty of a violation pursuant to § 5-1-108 and upon pleading guilty or nolo contendere to or being found guilty of failing to give the notice required by this subsection shall be punished by a fine not exceeding one thousand dollars ($1,000).

(7) The notice set forth in this subsection may be incorporated into the contract or affixed to the contract and shall be conspicuous, set out in boldface type, worded exactly as stated in all capital letters, and shall read as follows:

“IMPORTANT NOTICE TO OWNER

(8) (A) If the residential contractor supplies a performance and payment bond or if the transaction is a direct sale to the property owner, the notice requirement of this subsection shall not apply, and the lien rights arising under this subchapter shall not be conditioned on the delivery and execution of the notice.

(B) A sale shall be a direct sale only if the owner orders materials or services from the lien claimant.

(b) (1) (A) The General Assembly finds that owners and developers of commercial real estate are generally knowledgeable and sophisticated in construction law, are aware that unpaid laborers, subcontractors, and material suppliers are entitled to assert liens against the real estate if unpaid, and know how to protect themselves against the imposition of mechanics’ and material suppliers’ liens.

(B) The General Assembly further finds that consumers who construct or improve residential real estate containing four (4) or fewer units generally do not possess the same level of knowledge and awareness and need to be informed of their rights and responsibilities.

(2) As used in this subsection:

(A) “Commercial real estate” means:

(i) Nonresidential real estate; and

(ii) Residential real estate containing five (5) or more units; and

(B) “Service provider” means an architect, an engineer, a surveyor, an appraiser, a landscaper, an abstractor, or a title insurance agent.

(3) Because supplying the notice specified in subsection (a) of this section imposes a substantial burden on laborers, subcontractors, service providers, and material suppliers, the notice requirement mandated under subsection (a) of this section as a condition precedent to the imposition of a lien by a laborer, subcontractor, service provider, or material supplier shall apply only to construction of or improvement to residential real estate containing four (4) or fewer units.

(4) No subcontractor, service provider, material supplier, or laborer shall be entitled to a lien upon commercial real estate unless the subcontractor, service provider, material supplier, or laborer notifies the owner of the commercial real estate being constructed or improved, the owner’s authorized agent, or the owner’s registered agent in writing that the subcontractor, service provider, material supplier, or laborer is currently entitled to payment but has not been paid.

(5) (A) The notice shall be sent to the owner, the owner’s authorized agent, or the owner’s registered agent and to the contractor before seventy-five (75) days have elapsed from the time that the labor was supplied or the materials furnished.

(B) The notice may be served by any:

(i) Officer authorized by law to serve process in civil actions;

(ii) Form of mail addressed to the person to be served with a return receipt requested and delivery restricted to the addressee or the agent of the addressee; or

(iii) Means that provides written, third-party verification of delivery at any place where the owner, the owner’s registered agent, or the owner’s authorized agent maintains an office, conducts business, or resides.

(C) When served by mail, the notice shall be complete when mailed.

(D) If delivery of the mailed notice is refused by the addressee or the item is unclaimed:

(i) The lien claimant shall immediately send the owner, the owner’s authorized agent, or the owner’s registered agent a copy of the notice by first class mail; and

(ii) The unopened original of the item marked unclaimed or refused by the United States Postal Service shall be accepted as proof of service as of the postmarked date of the item.

(6) The notice shall contain the following information:

(A) A general description of the labor, service, or materials furnished, and the amount due and unpaid;

(B) The name and address of the person furnishing the labor, service, or materials;

(C) The name of the person who contracted for purchase of the labor, service, or materials;

(D) A description of the job site sufficient for identification; and

(E) The following statement set out in boldface type and all capital letters:

“NOTICE TO PROPERTY OWNER

Acts 1979, No. 746, §§ 1-5; 1981, No. 669, § 1; 1983, No. 304, § 1; A.S.A. 1947, §§ 51-608.1 — 51-608.6; Acts 1995, No. 1298, § 7; 2005, No. 1994, § 98; 2005, No. 2287, § 3; 2009, No. 454, § 3; 2011, No. 271, § 5.

Ark. Code 18-44-116 Service on nonresident or absconder.

(a) (1) Whenever property is sought to be charged with a lien under this subchapter, the notice may be filed with the recorder of deeds of the county in which the property is situated if the owner of the property so sought to be charged:

(A) Is not a resident of this state;

(B) Does not have an agent in the county in which the property is situated;

(C) Is a resident of this state but not of the county in which the property is situated; or

(D) Conceals himself or herself, has absconded, or absents himself or herself from his or her usual place of abode, so that the notice required by § 18-44-114 or § 18-44-115 cannot be served upon him or her.

(2) When filed, the notice shall have like effect as if served upon the owner or his or her agent in the manner contemplated in § 18-44-114 or § 18-44-115.

(b) A copy of the notice so filed, together with the certificate of the recorder of deeds that it is a correct copy of the notice so filed, shall be received in all courts of this state as evidence of the service, as provided in this section, of the notice.

(c) (1) The recorder of deeds in each county of this state shall receive, file, and keep every such notice presented to him or her for filing and shall further record it at length in a separate book appropriately entitled.

(2) For service so performed, the recorder of deeds shall receive for each notice, the sum of twenty-five cents (25cent(s)), and for each copy certified, as stated in this section, of each of the notices he or she shall receive the sum of fifty cents (50cent(s)), to be paid by the party so filing or procuring the certified copy, as the case may be.

(d) The costs of filing and of one (1) certified copy shall be taxed as costs in any lien suit to which it pertains to abide the result of the suit.

Acts 1895, No. 146, § 7, p. 217; C. & M. Dig., § 6918; Pope’s Dig., § 8877; A.S.A. 1947, § 51-609; Acts 2009, No. 454, § 3.

Ark. Code 18-44-117 Filing of lien.

(a) (1) It shall be the duty of every person who wishes to avail himself or herself of the provisions of this subchapter to file with the clerk of the circuit court of the county in which the building, erection, or other improvement to be charged with the lien is situated and within one hundred twenty (120) days after the things specified in this subchapter shall have been furnished or the work or labor done or performed:

(A) A just and true account of the demand due or owing to him or her after allowing all credits; and

(B) An affidavit of notice attached to the lien account.

(2) The lien account shall contain a correct description of the property to be charged with the lien, verified by affidavit.

(3) The affidavit of notice shall contain:

(A) A sworn statement evidencing compliance with the applicable notice provisions of §§ 18-44-114 — 18-44-116; and

(B) A copy of each applicable notice given under §§ 18-44-114 — 18-44-116.

(b) (1) (A) It shall be the duty of the clerk of the circuit court to endorse upon every account the date of its filing and to make an abstract of the account in a book kept by him or her for that purpose, properly indexed.

(B) This abstract shall contain:

(i) The date of the filing;

(ii) The name of the person laying or imposing the lien;

(iii) The amount of the lien;

(iv) The name of the person against whose property the lien is filed; and

(v) A description of the property to be charged with the lien.

(2) For this service, the clerk shall receive the sum of three dollars ($3.00) from the person laying or imposing the lien, which shall be taxed and collected as other costs in case there is suit on the lien.

(3) The clerk shall refuse to file a lien account that does not contain the affidavits and attachments required by this section.

Acts 1895, No. 146, §§ 11, 12, p. 217; C. & M. Dig., §§ 6922, 6923; Pope’s Dig., §§ 8881, 8882; Acts 1945, No. 55, § 2; 1961, No. 239, § 1; 1963, No. 124, § 1; 1977, No. 333, § 3; A.S.A. 1947, §§ 12-1720, 51-613, 51-614; Acts 2005, No. 2287, § 1; 2007, No. 810, § 1; 2009, No. 454, § 3.

Ark. Code 18-44-118 Filing of bond in contest of lien.

(a) (1) In the event any person claiming a lien for labor or materials upon any property shall file such a lien within the time and in the manner required by law with the circuit clerk or other officer provided by law for the filing of such a lien, and if the owner of the property, any mortgagee or other person having an interest in the property, or any contractor, subcontractor, or other person liable for the payment of such a lien shall desire to contest the lien, then the person so desiring to contest the lien may file:

(A) With the circuit clerk or other officer with whom the lien is filed as required by law a bond with surety, to be approved by the officer in the amount of the lien claimed; or

(B) An action under subsection (f) of this section to protest the filing of the lien.

(2) The bond shall be conditioned for the payment of the amount of the lien, or so much of the lien as may be established by suit, together with interest and the costs of the action, if upon trial it shall be found that the property was subject to the lien.

(b) (1) (A) Upon the filing of the bond, if the circuit clerk or other officer before whom it is filed approves the surety, he or she shall give to the person claiming the lien, at his or her last known address, three (3) days’ notice of the filing of the bond.

(B) The notice shall be in writing and served by any:

(i) Officer authorized by law to serve process in a civil action; or

(ii) Form of mail addressed to the person to be served with a return receipt requested and delivery restricted to the addressee or the agent of the addressee.

(2) (A) Within the three (3) days’ notice, the person claiming the lien may appear and question the sufficiency of the surety or form of the bond.

(B) At the expiration of three (3) days, if the person claiming the lien shall not have questioned the sufficiency of the bond or surety or if the circuit clerk finds the bond to be sufficient, the circuit clerk shall note the filing of the bond upon the margin of the lien record and the lien shall then be discharged and the claimant shall have recourse only against the principal and surety upon the bond.

(c) (1) If no action to enforce the lien shall be filed within the time prescribed by law for the enforcement of a lien against the surety, the bond shall be null and void.

(2) However, if any action shall be timely commenced, the surety shall be liable in like manner as the principal.

(d) If the circuit clerk shall determine that the bond tendered is insufficient, the person tendering the bond shall have twenty-four (24) hours within which to tender a sufficient bond, and unless a sufficient bond shall be so tendered, the lien shall remain in full force and effect.

(e) (1) Any party aggrieved by the acceptance or rejection of the bond may apply to any court of competent jurisdiction by an action which is appropriate.

(2) Upon notice as required by law, the court shall have jurisdiction to enter an interlocutory order as may be necessary for the protection of the parties by:

(A) Requiring additional security for the bond;

(B) Reinstating the lien in default of the bond, pending trial and hearing; or

(C) Requiring acceptance of the bond as may be necessary for the protection of the parties.

(f) (1) A protest under subdivision (a)(1)(B) of this section shall be filed as a civil action in the circuit court of the county where the lien is filed.

(2) The issues in the action shall be limited to whether:

(A) The lien was filed in the form required by § 18-44-117; and

(B) All of the applicable requirements of §§ 18-44-114 and 18-44-115 were satisfied.

(3) (A) The summons shall be in customary form directed to the sheriff of the county in which the action is filed, with directions for service of the summons on the named defendants. In addition, the clerk of the circuit court shall issue and direct the sheriff to serve upon the named defendants a notice in the following form:

“NOTICE OF INTENTION TO DISCHARGE LIEN

(B) If within five (5) days, excluding Sundays and legal holidays, following service of the summons, complaint, and notice the defendant or defendants have not filed a written objection to the claim of the plaintiff, the court shall immediately issue an order discharging the lien upon the property described in the complaint.

(C) If a written objection to the claim of the plaintiff is filed by the defendant or defendants within five (5) days from the date of service of the notice, summons, and complaint, the plaintiff shall obtain a date for the hearing of the plaintiff’s complaint and shall give notice of the date, time, and place of the hearing to all defendants.

(4) (A) The action shall be heard as expeditiously as the business of the circuit court permits.

(B) Evidence may be presented by affidavit, subject to Rule 56(e),(f), and (g) of the Arkansas Rules of Civil Procedure.

(5) If the circuit court finds that the lien was not in the form required by § 18-44-117 or that the applicable requirements of §§ 18-44-114 and 18-44-115 were not satisfied, then the circuit court shall enter an order discharging the lien.

(6) The prevailing party shall be entitled to a reasonable attorney’s fee and the costs of the protest.

(g) Nothing in this section shall be construed to limit the right of an owner, mortgagee, or any other person with an interest in the property to contest the lien by declaratory judgment proceedings under § 16-111-101 et seq.

Acts 1963, No. 66, § 2; A.S.A. 1947, § 51-641; Acts 2005, No. 2287, § 2; 2009, No. 454, § 3.

Ark. Code 18-44-119 Limitation of actions.

(a) All actions under this subchapter shall be commenced within fifteen (15) months after filing the lien and prosecuted without unnecessary delay to final judgment.

(b) No lien shall continue to exist by virtue of the provisions of this subchapter for more than fifteen (15) months after the lien is filed, unless within that time:

(1) An action shall be instituted as described in this subchapter; and

(2) A lis pendens is filed under § 16-59-101 et seq.

Acts 1895, No. 146, § 15, p. 217; 1899, No. 182, § 1, p. 322; C. & M. Dig., § 6926; Pope’s Dig., § 8888; A.S.A. 1947, § 51-616; Acts 2005, No. 2287, § 4.

Ark. Code 18-44-120 [Repealed.]

Ark. Code 18-44-121 [Repealed.]

Ark. Code 18-44-122 Contents of complaint.

The complaint, among other things, shall allege the facts necessary for securing a lien under this subchapter and shall contain a description of the property to be charged with the lien.

Acts 1895, No. 146, § 13, p. 217; C. & M. Dig., § 6927; Pope’s Dig., § 8889; A.S.A. 1947, § 51-617; Acts 2009, No. 454, § 4.

Ark. Code 18-44-123 Parties to suits.

In all suits under this subchapter, the parties to the contract and all other persons interested in the controversy and in the property charged with the lien may be made parties to the suit. Those that are not made parties shall not be bound by the proceedings.

Acts 1895, No. 146, § 19, p. 217; C. & M. Dig., § 6928; Pope’s Dig., § 8890; A.S.A. 1947, § 51-618.

Ark. Code 18-44-124 Contractor to defend actions on liens by third persons — Liability.

(a) In all cases in which a lien shall be filed under the provisions of this subchapter by any person other than a contractor, it shall be the duty of the contractor to defend at his or her own expense any action brought thereupon. During the pendency of the action, the owner may withhold from the contractor the amount of money for which the lien shall be filed.

(b) (1) In case of judgment against the owner or his or her property upon the lien, the owner shall be entitled to deduct from any amount due by him or her to the contractor the amount of the judgment and costs.

(2) If the owner shall have settled with the contractor in full, he or she shall be entitled to recover back from the contractor any amount so paid by the owner for which the contractor was originally liable.

Acts 1895, No. 146, § 8, p. 217; C. & M. Dig., § 6919; Pope’s Dig., § 8878; A.S.A. 1947, § 51-610.

Ark. Code 18-44-125 Court orders.

The court shall make orders in the case as will protect and enforce the rights of all interested therein.

Acts 1895, No. 146, § 20, p. 217; C. & M. Dig., § 6930; Pope’s Dig., § 8892; A.S.A. 1947, § 51-620.

Ark. Code 18-44-126 Warning order for nonresident or absconding owners.

Whenever the owner of an erection or improvement, or of land on which an erection or improvement is put, or the owner of any boat or vessel, is a nonresident of the state or resides out of the county in which the erection or other improvement is put, as provided by this subchapter, or when the owner so conceals himself or herself that personal service of summons cannot be had on him or her, then the mechanic, builder, artisan, workman, laborer, or other persons entitled to a lien under this subchapter, upon instituting suit, may cause a warning order to issue and be published as may be prescribed by law for the issuance of warning orders in proceedings under attachment. Such service shall be binding and of full force and effect.

Acts 1895, No. 146, § 16, p. 217; C. & M. Dig., § 6929; Pope’s Dig., § 8891; A.S.A. 1947, § 51-619.

Ark. Code 18-44-127 Trial and judgment.

(a) The court shall ascertain by a fair trial, in the usual way, the amount of the indebtedness for which the lien is prosecuted and may render judgment therefor in any sum not exceeding the amount claimed in the demand filed with the lien, together with interest and costs, although the creditor may have unintentionally failed to render in his or her account when filed the full amount of credits to which the debtor may have been entitled.

(b) The judgment if for the plaintiff shall be that he or she recover the amount of the indebtedness found due, to be levied out of the property charged with the lien therefor, and the property charged shall be correctly described in the judgment.

Acts 1895, No. 146, § 14, p. 217; C. & M. Dig., § 6931; Pope’s Dig., § 8893; A.S.A. 1947, § 51-621.

Ark. Code 18-44-128 Attorney’s fee.

(a) When any contractor, subcontractor, laborer, or material supplier who has filed a lien, as provided for in this chapter, gives notice thereof to the owner of property by any method permitted under § 18-44-115(b)(5) and the claim has not been paid within twenty (20) days from the date of service of the notice, and if the contractor, subcontractor, laborer, or material supplier is required to sue for the enforcement of his or her claim, the court shall allow the successful contractor, subcontractor, laborer, or material supplier a reasonable attorney’s fee in addition to other relief to which he or she may be entitled.

(b) If the owner is the prevailing party in the action, the court shall allow the owner a reasonable attorney’s fee in addition to any other relief to which the owner may be entitled.

Acts 1961, No. 240, § 1; A.S.A. 1947, § 51-639; Acts 1995, No. 1298, § 9; 2009, No. 454, § 5.

Ark. Code 18-44-129 [Repealed.]

Ark. Code 18-44-130 [Repealed.]

Ark. Code 18-44-131 Duty to enter satisfaction.

(a) Whenever any indebtedness which is a lien on any real estate, erection, building, or other improvement is paid and satisfied, it shall be the duty of the creditor to enter satisfaction of the lien upon the record or margin thereof in the office of the clerk of the circuit court.

(b) Any creditor refusing or neglecting to do so for ten (10) days after payment shall be liable to any person injured to the amount of injury and for cost of suit.

Acts 1895, No. 146, § 23, p. 217; C. & M. Dig., § 6934; Pope’s Dig., § 8896; A.S.A. 1947, § 51-624.

Ark. Code 18-44-132 Penalty for failure to discharge lien after payment.

(a) It shall be unlawful for any contractor, subcontractor, or other person who has performed work or furnished materials for the improvement of any property when the work or materials may give rise to a mechanic’s, laborer’s, or materialman’s lien under the laws of this state, this subchapter, §§ 18-44-201 — 18-44-210, and 18-44-301 — 18-44-305, or any other statute providing for a mechanic’s, laborer’s, or materialman’s lien, or the assignee of such person, knowingly to receive payment of the contract price or any portion of it without applying the money so received toward the discharge of any liens known to the person receiving the payment, or properly record it as required by statutes, with the intent thereby to deprive the owner or person so paying the contractor or other person receiving payment of his or her funds without discharging the liens and thereby to defraud the owner or person so paying.

(b) In any prosecution under this section as against the person so receiving payment, when it shall be shown in evidence that any lien for labor or materials existed in favor of any mechanic, laborer, or materialman and that the lien has been filed within the time provided by law in the office of the circuit clerk or other officer provided by law for the filing of such liens, and that the contractor, subcontractor, or other person charged has received payment without discharging the lien to the extent of the funds received by him or her, then the fact of acceptance of the payment without having discharged the lien within ten (10) days after receipt of the payment or the receipt of notice of the existence of the lien, whichever event shall occur last, shall be prima facie evidence of intent to defraud on the part of the person so receiving payment.

(c) (1) If the amount of the contract price so received and not applied to the discharge of the liens, with the intent to defraud, shall exceed the sum of twenty-five dollars ($25.00), the party so receiving shall be deemed guilty of a felony and shall be punished by a fine not exceeding one thousand dollars ($1,000) or by imprisonment in the Department of Corrections for not less than one (1) year nor more than five (5) years, or by both.

(2) If the amount so received does not exceed the sum of twenty-five dollars ($25.00), the party shall be deemed guilty of a misdemeanor and punished by imprisonment in the county jail for not more than one (1) year or by fine not less than ten dollars ($10.00) nor more than three hundred dollars ($300), or by both.

Acts 1963, No. 66, § 1; A.S.A. 1947, § 51-640.

Ark. Code 18-44-133

Ark. Code 18-44-134

Ark. Code 18-44-135 Jointly owned property.

In the event that property is jointly owned, the signature of one (1) of the owners is sufficient for the purposes of this chapter.

Acts 1995, No. 1298, § 12.