Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

Contract for Deed - General - Arkansas

Related Arkansas Legal Forms

Arkansas Statutes

Title 2. Agriculture.

Subtitle 1. General Provisions.

Chapter 7. Farm Mediation.

Subchapter 3. Mediation.

2-7-302. Release prior to proceedings required - Exceptions.

(a) In connection with a secured indebtedness of twenty thousand dollars ($20,000) or more, no proceeding against a farmer shall be commenced to foreclose a mortgage on agricultural property, to terminate a contract for deed to purchase agricultural property, to repossess or foreclose a security interest in agricultural property, to set off or seize an account, moneys, or other asset which is agricultural property, or to enforce any judgment against agricultural property unless the creditor has first obtained a release as provided in this chapter.

(b) An action for attachment or replevin may be commenced without first obtaining a release in those cases provided for under § 16-110-101(1)(A)(vi)-(viii) or § 18-60-807.

Acts 1989, No. 829, § 4.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 1. General Provisions.

18-12-101. Definition and applicability.

(a) The term "real estate" as used in this act shall be construed as co-extensive in meaning with "lands, tenements, and hereditaments" and as embracing all chattels real.

(b) This act shall not be construed so as to embrace last wills and testaments.

Rev. Stat., ch. 31, §§ 7, 8; C. & M. Dig., §§ 1501, 1502; Pope's Dig., §§ 1810, 1811; A.S.A. 1947, §§ 50-409, 50-410.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 1. General Provisions.

18-12-102. Transfer by deed – Warranty

(a) All lands, tenements, and hereditaments may be aliened and possession thereof transferred by deed without livery of seizin.

(b) The words, "grant, bargain and sell" shall be an express covenant to the grantee, his or her heirs, and assigns that the grantor is seized of an indefeasible estate in fee simple, free from encumbrance done or suffered from the grantor, except rents or services that may be expressly reserved by the deed, as also for the quiet enjoyment thereof against the grantor, his or her heirs, and assigns and from the claim and demand of all other persons whatever, unless limited by express words in the deed.

(c) The grantee, his or her heirs, or assigns, may, in any action, assign breaches as if such covenants were expressly inserted.

(d) As between the grantor and grantee, neither the statutory nor general express covenant of warranty against encumbrances shall be held to cover any taxes or assessments of any improvement district of any kind, whether formed under general statutes authorizing the assessment of lands for local improvements of any kind or whether the improvement district is formed by public or private act of the General Assembly. The lien for any such local assessment or tax shall run with the land and be assumed by the grantee, and the grantee shall pay any and all installments of the tax or assessment becoming due after the execution and delivery of the deed, unless otherwise expressly provided.

Rev. Stat., ch. 31, §§ 1, 2; Acts 1917, No. 332, § 1, p. 1671; C. & M. Dig., §§ 1495, 1496; Pope's Dig., §§ 1795, 1796; A.S.A. 1947, §§ 50-401, 50-402.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 1. General Provisions.

18-12-103. Restrictive covenants.

(a) As used in this section, "restrictive covenant" means a restriction on the use or development of real property regardless of whether the restriction is created by a covenant in a deed or bill of assurance, or by any other instrument.

(b) An instrument creating a restrictive covenant is not effective to restrict the use or development of real property unless the instrument purporting to restrict the use or development of the real property is executed by the owners of the real property and recorded in the office of the recorder of the county in which the property is located.

(c) If the instrument creating a restrictive covenant contains separate sections stating the duration of the covenant and the requirements for amending the covenant, the section or sections stating the duration of the covenant shall be read independently of the section or sections stating the requirements for amending the covenant so that the duration of the covenant does not limit the ability to amend a restrictive covenant at any time.

Acts 1965, No. 395, § 1; A.S.A. 1947, § 50-427; Acts 2011, No. 185, § 2.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 1. General Provisions.

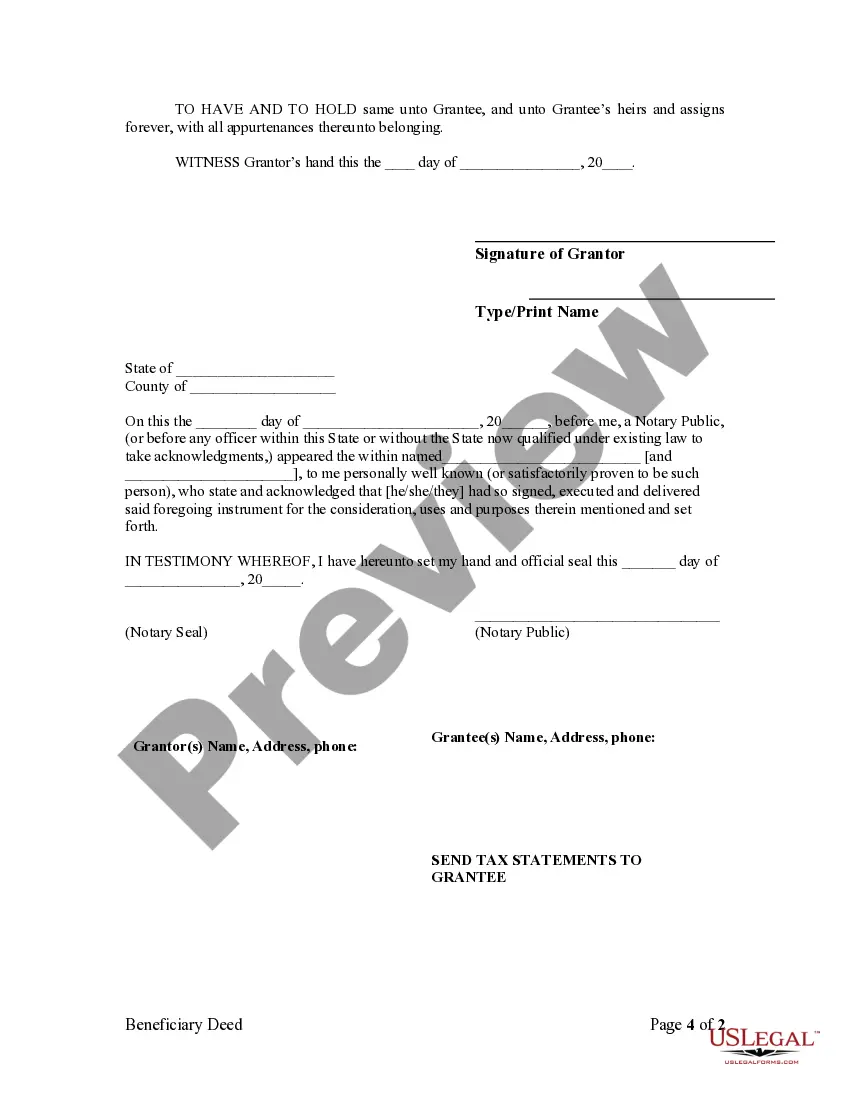

18-12-104. Execution of deeds.

Deeds and instruments of writing for the conveyance of real estate shall be executed in the presence of two (2) disinterested witnesses or, in default thereof, shall be acknowledged by the grantor in the presence of two (2) such witnesses, who shall then subscribe the deed or instrument in writing for the conveyance of the real estate. When the witnesses do not subscribe the deed or instrument of writing as described in this section at the time of the execution thereof, the date of their subscribing it shall be stated with their signatures.

Rev. Stat., ch. 31, § 12; C. & M. Dig., § 1515; Pope's Dig., § 1824; A.S.A. 1947, § 50-417.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 2. Acknowledgment And Proof Of Instruments

18-12-201. Proof or acknowledgment as prerequisite to recording real estate conveyances.

All deeds and other instruments in writing for the conveyance of any real estate, or by which any real estate may be affected in law or equity, shall be proven or duly acknowledged in conformity with the provisions of this act before they or any of them shall be admitted to record.

Rev. Stat., ch. 31, § 22; C. & M. Dig., § 1525; Pope's Dig., § 1835; A.S.A. 1947, § 49-211.

/

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 2. Acknowledgment And Proof Of Instruments

18-12-202. Forms of acknowledgments – Validity – Acknowledgments of married persons.

(a) (1) Either the forms of acknowledgments now in use in this state or any other forms may be used in the case of all deeds and other instruments in writing for the conveyance of real or personal property which:

(A) Specify, in the caption or otherwise, the state and county or other place where the acknowledgment is taken;

(B) Set out the name of the person acknowledging and, in instances in which he or she acknowledges otherwise than in his or her own right, the name of the person, association, or corporation for which he or she acknowledges; and

(C) Recite in substance or the equivalent that the execution of the instrument was acknowledged by the person so named as acknowledging, or any other form of acknowledgment provided by law.

(2) These forms may also be used when the property is to be affected in law or equity and also in any other case in which such an acknowledgment is for any purpose required or authorized by law.

(3) An acknowledgment in any of these forms shall be sufficient to entitle the instrument to be recorded and to be read in evidence.

(b) The acknowledgment of a married person, both as to the disposition of his or her own property and as to the relinquishment of dower, curtesy, and homestead in the property of a spouse, may be made in the same form as if that person were sole and without any examination separate and apart from a spouse, and without necessity for a specific reference therein to the interest so conveyed or relinquished.

Acts 1937, No. 44, § 1; Pope’s Dig., § 1831; Acts 1981, No. 714, § 3; A.S.A. 1947, § 49-201.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 2. Acknowledgment And Proof Of Instruments

18-12-203. Officers authorized to take proof or acknowledgment of real estate conveyances.

(a) The proof or acknowledgment of every deed or instrument of writing for the conveyance of any real estate shall be taken by one (1) of the following courts or officers:

(1) When acknowledged or proved within this state, before the Supreme Court, the circuit court, or any justices or judges thereof, the clerk of any court of record, any county judge, or before any notary public;

(2) When acknowledged or proved outside this state, and within the United States or its territories, or in any of the colonies or possessions or dependencies of the United States, before any court of the United States, or any state or territory, or colony or possession or dependency of the United States, having a seal, or a clerk of any such court, or before any notary public, or before the mayor of any incorporated city or town, or the chief officer of any city or town having a seal, or before a commissioner appointed by the Governor; and

(3) When acknowledged or proved outside the United States, before any:

(A) Court of any state, kingdom, or empire having a seal;

(B) Mayor or chief officer of any city or town having an official seal; or

(C) Officer of any foreign country who by the laws of that country is authorized to take probate of the conveyance of real estate of his or her own country if the officer has, by law, an official seal.

(b) The acknowledgment of any deed or mortgage, when taken outside the United States, may be taken and certified by a United States consul.

Rev. Stat., ch. 31, § 13; Acts 1874, No. 13, § 1, p. 58; 1887, No. 91, § 1, p. 142; 1897, No. 26, § 1, p. 33; 1899, No. 150, § 1, p. 276; C. & M. Dig., § 1516; Acts 1921, No. 233, § 1; 1923, No. 464, §§ 1, 2; Pope’s Dig., § 1825; A.S.A. 1947, §§ 49-202, 49-203; Acts 2003, No. 1185, § 252.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 2. Acknowledgment And Proof Of Instruments

18-12-206. Manner of making acknowledgment – Proof of deed or instrument – Proof of identity of grantor or witness.

(a) The acknowledgment of deeds and instruments of writing for the conveyance of real estate, or whereby such real estate is to be affected in law or equity, shall be by the grantor appearing in person before a court or officer having the authority by law to take the acknowledgment and stating that he or she had executed the deed or instrument for the consideration and purposes therein mentioned and set forth.

(b) When a deed or instrument referred to in subsection (a) of this section is to be proved, it shall be done by one (1) or more of the subscribing witnesses personally appearing before the proper court or officer and stating on oath that he or she saw the grantor subscribe the deed or instrument of writing or that the grantor acknowledged in his or her presence that he or she had subscribed and executed the deed or instrument for the purposes and consideration therein mentioned, and that he or she had subscribed the deed or instrument as a witness at the request of the grantor.

(c) If any grantor has not acknowledged the execution of a deed or instrument referred to in subsection (a) of this section and the subscribing witnesses are dead or cannot be had, then the deed or instrument may be proved by the evidence of the handwriting of the grantor and of at least one (1) of the subscribing witnesses. This evidence shall consist of the deposition of two (2) or more disinterested persons, swearing to each signature.

(d) (1) When any grantor in any deed or instrument that conveys real estate or whereby any real estate may be affected in law or equity, or any witness to any like instrument, shall present himself or herself before any court or other officer for the purpose of acknowledging or proving the execution of the deed or instrument, if the grantor or witness shall be personally unknown to the court or officer, his or her identity and his or her being the person he or she purports to be on the face of such instrument of writing shall be proved to the court or officer.

(2) Proof may be made by witnesses known to the court or officer or by the affidavit of the grantor or witness if the court or officer shall be satisfied therewith. The proof or affidavit shall also be endorsed on the deed or instrument of writing.

Rev. Stat., ch. 31, §§ 17-20; C. & M. Dig., §§ 1520-1523; Pope’s Dig., §§ 1829, 1830, 1832, 1833; A.S.A. 1947, §§ 49-207 — 49-210.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 2. Acknowledgment And Proof Of Instruments

18-12-208. Defects.

(a) All deeds, conveyances, deeds of trust, mortgages, marriage contracts, and other instruments in writing affecting or purporting to affect the title to any real estate or personal property situated in this state, which have been recorded and which are defective or ineffectual because:

(1) Of failure to comply with § 18-12-403;

(2) The officer who certified the acknowledgment or acknowledgments to such instruments omitted any words required by law to be in the certificate or acknowledgments;

(3) The officer failed or omitted to attach his or her seal to the certificate;

(4) The officer attached to any such certificate a seal not bearing the words and devices required by law;

(5) The officer was a mayor of a city or an incorporated town in the State of Arkansas and as such was not authorized to certify to executions and acknowledgments to such instruments, or was the deputy of an official duly authorized by law to take acknowledgments but whose deputy was not so authorized;

(6) The notary public failed to state the date of the expiration of his or her commission on the certificate of acknowledgment, or incorrectly stated it thereon;

(7) The officer incorrectly dated the certificate of acknowledgment or failed to state the county wherein the acknowledgment was taken; or

(8) The acknowledgment was certified in any county of the State of Arkansas by any person holding an unexpired commission as notary public under the laws of the state who had, at the time of the certification, ceased to be a resident of the county within and for which he or she was commissioned, shall be as binding and effectual as though the certificate of acknowledgment or proof of execution was in due form, bore the proper seal, and was certified to by a duly authorized officer.

(b) A deed, conveyance, deed of trust, mortgage, marriage contract, and other instrument in writing, affecting or purporting to affect the title to any real estate or personal property situated in this state, which is executed after August 13, 1993, shall not be deemed defective or ineffectual because:

(1) The officer failed or omitted to attach his or her seal to the certificate;

(2) The officer attached to any such certificate a seal not bearing the words and devices required by law;

(3) The notary public failed to state the date of the expiration of his or her commission on the certificate of acknowledgment, or incorrectly stated it thereon;

(4) The officer incorrectly dated the certificate of acknowledgment or failed to state the county wherein the acknowledgment was taken; or

(5) The acknowledgment was certified in any county of the State of Arkansas by any person holding an unexpired commission as notary public under the laws of the state who had, at the time of the certification, ceased to be a resident of the county within and for which he or she was commissioned.

(c) A deed, conveyance, deed of trust, mortgage, marriage contract, and any other instrument in writing, affecting or purporting to affect the title to any real estate or personal property situated in this state, whether executed before, on, or after the effective date of this subsection, shall not be found insufficient to satisfy the requirements of § 18-12-202:

(1) Because the acknowledgment thereof does not strictly comply with the form contained in § 16-47-107 or omits the words “for the consideration, uses, and purposes therein mentioned or set forth” or uses similar words;

(2) Because the gender listed in the acknowledgment thereof does not match the gender of the person acknowledging the instrument;

(3) Because the acknowledgment thereof does not identify the title or position of the person acknowledging the instrument on behalf of a corporation, partnership, company, trust, association, or other entity; or

(4) Where a good faith attempt at material compliance with § 16-47-107(a), (b), or (c), as applicable, has been made and there is no factual dispute as to the authenticity of the signature of the person making acknowledgement thereof.

(d) Notwithstanding an acknowledgment to a deed or other instrument which may contain one (1) or more of the defects set forth in this section, if a deed or other instrument is recorded, it shall:

(1) Provide constructive notice thereafter to all parties of the matters contained in the deed or other instrument; and

(2) Be treated as any other deed or instrument in writing under § 16-47-110, and may be read into evidence in any court in this state without further proof of execution.

(e) A valid jurat may act as a substitute for a certificate of acknowledgment for instruments recorded on or after the effective date of this subsection.

Acts 1955, No. 101, § 1; A.S.A. 1947, § 49-213; Acts 1993, No. 1081, §§ 1, 2; 2013, No. 999, § 4.

18-12-209. Recorded deed or written instrument affecting real estate.

(a) Every deed or instrument in writing which conveys or affects real estate and which is acknowledged or proved and certified as prescribed by this act may, together with the certificate of acknowledgment, proof, or relinquishment of dower, be recorded by the recorder of the county where such land to be conveyed or affected thereby is located, and when so recorded may be read in evidence in any court in this state without further proof of execution.

(b) If it appears at any time that any deed or instrument duly acknowledged or proved and recorded as prescribed by this act is lost or not within the power and control of the party wishing to use the deed or instrument, the record thereof, or a transcript of the record certified by the recorder, may be read in evidence without further proof of execution.

(c) Neither the certificate of acknowledgment nor the probate of any such deed or instrument, nor the record or transcript thereof, shall be conclusive, but it may be rebutted.

Rev. Stat., ch. 31, §§ 26-28; C. & M. Dig., §§ 1530-1532; Pope’s Dig., §§ 1840-1842; A.S.A. 1947, §§ 28-919 — 28-921.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-601. After-acquired title.

If any person shall convey any real estate by deed purporting to convey it in fee simple absolute, or any less estate, and shall not at the time of the conveyance have the legal estate in the lands, but shall afterwards acquire it, then the legal or equitable estate afterwards acquired shall immediately pass to the grantee and the conveyance shall be as valid as if the legal or equitable estate had been in the grantor at the time of the conveyance.

Rev. Stat., ch. 31, § 4; C. & M. Dig., § 1498; Pope’s Dig., § 1798; A.S.A. 1947, § 50-404.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-602. Land in adverse possession.

Any person claiming title to any real estate, notwithstanding there may be an adverse possession thereof, may sell and convey his or her interest in the same manner and with like effect as if he or she were in the actual possession of the real estate.

Rev. Stat., ch. 31, § 6; C. & M. Dig., § 1500; Pope’s Dig., § 1809; A.S.A. 1947, § 50-408

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-603. Grants to two or more as tenancy in common.

Every interest in real estate granted or devised to two (2) or more persons, other than executors and trustees as such, shall be in tenancy in common unless expressly declared in the grant or devise to be a joint tenancy.

Rev. Stat., ch. 31, § 9; C. & M. Dig., § 1503; Pope’s Dig., § 1812; A.S.A. 1947, § 50-411.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-604. Deed to trustee or agent.

(a) (1) The appearance of the words “trustee”, “as trustee”, or “agent” following the names of the grantee in any deed of conveyance of land executed, without other language showing a trust, shall not be deemed to give notice to, or put on inquiry, any person dealing with the land that a trust or agency exists or that there are other beneficiaries of the conveyance except the grantee named therein.

(2) The conveyance shall vest the title to the land in the grantee.

(b) A conveyance of land by the grantee, whether followed by the words “trustee”, “as trustee”, or “agent” or not, shall vest title in his or her grantee free from any claims of all persons or corporations.

Acts 1919, No. 444, § 1; C. & M. Dig., § 1504; Pope’s Dig., § 1813; A.S.A. 1947, § 50-412.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

18-12-605. Deeds of administrators, executors, guardians, commissioners, and sheriffs.

(a) (1) All deeds of conveyance made by an administrator, an executor, a guardian, or a commissioner, deeds of real estate sold under an execution made and executed by a sheriff, and deeds made and executed by a trustee or an attorney pursuant to a foreclosure of a deed of trust or mortgage, duly made and executed, acknowledged, and recorded, as now required by law and purporting to convey real estate, shall vest in the grantee and his or her heirs and assigns a good and valid title, both in law and in equity.

(2) (A) The deeds shall be evidence of the facts recited in the deeds and of the legality and regularity of the sale of the real estate so conveyed.

(B) However, the deeds do not warrant title to a subsequent grantee, and any subsequent grantee may not assert or claim any warranty of title deriving from the deeds.

(b) Nothing in this section shall prohibit a deed made under subdivision (a)(1) of this section from warranting title by express use of warranty language.

(c) Every deed so made, executed, acknowledged, and recorded, or a certified copy of the deed, under the seal of the recorder of the proper county shall be received in evidence in any court in this state without further proof of its execution.

Acts 1853, §§ 1, 2, p. 207; C. & M. Dig., §§ 1534, 1535; Pope’s Dig., §§ 1844, 1845; A.S.A. 1947, §§ 50-419, 50-420; Acts 2005, No. 1884, § 1.

Title 18. Property.

Subtitle 2. Real Property

Chapter 12. Conveyances.

Subchapter 6. Miscellaneous Conveyances

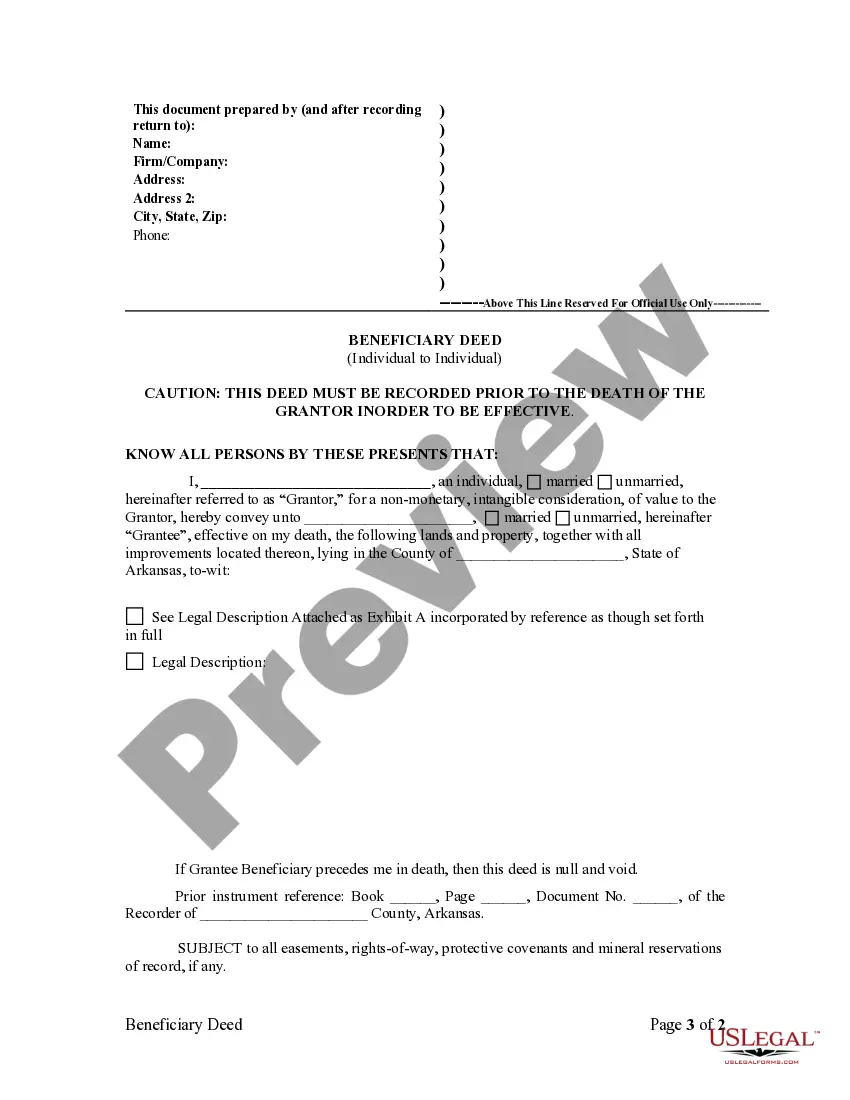

18-12-608. Beneficiary deeds — Terms — Recording required. (Amended March 9, 2007 by Act 243)

(a) (1) (A) A beneficiary deed is a deed without current tangible consideration that conveys upon the death of the owner an ownership interest in real property other than a leasehold or lien interest to a grantee designated by the owner and that expressly states that the deed is not to take effect until the death of the owner.

(B) (i) A beneficiary deed transfers the interest to the designated grantee effective upon the death of the owner, subject to:

(a) All conveyances, assignments, contracts, leases, mortgages, deeds of trust, liens, security pledges, oil, gas, or mineral leases, and other encumbrances made by the owner or to which the real property was subject at the time of the owner’s death, whether or not the conveyance or encumbrance was created before or after the execution of the beneficiary deed; and

(b) A claim for reimbursement of federal or state benefits by the Department of Human Services from the estate of the grantor or the interest acquired by a grantee of the beneficiary deed under § 20-76-436.

(ii) No legal or equitable interest shall vest in the grantee until the death of the owner prior to revocation of the beneficiary deed.

(2) (A) The owner may designate multiple grantees under a beneficiary deed.

(B) Multiple grantees may be joint tenants with right of survivorship, tenants in common, holders of a tenancy by the entirety, or any other tenancy that is otherwise valid under the laws of this state.

(3) (A) The owner may designate one (1) or more successor grantees, including one (1) or more unnamed heirs of the original grantee or grantees, under a beneficiary deed.

(B) The condition upon which the interest of a successor grantee vests, such as the failure of the original grantee to survive the grantor, shall be included in the beneficiary deed.

(b) (1) If real property is owned as a tenancy by the entirety or as a joint tenancy with the right of survivorship, a beneficiary deed that conveys an interest in the real property to a grantee designated by all of the then surviving owners and that expressly states the beneficiary deed is not to take effect until the death of the last surviving owner transfers the interest to the designated grantee effective upon the death of the last surviving owner.

(2) (A) If a beneficiary deed is executed by fewer than all of the owners of real property owned as a tenancy by the entirety or as joint tenants with right of survivorship, the beneficiary deed is valid if the last surviving owner is a person who executed the beneficiary deed.

(B) If the last surviving owner did not execute the beneficiary deed, the beneficiary deed is invalid.

(c) (1) A beneficiary deed is valid only if the beneficiary deed is recorded before the death of the owner or the last surviving owner as provided by law in the office of the county recorder of the county in which the real property is located.

(2) A beneficiary deed may be used to transfer an interest in real property to a trustee of a trust estate even if the trust is revocable and may include one (1) or more unnamed successor trustees as successor grantees.

(d) (1) A beneficiary deed may be revoked at any time by the owner or, if there is more than one (1) owner, by any of the owners who executed the beneficiary deed.

(2) To be effective, the revocation shall be:

(A) Executed before the death of the owner who executes the revocation; and

(B) Recorded in the office of the county recorder of the county in which the real property is located before the death of the owner as provided by law.

(3) If the revocation is not executed by all the owners, the revocation is not effective unless executed by the last surviving owner and recorded before the death of the last surviving owner.

(4) A beneficiary deed that complies with this section may not be revoked, altered, or amended by the provisions of the owner’s will.

(e) If an owner executes more than one (1) beneficiary deed concerning the same real property, the recorded beneficiary deed that is last signed before the owner’s death is the effective beneficiary deed, regardless of the sequence of recording.

(f) (1) This section does not prohibit other methods of conveying real property that are permitted by law and that have the effect of postponing enjoyment of an interest in real property until the death of the owner.

(2) This section does not invalidate any deed otherwise effective by law to convey title to the interests and estates provided in the deed that is not recorded until after the death of the owner.

(g) A beneficiary deed is sufficient if it complies with other applicable laws and if it is in substantially the following form:

“Beneficiary Deed

(h) The instrument of revocation shall be sufficient if it complies with other applicable laws and is in substantially the following form:

Revocation of Beneficiary Deed

Acts 2005, No. 1918, § 1; 2007, No. 243, § 1.

Arkansas Case Law

Arkansas courts have ruled in Ashworth v. Hankins, 452 S.W.2d 838 (Ark. Sup.Ct. 1970); Held vendor may waive his right to forfeiture under a contract for deed, but may thereafter reinstate it with proper notice. Case shows Arkansas interpretation of contract for deed forfeiture clauses. Forfeiture provisions are normally held to be valid and timely enforced.