Starting An Llc In Arkansas Foreign

Description

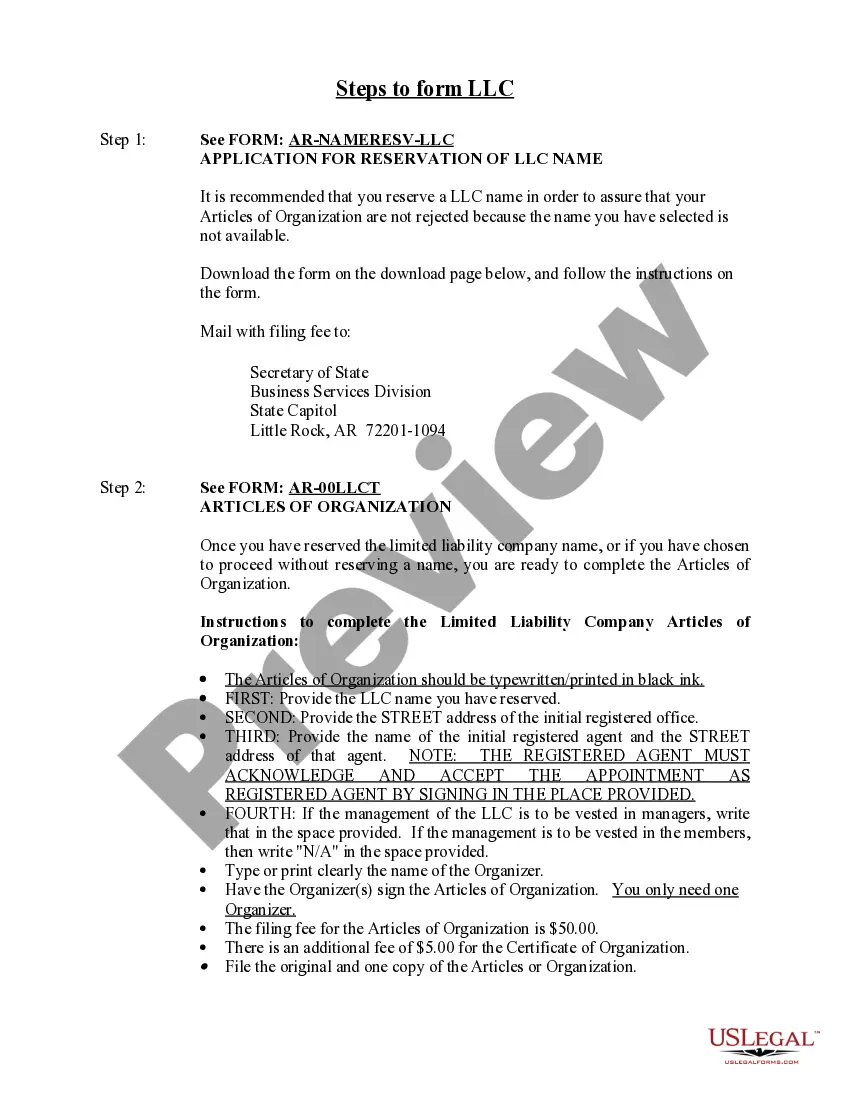

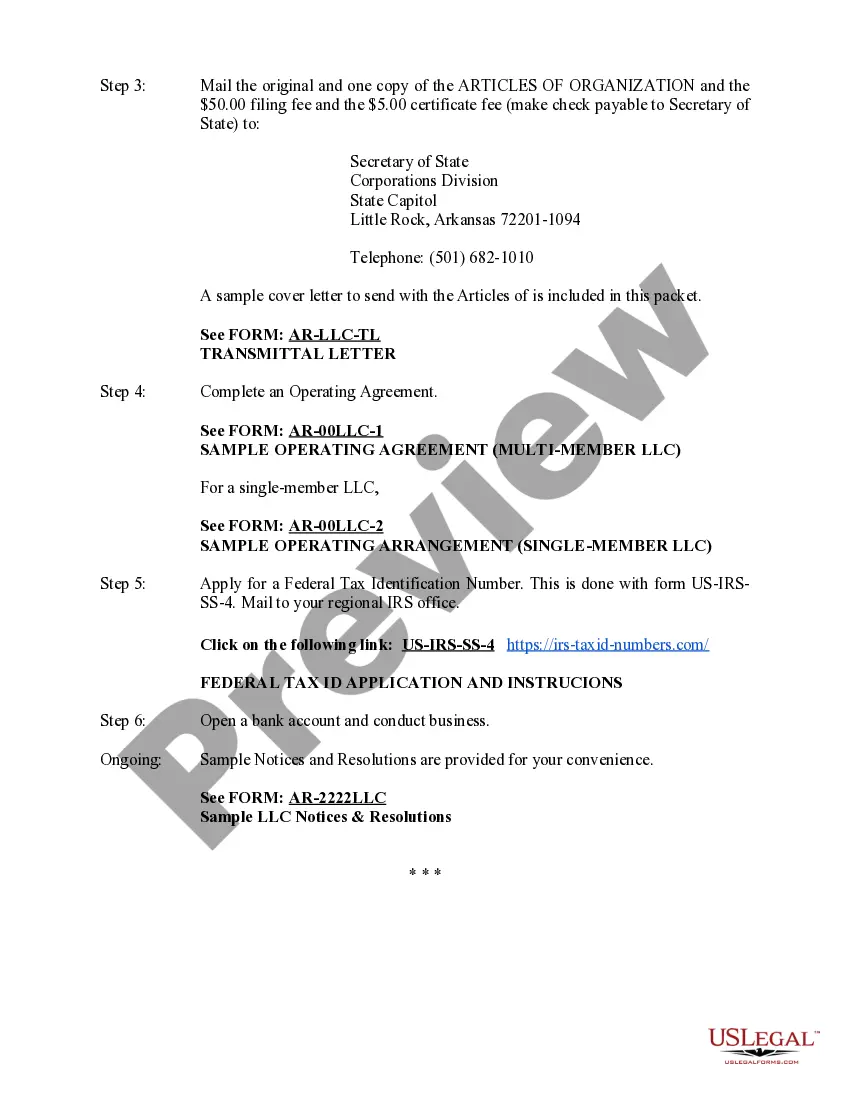

How to fill out Arkansas Limited Liability Company LLC Formation Package?

The Initiating An LLC In Arkansas Foreign you observe on this site is a versatile legal template created by expert lawyers in alignment with federal and local statutes and regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and lawyers with more than 85,000 verified, state-specific documents for any business and personal occasion. It’s the quickest, easiest, and most reliable method to acquire the forms you require, as the service ensures bank-level data security and anti-malware safeguards.

Select the format you prefer for your Initiating An LLC In Arkansas Foreign (PDF, DOCX, RTF) and download the example onto your device.

- Search for the document you require and examine it.

- Browse the file you searched and preview it or review the form description to confirm it meets your needs. If it doesn’t, utilize the search function to locate the suitable one. Click Buy Now when you have identified the template you desire.

- Register and Log In.

- Select the pricing plan that best fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the fillable template.

Form popularity

FAQ

Failure to pay can result in the imposition of additional fees, penalties and interest, or even revocation of the authorization to do business. Franchise taxes continue to accrue, even for revoked businesses, until the business is dissolved, withdrawn, or merged.

The registered agent may or may not be an owner, shareholder or officer of the corporation. Many corporations use their attorney or a professional corporate service company for this service. The registered agent's address must be a street address in Arkansas, and the agent must be located at that address.

Arkansas LLC Cost. Arkansas charges a $45 state fee to form an LLC ($50 by mail). You'll also need to pay $150 every year to file a franchise tax report, and you may have to pay for additional services for your LLC?such as filing a DBA or hiring a professional registered agent.

To be your own LLC Registered Agent, you need to have a physical address in Arkansas. This is because Registered Agents must have a physical street address in the state. PO Boxes are not allowed. (Note: The address of a Registered Agent is the Registered Office.

An ?Application for Certificate of Authority? is filed along with an original certificate of existence (?good standing?) from the ?home? state. The filing fee is $300.00 for business corporations and $300.00 for nonprofit corporations and can be filed online.