Trust Deeeds

Description

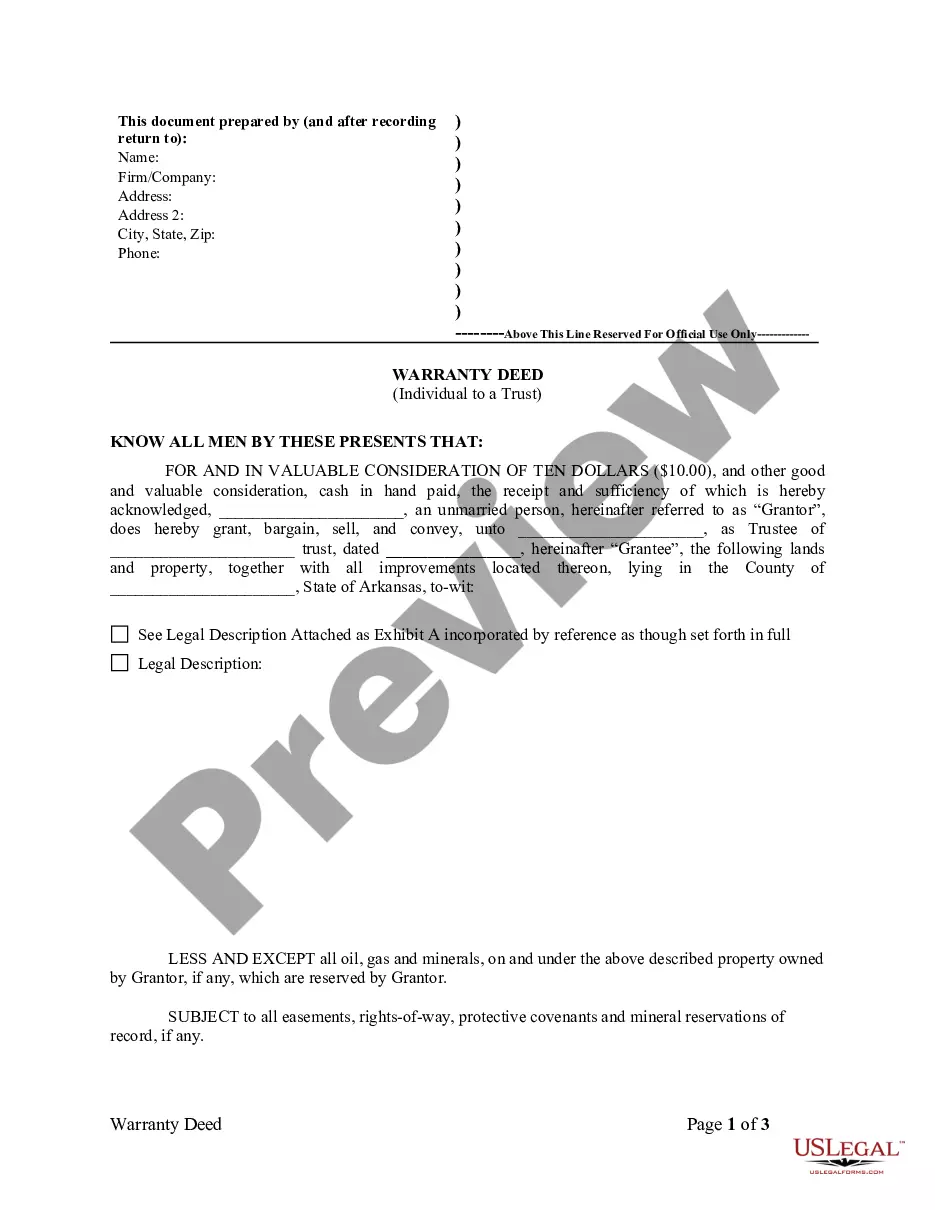

How to fill out Arkansas Warranty Deed From Individual To A Trust?

- If you're a returning user, log in to your account and navigate to the required form template. Ensure your subscription is active to avoid any interruptions.

- For first-time users, start by checking the Preview mode and form description. Confirm that the selected form meets your needs and complies with local legal requirements.

- If adjustments are necessary, utilize the Search tab to find the most suitable template. Select the right form and proceed to the next step.

- Purchase the selected document by clicking the Buy Now button, and choose your preferred subscription plan. An account registration will grant you access to their extensive library.

- Complete your purchase by entering your payment information or using PayPal for convenience.

- Download the completed form to your device. You can also find it anytime in the My Forms section of your profile.

Utilizing US Legal Forms provides you with access to a vast collection of over 85,000 legal templates, far surpassing competitors in quality and quantity. Their service not only streamlines the process but also connects you with premium legal experts for precise document completion.

Choose US Legal Forms for your document needs and experience the ease of legal processes. Start today and ensure your legal documents are done right!

Form popularity

FAQ

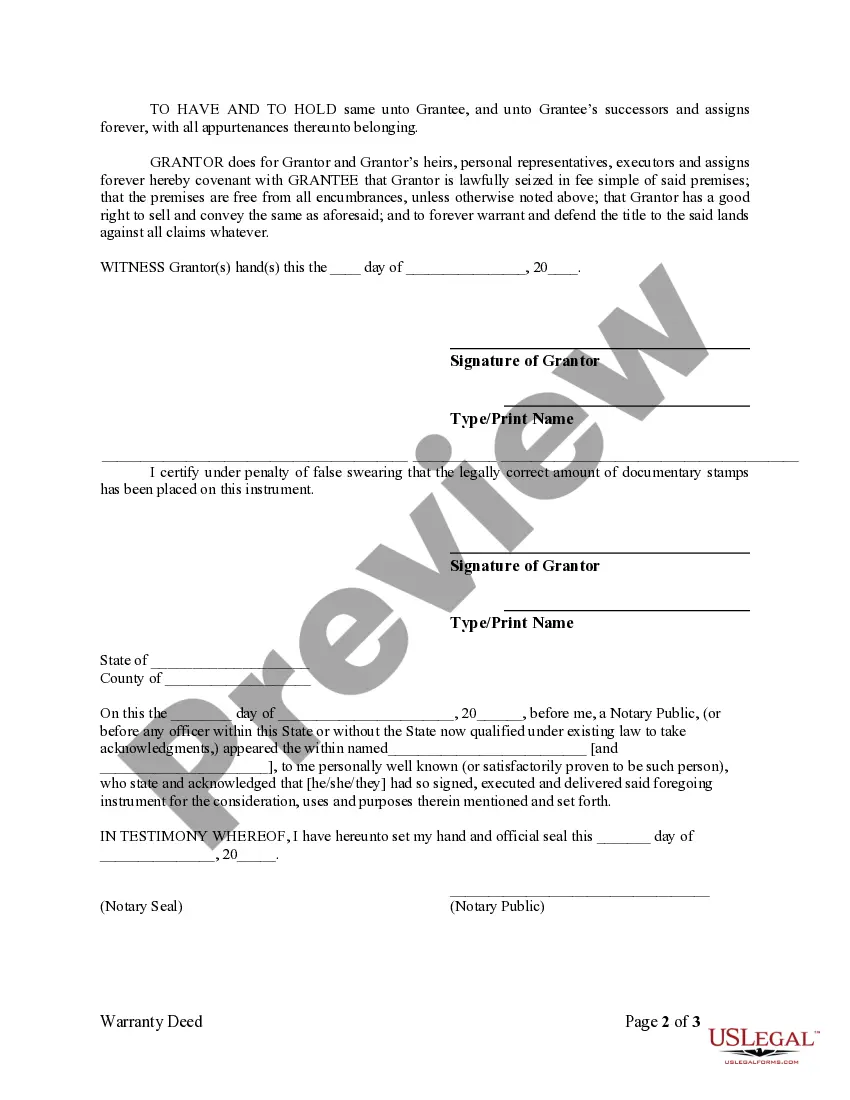

The structure of a deed of trust generally includes the introductory summary, the parties involved, detailed property description, and specific clauses relating to default and foreclosure. This organized layout clarifies each party’s responsibilities and rights. Utilizing a platform like UsLegalForms can streamline acquiring a well-structured deed of trust tailored for your needs.

A trust deed typically consists of several sections, including the names of the trustee and beneficiaries, property descriptions, and terms of the trust. Visually, it appears similar to other legal documents, formatted with clear headings and organized information. When you access a trust deed through platforms like UsLegalForms, you'll receive a professionally formatted document that is ready for use.

A deed of trust template is a legal document that helps outline the terms of a trust agreement. It serves as a framework for creating a trust deed, making it easier to customize based on individual needs. By using a deed of trust template, you can ensure the important elements are included, which simplifies the process and reduces the risk of errors.

Disadvantages of a trust deed can include limited borrower protection compared to traditional mortgages and a quicker foreclosure process. This rapid procedure can increase stress for borrowers facing financial difficulties. Being aware of these downsides helps borrowers make informed decisions about trust deeds.

One key disadvantage of a trust deed is the potential for the borrower to lose their property quickly if they default on payments. Unlike a mortgage, a trust deed allows for a faster foreclosure process, which can leave limited time for the borrower to rectify their situation. Understanding these risks is crucial when considering trust deeds.

The creation of a trust deed is typically a collaborative effort between the borrower and the lender. Lenders often have forms and legal language that must be included. You can simplify this process by using trusted sources like US Legal Forms, which offer templates designed to meet your needs while ensuring compliance with local laws.

Yes, you can write your own trust deed, but it is important to understand the legal requirements governing trust deeds. While many people choose to create a trust deed independently, an improperly drafted trust deed can lead to issues in the future. For peace of mind and to ensure legal compliance, consider using US Legal Forms to guide you through the process.