Arkansas Transfer On Death Form For Stocks

Description

How to fill out Arkansas Beneficiary Or Transfer On Death Deed Or TOD - Husband And Wife Or Two Individuals To Husband And Wife Or Two Individuals?

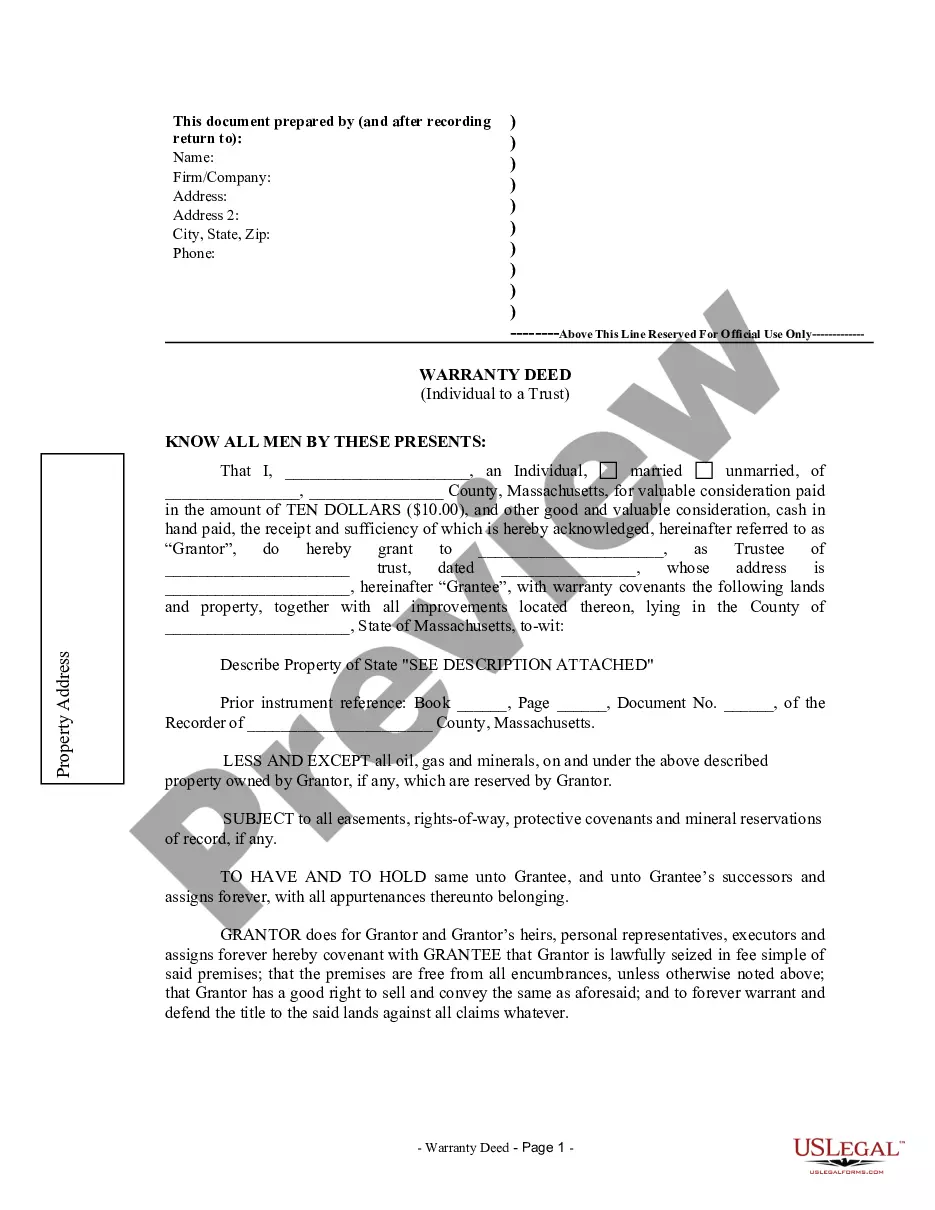

Whether for business purposes or for personal affairs, everyone has to manage legal situations sooner or later in their life. Completing legal documents demands careful attention, starting with picking the right form template. For instance, when you select a wrong version of a Arkansas Transfer On Death Form For Stocks, it will be rejected once you send it. It is therefore essential to get a trustworthy source of legal documents like US Legal Forms.

If you need to obtain a Arkansas Transfer On Death Form For Stocks template, stick to these simple steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Examine the form’s description to ensure it fits your case, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect form, go back to the search function to find the Arkansas Transfer On Death Form For Stocks sample you require.

- Download the file when it meets your requirements.

- If you already have a US Legal Forms account, click Log in to access previously saved templates in My Forms.

- In the event you don’t have an account yet, you can download the form by clicking Buy now.

- Pick the correct pricing option.

- Complete the account registration form.

- Choose your transaction method: you can use a bank card or PayPal account.

- Pick the document format you want and download the Arkansas Transfer On Death Form For Stocks.

- After it is saved, you can complete the form with the help of editing applications or print it and finish it manually.

With a large US Legal Forms catalog at hand, you do not need to spend time searching for the right template across the web. Utilize the library’s straightforward navigation to get the correct template for any situation.

Form popularity

FAQ

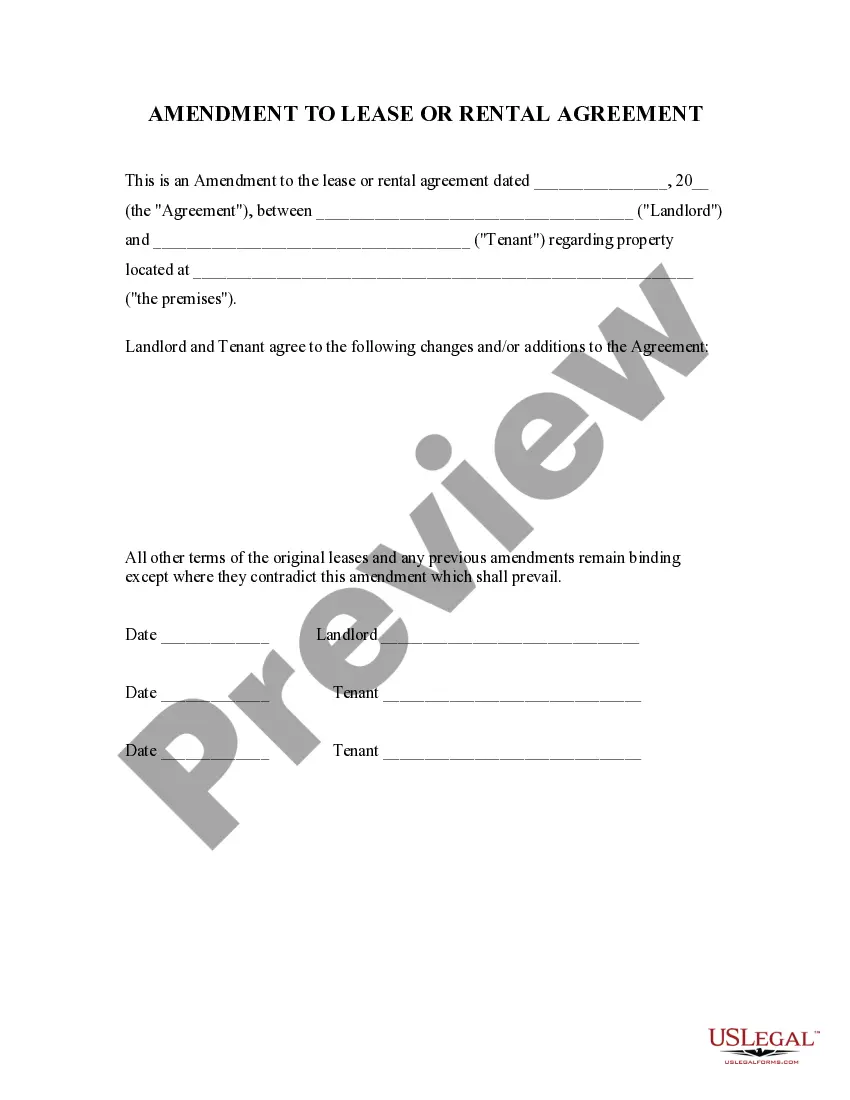

(Ark. Code Ann. § 18-12-608.) You must sign the deed and get your signature notarized, and then record (file) the deed before your death with the county clerk, circuit clerk, or recorder's office (the name varies by county) in the county where the real estate is located.

Upon the death of one person, the stocks are immediately transferred to the surviving owner. There is also something called automatic stock transfer where you fill a transfer-on-death designation that allows you to give your stocks to a beneficiary.

Arkansas allows you to leave real estate with transfer-on-death deeds. These deeds are also called beneficiary deeds. You sign and record the deed now, but it doesn't take effect until your death.

Transfer on Death (TOD) Registration This typically involves sending a copy of the death certificate and an application for re-registration to the transfer agent. State law, rather than federal law, governs the way securities may be registered in the names of their owners.

Arkansas charges a real property transfer tax for real estate transfers involving more than $100.00 in payment. The total transfer tax rate is $3.30 per $1,000.00 of consideration?two-thirds of which is expressly the new owner's responsibility.