Arkansas Purchase Real For Sale

Description

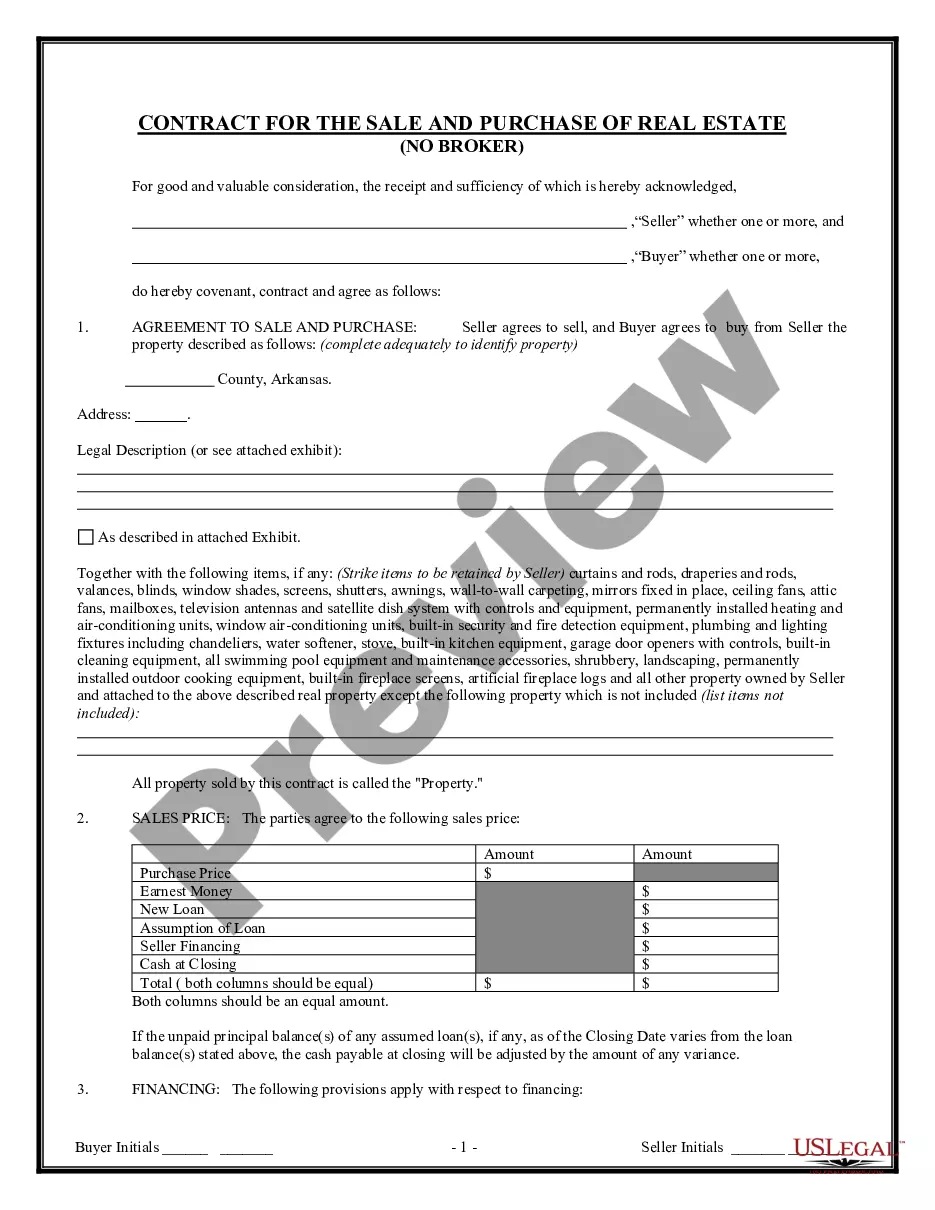

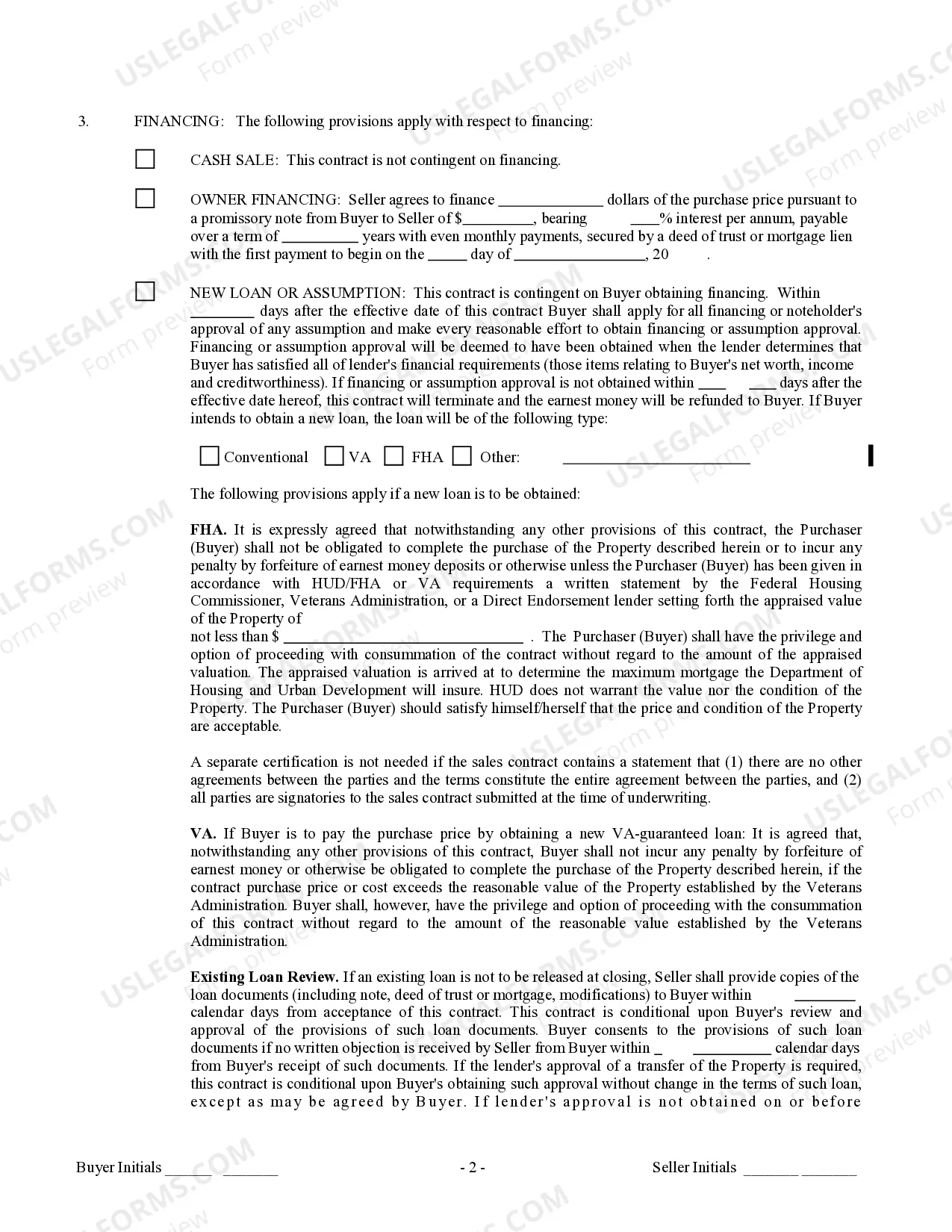

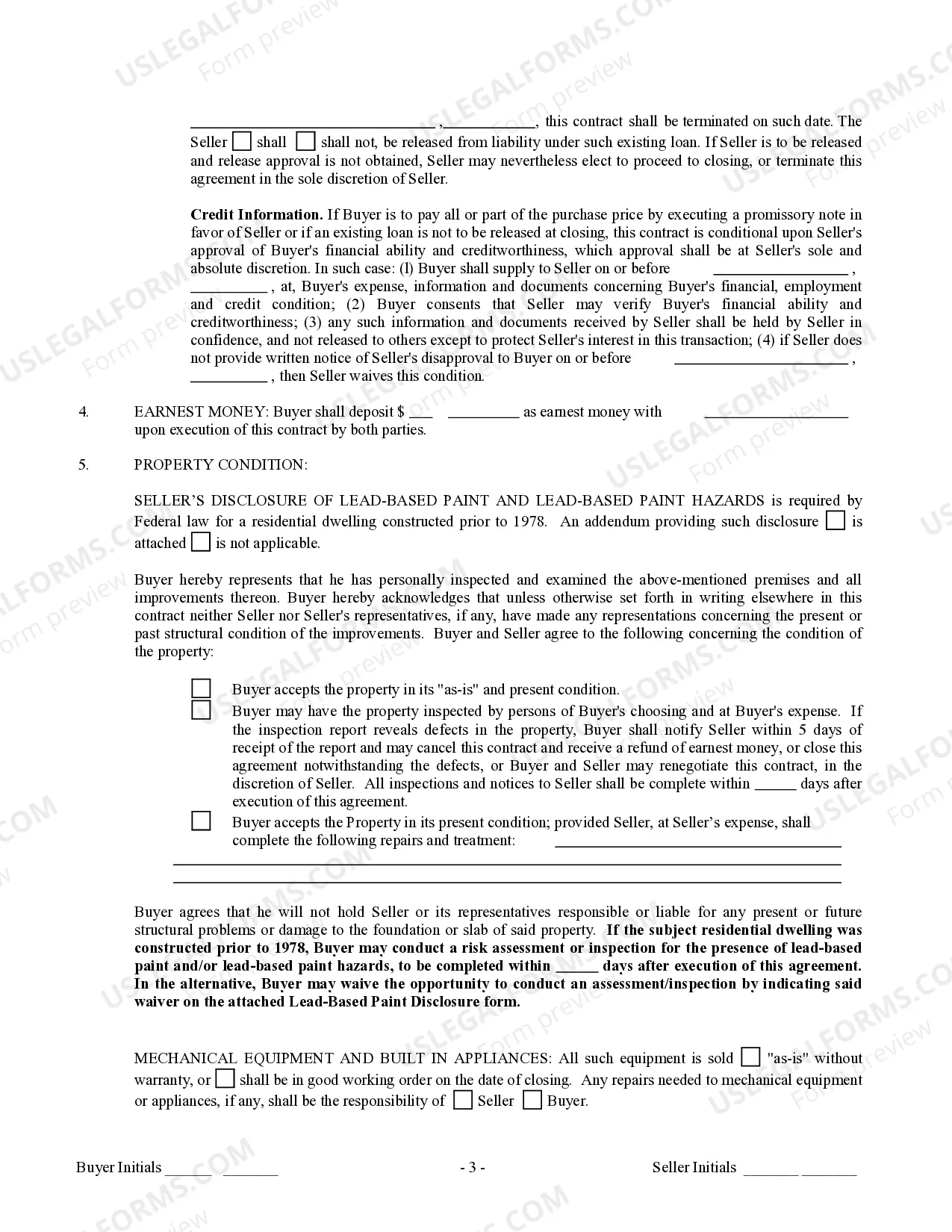

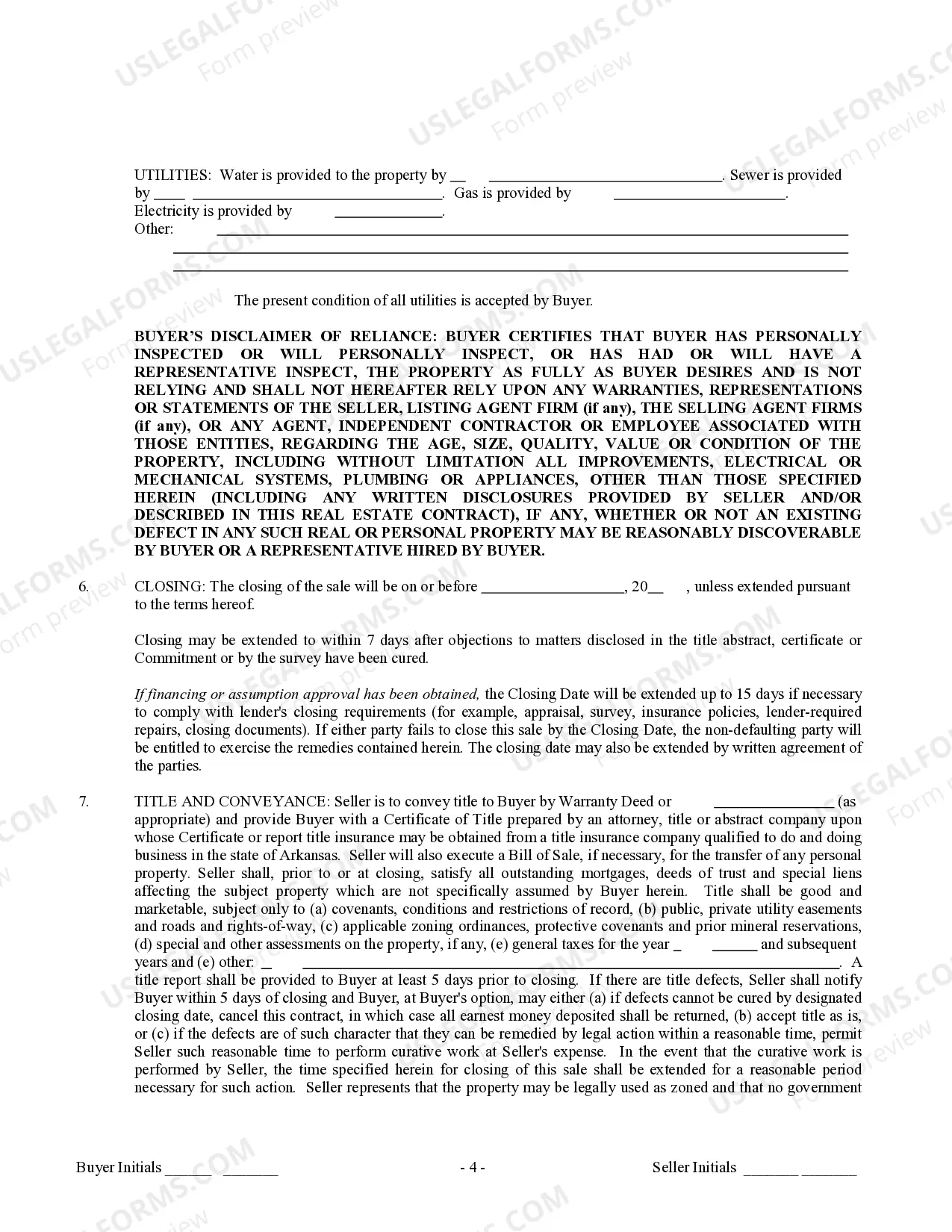

How to fill out Arkansas Contract For Sale And Purchase Of Real Estate With No Broker For Residential Home Sale Agreement?

It’s clear that one cannot transform into a legal specialist instantly, nor can one swiftly learn how to prepare the Arkansas Purchase Real For Sale without possessing a distinct set of abilities.

Generating legal documents is a lengthy endeavor demanding particular education and expertise.

So why not entrust the preparation of the Arkansas Purchase Real For Sale to the professionals.

Preview it (if this option is available) and review the accompanying description to ascertain whether the Arkansas Purchase Real For Sale is what you’re looking for.

Establish a free account and select a subscription plan to acquire the form.

- With US Legal Forms, one of the most extensive legal document repositories, you can discover anything from court documents to templates for internal corporate correspondence.

- We understand the significance of compliance and adherence to federal and state laws and regulations.

- That’s why, on our platform, all documents are location-specific and current.

- Here’s how you can initiate your journey on our platform and obtain the form you require in just a few minutes.

- Locate the document you need by utilizing the search bar at the top of the page.

Form popularity

FAQ

The Real Property Transfer Tax is levied on each deed, instrument, or writing by which any lands, tenements, or other realty sold shall be granted, assigned, transferred, or otherwise conveyed. The tax rate is $3.30 per $1,000 of actual consideration on transactions that exceed $100.

Property owners or bidders can search tax delinquent (tax deed) parcels at the Commissioner of State Lands (COSL) website and print the forms needed to complete a redemption or purchase. Interested buyers may also print their own offer form on a tax deed parcel, or parcels, and mail it with the appropriate payment.

Homebuyers in the majority of the country ? minus 13 states ? need to account for ?real estate transfer taxes? in their closing costs, including Arkansas. Transfer taxes are local and state government taxes that are paid as the seller transfers the home to the buyer.

Examples of items subject to Use Tax include records, CD's, books, furniture, jewelry, clothing, food, hunting and fishing gear, etc. These are only a few examples; all tangible personal property purchased out of state is subject to the Use Tax.