Federal Odometer Statement Arkansas Withholding

Description

How to fill out Arkansas Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

Creating legal documents from scratch can occasionally be daunting. Some situations may require extensive investigation and substantial financial investment.

If you're seeking a simpler and more affordable method for generating Federal Odometer Statement Arkansas Withholding or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal concerns. With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously crafted for you by our legal professionals.

Utilize our website whenever you require trustworthy and dependable services to effortlessly locate and download the Federal Odometer Statement Arkansas Withholding. If you're already familiar with our offerings and have established an account with us before, simply Log In to your account, select the template, and download it, or access it again later in the My documents section.

Choose the most suitable subscription plan to acquire the Federal Odometer Statement Arkansas Withholding. Download the document, then fill it out, sign it, and print it. US Legal Forms has an excellent reputation and more than 25 years of experience. Join us today and make document management a seamless and efficient process!

- Don't have an account? No issue. It requires minimal time to create one and browse the catalog.

- But before proceeding to download the Federal Odometer Statement Arkansas Withholding, follow these recommendations.

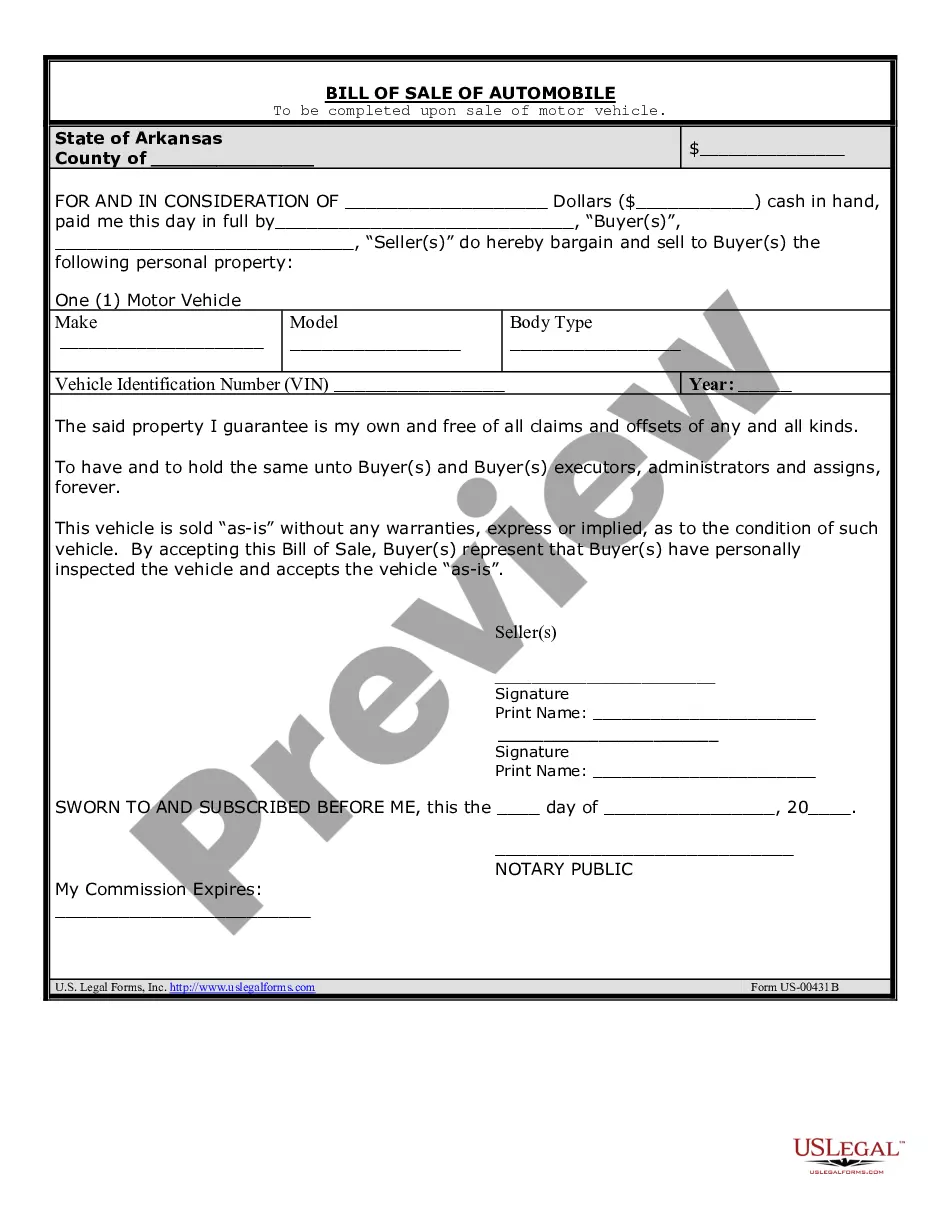

- Review the document preview and descriptions to confirm that you have located the correct form.

- Ensure the template you select adheres to the rules and regulations of your state and county.

Form popularity

FAQ

You can get a federal odometer statement by completing the necessary forms required during a vehicle’s sale. These forms can often be obtained from your local DMV or websites dedicated to vehicle documentation. Ensure that the statement meets the requirements for Arkansas withholding to avoid issues during a sale. Using platforms like USLegalForms can streamline this process and provide the precise document you need.

To obtain an odometer report, you can contact your local Department of Motor Vehicles (DMV) or use online services. Many platforms provide easy access to reports that include the odometer readings for used vehicles. If you need a federal odometer statement for Arkansas withholding, look for services that offer this documentation as part of your report retrieval.

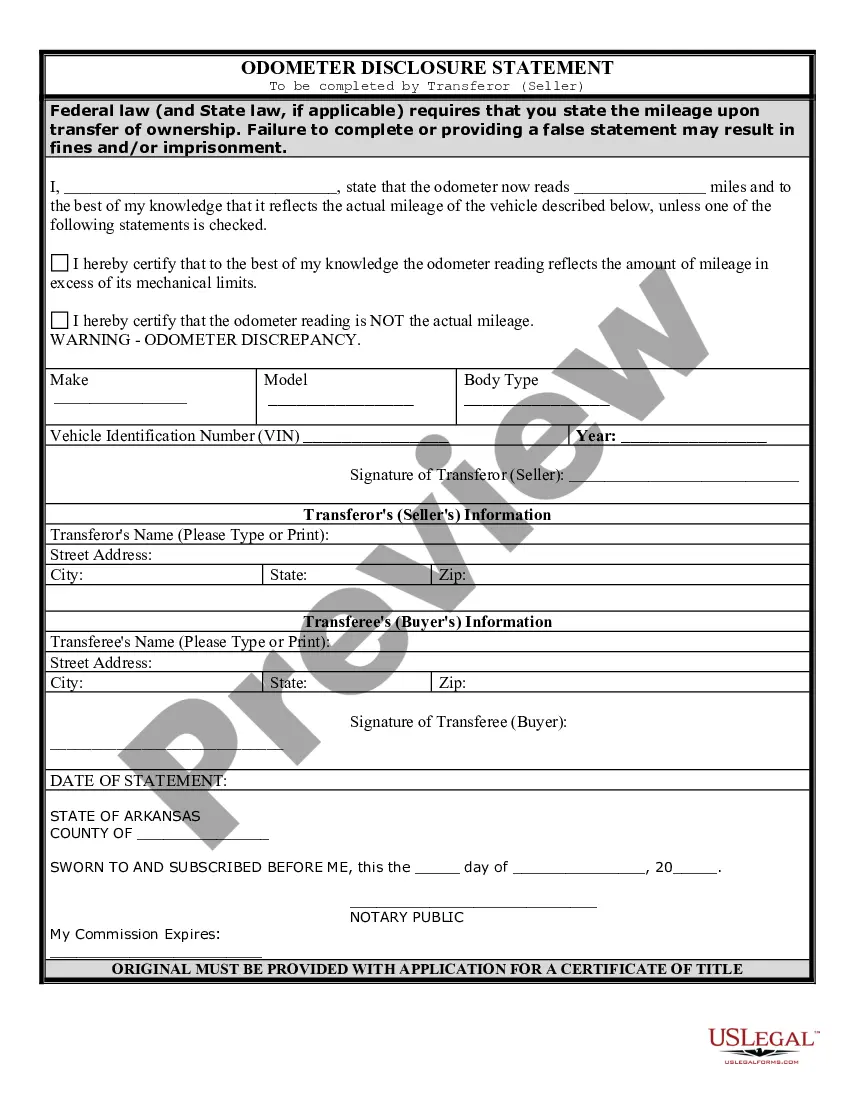

The seller of the vehicle typically keeps the odometer disclosure statement. This document is crucial during a sale, as it confirms the accuracy of the vehicle’s mileage. If you are engaging in a sale that requires the federal odometer statement for Arkansas withholding, ensure you keep a copy for your records. This helps protect both you and the buyer in future transactions.

In Arkansas, you can obtain a federal odometer statement by visiting your local Department of Motor Vehicles or accessing it online. You can also use services like USLegalForms to download a template that complies with Arkansas laws. Having this statement ready ensures you meet the federal odometer statement Arkansas withholding requirements during your vehicle transaction.

Filling out a federal odometer statement involves entering the vehicle's identification number, the current odometer reading, and confirming that the mileage is accurate. Both the seller and buyer must sign the document to ensure its authenticity. Utilizing platforms like USLegalForms can simplify the process, making it easy to create and fill out this necessary paperwork correctly.

An example of an odometer disclosure statement includes sections where the seller records the vehicle's current mileage and attests to its accuracy. The seller and buyer must sign the statement to validate the transaction. This document serves as a vital part of the paperwork during a vehicle sale, especially under the federal odometer statement Arkansas withholding requirements.

In Arkansas, a federal odometer statement serves as a mandatory disclosure that sellers must provide when transferring vehicle ownership. This statement verifies the odometer reading and confirms that it reflects the actual mileage. Using this document helps you meet federal odometer statement Arkansas withholding regulations and protects both buyers and sellers.

An odometer disclosure statement is a legal document that records the mileage of a vehicle at the time of sale. This statement helps prevent fraud by ensuring the seller provides accurate information about the vehicle's mileage. Specifically, in Arkansas, the federal odometer statement is crucial for compliance with state laws regarding vehicle sales.

To secure a notarized odometer statement online, look for reputable document preparation services that offer notary services. Ensure that they provide templates that comply with state laws, particularly regarding federal odometer statement Arkansas withholding. USLegalForms provides a reliable platform where you can obtain these documents easily, ensuring that they are notarized and ready for your needs. This convenience saves you time and adds peace of mind.

You can obtain a federal odometer statement by completing the necessary forms required by your state. Visit the DMV website for your state to find the specific requirements related to the federal odometer statement Arkansas withholding. USLegalForms can help you find and fill out these forms, ensuring you meet all legal obligations. This will help you ensure a smooth transaction when buying or selling a vehicle.