Deed Assignment Of Debt

Description

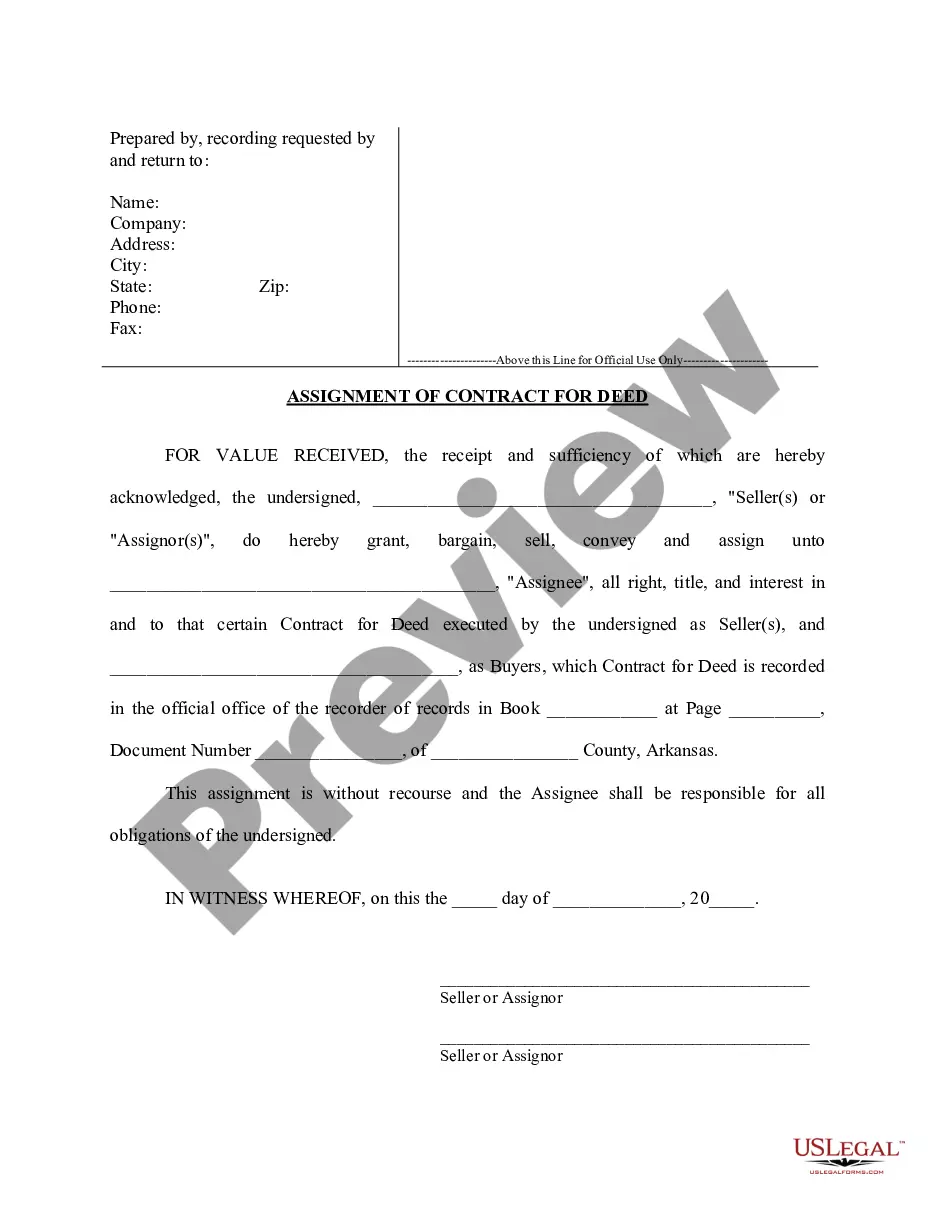

How to fill out Arkansas Assignment Of Contract For Deed By Seller?

Properly composed formal documentation is one of the essential assurances for preventing issues and lawsuits, but acquiring it without legal counsel may require time.

Whether you must swiftly locate an up-to-date Deed Assignment Of Debt or any other forms for employment, family, or business scenarios, US Legal Forms is always available to assist.

The process is even simpler for current users of the US Legal Forms library. If your subscription is active, you just need to Log In to your account and click the Download button next to the selected document. Furthermore, you can retrieve the Deed Assignment Of Debt at any time later, as all the documentation obtained on the platform remains accessible within the My documents tab of your profile. Save time and money on preparing formal paperwork. Try US Legal Forms today!

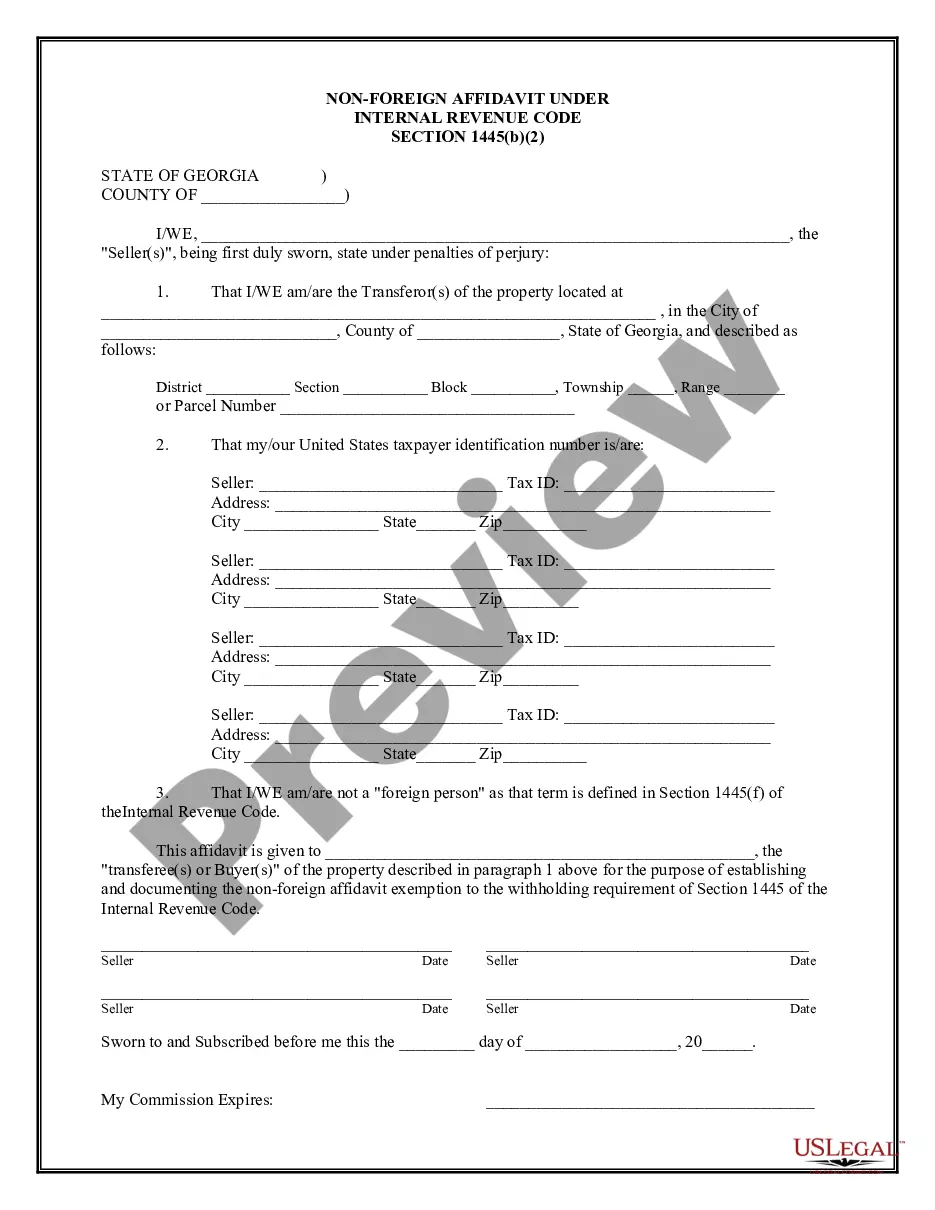

- Ensure that the form is appropriate for your situation and location by verifying the description and preview.

- Look for another example (if necessary) using the Search bar in the page header.

- Click Buy Now once you find the suitable template.

- Choose the pricing plan, Log In to your account or create a new one.

- Select the payment method you prefer to purchase the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX file format for your Deed Assignment Of Debt.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

The assignment of note and deed to secure debt involves transferring both the promissory note and the accompanying deed. This ensures that the new lender has the rights to collect payment directly from the borrower. This process is vital for the effective management of the deed assignment of debt, protecting both lenders and borrowers alike.

A deed of assignment, also known as a deed of agreement, is a legal document that officially transfers interest in a property or debt obligation. This deed outlines the terms and conditions of the assignment in clear language. Using such a document is vital, especially when dealing with the deed assignment of debt, to prevent disputes later.

An assignment of note is the process where the original lender transfers their rights under a promissory note to another party. This action typically involves the endorsement of the note and a formal written agreement. Understanding the nuances of deed assignment of debt can help protect your interests in these transactions.

An assignment of debt is a legal process where a creditor transfers their rights to collect a debt to another party. This can occur in various financial situations, such as selling accounts receivable or consolidating debt. Utilizing tools like USLegalForms can streamline this process, ensuring all legal requirements are met and providing clarity for everyone involved.

Assigning a debt means transferring the rights to collect the debt from one party to another, thus changing who is responsible for repayment. This often occurs in business deals or financial restructures, simplifying the management of accounts receivable. Understanding this process can help you navigate obligations and maximize asset collections effectively.

A pledge involves using an asset as collateral for a debt, meaning the asset can be claimed by the lender if the borrower fails to repay. In contrast, an assignment of debt transfers the debt obligations outright to another party. This distinction is crucial as it affects the risk profile and security involved in the transaction, impacting how you manage your financial agreements.

Assigned debt refers to a debt that has been transferred from one creditor to another, while owned debt means the original creditor still holds the debt responsibility. When a debt is assigned, the original creditor relinquishes their rights, and the assignee takes over collection efforts. Understanding these terms helps clarify your obligations and ensures accurate tracking of payments.

The deed of assignment serves to transfer rights or interests in a particular property or debt from one party to another. In the context of debt, it details the transition of responsibility for repayment from an original creditor to a new party. This is essential for clarity and legal validation in financial transactions, ensuring that all parties involved understand their obligations.

A letter of assignment of debt is a formal document that notifies the debtor about the transfer of their debt obligation. This letter typically outlines the details of the debt and the new creditor. By utilizing a deed assignment of debt, you ensure that this process is legally binding and transparent, fostering trust during the transition.

While assignment does not always need to be by deed, using a deed assignment of debt offers additional legal protection. A deed provides a written record of the agreement and the terms of the assignment, solidifying the arrangement. When clarity and enforceability matter, opting for a deed can be beneficial for both parties involved.