Transfer Deed Beneficiary For A Trust

Description

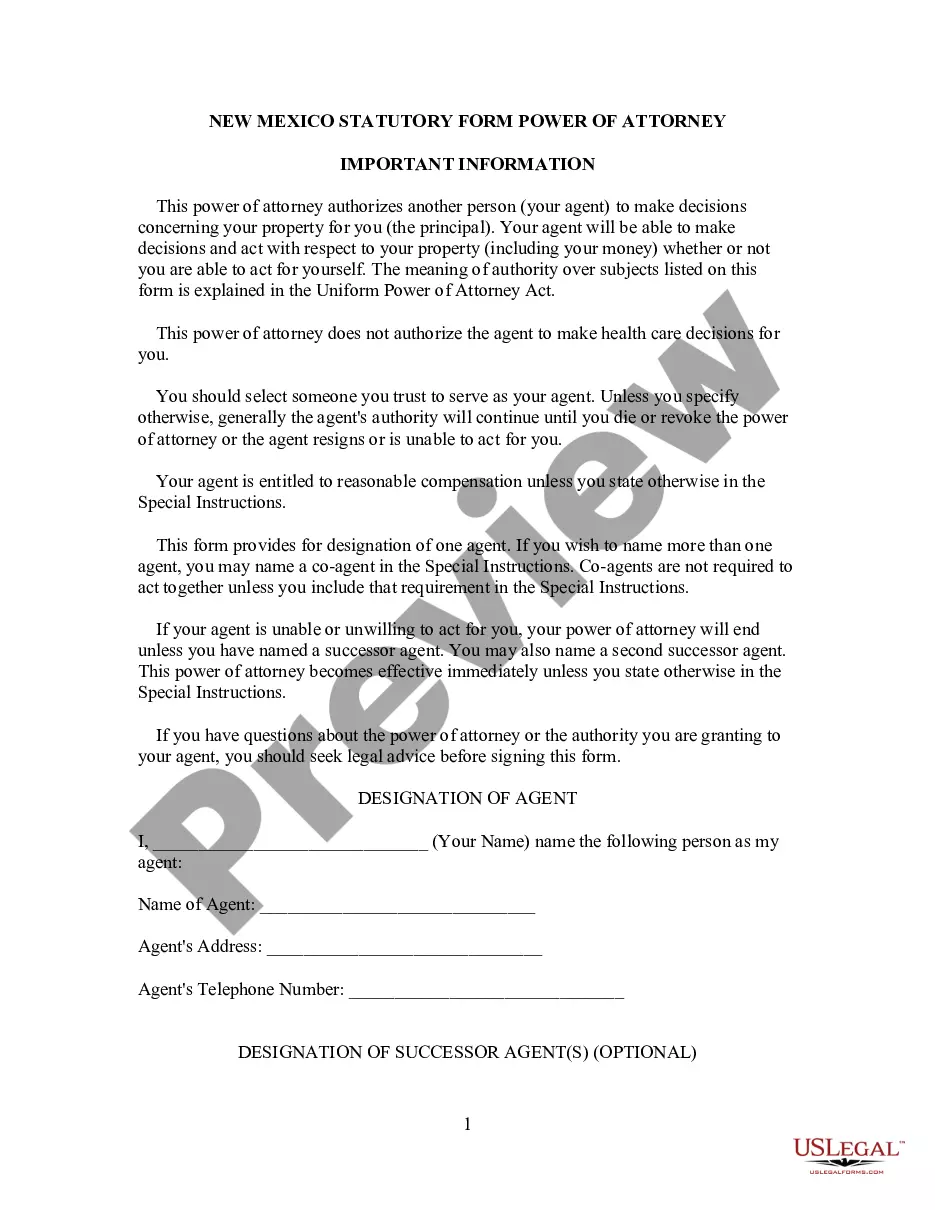

How to fill out Arkansas Transfer On Death Deed Or TOD - Beneficiary Deed For One Individual To Four Individuals?

- Start by logging into your US Legal Forms account. If you’re new, create an account to access the necessary forms.

- Navigate to the form collection and search for the specific form related to transferring the deed beneficiary.

- Preview the form and ensure it aligns with your requirements and local jurisdiction.

- If the correct form isn’t found, utilize the Search feature to explore different templates.

- Select the appropriate template and click on the 'Buy Now' button, then choose a subscription plan that suits your needs.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Once your payment is processed, download the selected form to your device. You can find it in the 'My Forms' section of your profile for future reference.

Following these steps ensures a seamless experience when transferring a deed beneficiary for a trust. US Legal Forms not only empowers users with a vast array of templates but also provides access to premium expert support.

Start your journey with US Legal Forms today and simplify your legal documentation process!

Form popularity

FAQ

Writing a beneficiary deed involves drafting a legal document that outlines how your assets will be handled upon your passing. Start by clearly identifying the property and the intended transfer deed beneficiary for a trust. Ensure that the deed complies with state requirements, including signatures and notary verification. If you find it challenging, using platforms like US Legal Forms can simplify the process by providing templates and guidance for drafting a valid beneficiary deed.

One downside of putting assets in a trust is the potential loss of control over those assets until the trust is dissolved. While it provides benefits such as avoiding probate, it may limit the asset holder's ability to manage their property freely. Additionally, having a transfer deed beneficiary for a trust means that some legal complexities arise, which may be hard for some people to navigate. It is essential to weigh these cons against the benefits before making a decision.

Filling out a beneficiary designation form for a trust requires careful attention to detail. Start by gathering all necessary information about the trust and its beneficiaries, including names, addresses, and relationship to the trustor. Clearly specify the transfer deed beneficiary for a trust in the appropriate section of the form, ensuring that the intended beneficiaries are well-defined. After completing the form, review it with a legal professional to prevent any errors that could impact the trust.

A common mistake parents make is failing to fund the trust adequately. If assets are not transferred into the trust, it cannot operate as intended, leading to potential issues in estate management. Furthermore, neglecting to designate a clear transfer deed beneficiary for a trust can create confusion for heirs. It's vital for parents to periodically review and update their trust to ensure everything is in order.

While trusts offer many benefits, they can come with some drawbacks, such as setup costs and ongoing maintenance requirements. It's essential to understand that a poorly structured trust may not effectively achieve desired goals, which is why careful planning is crucial. If your parents decide to use a transfer deed beneficiary for a trust, they should also ensure compliance with state laws to avoid complications. Consulting with legal professionals can help navigate these challenges.

Creating a trust can be a smart move for your parents, as it often simplifies estate management and ensures a smooth transfer of assets. By establishing a trust, they can designate a transfer deed beneficiary for a trust, allowing for clear instructions on how their assets should be handled. Additionally, a trust can help avoid probate, saving time and costs for heirs. Overall, it provides peace of mind in planning for the future.

The choice between a transfer-on-death (TOD) deed and a trust often depends on individual needs. A TOD can be simpler and allow for direct property transfer without probate, making it appealing for some. However, a trust generally offers more comprehensive control over how assets are managed and distributed after death. It is advisable to evaluate your situation and consider the transfer deed beneficiary for a trust for a more robust estate planning solution.

Several factors can override a trust, including changes in laws, the financial situation of the grantor, and specific court rulings. Additionally, if the trust is deemed invalid due to improper execution or lack of capacity of the grantor, it may be overridden. In some cases, certain state laws regarding property transfer might take precedence, impacting the transfer deed beneficiary for a trust. It is essential to stay informed about these elements to ensure your trust remains effective.

Beneficiaries of a trust deed are individuals or entities who receive benefits from the trust. These beneficiaries can include family members, friends, or charitable organizations, depending on the creator's wishes. The transfer deed beneficiary for a trust can help ensure that these distributions occur smoothly and according to the specific terms outlined in the trust document. Understanding who these beneficiaries are is crucial for effective estate planning.

One major disadvantage of a transfer-on-death (TOD) deed is that it does not provide a comprehensive estate plan. A TOD allows property to pass directly to the designated beneficiary, but it may not address other asset distribution issues or debts. Additionally, complications can arise if the beneficiary predeceases the owner, which can create confusion and potential legal battles. Therefore, considering the transfer deed beneficiary for a trust may offer a more thorough approach to estate management.