Arkansas Certificate Of Non Coverage Withholding Tax

Description

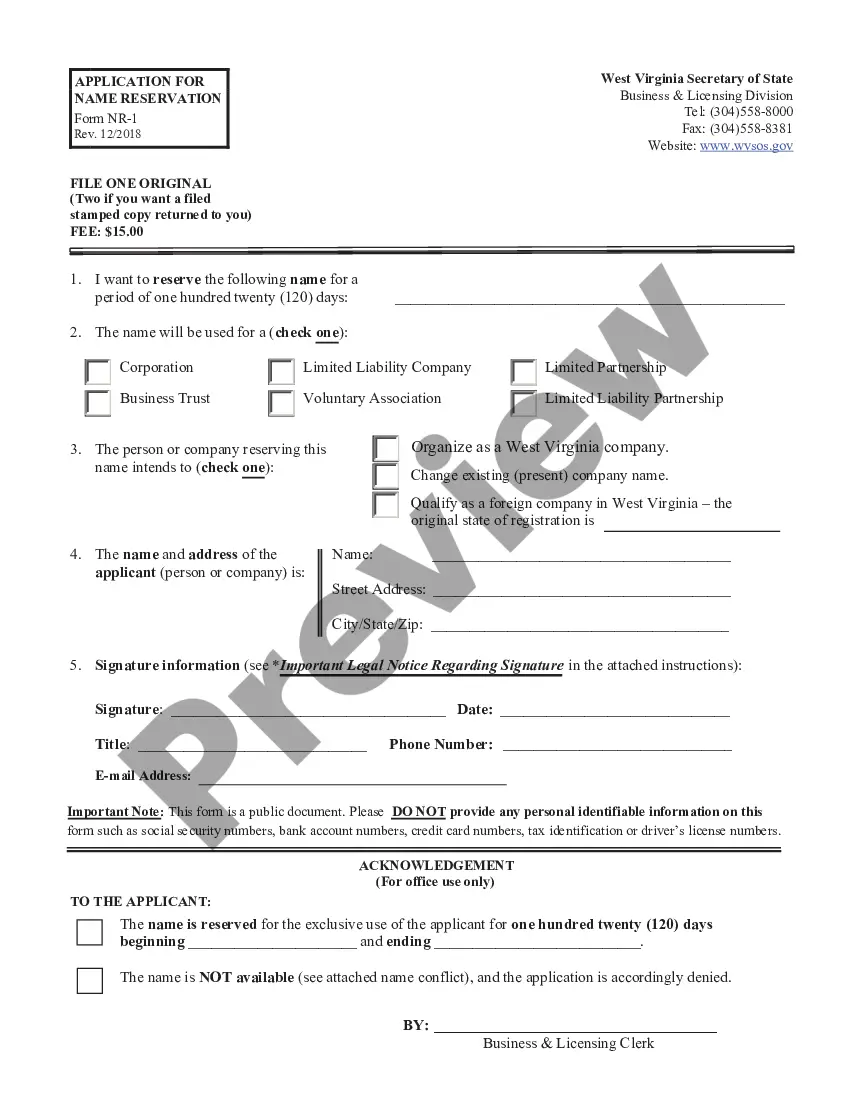

How to fill out Arkansas Instructions On Fee And Notary Statement Application For Certificate Of Non-Coverage (2-Sided) Required Notary Statement?

Whether for commercial objectives or personal matters, everyone eventually needs to handle legal issues in their lifetime. Completing legal documentation demands meticulous care, beginning with selecting the correct form template.

For instance, if you select an incorrect version of the Arkansas Certificate Of Non Coverage Withholding Tax, it will be denied once submitted. Therefore, it is crucial to have a trustworthy source for legal documents like US Legal Forms.

With a comprehensive catalog from US Legal Forms available, you will never need to waste time searching for the right sample online. Utilize the library’s user-friendly navigation to find the suitable template for any occasion.

- Obtain the template you require using the search bar or catalog navigation.

- Examine the details of the form to ensure it aligns with your circumstances, state, and locality.

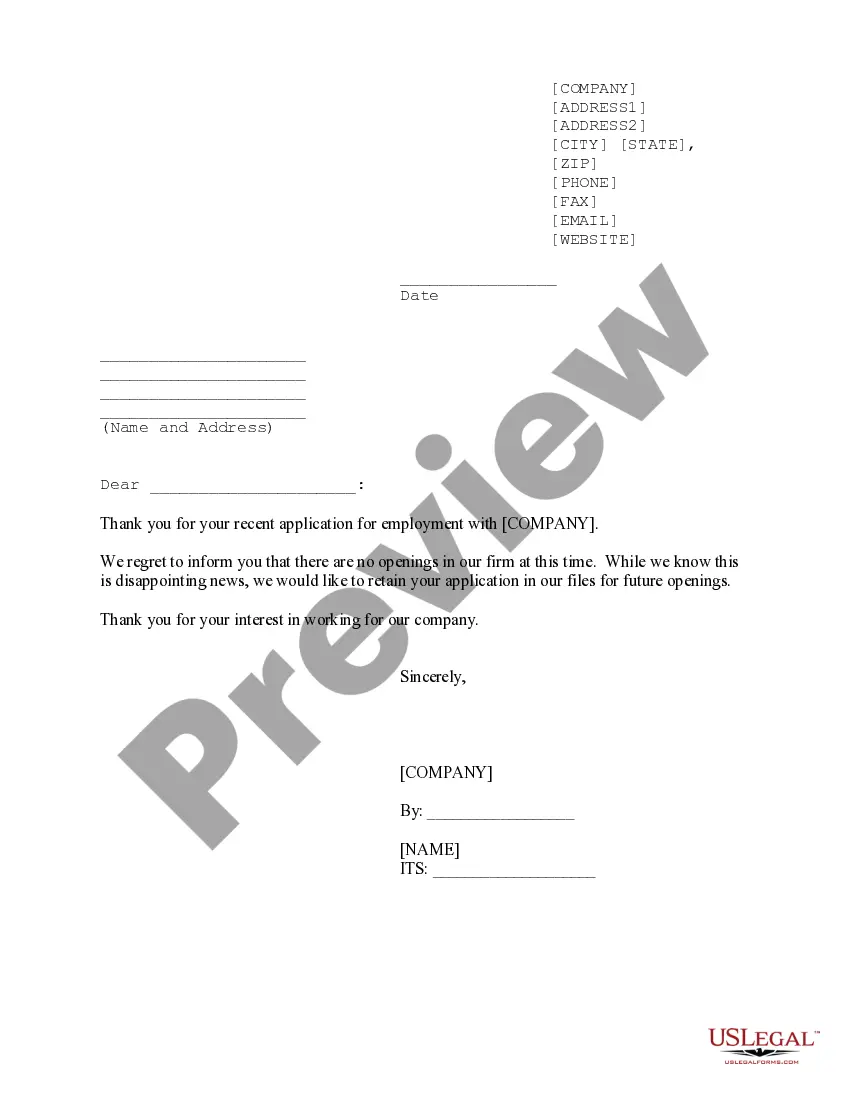

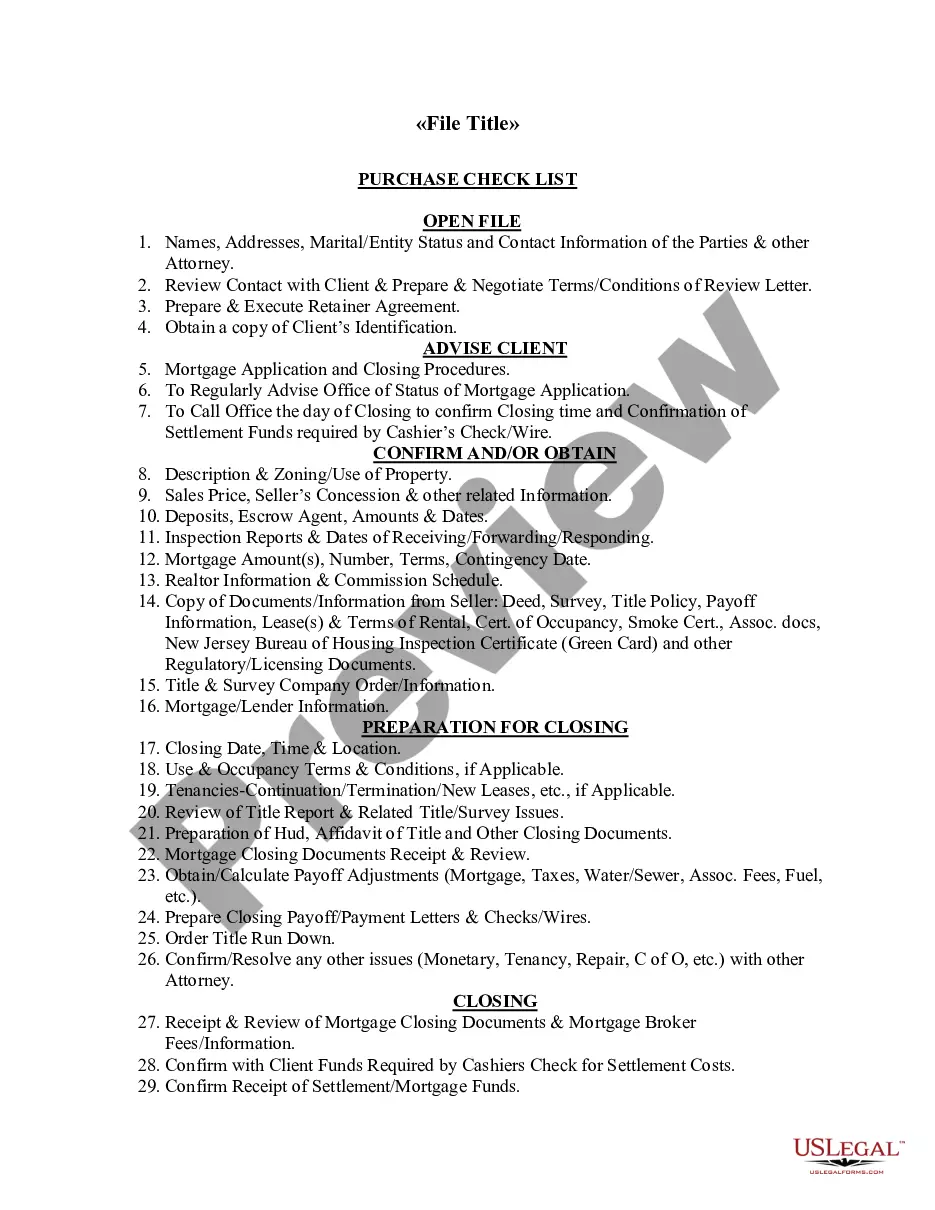

- Click on the form's preview to review it.

- If it is not the correct form, return to the search function to find the Arkansas Certificate Of Non Coverage Withholding Tax template you need.

- Acquire the template if it fulfills your specifications.

- If you possess a US Legal Forms account, simply click Log in to access previously saved files in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: either a credit card or PayPal account.

- Choose your desired file format and download the Arkansas Certificate Of Non Coverage Withholding Tax.

- Once saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

The withholding tax rate for non-residents in Arkansas typically aligns with the state's income tax rates. This rate may vary based on the specific income brackets applicable to non-residents. If you are applying for an Arkansas certificate of non coverage withholding tax, ensure that you're informed about these rates to comply efficiently.

Your Arkansas withholding account ID is provided once you register your business with the state. It's unique to your business and essential for filing taxes. Keeping your Arkansas certificate of non coverage withholding tax documents in order helps manage your tax obligations effectively.

In Arkansas, workers' compensation provides benefits to employees injured on the job. Employers must carry workers' compensation insurance to cover medical costs and lost wages for employees. As part of your overall tax planning, ensure you are also compliant with the Arkansas certificate of non coverage withholding tax to avoid additional penalties.

To register for an Arkansas withholding account, visit the Arkansas Department of Finance and Administration's website and complete the registration forms online. You will need to provide essential details about your business. After registration, you can obtain your Arkansas certificate of non coverage withholding tax to meet state requirements.

Getting your Arkansas withholding tax ID number involves registering with the Arkansas Department of Finance and Administration. You will need to complete an application where you provide relevant business information. Once you register, you can also obtain your Arkansas certificate of non coverage withholding tax to streamline your tax compliance.

To find your Arkansas state tax ID number, check with the Arkansas Department of Finance and Administration. You can also access it through documents related to your business tax filings. If your business requires an Arkansas certificate of non coverage withholding tax, ensure that your tax ID is accurate to avoid any compliance issues.

Yes, you can file Arkansas state taxes online. The state offers a portal that enables taxpayers to easily file their returns and manage payments. Additionally, platforms like USLegalForms can assist you with various tax forms, including those related to the Arkansas certificate of non coverage withholding tax. This ensures a smooth and efficient tax filing experience from the comfort of your home.

To file an employee withholding certificate in Arkansas, you need to complete the appropriate form, which is often referred to as the Arkansas certificate of non coverage withholding tax. This form allows you to report the withholding status of your employees. You can submit the completed form to your payroll department or directly to the Arkansas Department of Finance and Administration. For a streamlined process, consider using the resources available on the USLegalForms platform, which provides detailed guidance on filing.

The Arkansas state withholding tax is a tax that employers deduct from employees' paychecks and remit to the state. This tax helps fund state services and obligations. Understanding the Arkansas certificate of non coverage withholding tax can assist you in managing your finances effectively. If you need further clarification on this tax or related issues, uslegalforms offers straightforward solutions.

Filling out a withholding certificate can give you control over how much tax is deducted from your paycheck. In many cases, especially if you have varying income levels, it is a good idea to complete one. The Arkansas certificate of non coverage withholding tax can help you optimize your withholding. If you are unsure, the platform at uslegalforms can provide resources to guide you through the process.